Bitcoin’s price has risen this week from where it left off the week before, hitting consecutive all-time highs in the past seven days. In recent days, the big question on everyone’s mind has been: when will the leading cryptocurrency cross the $100,000 level?

While most investors are concerned about a short-term target, some market participants are more concerned about the long-term prospects of the world’s largest cryptocurrency. According to the latest on-chain data, it appears that Bitcoin’s price could experience a shakeout sooner than expected.

Will rising bullish sentiment sustain the rally?

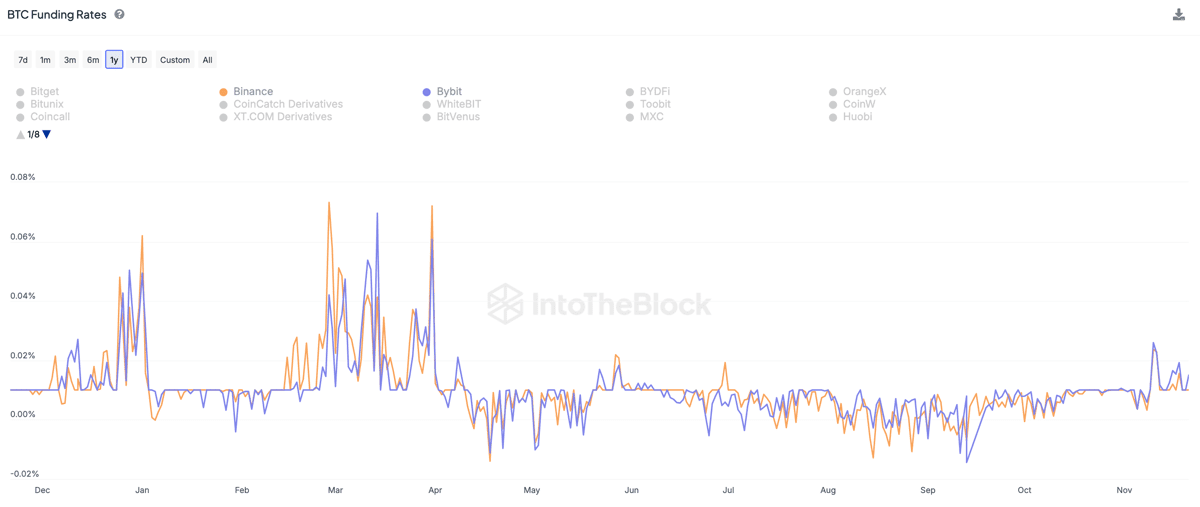

According to the market information platform InHetBlokBitcoin funding rates have witnessed a remarkable increase in the past few days. The relevant indicator here is the ‘funding rate’ metric, which tracks the periodic consideration exchanged between traders in the derivatives market (perpetual futures).

When the funding rate is high or positive, it means that the long traders are paying traders with short positions. Typically, this direction of the periodic payment indicates strong bullish sentiment in the market.

On the other hand, a negative value of the funding rate measure means that investors with short positions pay traders with buy positions in the derivatives market. This trend indicates that the market is enveloped in bearish sentiment.

Data from IntoTheBlock shows that Bitcoin funding costs for perpetual swaps have risen by more than 10% – and up to 20% on major trading platforms. However, the on-chain company noted that this continued funding rate growth could indicate speculative overheating, potentially resulting in market corrections.

According to IntoTheBlock, one of the possible catalysts of this bullish sentiment is the US government’s approach to crypto under Donald Trump. With ‘strategic Bitcoin reserves’ becoming increasingly possible under the incoming US president, investors are betting Bitcoin will surpass a six-figure valuation.

At the time of writing, the flagship cryptocurrency is valued at around $98,400, reflecting a 1% increase in the past 24 hours.

Bitcoin Perpetual Futures Market Remains Reluctant – What It Means

In a recent post on the X platform, Glassnode revealed that the Bitcoin perpetual futures market ‘remains subdued’. This suggests that several traders are still approaching the market with caution, despite BTC’s steady price increase in recent weeks.

Data from Glassnode shows that Bitcoin funding rates are just above 0.01%, which is lower than the level seen in March 2024 (~0.07%) when the BTC price reached a local top. Ultimately, this suggests that there is still room for growth in the value of the major cryptocurrency.