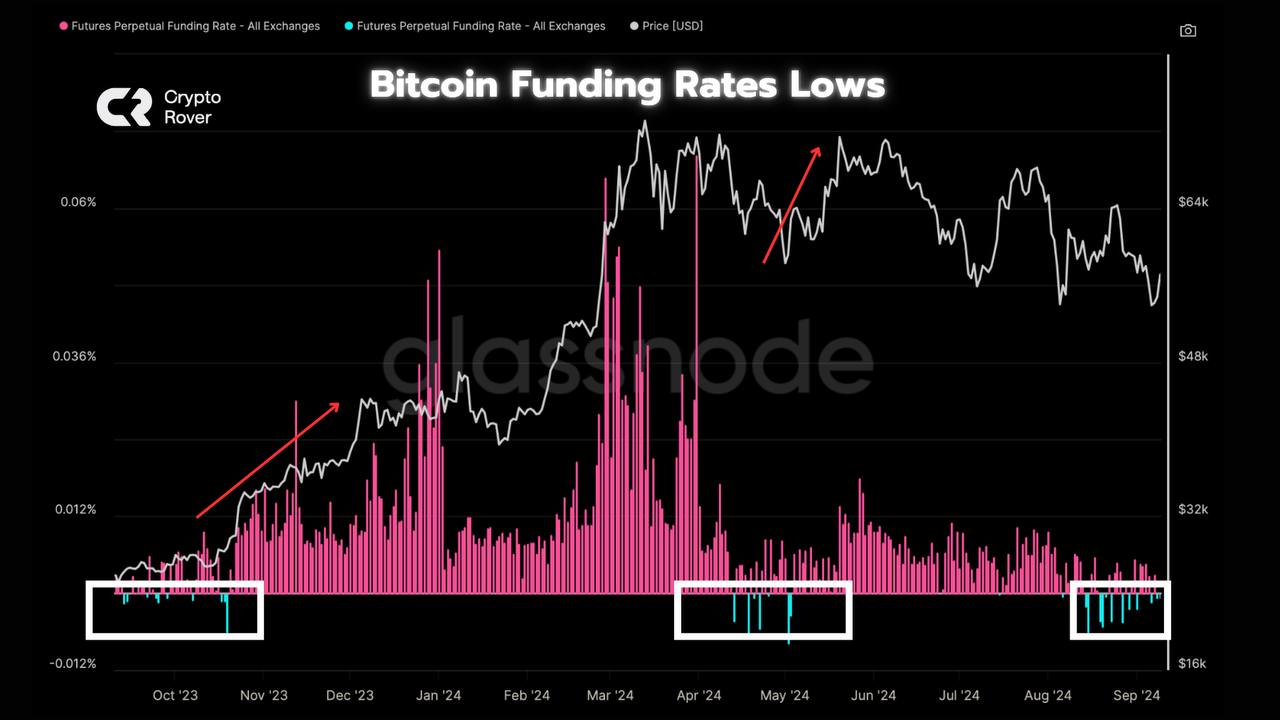

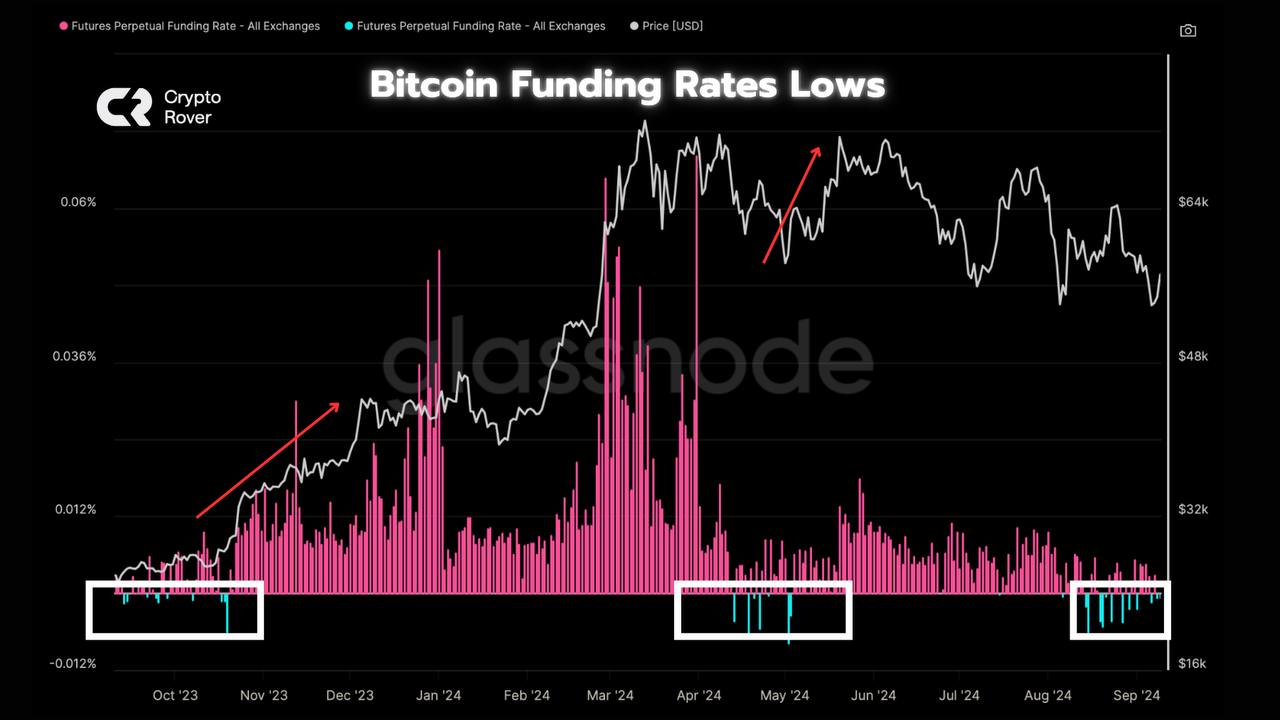

- Bitcoin Funding Rates turned negative at the time of writing – the sign of a possible turnaround.

- Bitcoin will reach new highs if it breaks the $65,000 mark.

Bitcoins [BTC] The financing interest rate turned negative, signaling a shift in market sentiment. Traders are becoming more cautious, with the long/short ratio falling to 1.61 at the time of writing.

Futures are showing stronger selling pressure as CVD Futures are at -1.91 billion. Historically, when financing rates become negative, this often indicates a bottom in the market.

Bitcoin Funding Rate Drops Hints

Since 2018, when average 30-day funding rates turned negative, Bitcoin has seen an average 90-day return of 79%, according to K33 Research.

Negative funding rates can often lead to short squeezes, driving the price higher as bearish positions promote a recovery.

Source: Glassnode

Looking at Bitcoin’s price action, especially the BTC/USDT pair, it appears that the market is showing signs of change.

Bitcoin was trading near a critical resistance level of $58,000 at the time of writing. If the king coin breaks and stays above this level, it could push the price higher towards $65,000.

Historically, negative funding rates indicate an impending rise, and the recent strong candles suggest this move could happen soon.

If Bitcoin fails to break the $58,000 level, the price could return to lower key levels, potentially reaching liquidity around the psychological $50,000 level.

Source: TradingView

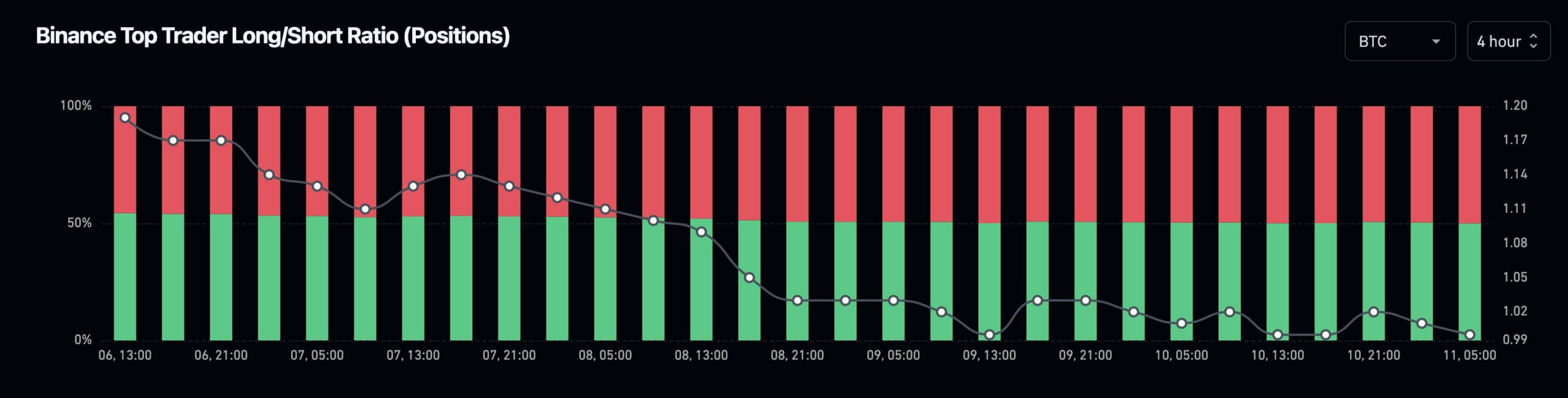

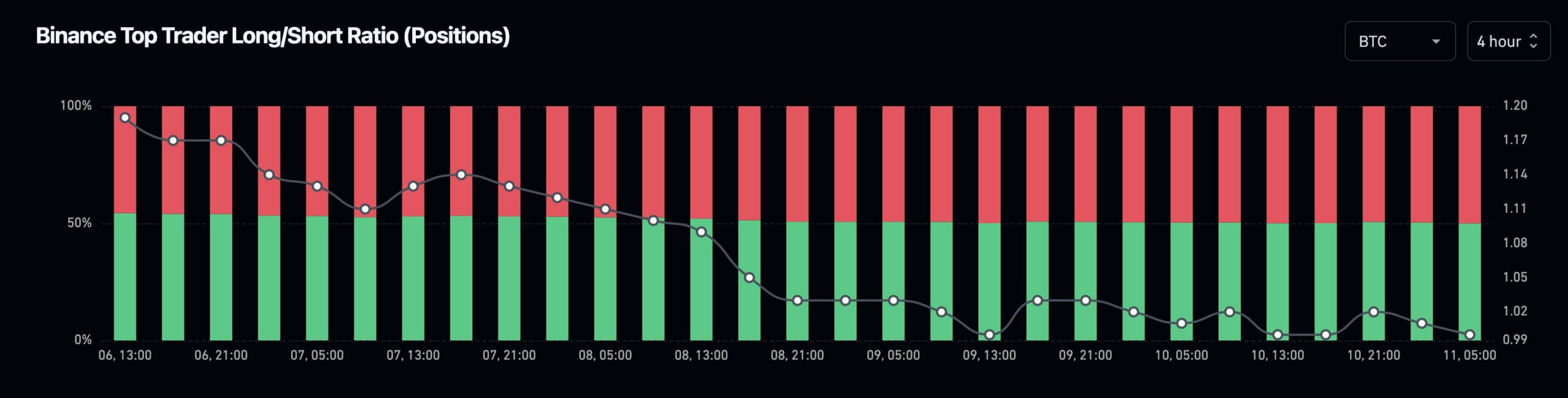

The best traders on the stock exchanges go long

Further analysis revealed that top traders on exchanges such as Binance [BNB] have moved to long positions, indicating confidence in a higher BTC price.

These top traders, often considered smart money, are buying Bitcoin while the market remains fearful. The shift in long trades supports the idea that Bitcoin is headed for a price rise, with data pointing to a bullish outlook.

Source:

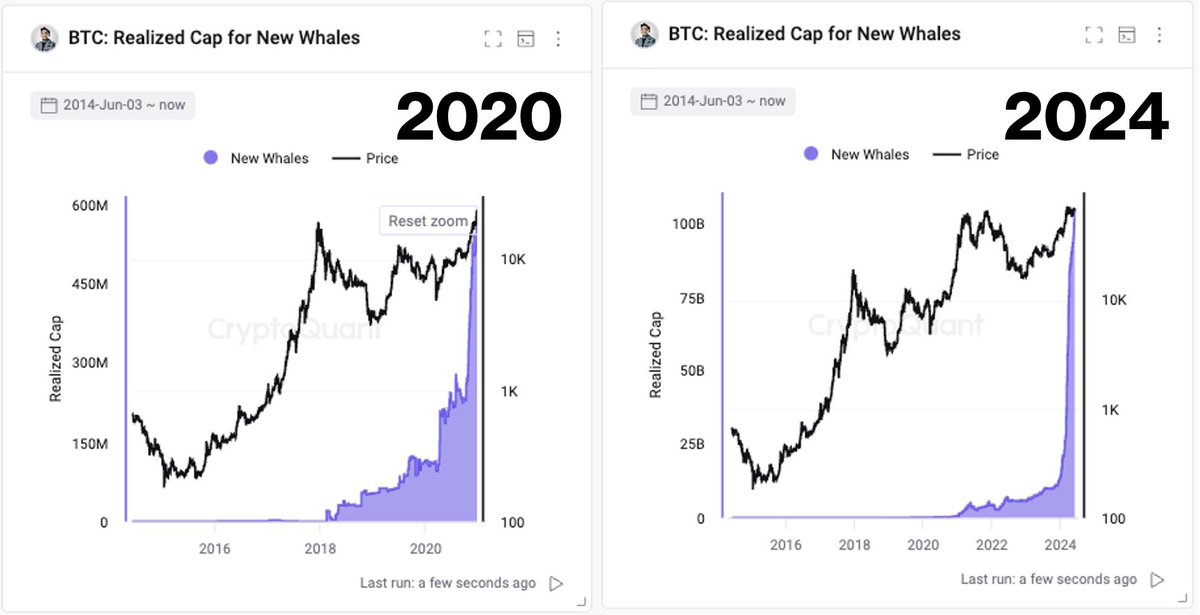

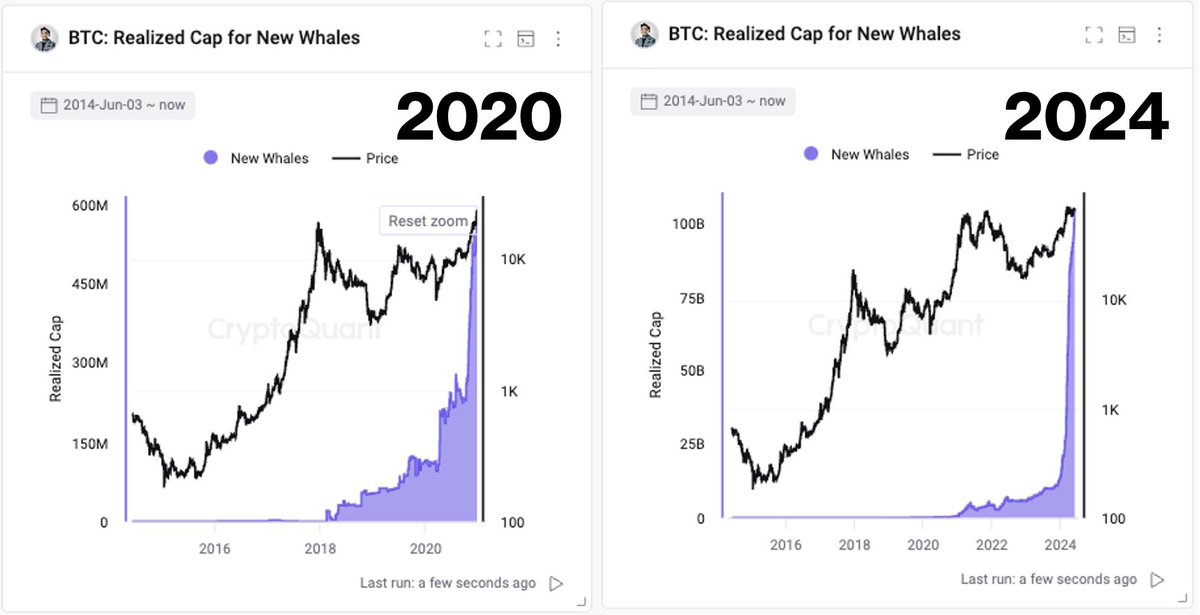

Whales buy aggressively

New Bitcoin whales also made aggressive moves, further confirming the bullish sentiment.

New whales in 2024 have multiplied their holdings 150 times compared to those from 2020, a time when Bitcoin had a major bull run.

This increase in whale activity indicated stronger adoption of Bitcoin in this cycle compared to previous ones.

Source: CryptoQuant

The influx of new investment in whales suggested that negative financing rates could trigger a rally to a new record, possibly by the end of this year or early next year, as well as early 2024.

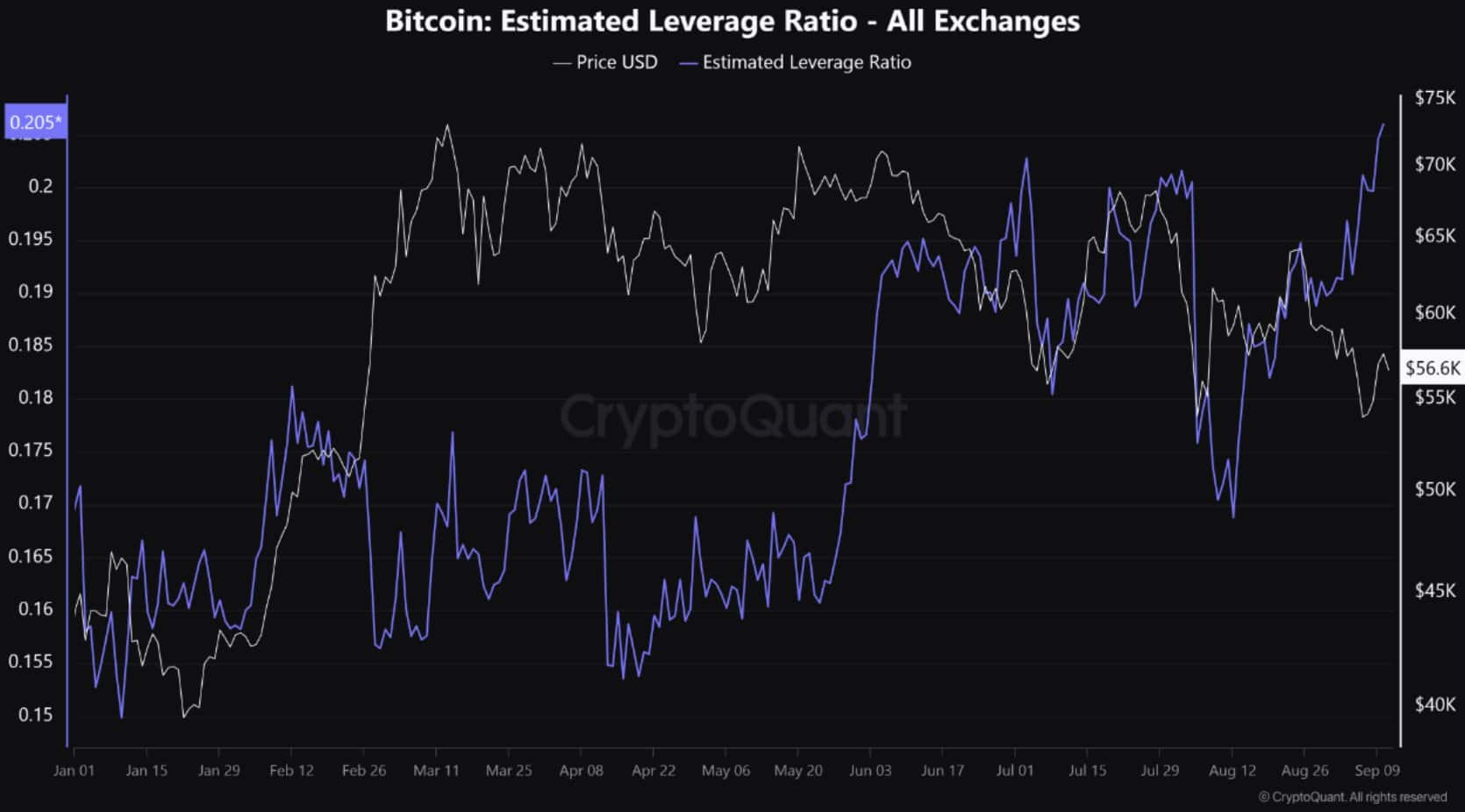

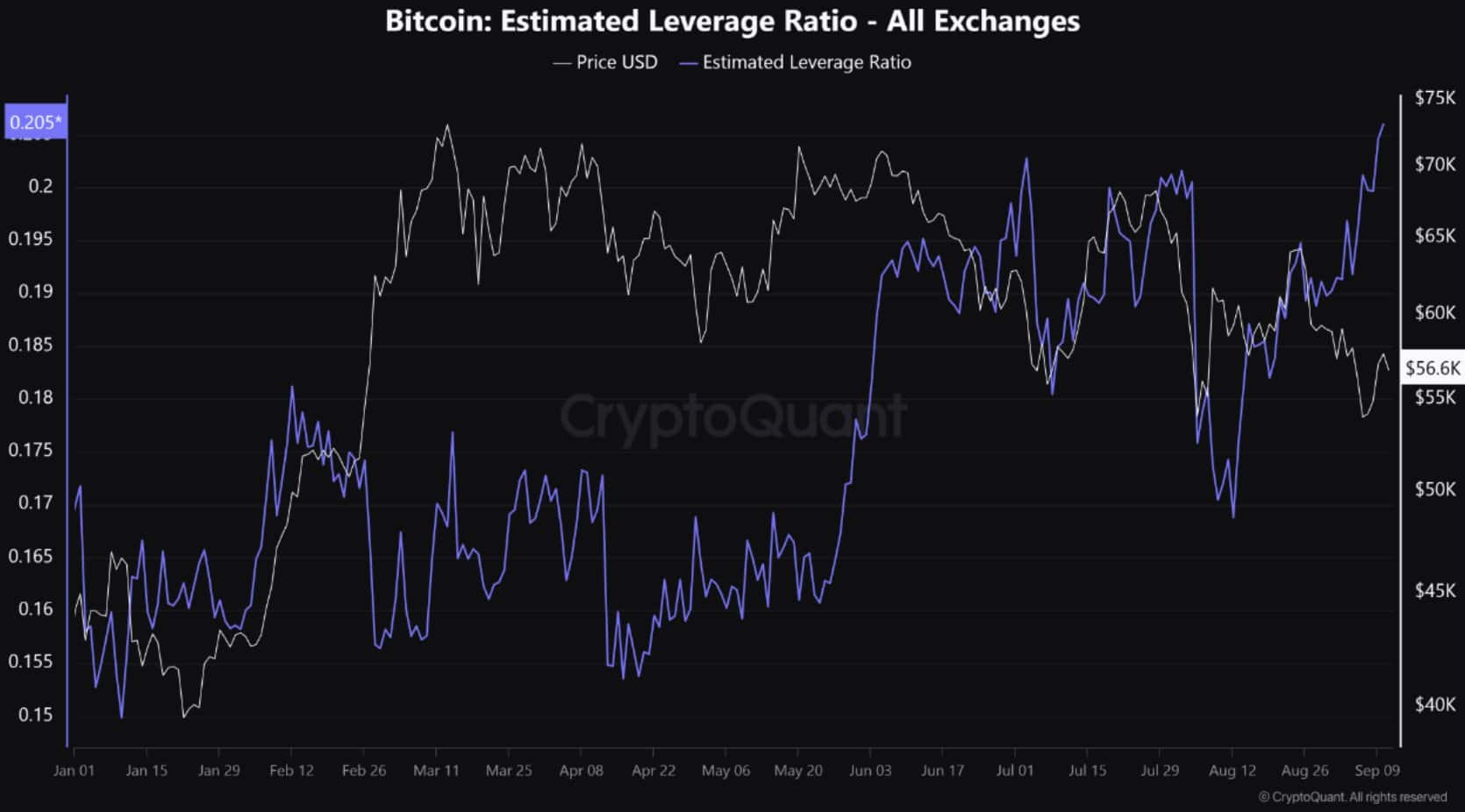

Estimated leverage ratio

Finally, Bitcoin’s estimated leverage ratio has hit a new year-to-date high. This increase in leverage in the derivatives market indicated that investors are becoming more active.

The growing involvement in derivatives is likely to drive Bitcoin’s price action in the long term.

Read Bitcoin’s [BTC] Price forecast 2024–2025

As more traders use leverage, the likelihood of significant price movements increases, pushing Bitcoin’s price higher in the near future.

With current market conditions and key indicators aligning, Bitcoin appears poised for higher gains.

Source: CryptoQuant