- BTC reaches $64,000 for the first time since 2021.

- Open interest now stands at almost $27 billion.

Bitcoin [BTC] recently made waves, with significant price increases and strong moves in some of its metrics.

Bitcoin is entering a new price zone

On February 28, Bitcoin showed notable price action, closing at around $62,393 on the daily time chart, marking a notable increase of over 9%.

However, a more detailed examination of lower time frames showed that BTC peaked at $64,000 before retreating to its closing range. This over 9% increase ended a five-day streak of consecutive increases for BTC.

Moreover, it is worth highlighting that this price level marked the first time since 2021 that Bitcoin reached the $60,000 range.

At the time of writing, Bitcoin was trading around $63,000, seeing an increase of almost 1%. Furthermore, the recent rebound has pushed Bitcoin into the oversold zone, as indicated by the Relative Strength Index, which stood above 85 at the time of writing this article.

Key Bitcoin metrics show yearly highs

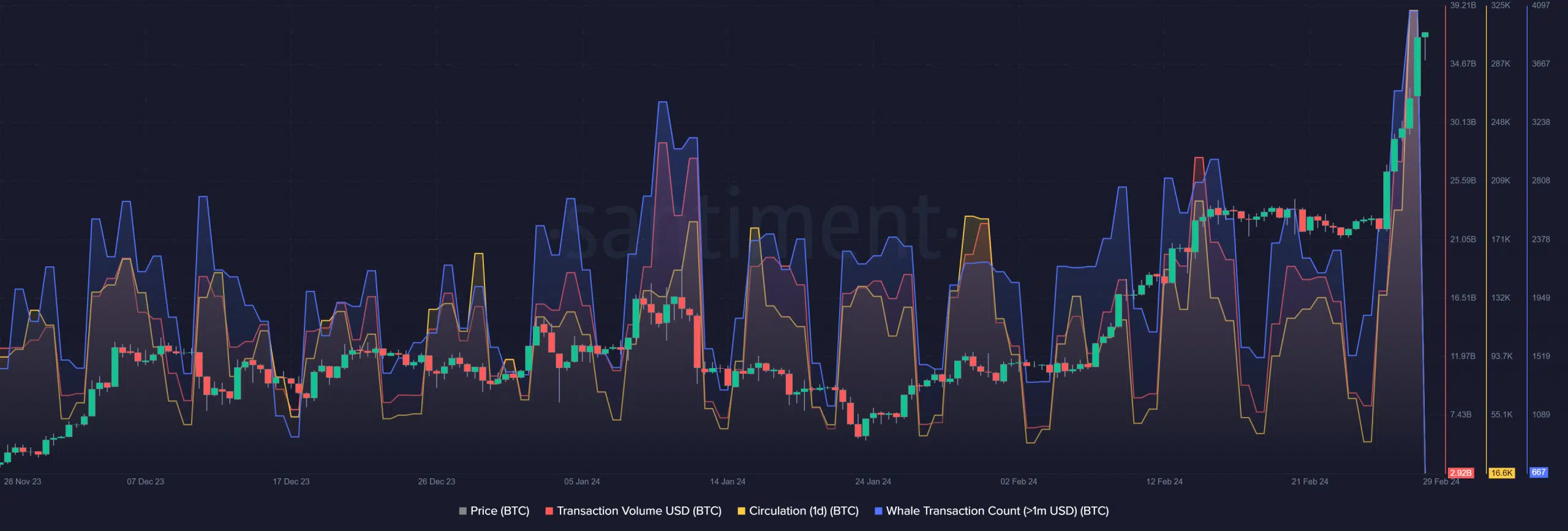

Analysis of Santiment Data showed that Bitcoin experienced significant increases in its price, whale transactions, transaction volume, and daily circulation. These statistics have reached unprecedented levels since 2022.

By the end of February 28, transaction volume rose to over $38 billion, whale transactions exceeded 4,000 and daily circulation exceeded 322,000.

At the time of writing this article, transaction volume was approaching $3 billion, more than 600 whale transactions had been completed, and daily circulation was over 16,000.

Furthermore, an examination of BTC volume showed that it closed at over $80 billion and peaked on February 28. Currently, the volume is over $93 billion, which is the first time since 2022 that it has reached these high levels.

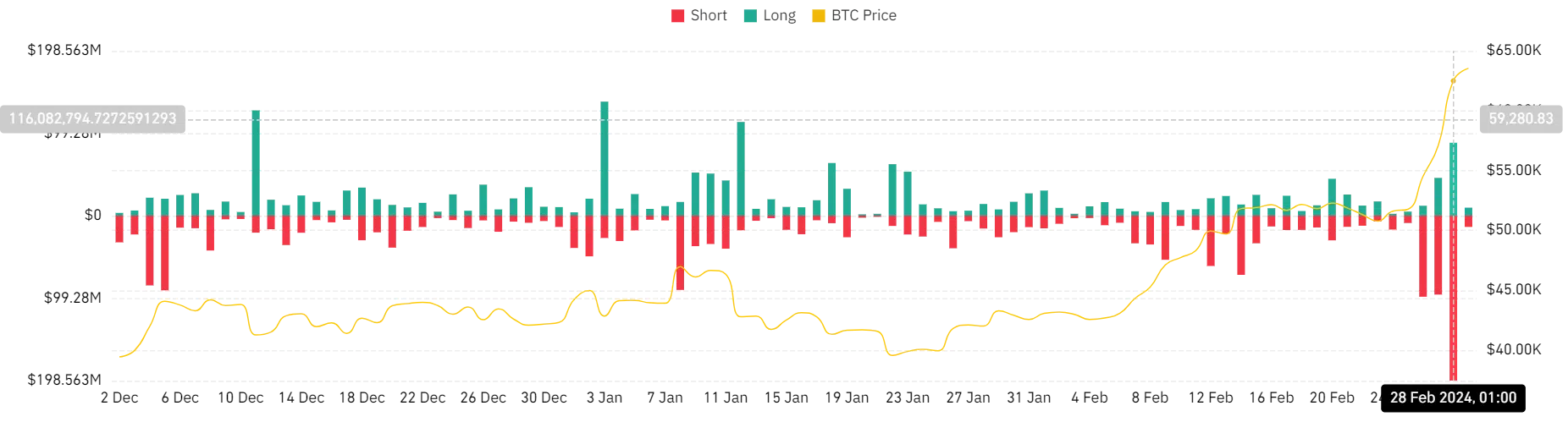

Short and long positions are taking significant hits

The remarkable rise in Bitcoin’s price led to significant liquidation of positions, according to Bitcoin data Mint glass. As of February 28, BTC’s liquidation volume exceeded $286 million.

A detailed overview showed that short positions were liquidated the most, with a total amount of more than $198 million. By comparison, nearly $88 million was liquidated from long positions.

Is your portfolio green? Check out the Bitcoin profit calculator

Interestingly, despite the significant liquidation volume, there was a continued inflow of money into BTC.

An analysis of the Open Interest metric showed a rise to a multi-month high, approaching $27 billion at the time of this writing.