This article is available in Spanish.

Less than a day before the polls closed in the United States, crypto analysts continued to offer their two cents on the future of Bitcoin and cryptocurrencies.

For example, many Wall Street analysts say wild BTC market prices will continue after the election. Other analysts and observers have shared their price predictions based on who will win this Tuesday.

Related reading

Gautam Chhugani of the Berstein Group projects that Bitcoin could rise to $80,000 or even $90,000 if Republican Donald Trump wins the election. If Kamala Harris wins the polls, Chhugani expects the BTC price to drop to $50,000.

But Bernstein didn’t immediately stop making Bitcoin predictions election; the group remains bullish on Bitcoin in the near term and expects the digital asset to reach $200,000 by 2025.

According to Bernstein analysts, the other major factors driving Bitcoin’s price are increasing demand for spot BTC ETFs and rising US debt.

Bernstein Adjusts BTC Price Predictions: $50,000 Under Harris, $80-90,000 Under Trump

Bernstein analysts have adjusted their Bitcoin price estimates based on the possible outcomes of the upcoming US elections. If Harris wins, they expect Bitcoin to fall to around $50,000, while a… pic.twitter.com/Z1zJ21aJ48

— The Wolf of All Streets (@scottmelker) November 4, 2024

Bernstein’s Bullish Outlook for Bitcoin Next Year

Analysts at Bernstein are betting on Bitcoin and expect the price to reach $200,000 by the end of next year, regardless of the election results. Gautam Chhugani made the bold prediction days before Americans went to the polls, adding that the results would not impact the long-term prospects for the assets.

The analyst’s bullish project on Bitcoin is anchored by several factors. He even compared the asset to a ‘genie out of the bottle’ and said it is difficult to stop the price trajectory.

Chhugani identified a number of factors that could influence the asset’s price, including increased interest on the BTC ETFs and higher government debt. Last month, Bernstein’s top analyst targeted $100,000 for Bitcoin, but quickly revised his projection to reflect changes in market trends.

BTC’s erratic price action ahead of the elections

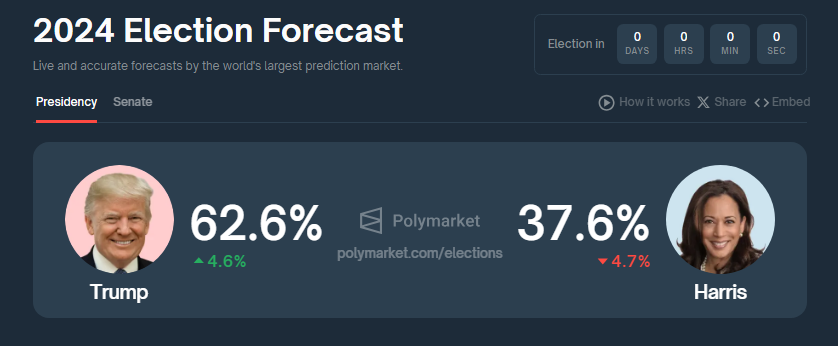

This year’s election battle between Trump and Harris is one of the most talked about and anticipated battles. In addition to traditional polls, data from betting markets such as Polymarket also became famous.

At Polymarket, for example Trump remains the favoritewho took 63% of all corner bets, while Harris got 38%. Bernstein analysts say that regardless of the results, the asset will experience price movements in the short term.

However, they expect BTC to benefit more from a Trump victory. In the same Bernstein analysis, Bitcoin could rise to $90,000 if the Republican wins.

Currently, the price of Bitcoin has fallen to $69,000 to $68,000 due to profit taking. Analysts also pointed to weak inflows into ETFs this week. Most analysts agree that Bitcoin is still poised for a year-end rally.

Related reading

US election results could affect other digital assets

The American elections affect other digital assets besides Bitcoin. For example, during a Harris presidency, Ether may win due to stricter regulations that could limit the performance of competitors like Solana.

Chhuhani, however, has a different view, saying that if the SEC adopts a moderate policy, it could boost Bitcoin and other assets.

This year’s election cycle puts crypto and the blockchain at the center of the debates. Both candidates shared their thoughts on crypto, with Trump offering more crypto-friendly solutions.

Initially, Democrat Harris was hesitant to make policy proposals, but she changed her tune as the campaign progressed.

Featured image from Invezz, chart from TradingView