- The Bitcoin liquidation cascade of the past few hours saw a strong recovery, with BTC already up 6.5%.

- It’s difficult to time the bottom of any dip, but it helps to have a plan of action when the dip comes.

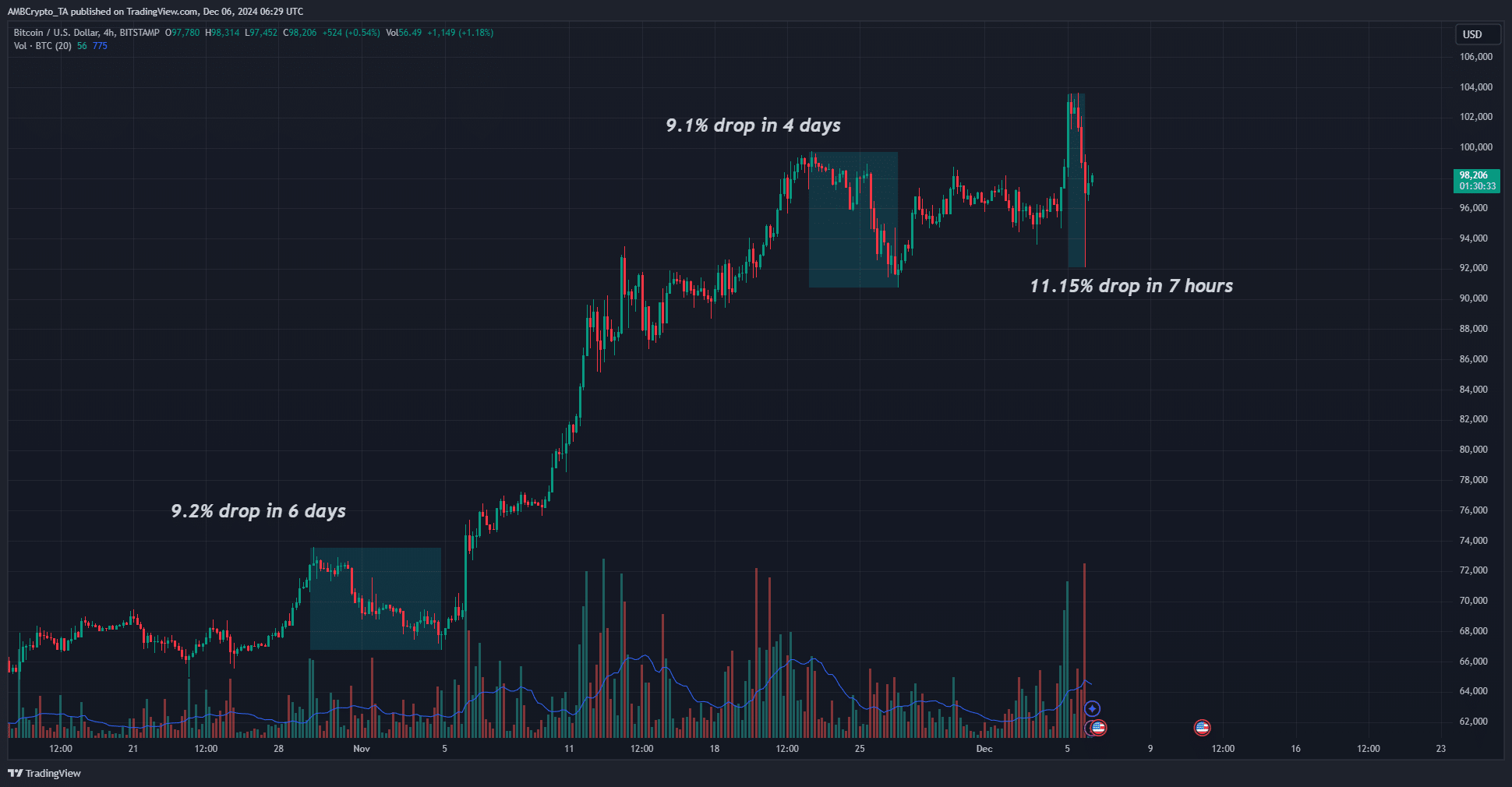

Bitcoin [BTC] saw a liquidation cascade during the Asia trading session on Friday, December 6. A liquidation cascade occurs when a particularly dense cluster of liquidation levels is challenged by price.

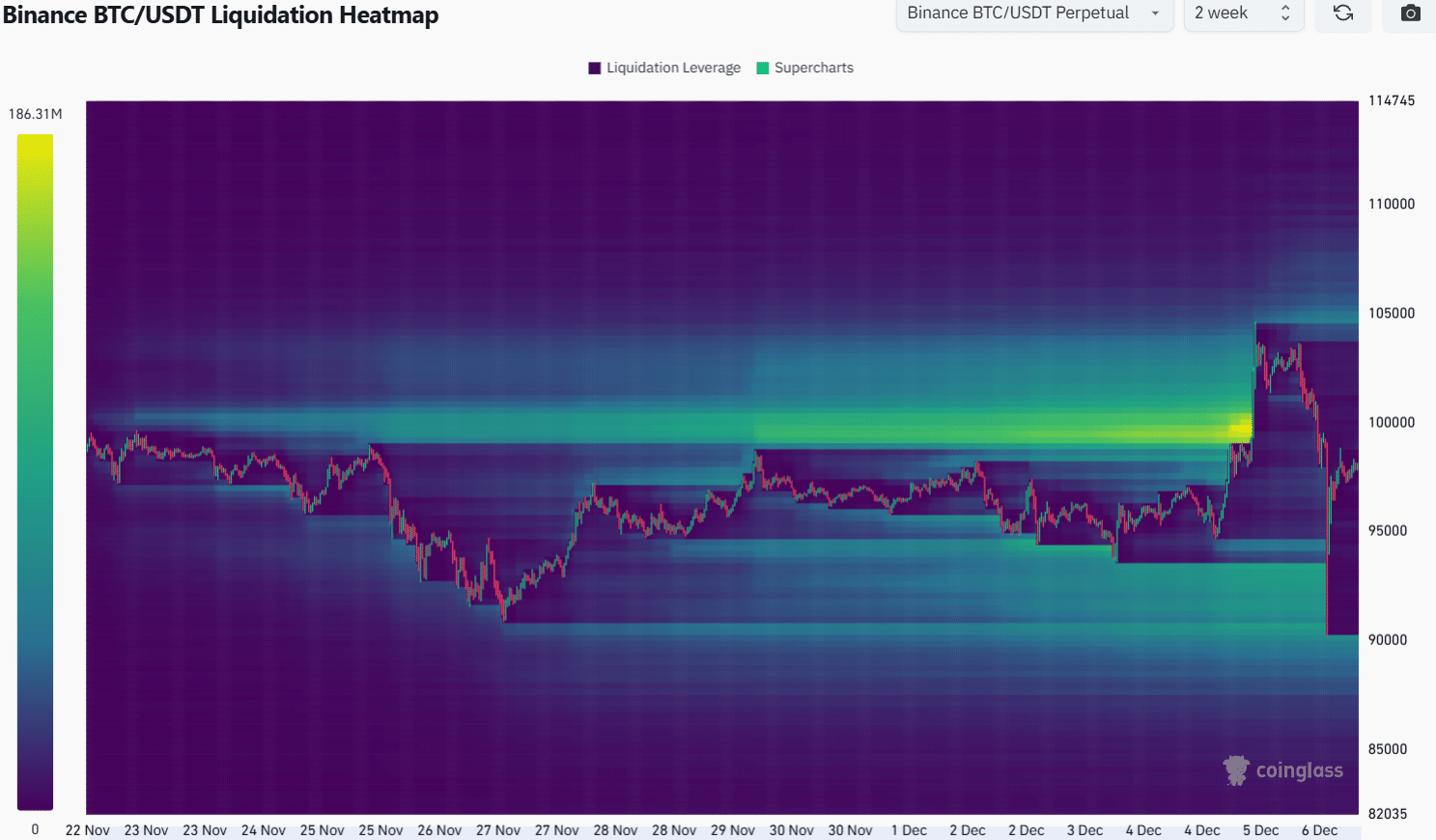

The forced selling activity over the past few hours brought BTC close to below $90,000. AMBCrypto’s analysis of the liquidation map showed that two liquidation cascades have occurred in recent days.

The price spike to $104,000 occurred after the $100,000 liquidity cluster was swept. A move to $94,000 then eliminated overleverage bulls, paving the way for the next Bitcoin move that was executed at a less frenetic pace.

Liquidation cascades – a trading opportunity

Coin glass data showed that at the time of writing, $883 million in liquidations had occurred in the crypto ecosystem in the past 24 hours. Bitcoin saw nearly $493 million in liquidations, with $418 million short.

This happened after a 12.59% BTC price drop on Binance, with slightly different values on other exchanges. The move went from $103.5k to $90.5k in the space of seven hours. Yet the bull run was still a reality, and during bull runs it is common for Bitcoin to see large retracements.

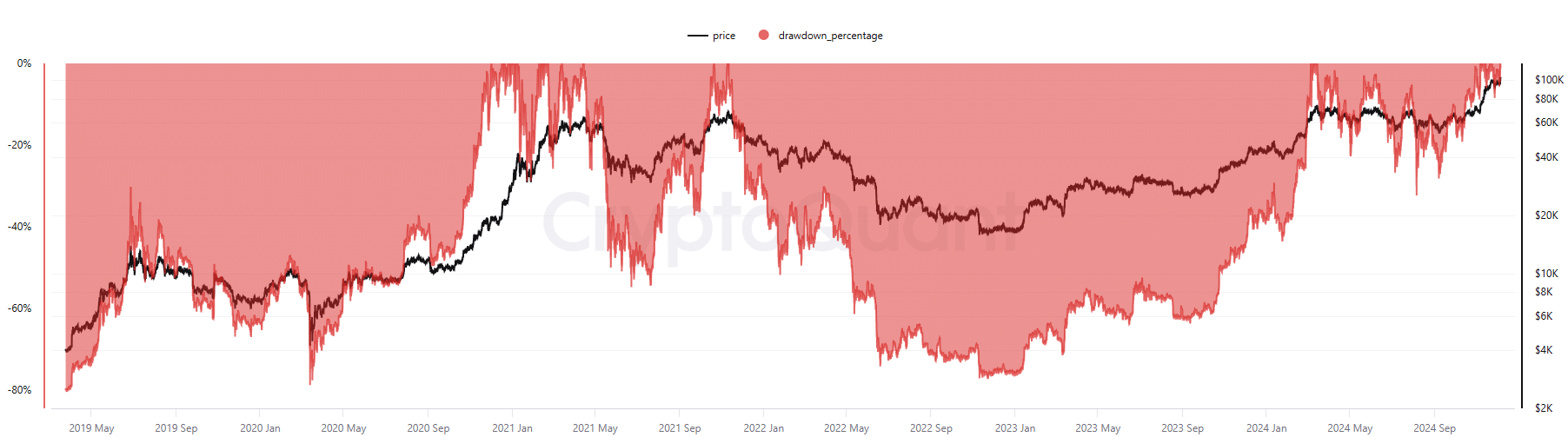

During 2020-2021, we could see multiple price drops of 20% or more as measured from all-time highs. The recent dip was not that big and was already recovering, with BTC prices at $98,000 at the time of writing.

It was an interesting time to show the profits traders could have made if they had caught the big recent price drops.

How much profit would you make if you had bought the recent Bitcoin dips?

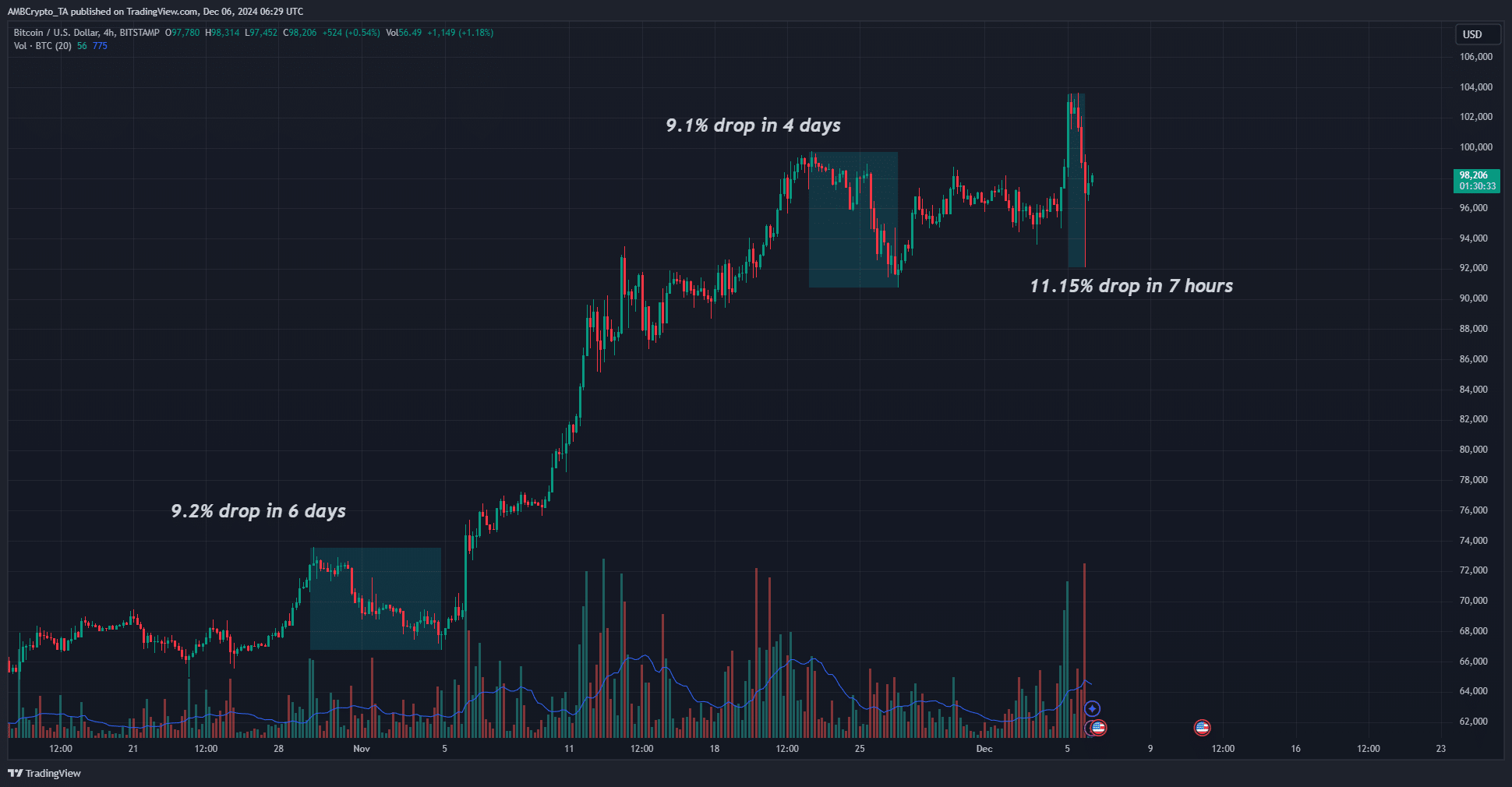

Source: BTC/USDT on TradingView

Since October 29, Bitcoin has had three relatively large price drops, with the largest being the most recent. As mentioned, different exchanges saw prices drop to slightly different levels, and the drop was 11.15% on Bitstamp.

The first two declines were also not liquidation cascades, which typically occur when the market is highly excitable, such as during a bull run where Open Interest reaches record highs every two months.

If a trader had used each of these declines and bought $1,000 worth of BTC at the bottom of each of the past three declines, they would be quite profitable.

When Bitcoin hits the $100,000 mark again, the $3,000 invested during the three most recent dips would be worth about $3,685. It should be noted that much of these gains came after the strong rally following the US presidential election results.

Read Bitcoin’s [BTC] Price forecast 2024-25

A 68.5% return in just over a month sounds good enough for traders who just buy the dip. Hindsight is of course 20/20, and determining the exact bottom is difficult.

Still, the charts show that in a bull run, the trend is your friend, and high-conviction investors shouldn’t be afraid to buy the dip in the coming months.