- Bitcoin’s back-to-back ‘Super Signals’ indicate explosive gains – last seen before a 10,000% rally.

- More than 94% of Bitcoin holders made profits as volume trends suggested strong bullish sentiment going forward.

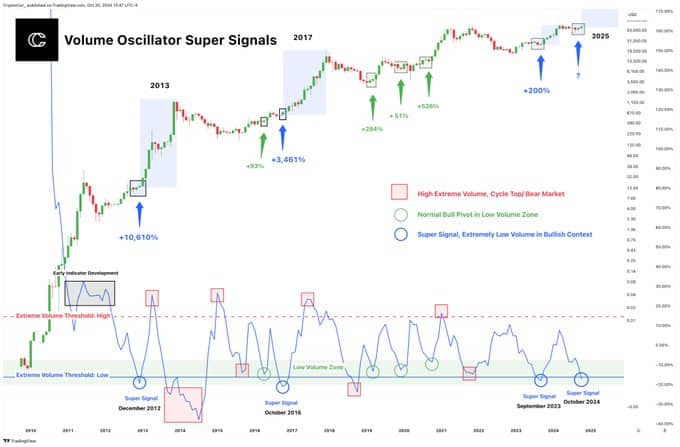

Bitcoins [BTC] volume oscillator has recently spotted back-to-back ‘Super Signals’, a rare event that has only occurred during major bull runs.

Historically, such signals have preceded huge rallies, including gains of more than 10,000% in 2012 and 3,000% in 2016.

The last occurrence, observed in September 2023, followed a +200% increase in the price of Bitcoin, with a new super signal in October 2024.

Source:

The ‘Super Signal’ appears when trading volume is extremely low in a bullish market. Analysts to suggest that these conditions indicate accumulation, as the number of sellers decreases while purchasing interest remains stable.

The absence of previous high volume peaks further supports the bullish outlook, distinguishing this phase from bearish low volume patterns.

Bitcoin’s price gains and market data

At the time of writing, Bitcoin was priced $68,378.05, with a market capitalization of $1.35 trillion and a 24-hour trading volume of $24.5 billion.

This represents an increase of 5.96% over the past seven days, showing steady gains. Bitcoin’s circulating supply is 20 million BTC.

Bitcoin Futures open interest is up 2.39% to $40.69 billion at the time of writing, indicating increased trading activity and possible bullish sentiment.

CoinGlass data showed a 90.33% jump in trading volume to $42.62 billion, while options volume rose 182.07% to $1.60 billion.

Options Open Interest also rose 2.29%, now at $24.31 billion. The alignment of these metrics with Bitcoin’s price movements indicates growing optimism among traders.

Bullish sentiment

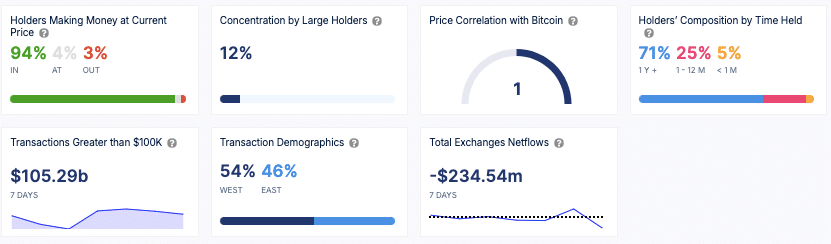

Data from IntoTheBlock showed that 94% of Bitcoin holders made profits at current prices, indicating positive market sentiment.

The analysis also found that 71% of Bitcoin holders have held their positions for more than a year, indicating strong long-term behavior.

Meanwhile, 12% of Bitcoin’s supply was held by large holders, indicating a moderate concentration of ownership among whales.

Source: IntoTheBlock

Additionally, there have been a net outflow of $234.54 million from the exchanges over the past week, indicating potential accumulation as investors move assets into cold storage.

More than $105.29 billion in trades over $100,000 took place last week, driven by institutional investors and large traders.

Read Bitcoin’s [BTC] Price forecast 2024 – 2025

The geographical distribution of transactions is fairly balanced: 54% come from the western regions and 46% from the eastern regions.

Overall, the presence of back-to-back super signals a unique event in Bitcoin history, anticipating potential price moves similar to previous bull cycles.