Bitcoin price has had a rough start to the new week after losing its position above $52,000 on Tuesday. However, all hope is not lost as indicators still point to a continuation of this trend. Crypto analyst Tony The Bull has identified a major trend in the Bitcoin chart that could see a continuation of the trend above $52,000.

Bitcoin Fisher 1-week transformation at crucial point

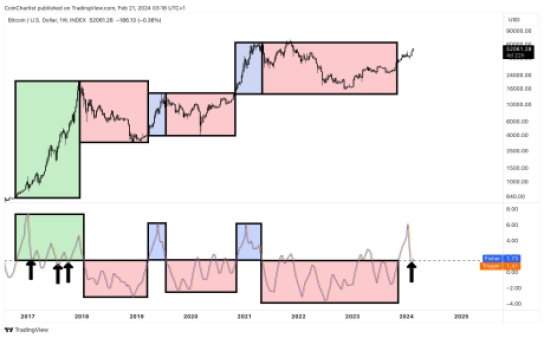

In an analysis Posted on X (formerly Twitter), the crypto analyst shared a chart showing the Bitcoin Fisher Transform compared to the price. Most importantly, the chart showed the one-week Fisher Transform and how it has evolved since 2017.

The analysis shows some similarities between the current trend and the trends of 2017. A similar trend was also observed in 2019 and 2021, where the Fisher Transform rose rapidly before falling. But the importance of this trend lies in where the Fisher Transform is going.

The current important level is the standard deviation of 1.5, which has been a crucial point when this trend has occurred. Now, if the Fisher Transform can hold above this level, it will be bullish for the price. However, if the price falls below this standard deviation, the price is very bearish.

Source: Tony The Bull on X

“This is a critical area based on historical price action and 2017 behavior that you won’t see in 2019 or 2021,” the crypto analyst explains. “Below it tends to bearish trends, while holding it above gives bulls extra strength.”

BTC price at $51,100 | Source: BTCUSD on Tradingview.com

Bears and bulls battle for control of the BTC price

The interest in the next direction of the Bitcoin price has led to bulls and bears clashing over which camp will regain control of BTC. This caused the price of the digital asset to fluctuate wildly in recent days, from $53,000 to less than $51,000, before bouncing back up in the early hours of Wednesday.

This tug-of-war continues to keep Bitcoin’s price low, but even as a result, investor sentiment appears to be rising. According to the Bitcoin Fear & Greed Index, investor sentiment has reached extreme greed for the first time in one year.

Historically, the index that has entered extreme greed has marked the top of the market, with prices falling not long after. However, Bitcoin is still seeing positive indicators, with trading volume increasing by over 40% in the last 24 hours alone.

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.