- About 4.27% of Bitcoin’s supply was to back exchange-traded funds at the time of writing.

- Analysts predict a market peak between November 2024 and February 2025.

Bitcoin [BTC] continues to show the crypto market why it is the king’s coin. After nearly a month of consolidation and sideways moves, the market leader hit a new all-time high after surpassing $80,000.

The cryptocurrency is up more than 5% in 24 hours and more than 18% in the past seven days, AMBCrypto noted using CoinMarketCap facts.

Bullish environment for growth

Bitcoin’s move comes on the General’s back market bullish, especially after the SEC’s approval of Bitcoin Exchange Trader Funds (ETFs) in January.

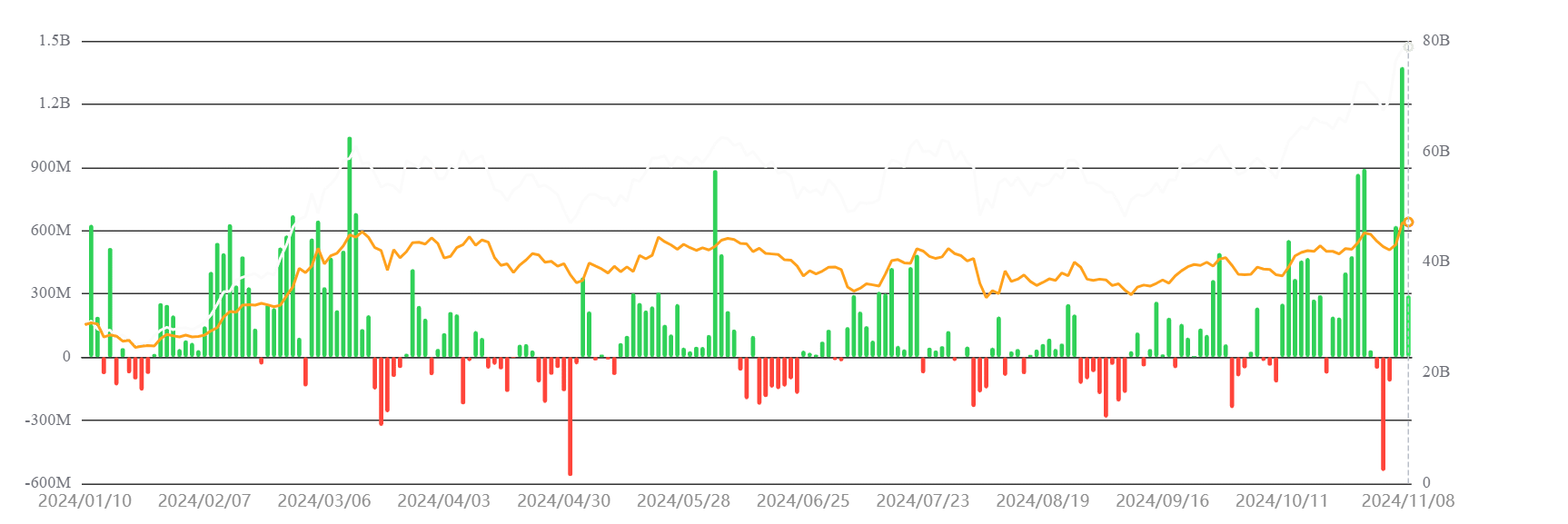

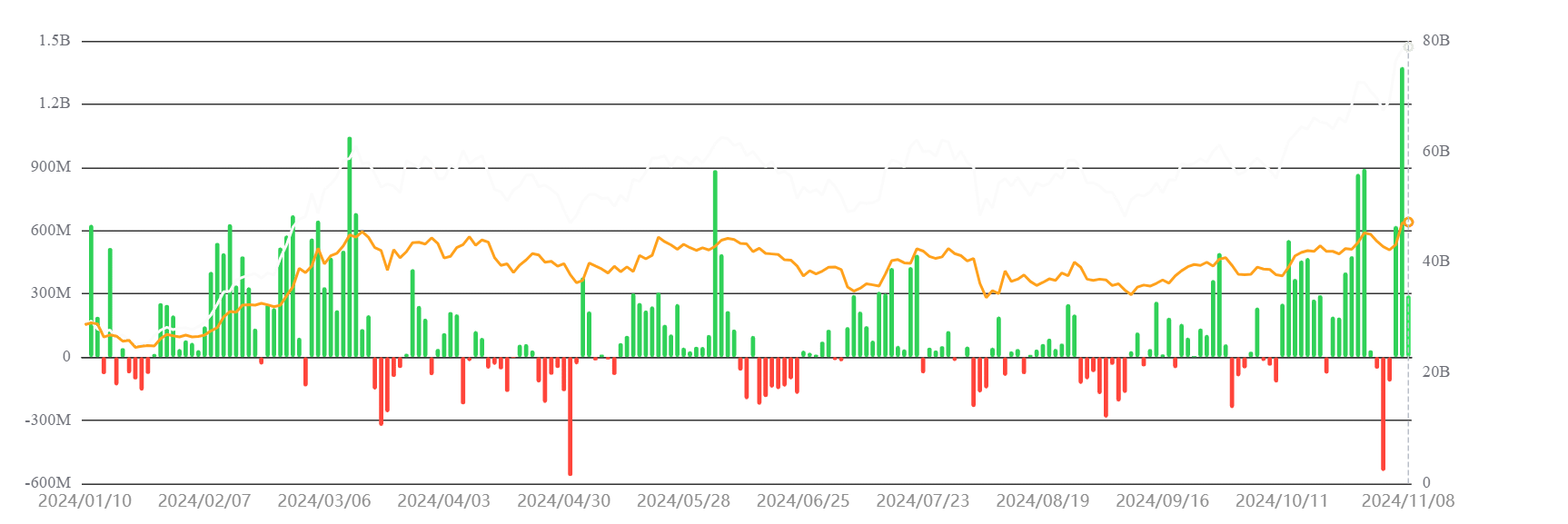

According to AMBCrypto’s analysis of SoSo Value data, nearly $26 billion worth of BTCs have flowed into these funds since they were listed.

Also, inflows have increased dramatically after an initial burst of outflows from the Grayscale Bitcoin Trust (GBTC).

Furthermore, at the time of writing, assets under management or AUMs for Bitcoin spot ETFs were nearly $79 billion, accounting for 5.21% of Bitcoin’s total supply.

Source: SosoValue

There are other reasons beyond crypto that could explain Bitcoin’s performance.

Inflation has decreased significantly in recent months. The labor market has also improved.

This led TThe US Federal Reserve (Fed) opts for a relatively flexible approach and leaves interest rates unchanged stable during last month’s FOMC meeting.

The broad consensus among investors and policymakers was that rates would remain unchanged at the next meeting, with the possibility of a rate cut later this year if inflation remains under control.

What this has done is that people have started spending money on risky assets like stocks and cryptocurrencies.

Is Bitcoin becoming scarcer and more expensive?

The increasing number of Bitcoins getting locked up in spot ETFs created scarcity in the broader market.

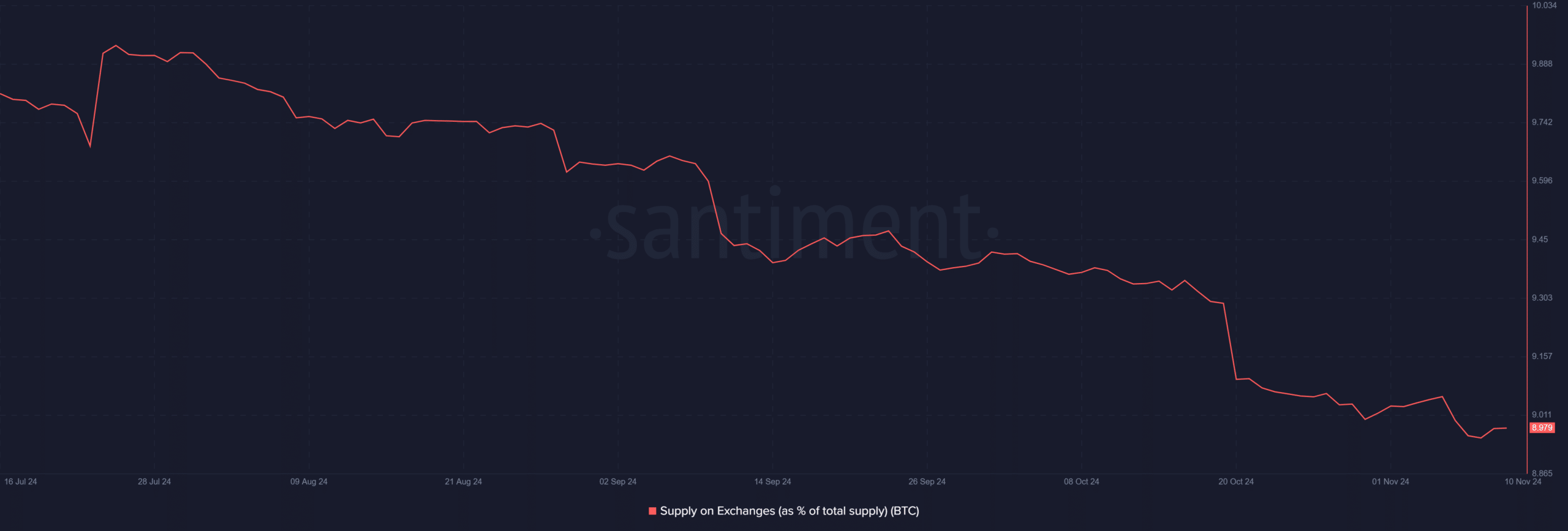

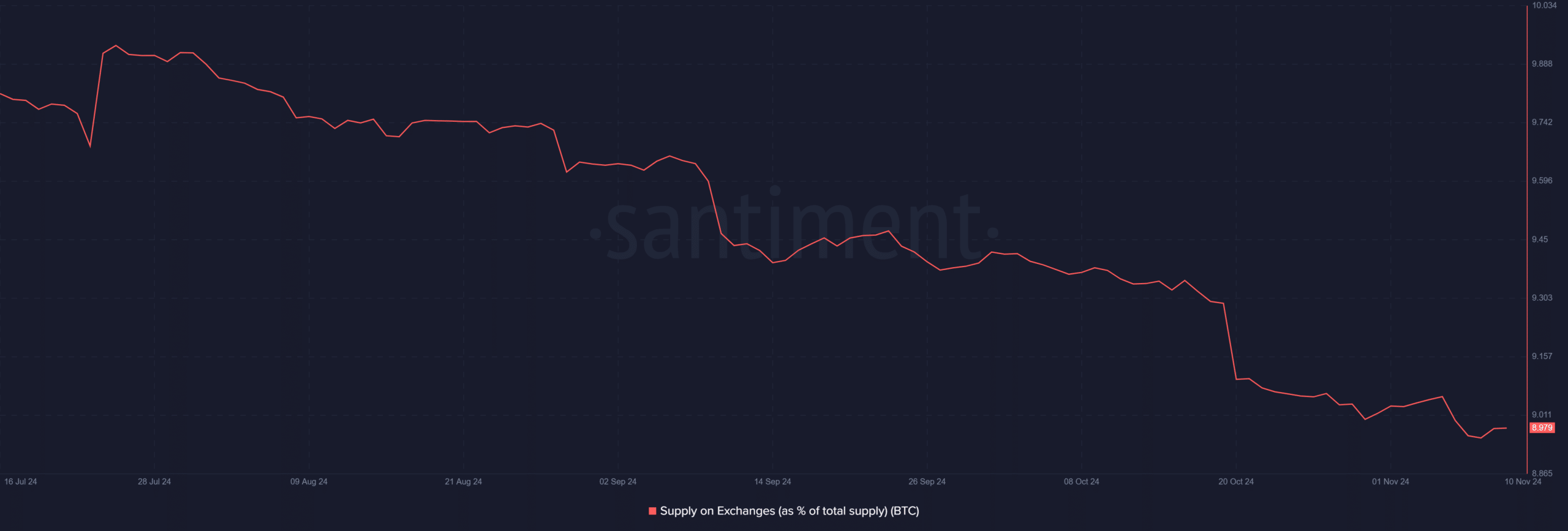

To that extent, supply on the exchanges continued to decline, according to AMBCrypto’s examination of Santiment data.

Furthermore, at the time of writing, approximately 9% of Bitcoin’s total circulating supply was held on exchanges, up from almost 12% at the beginning of 2024.

Source: Santiment

Even though supply fell, there was no drop on the demand side. On the contrary Unlike previous bull cycles, the 2024 Bitcoin rally was driven by both private and institutional interest.

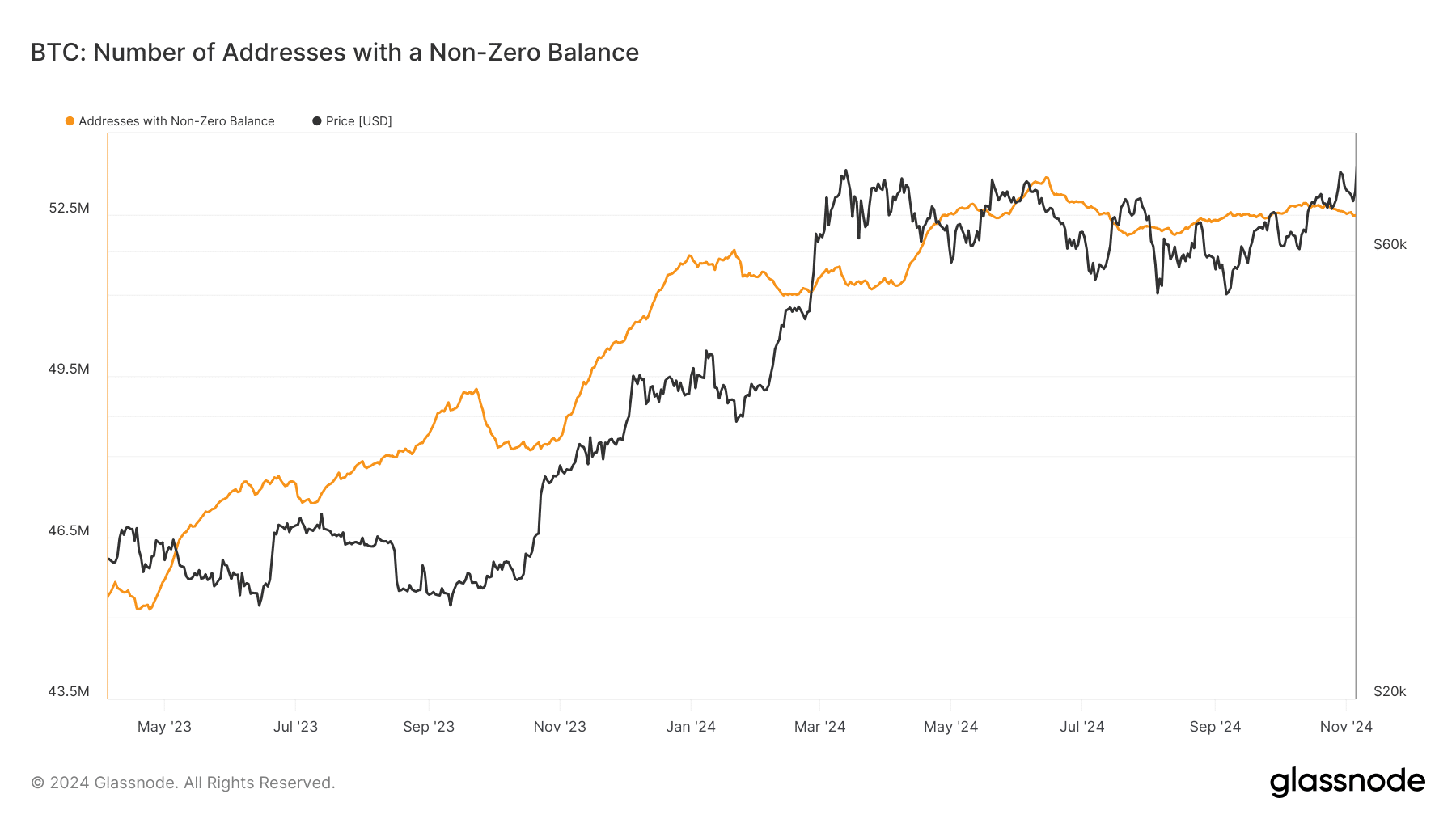

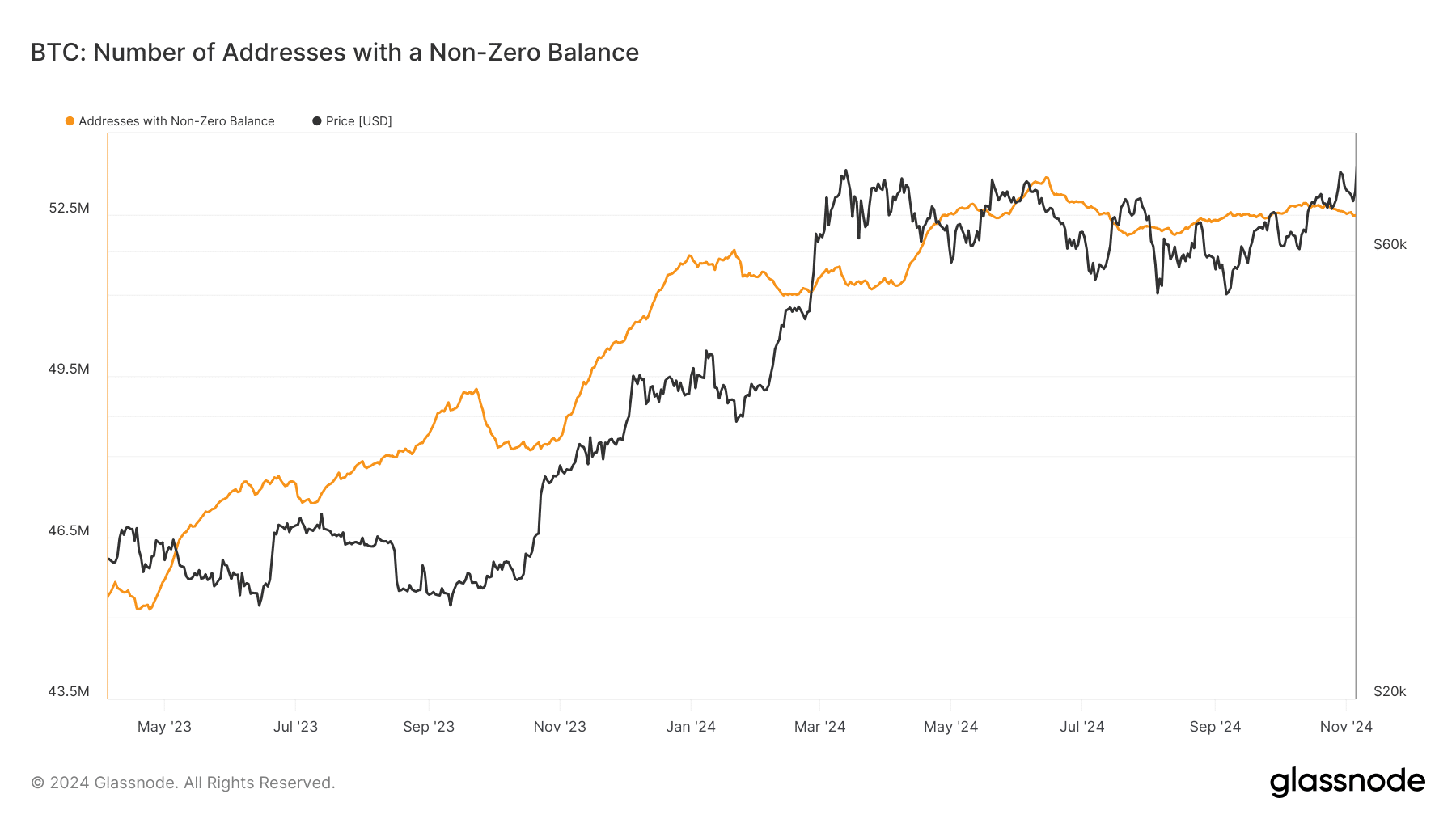

Using Glassnode, AMBCrypto saw a marked increase in the number of whale entities with 1K coins, while addresses with non-zero balances also increased since the start of 2024.

Source: Glassnode

Rocket ready for the moon?

This bullish scenario of decreasing supply and increasing demand had the potential to push Bitcoin to all-time highs this cycle.

Read Bitcoin’s [BTC] Price forecast 2024-25

Well-known technical analyst Ali Martinez had previously predicted that the market peak would be reached sometime between November 2024 and February 2025.

So $80,000 seems like just the beginning as we launch from the ground up. The rocket has enough fuel for the moon, it seems!