Amid the current market turmoil, the Bitcoin Fear & Greed Index has continued to decline sharply. The decline has pushed the index to its lowest level in more than three months, as crypto investors have grown more anxious and withdrawn their investments from the market.

Bitcoin Fear & Greed Index takes a nosedive

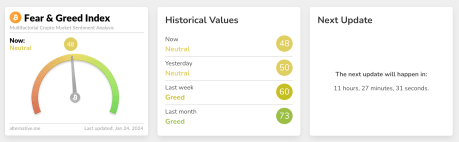

In the months leading up to year-end 2023, the Bitcoin Fear & Greed Index rose climbed steadily until it reached a high level of greed. Now, this index takes into account a number of factors to place investor sentiment into a number of categories ranging from extreme fear, fear, neutral, greed and extreme greed.

The Fear & Greed Index represents investor sentiment with scores between 1 and 100, with the lower end of the score representing fear levels and the higher ends representing greed. A score between 1 and 25 puts investor sentiment in the Extreme Fear category, 26-46 is Fear, 47-52 is Neutral, 53-75 is Greed and 76-100 is Extreme Greed.

In 2023, the score climbed to 74 as Bitcoin rallied towards $50,000. But as the market has retreated, so has investor sentiment, which is currently trending towards fear. At the time of writing, the Bitcoin Fear & Greed Index shows a score of 58, which puts it in neutral territory. It is also two scores lower than the previous day’s figures of 50, meaning investor sentiment is leaning more towards fear than greed.

Source: alternative.me

The current figure is the lowest the index has reached since October 2023. The last time the Bitcoin Fear & Greed Index fell below 48 was on October 17, 2023. In cases like this, it appears that investors are less inclined to put money into the stock markets. market. This causes demand to drop, and as a result, asset prices across the space suffer.

BTC price begins to show strength | Source: BTCUSD On Tradingview.com

When will the bleeding stop?

So far, the Bitcoin price drop has been caused by massive outflows from the Grayscale Bitcoin Trust (GBTC) as investors redeemed their shares. More than $2 billion worth of BTC has flowed out of the fund, putting a lot of selling pressure on the asset.

However, as the week progresses, outflows are expected to slow as investors stop selling. In such a case, demand could merely overtake the supply being dumped on the market, giving Bitcoin and other assets a chance to recover.

At the time of writing, the Bitcoin price is still hovering around $40,000, after returning from a dip to $38,500. According to data from Coinmarketcap, the price has risen 2.6% over the past week.

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.