- Bitcoin Seizes on Moderate Fear; If this continues, short-term holders may sell to break even.

- Their departure could mean a rock bottom price.

Bitcoin [BTC] Bulls have prevailed after what appears to be the longest consolidation in history, pushing BTC above $60,000. However, the momentum was short-lived, with BTC falling below support and trading at $59.8K at the time of writing.

As a result, market sentiment has returned to fear as bulls and bears battle for control of key support levels.

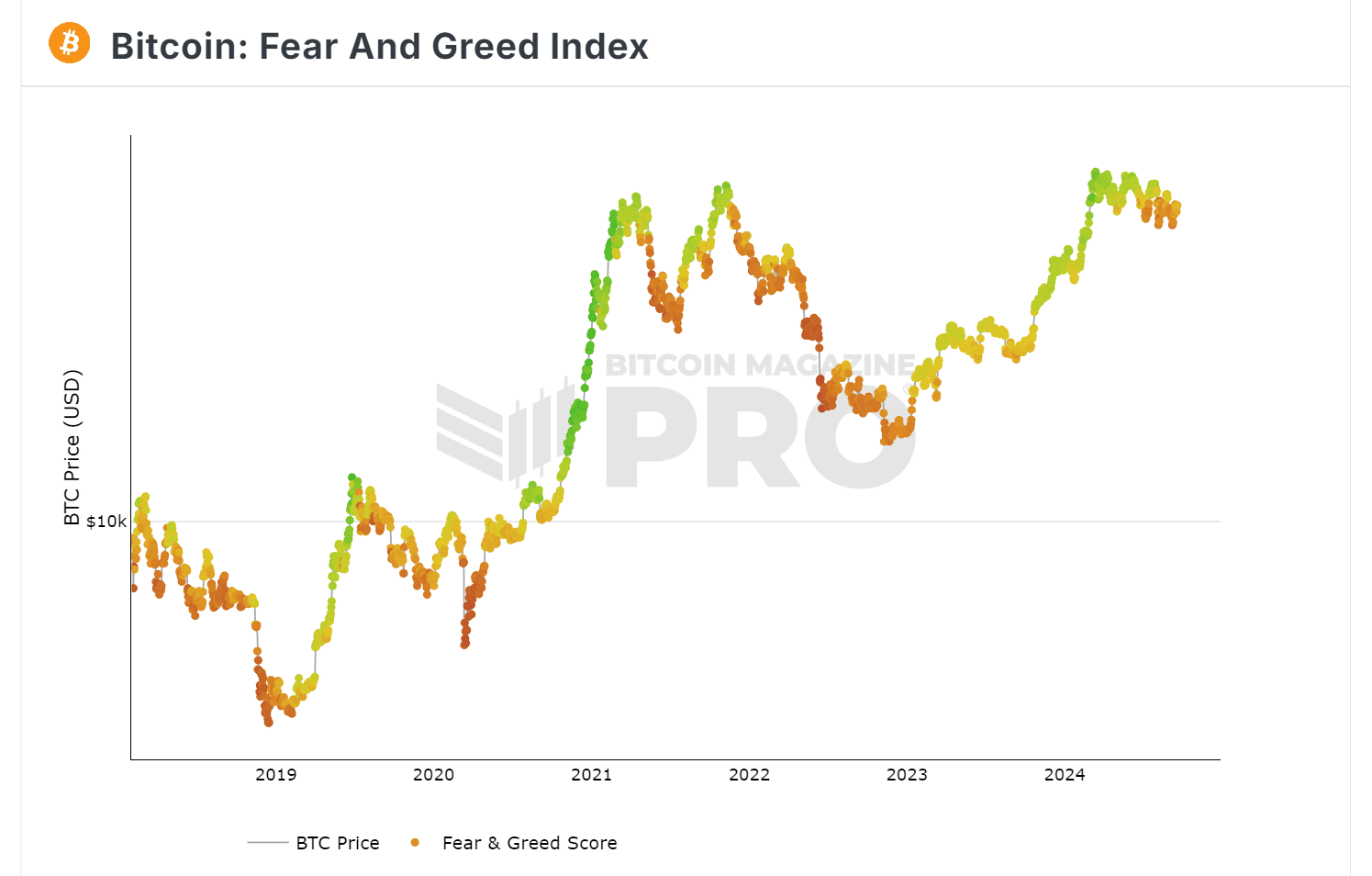

Bitcoin Fear and Greed shows great fear

Historically, an index below 20 has meant extreme fear, often in line with price bottoms. During these periods, new investors flood the market in search of cheap BTC, while short-term holders exit to break even.

Currently, the Bitcoin market is experiencing moderate fear, making investors more cautious. If this trend continues, it could increase the likelihood of a price bottom.

Source: Bitcoin Magazine Pro

Simply put, if fear persists, short-term holders may sell, driving prices down. Only once a price bottom is reached can a recovery prompt investors to buy the dip.

Therefore, monitoring STH activity could provide insights. If fear leads to panic selling, Bitcoin could be headed for a price bottom.

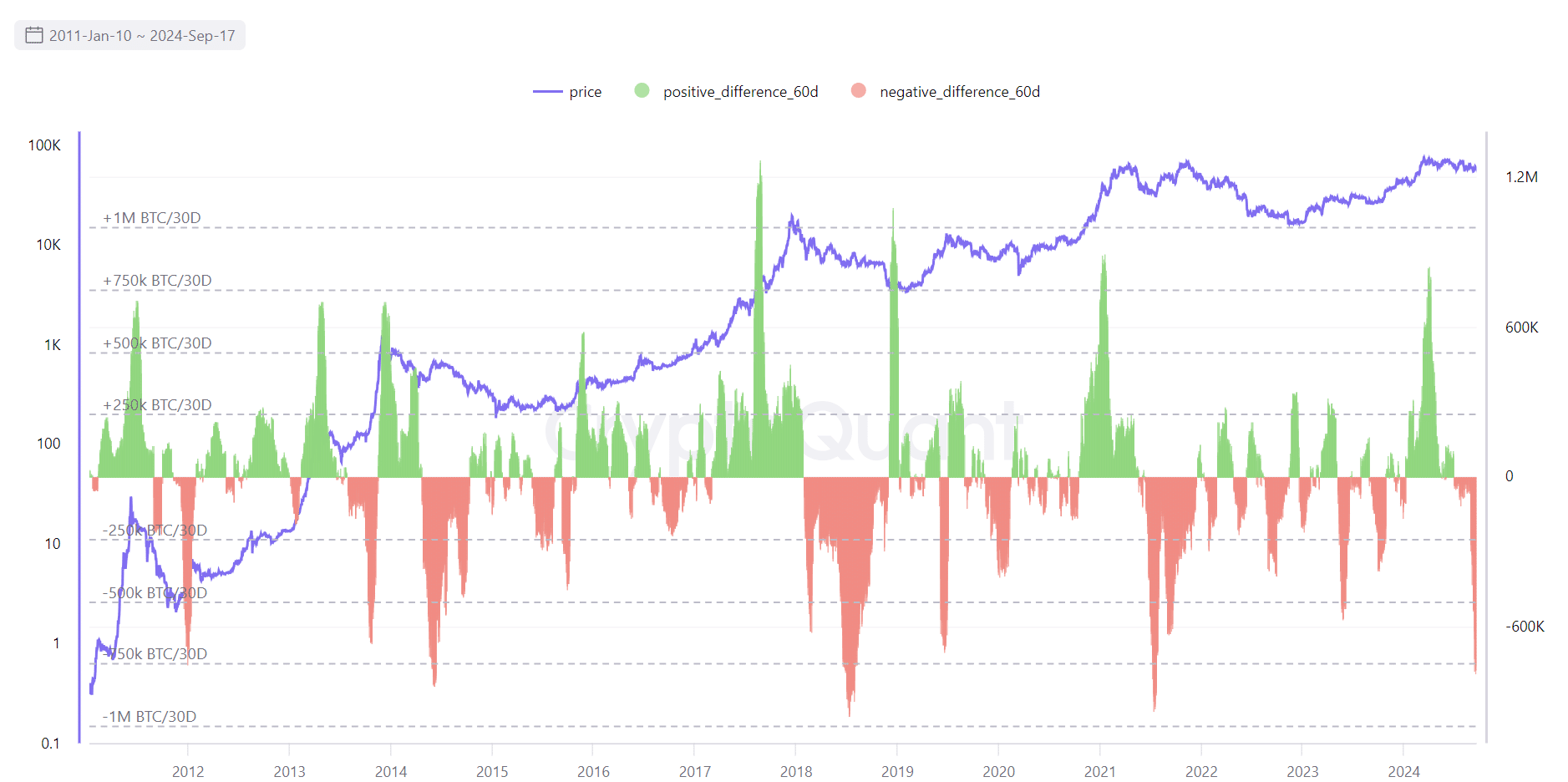

STH’s exit poses a real threat

According to AMBCrypto’s analysis of the chart below, a spike in STH’s negative net position often indicates a market top followed by a bearish pullback.

In short, STH exits typically occur when BTC encounters significant resistance, with the subsequent decline reflecting their strategy to exit before prices fall.

Source: CryptoQuant

Contrary to popular belief, if this trend continues, the $60,000 – $61,000 range could act as resistance rather than support.

Therefore, if the bulls fail to maintain control, BTC could return to the $51,000 support before a possible correction.

To confirm this trend, AMBCrypto examined long-term holders. If $60,000 becomes the next bottom, it could present a buy-the-dip opportunity.

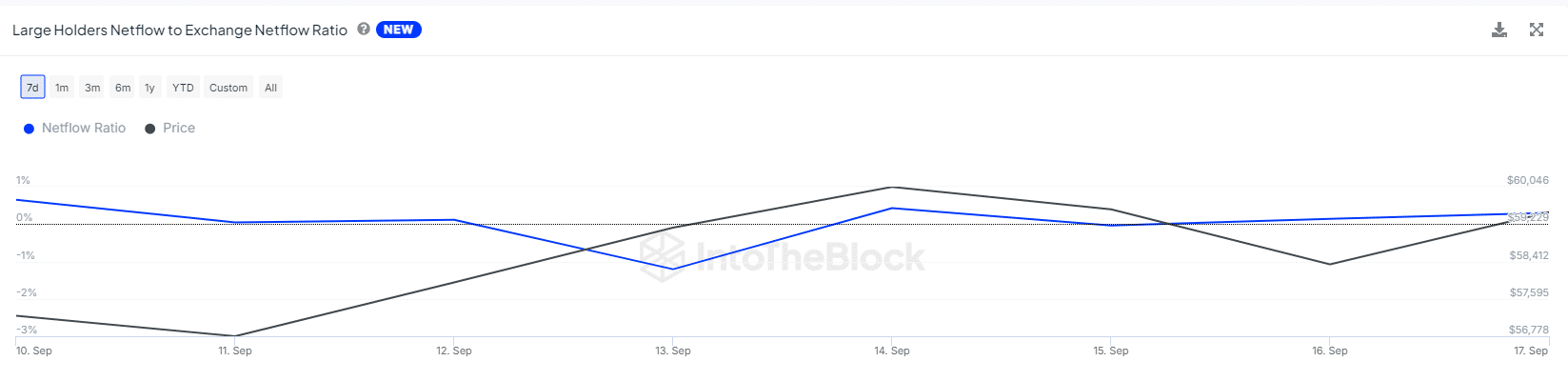

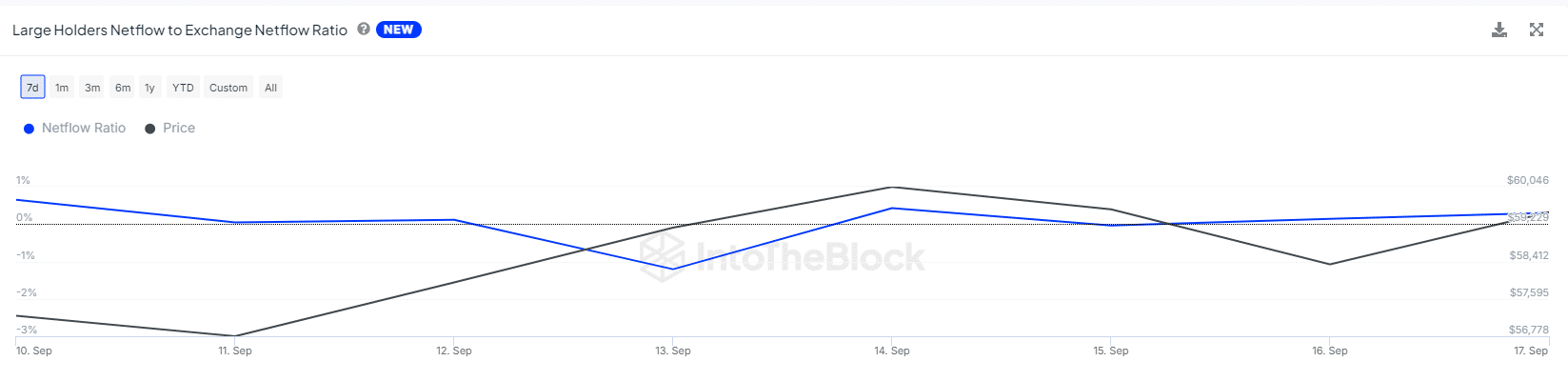

Large cohorts hold the key to the top

While short-term holders are adjusting their positions as BTC encounters crucial resistance, long-term holders have been actively disinvesting to keep the $60,000 level as the next support zone.

The net flow ratio, now at 0.30%, has doubled from the previous day, indicating increasing support from large hodlers, as shown in this after.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024-25

$60,000 represents a key battleground, with short-term holders viewing this as a potential market bottom, reinforced by growing fear.

The reversal from $60,000 to solid support depends on long-term holders, whose actions could call into question the price floor.