- Bitcoin trading volume on Binance has declined sharply, increasing the market’s vulnerability.

- Retail interest remains inconsistent, indicating uncertain market sentiment in the near term.

After a brief period of optimism earlier in December, Bitcoin [BTC] has failed to maintain its momentum, falling below the $100,000 mark and remaining stagnant in recent weeks.

The digital asset has seen little upward movement and its price now stands at $92,790, reflecting a 13.2% decline in the past two weeks.

At this level, Bitcoin was trading 14.2% below its all-time high of $108,135 at the time of writing, reached earlier in December.

This lackluster performance has raised concerns among market participants, with both trading volume and retail interest showing noticeable declines.

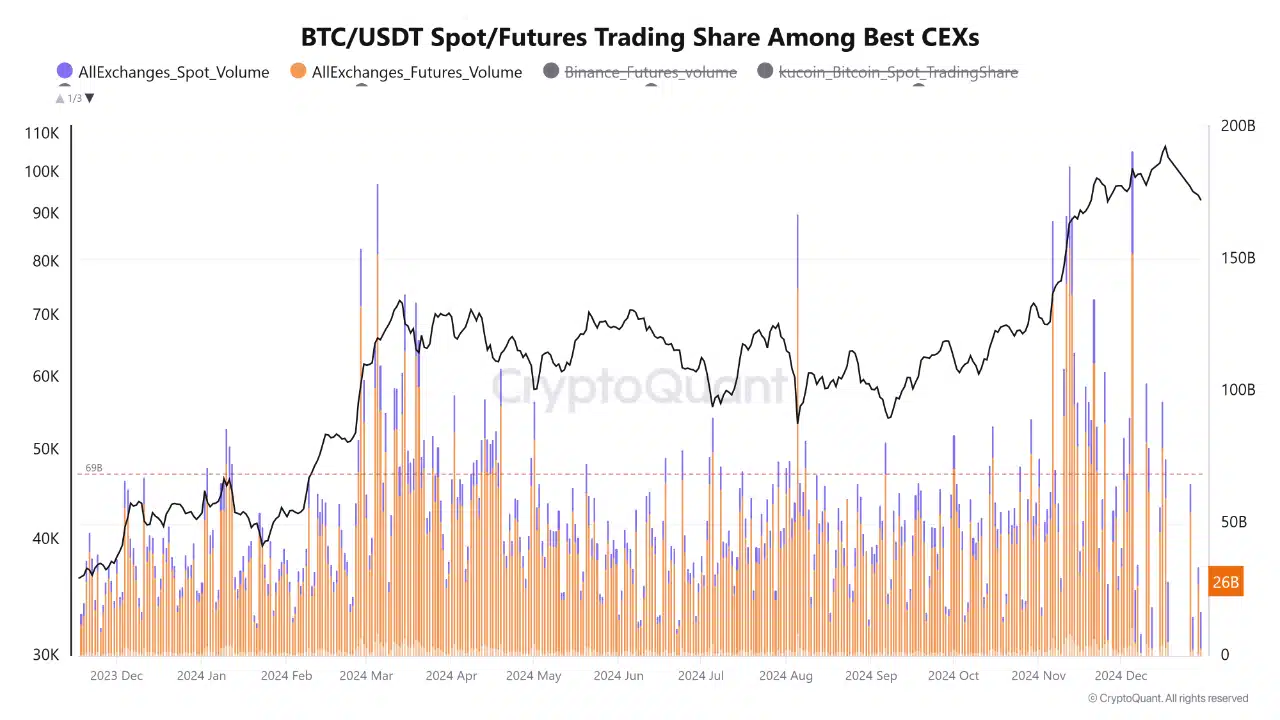

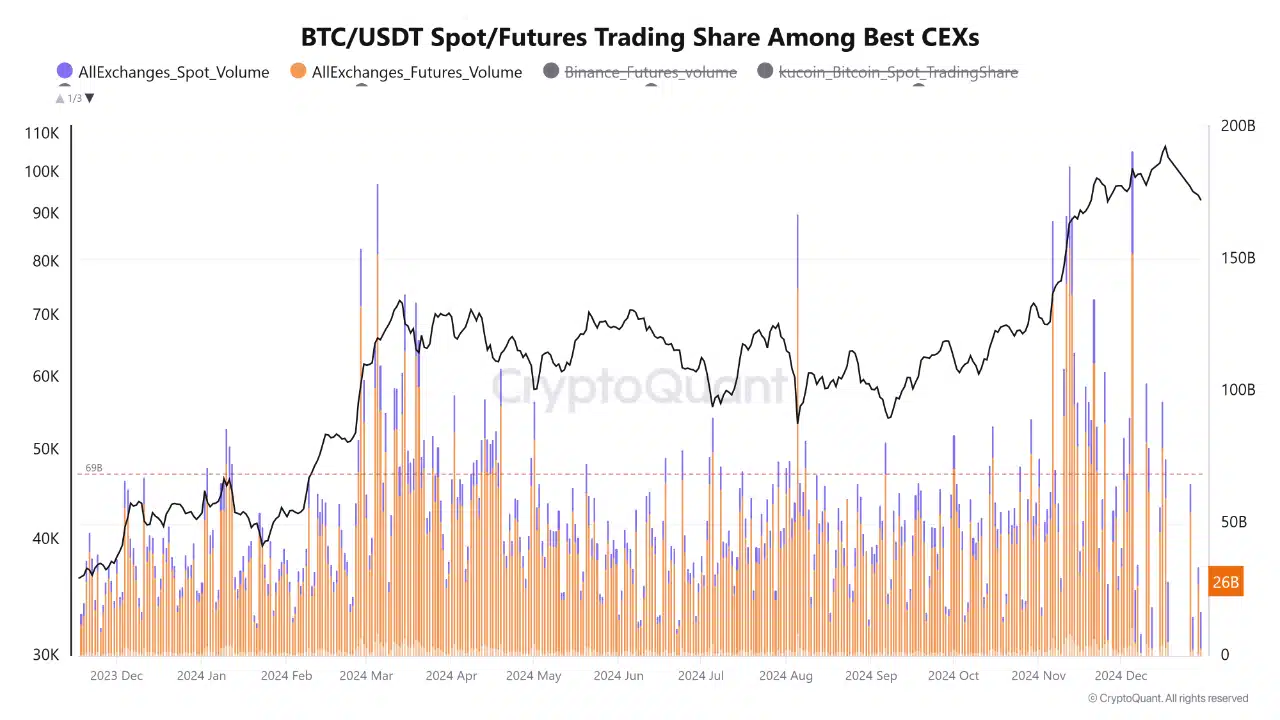

A key factor Adding to this lackluster performance is the significant drop in Bitcoin trading volume on Binance, the world’s largest cryptocurrency exchange.

This past week, trading activity on both spot and futures BTC/USDT pairs has fallen sharply.

Source: Glassnode

Centralized exchanges are crucial for providing liquidity and maintaining the balance between supply and demand.

Reduced activity on Binance has made the market more vulnerable as lower demand makes it harder to counter selling pressure.

This imbalance creates an environment where even small fluctuations in buying or selling activity can cause significant price swings.

Analysts advise traders to be cautious and avoid impulsive decisions as current market sentiment remains fragile.

Mixed signals from retail activity

In addition to trading volume, other critical Bitcoin metrics provide further insight into the asset’s current market conditions.

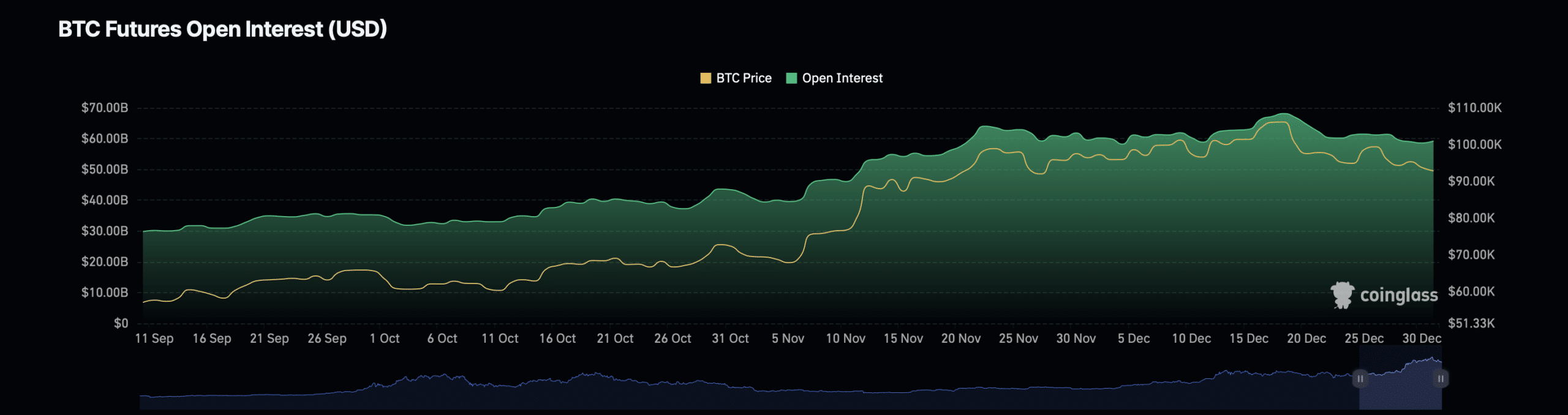

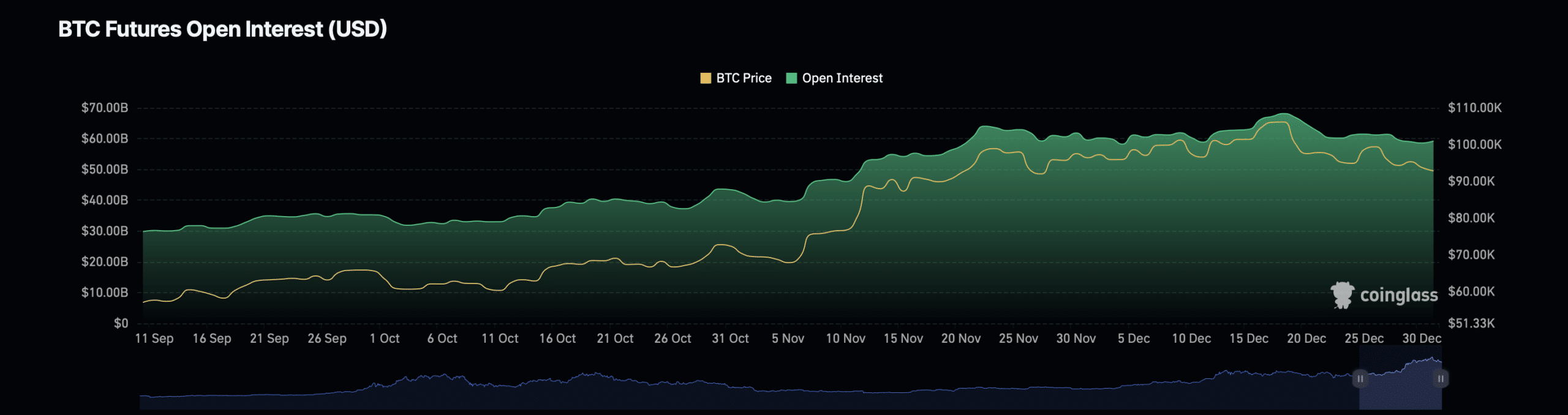

Facts from Coinglass revealed that Bitcoin Open Interest – which represents the total value of outstanding futures contracts – fell 2.58% to approximately $57.66 billion.

Source: Coinglass

This decline signals declining interest from futures traders, which is typically interpreted as a sign of reduced speculative activity.

In contrast, however, Bitcoin Open Interest volume has increased by 71.7%, now valued at $109.92 billion.

This increase suggests that even though there are fewer traders active, those still participating in the market are taking larger positions, possibly indicating a degree of confidence in future price movements.

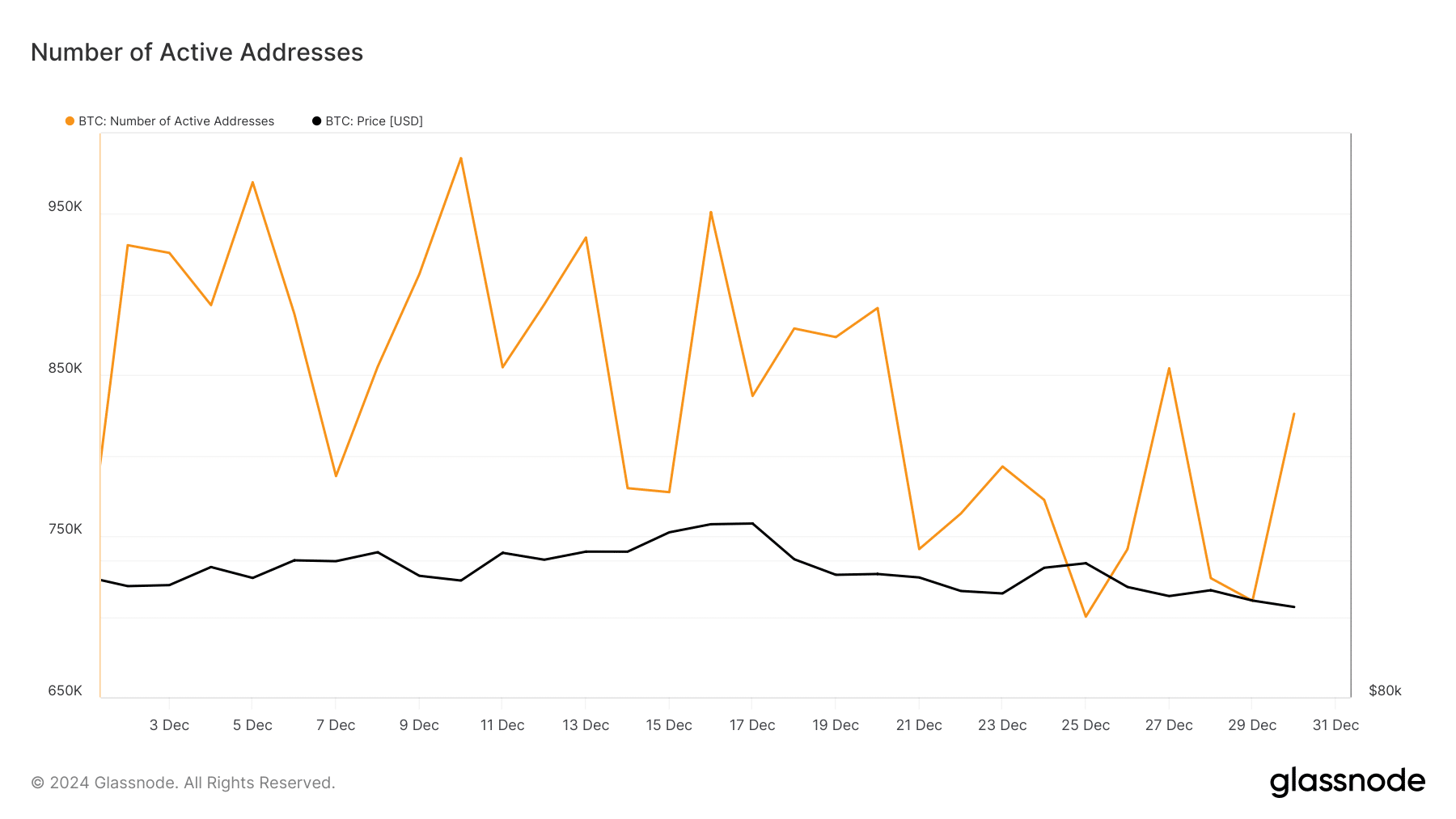

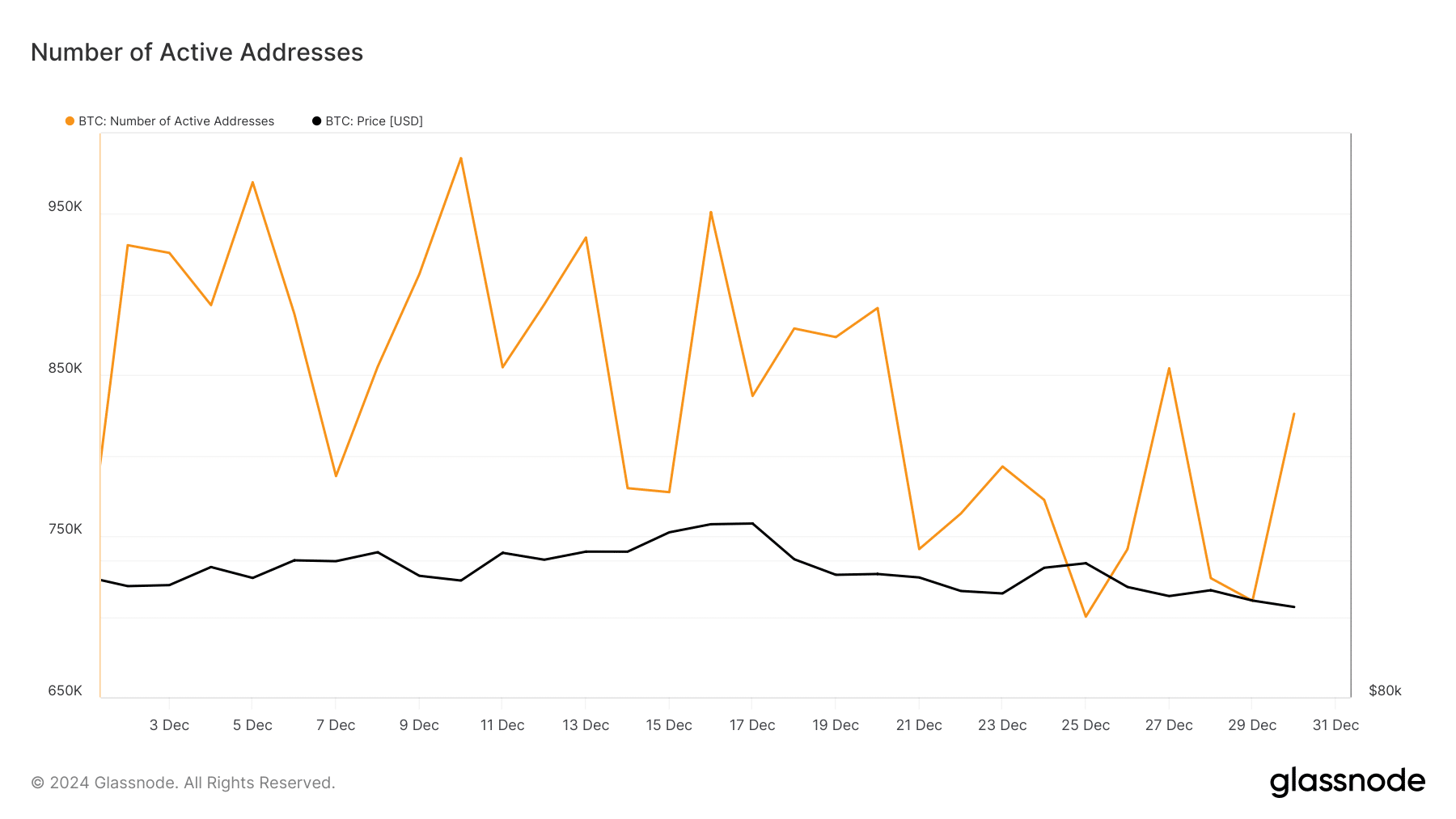

Going forward, Bitcoin’s active address count provides insight into retail participation and on-chain activity. Active addresses reflect the number of unique Bitcoin addresses involved in transactions on a given day.

Active addresses earlier in December hit a low of 787,000 before recovering to 984,000 on December 10.

However, activity fell again to 700,000 on December 25, before recovering slightly to 826,000 on December 30.

Source: Glassnode

Read Bitcoin’s [BTC] Price forecast 2024–2025

This pattern indicates inconsistent retail interest, with short bursts of activity followed by sharp declines.

Such fluctuations indicate a lack of sustainable retail momentum, which remains crucial to driving Bitcoin’s price higher during bull cycles.