- Bitcoin lost much of its recent gains during the week leading up to election night in the US

- Historical patterns pointed to an impending bull rally on the charts

After a peak that was getting closer to its all-time high [ATH] with a price of $73,600, Bitcoin [BTC] took a detour. In fact, the price fell to a low of $67,459 on November 3.

However, does this decline mean the bear market is back or is it just a short-term correction?

Why has Bitcoin fallen?

To answer the question, AMBCrypto took a closer look at BTC’s historical data to discover that the price drop could actually be its last. For example, in 2016, the cryptocurrency dropped 10% just days before the election.

Similarly, Bitcoin’s value fell by 6.2% in 2020. BTCs The continued decline appears to reflect these past patterns, with Bitcoin losing more than 8% of its value since the aforementioned high.

Election-induced uncertainty

A similar view was shared by Quinten Francois, co-founder of WeRate, who explained that the period of increased unpredictability before the elections directly affects investor sentiment. He posted on X,

“Financial markets do not like uncertainty. There is a lot of uncertainty during election week. That’s why $BTC has fallen.”

The founder of CryptoSea, known as Crypto Rover, supported this perspective to report,

“Bitco always dumps right before the US elections.”

Here it is worth pointing out that at the time of writing, the cryptocurrency had recovered and was trading just below $69,000 on the charts.

What’s next for Bitcoin?

With the cause of the dip seemingly rooted in the uncertainty surrounding the upcoming elections, the pressing question is: what comes next for the king coin?

Well, previous patterns dictate that post-election periods have marked the beginning of bull runs that will continue well into the next year.

In 2016, Bitcoin gained about 60% two months after the election.

Source: TradingView

Moreover, there is a profit of approx 150% were registered after the 2020 presidential election.

Source: TradingView

So if history repeats itself, BTC could reach a new ATH in the coming months.

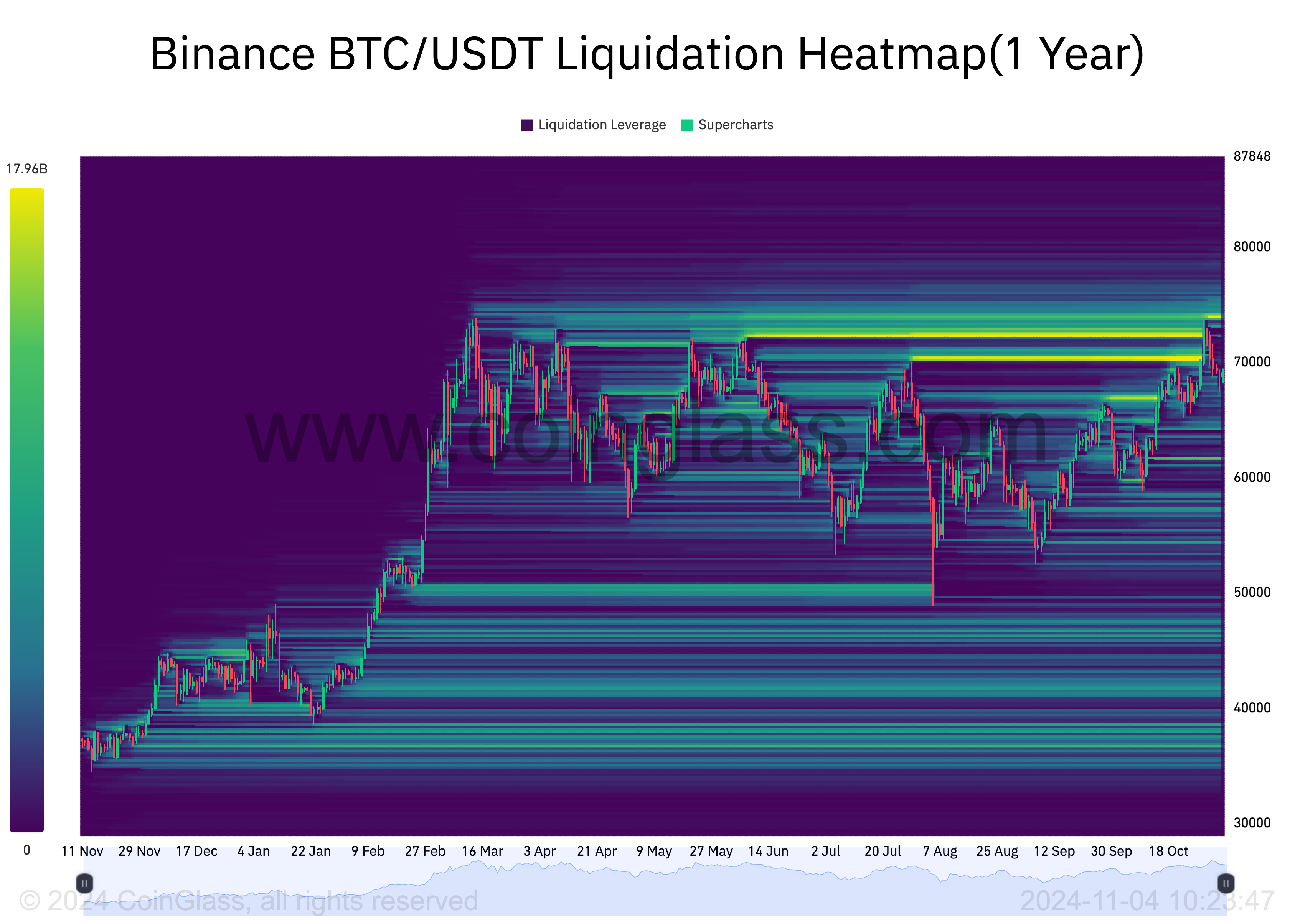

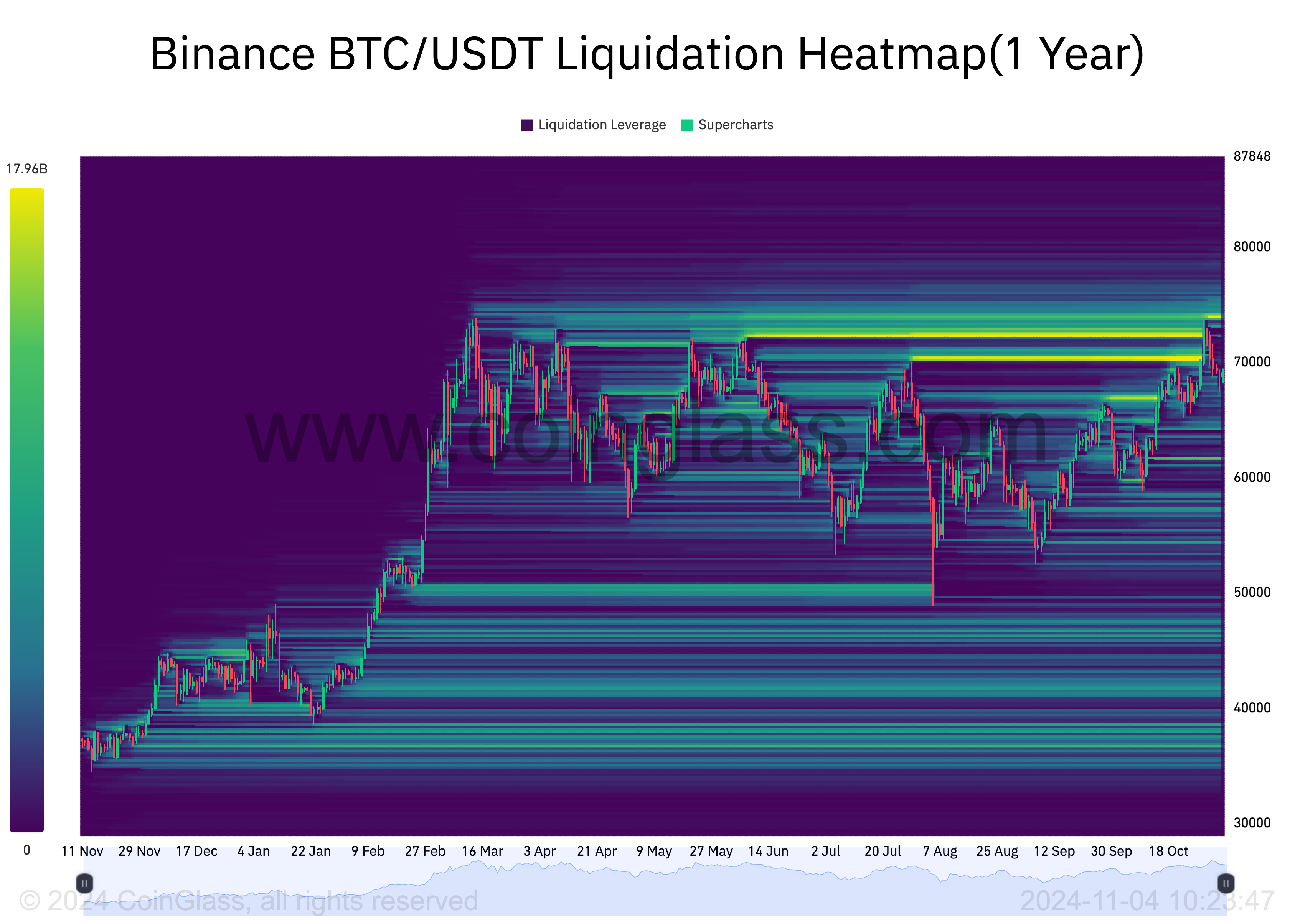

Finally, AMBCrypto’s analysis of the 1-year-old liquidation heatmap from Coinglass also hinted at the likelihood of more highs.

A strong liquidity cluster formed around $74,000. This magnetic zone could attract the price and mark a new ATH for the king coin.

Source: Coinglass

Altcoin Outlook: Trump vs. Harris Win

While a Bitcoin bull run seems likely regardless of the election outcome, the outlook for altcoins varies. AMBCrypto before reported that a Donald Trump victory could mean a more favorable environment for altcoins.

This is due to possible relaxed crypto regulations from the Republican government. Clearer SEC guidelines based on which altcoins qualify as securities could also trigger bull runs for the assets.

Also AMBCrypto noted that while Bitcoin investors redistribute post-election profits, some altcoins could see gains. Nevertheless, the likelihood of a prolonged ‘altcoin season’ remains uncertain at this time.