- BTC’s long/short ratio fell, indicating a price correction.

- The technical indicators remained bullish.

Bitcoin [BTC] successfully breached $66,000 a few days ago, creating excitement in the community. But the trend did not hold and fell below that level again. In fact, the latest data showed that this could be the start of a major price correction.

Bitcoin is at risk in the future

Bitcoin witnessed a price correction in the last 24 hours, pushing its value below $66,000. To be precise, at the time of writing, BTC was trade for $65,504.34. Basically AMBCrypto reported rather that there were chances that BTC would fall victim to a price correction.

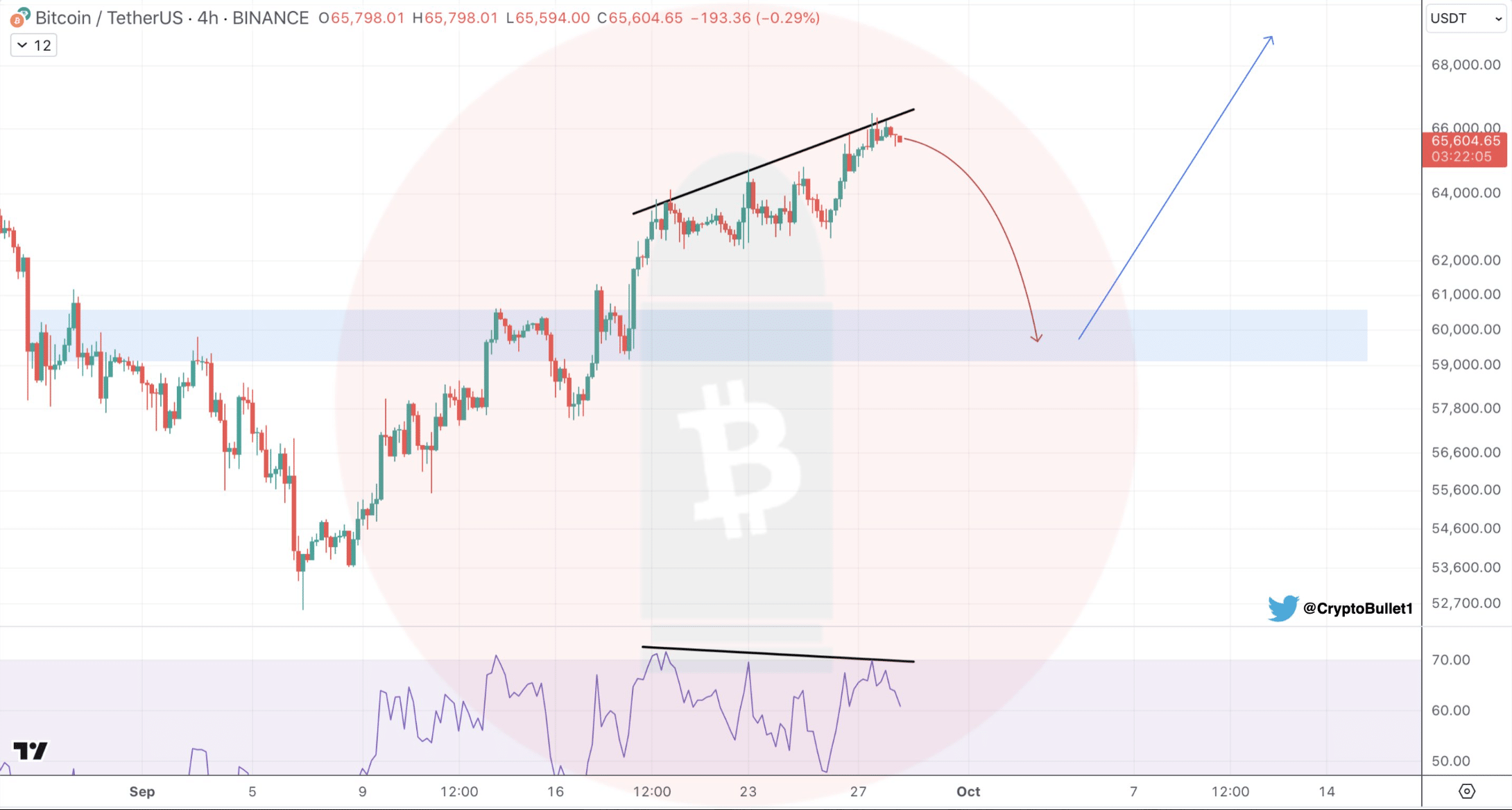

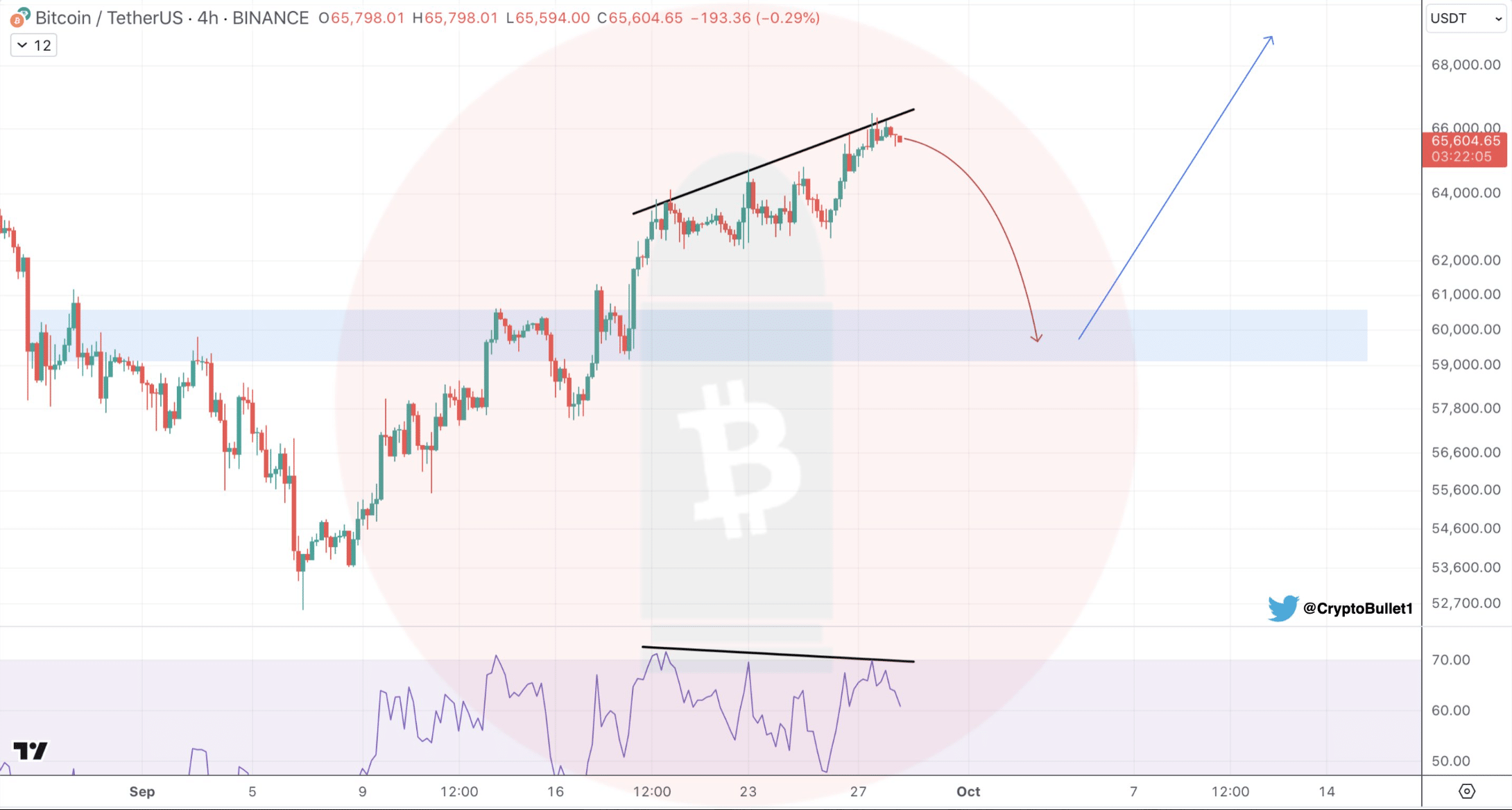

In the meantime, Crypto Bullet, a popular crypto analyst, recently posted a tweet revealing a bearish divergence on BTC’s 4-hour chart.

Whenever such a difference occurs, it indicates that the likelihood of a price correction is high. The tweet stated that in the event of a bearish trend reversal, investors might as well witness a drop in BTC to $60,000.

Source:

What statistics suggest

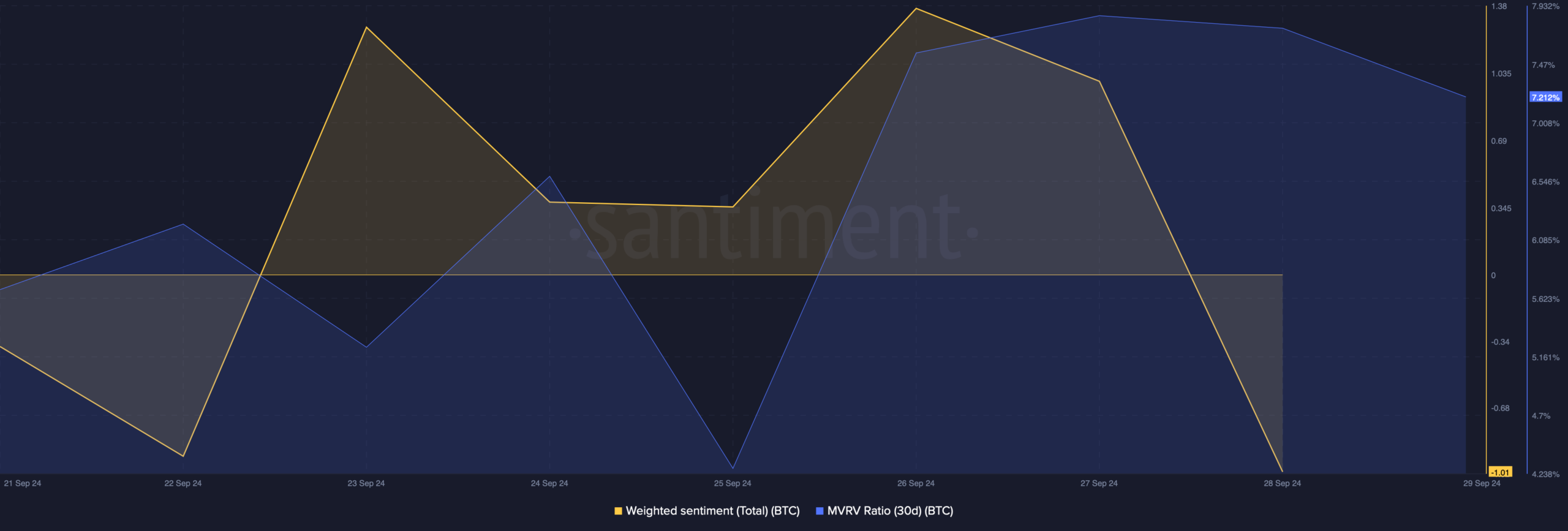

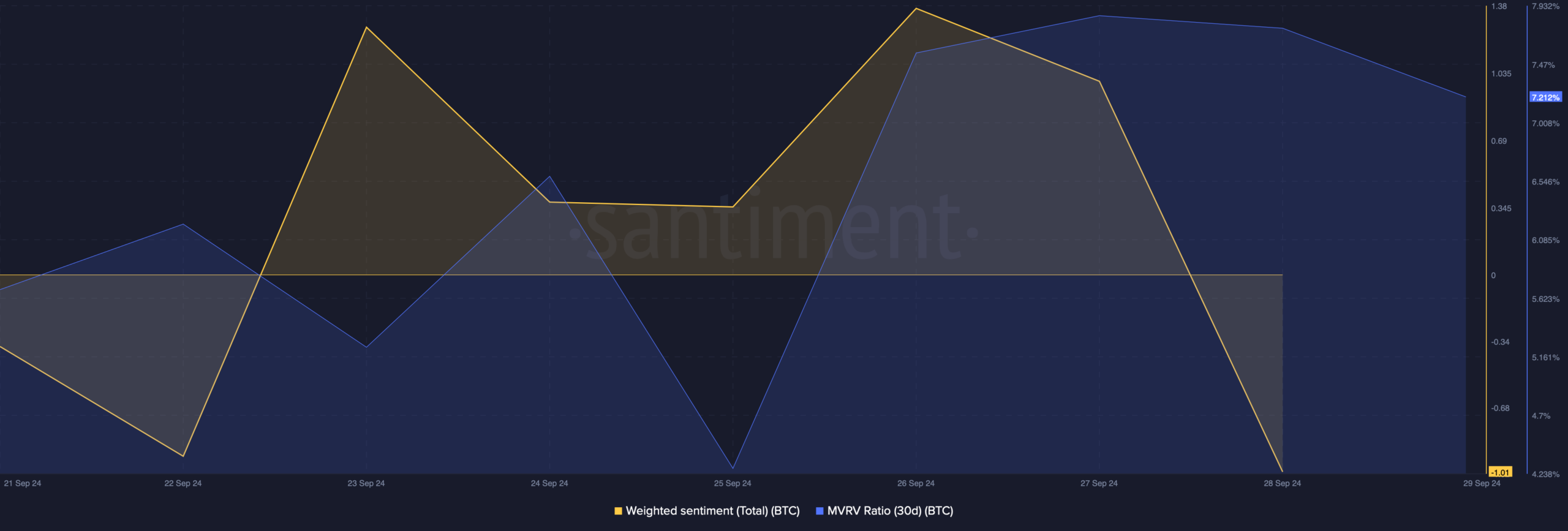

AMBCrypto then checked the king coin’s on-chain data to find out if it also indicated a price correction.

Our analysis of Santiment’s data shows that after peaking, BTC’s MVRV ratio has fallen slightly in recent days, which can be inferred as a bearish signal.

Market sentiment around the coin also turned bearish, which was evident from the drop in weighted sentiment.

Source: Santiment

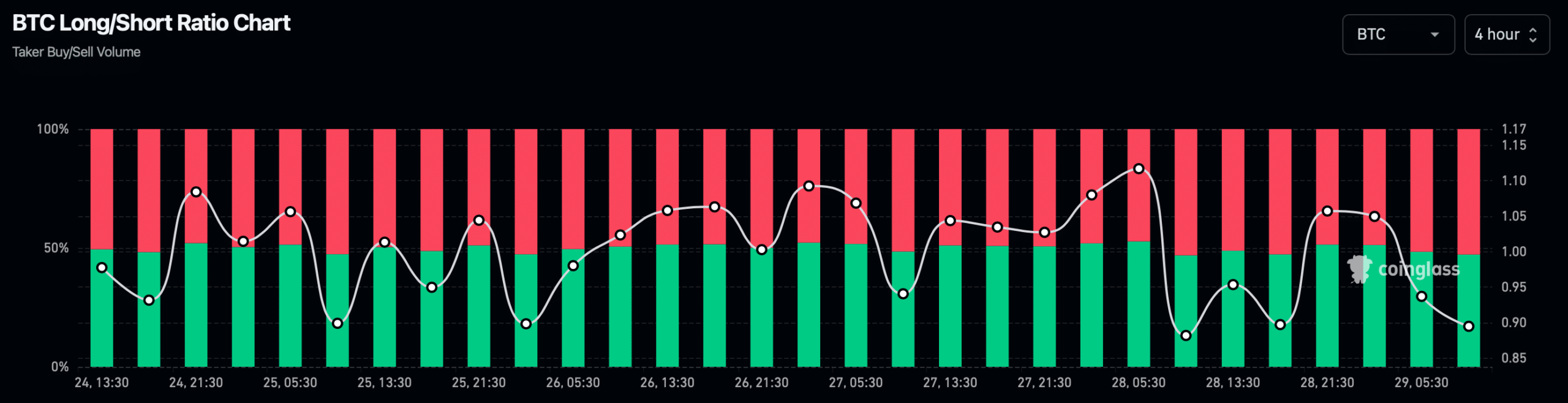

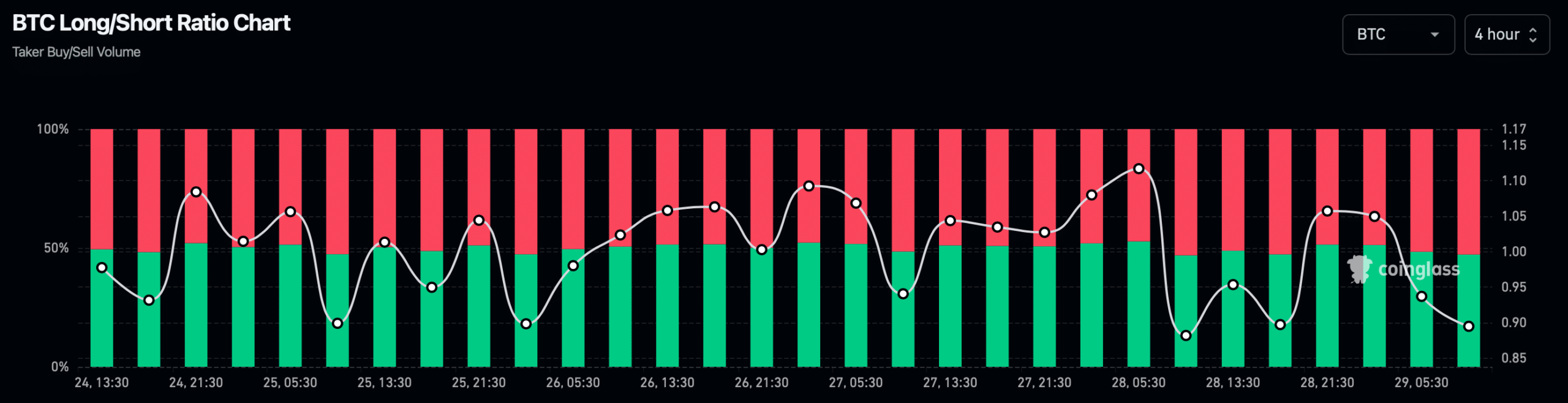

Apart from that, AMBCrypto’s look at Coinglass’s data also revealed a bearish signal. We found that Bitcoin’s long/short ratio fell. A decline in the benchmark means that there are more short positions in the market than long positions.

This can be considered a bearish signal as it indicates an increase in bearish sentiment.

Source: Coinglass

However, not everything was in the bears’ favor. For example the fear and greed index had a value of 38% at the time of printing. This meant that the market was in a ‘fear phase’.

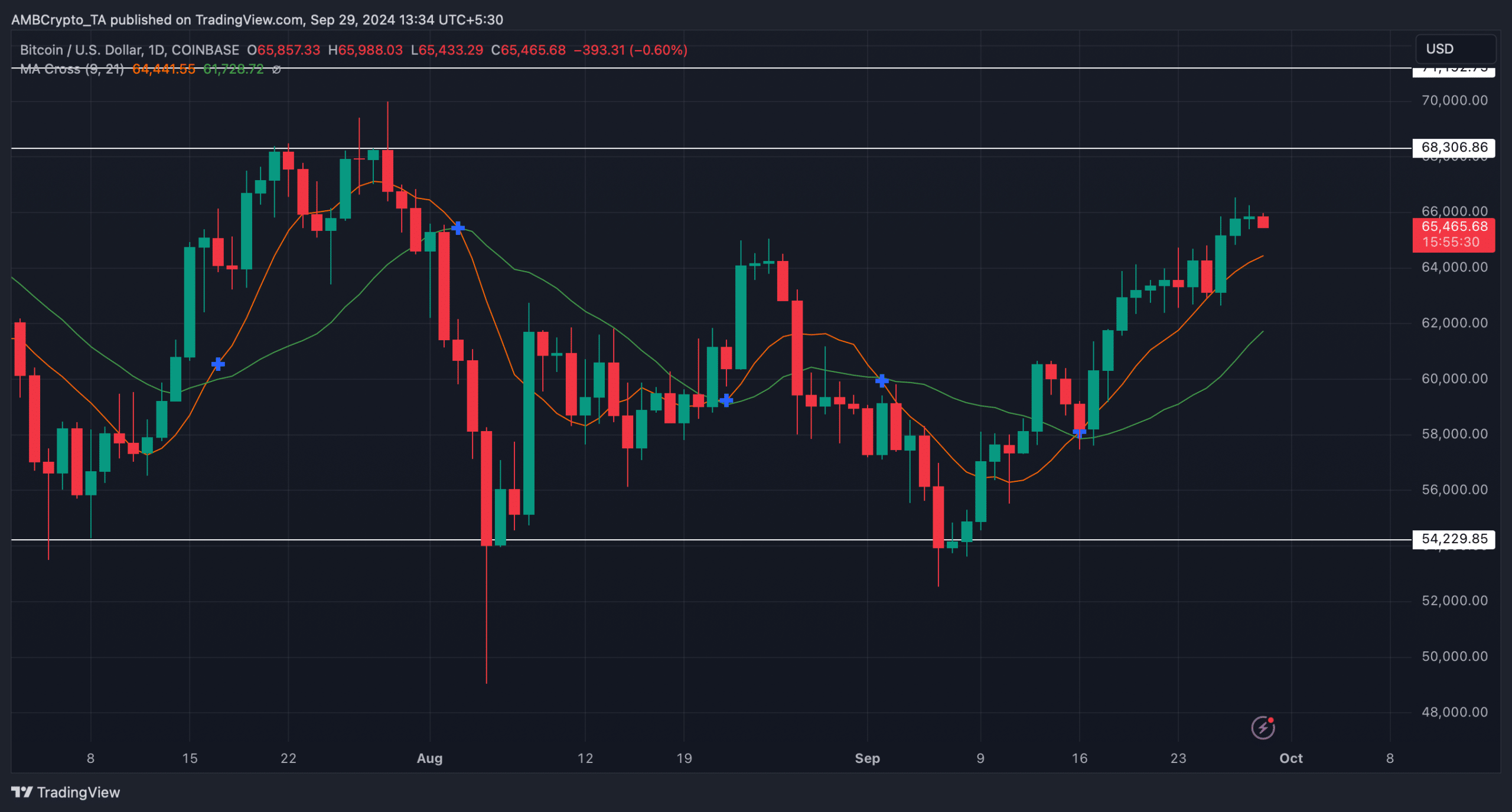

When that happens, it indicates that there is an opportunity for a price increase. If that turns out to be true, BTC might not be able to drop to $60,000 any time soon. That’s why we checked the daily chart of the coin.

Is your portfolio green? View the BTC profit calculator

According to our analysis, the 9-day MA was still well above the 21-day MA, indicating bullish upside in the market. If the bull rally restarts, BTC could potentially target $68,000 first.

If the above analysis is true, BTC could drop to $60,000 again.

Source: TradingView