- Bitcoin broke past the USD 96K resistance, signaling strong bullish momentum towards USD 120K.

- Rising active addresses and declining foreign exchange reserves strengthened the rally.

Bitcoin [BTC] recently broke the critical resistance at $96,000, in line with the predictions of the Long-Term Power Law model. This milestone opens the way for potential price development towards $120,000.

At the time of writing, Bitcoin was trading at $98,633.53, up 0.50% in the past 24 hours.

However, holding above $96,000 remains essential as losing this level could lead to local selling. Will Bitcoin’s breakout trigger a broader bull run?

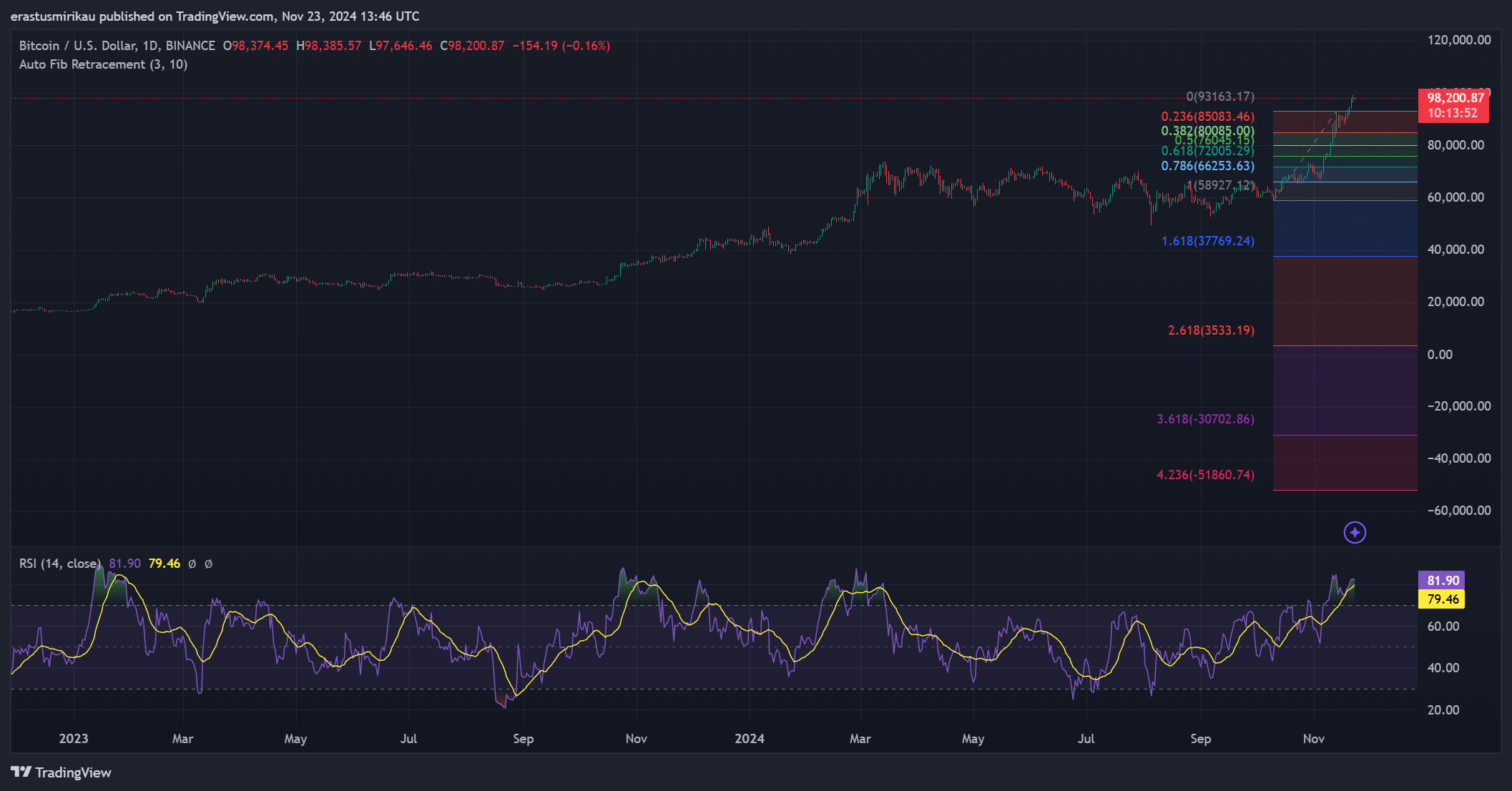

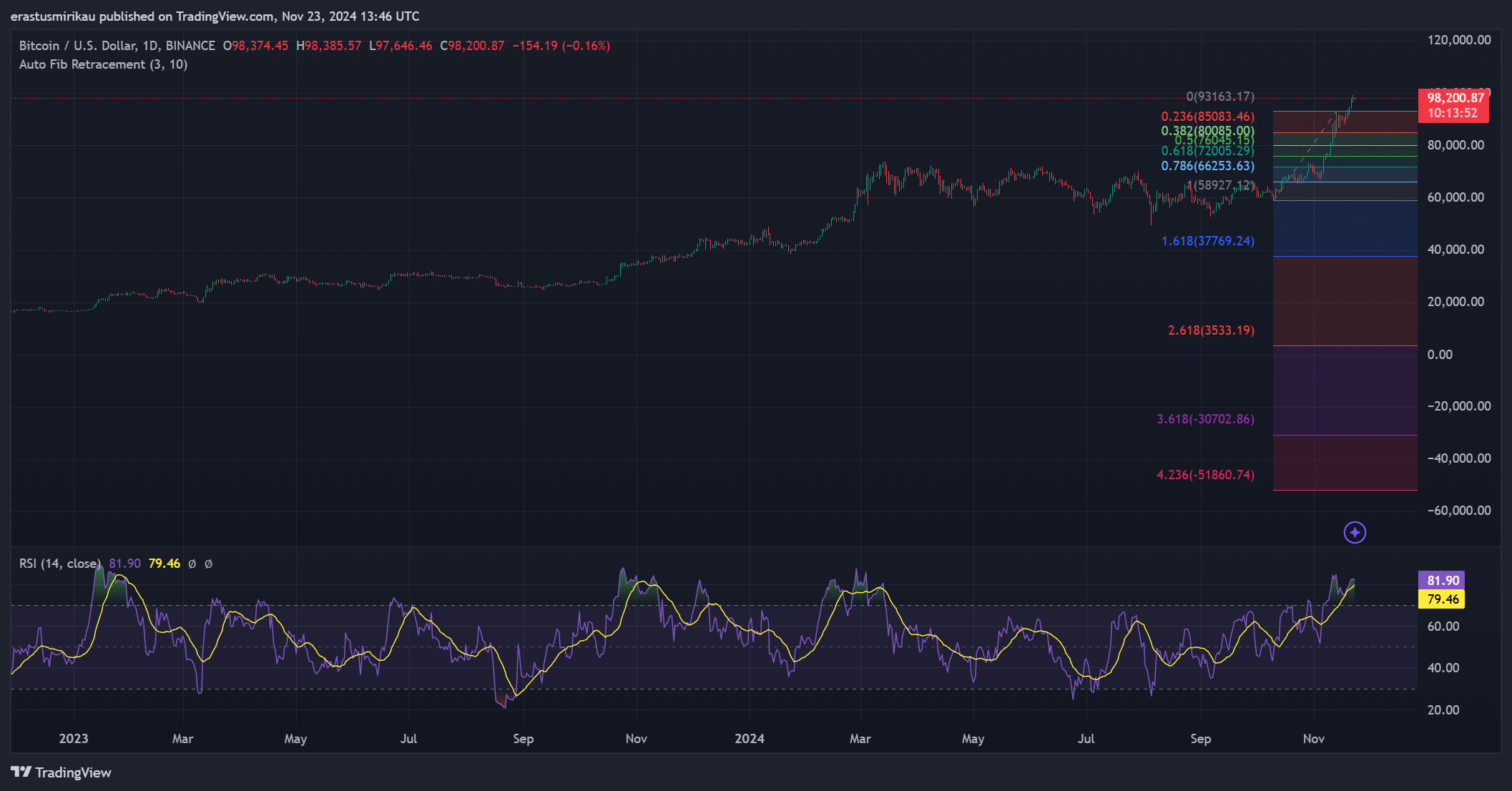

Technical signals confirm bullish momentum

Bitcoin’s price action suggested solid bullish momentum. The RSI was 79, reflecting strong buying activity at the time of writing, but also approaching overbought territory.

Moreover, the Fibonacci retracement levels indicated that Bitcoin was safely above the critical retracement zone of 0.786 at $85K, strengthening its upward trajectory.

The next major Fibonacci extension at $120,000 could be within reach if $96,000 remains a solid support. However, the risk of a retracement remains.

In particular, a drop below $96,000 could undermine the rally and lead to consolidation or corrections towards lower levels.

Source: TradingView

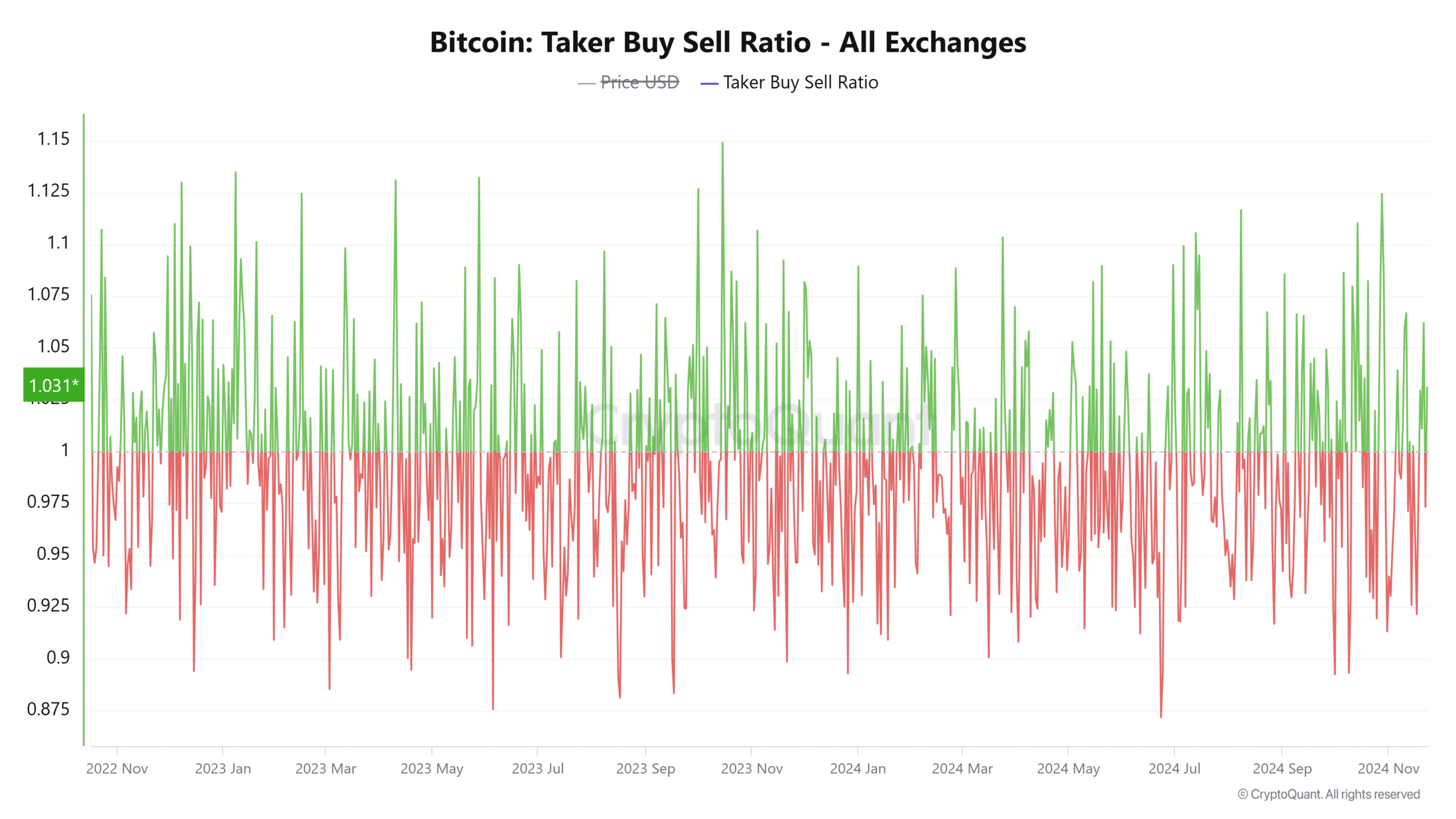

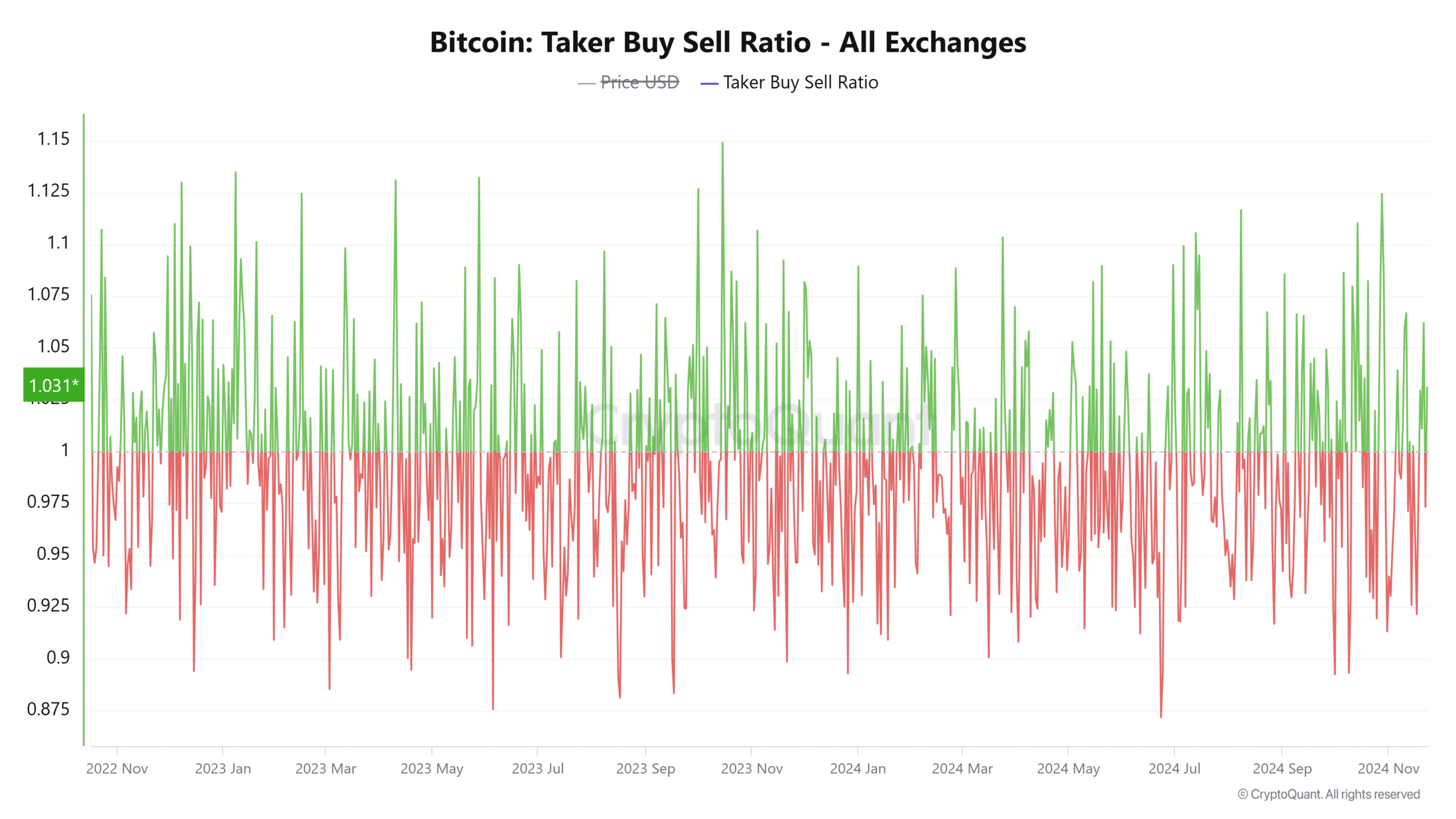

The increased buying pressure stimulates BTC

Bitcoin buying pressure has increased across all major exchanges, with the Taker Buy/Sell Ratio increasing to 1.03. This marks a consistent trend of buyers outpacing sellers, further supporting the rise above $96K.

Platforms like Binance, OKX and Bybit have experienced robust activity, reflecting growing demand from both institutional and retail investors.

This increase in buying interest continues to strengthen Bitcoin’s bullish momentum, strengthening its position above the key support levels and making $120,000 a realistic target.

Source: CryptoQuant

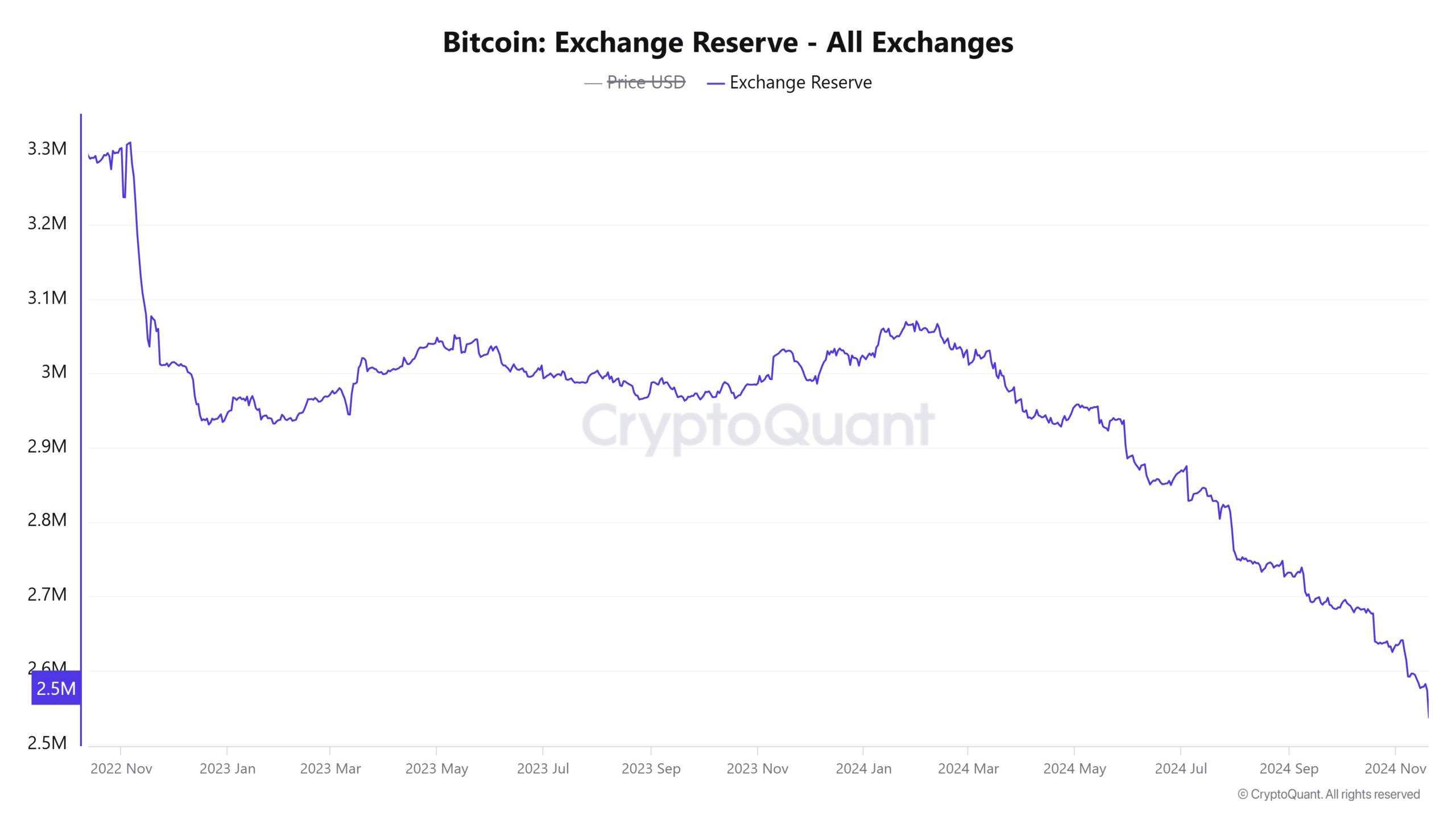

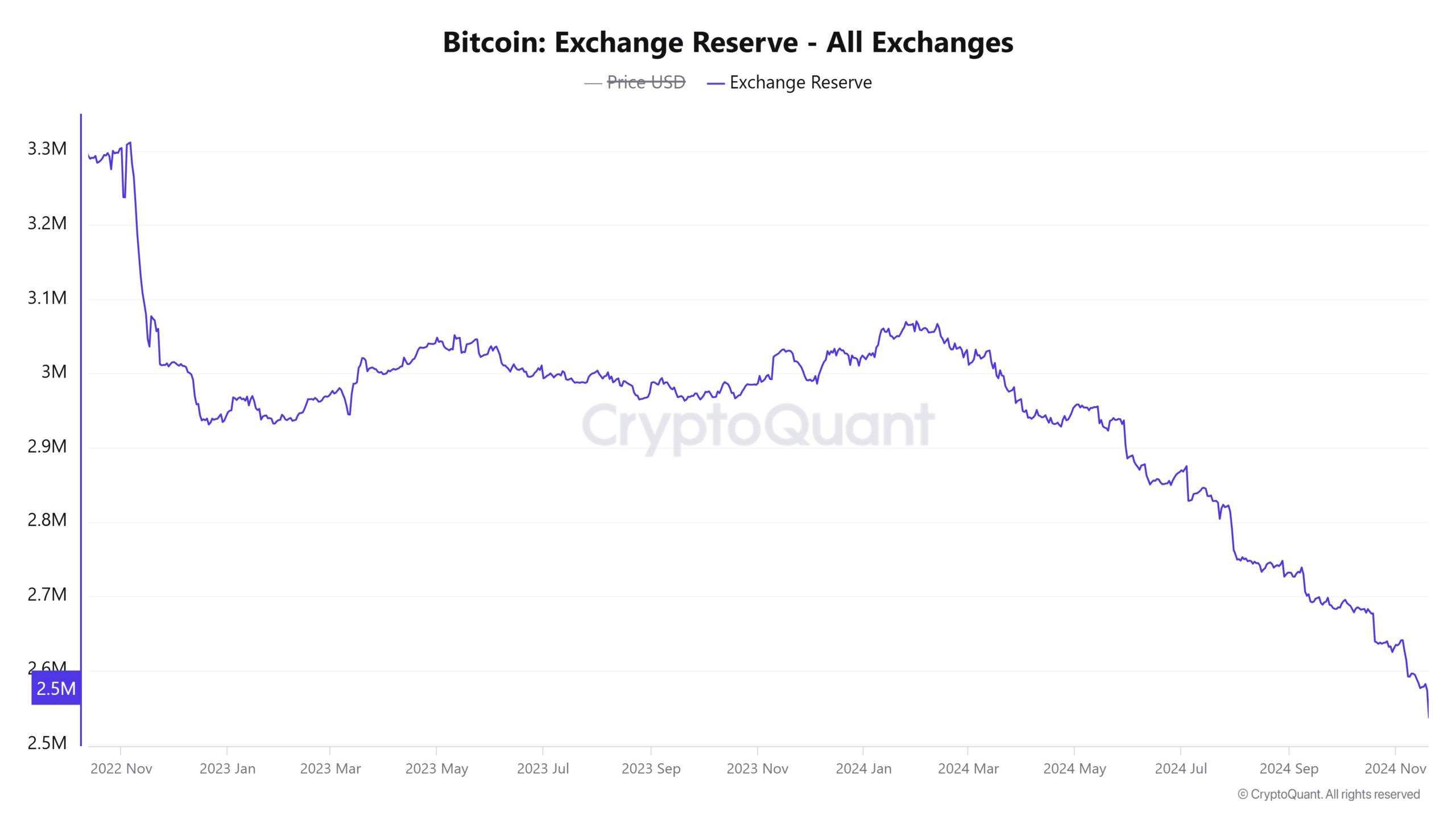

The supply on the stock exchanges continues to decline

In addition to strong buying interest, Bitcoin foreign exchange reserves have fallen by 0.29% over the past 24 hours, reaching 2.509 million BTC at the time of writing.

This decline reflects increased cold wallet withdrawals, indicating long-term investor confidence and reduced immediate selling pressure.

Lower foreign exchange reserves often lead to tighter supply, which can amplify upward price movements.

Source: CryptoQuant

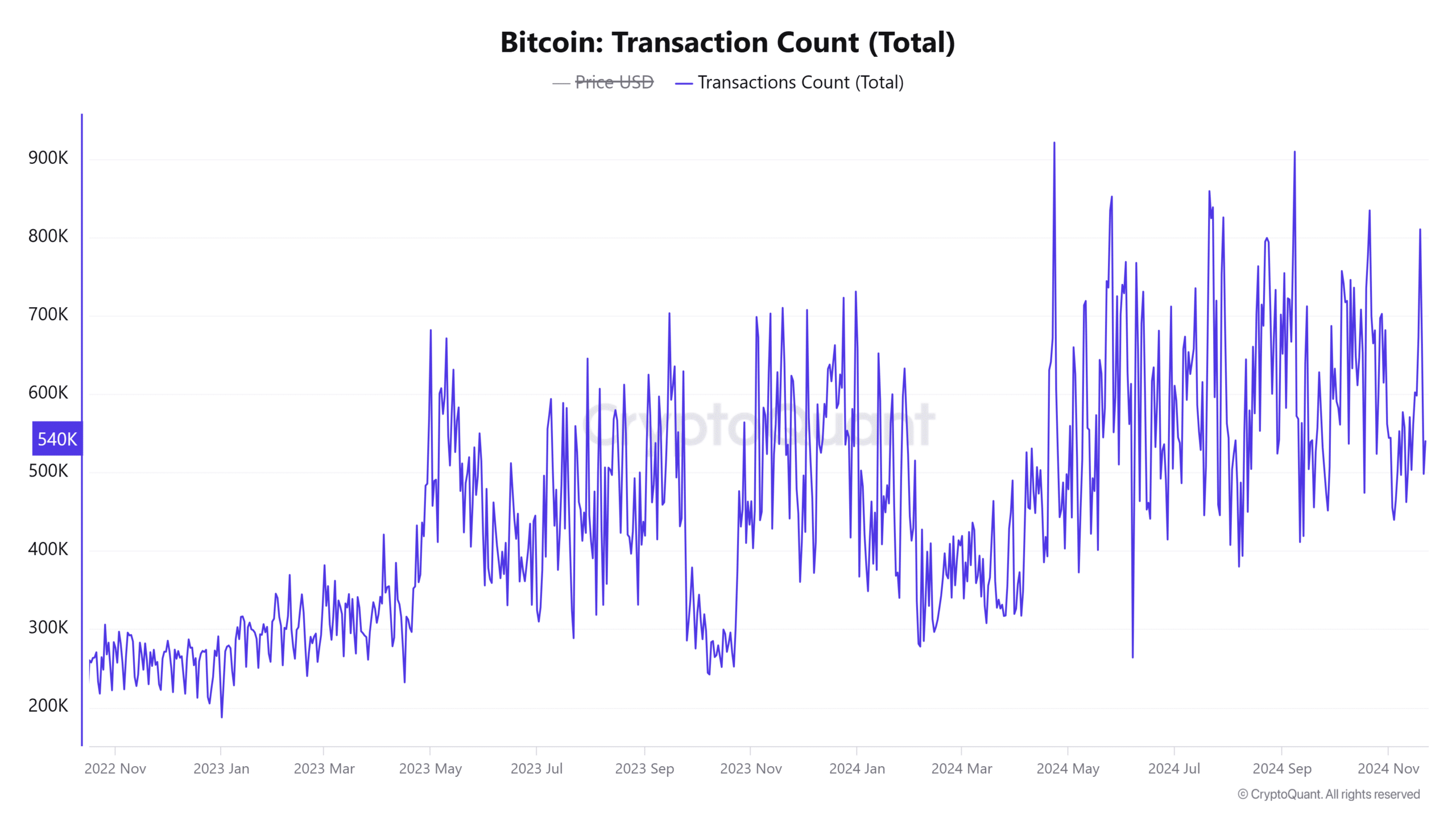

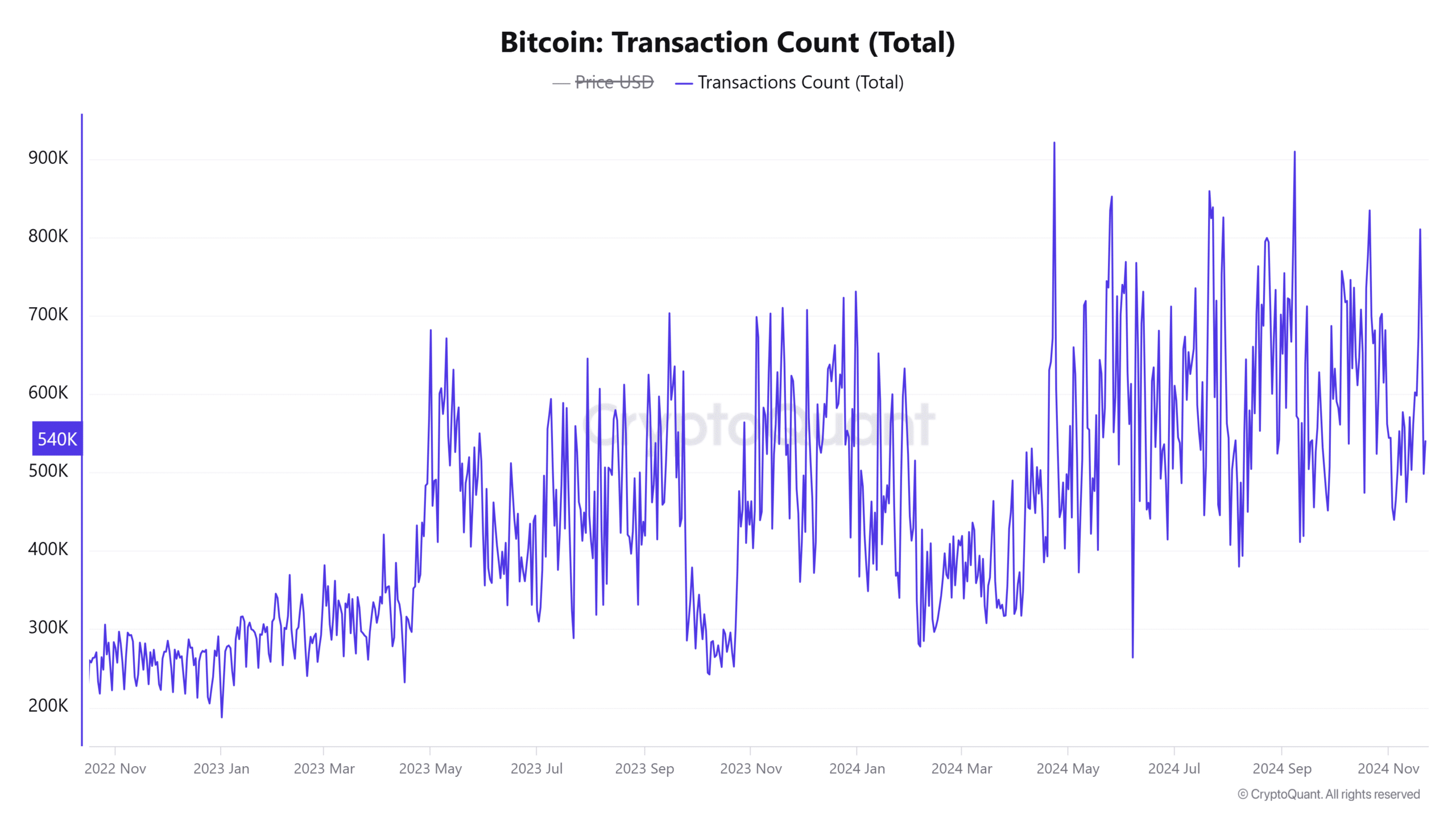

BTC’s network activity strengthens the bullish case

Looking ahead, AMBCrypto noted that the number of active addresses increased by 1% over the past 24 hours to 10,703K, reflecting increased user activity.

Similarly, transactions increased by 0.79% to 540,000, indicating increased utility. This combination of robust buying interest and healthy network activity reinforces Bitcoin’s bullish story.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024-25

Bitcoin’s break above $96,000 is a pivotal moment, supported by strong technical and on-chain metrics. The bullish momentum appears sustainable, with $120K becoming the next major target.

Therefore, the rally is likely to continue as long as Bitcoin remains above $96,000, keeping the broader bull run intact.