- BTC price could reach $103,000 driven by liquidity fluctuations.

- A likely surge in global long positions could mark a potential BTC reversal and bull trap.

The past few days Bitcoin [BTC] has remained above $100,000, but the next direction could be set in motion by the Fed’s decision to cut rates.

After last week’s US inflation and labor figures, the market was prices a 96% chance of another 25 basis point rate cut during the Fed’s next interest rate decision on December 18.

Next BTC moves

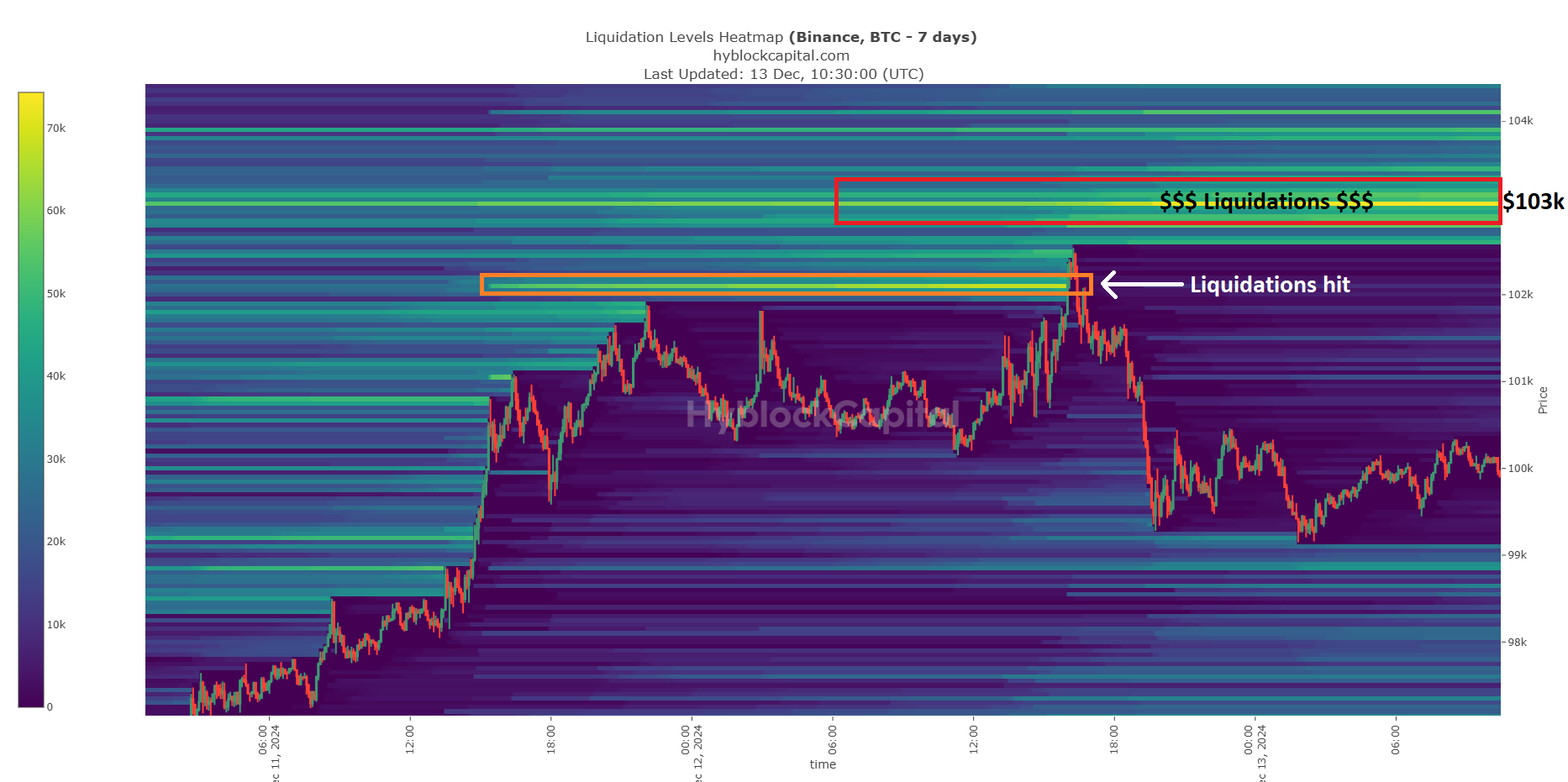

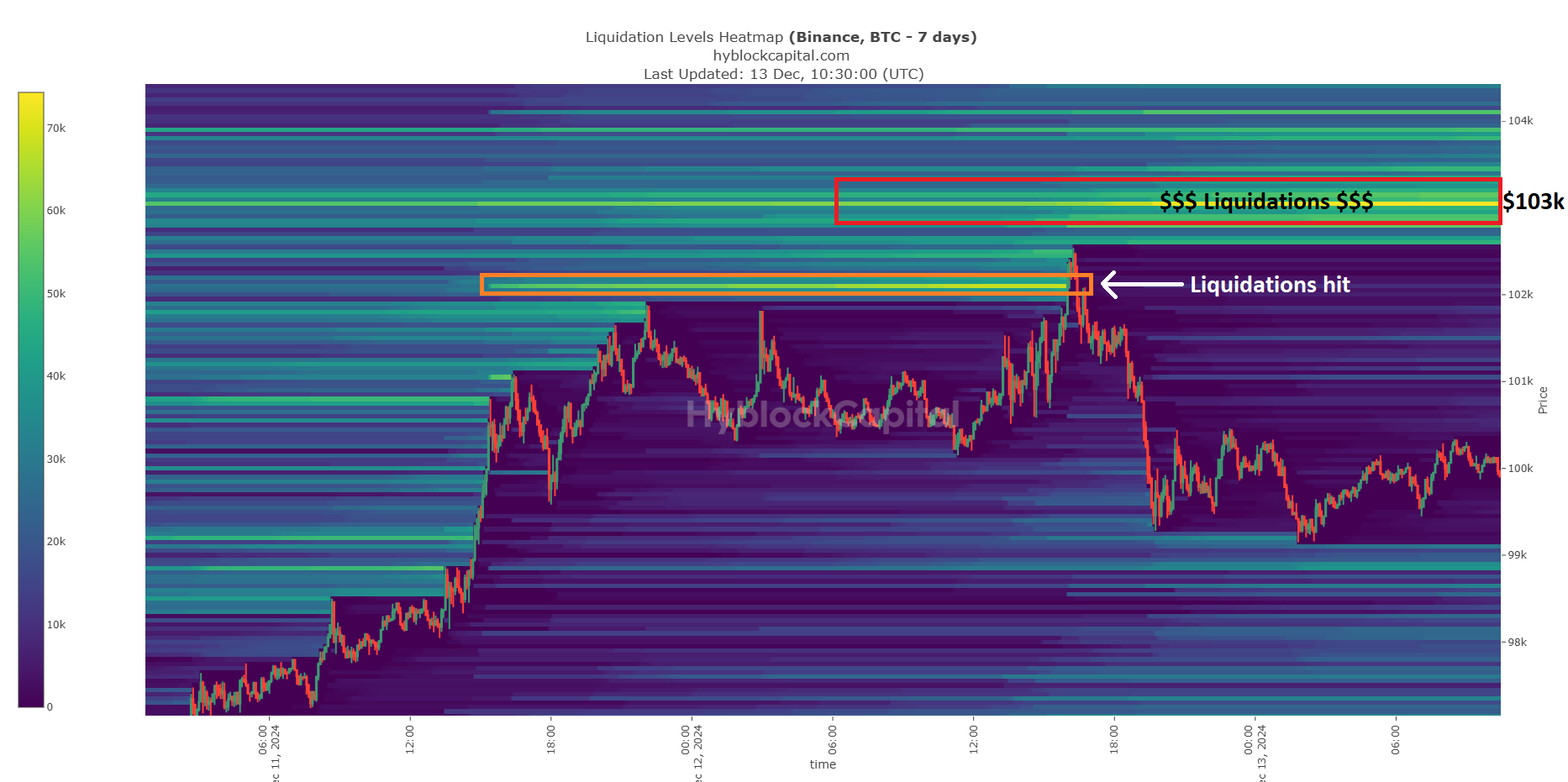

Which way will BTC go? According to BTC trader CrypNuevo, the most likely move was a liquidity chase at $103K/104K, citing recent trends. Part of his analysis on X read,

“Lots of short liquidations for $103,000. It may be the right time to hunt them down… We can see how they have been consistently targeting these liquidation clusters in recent days.”

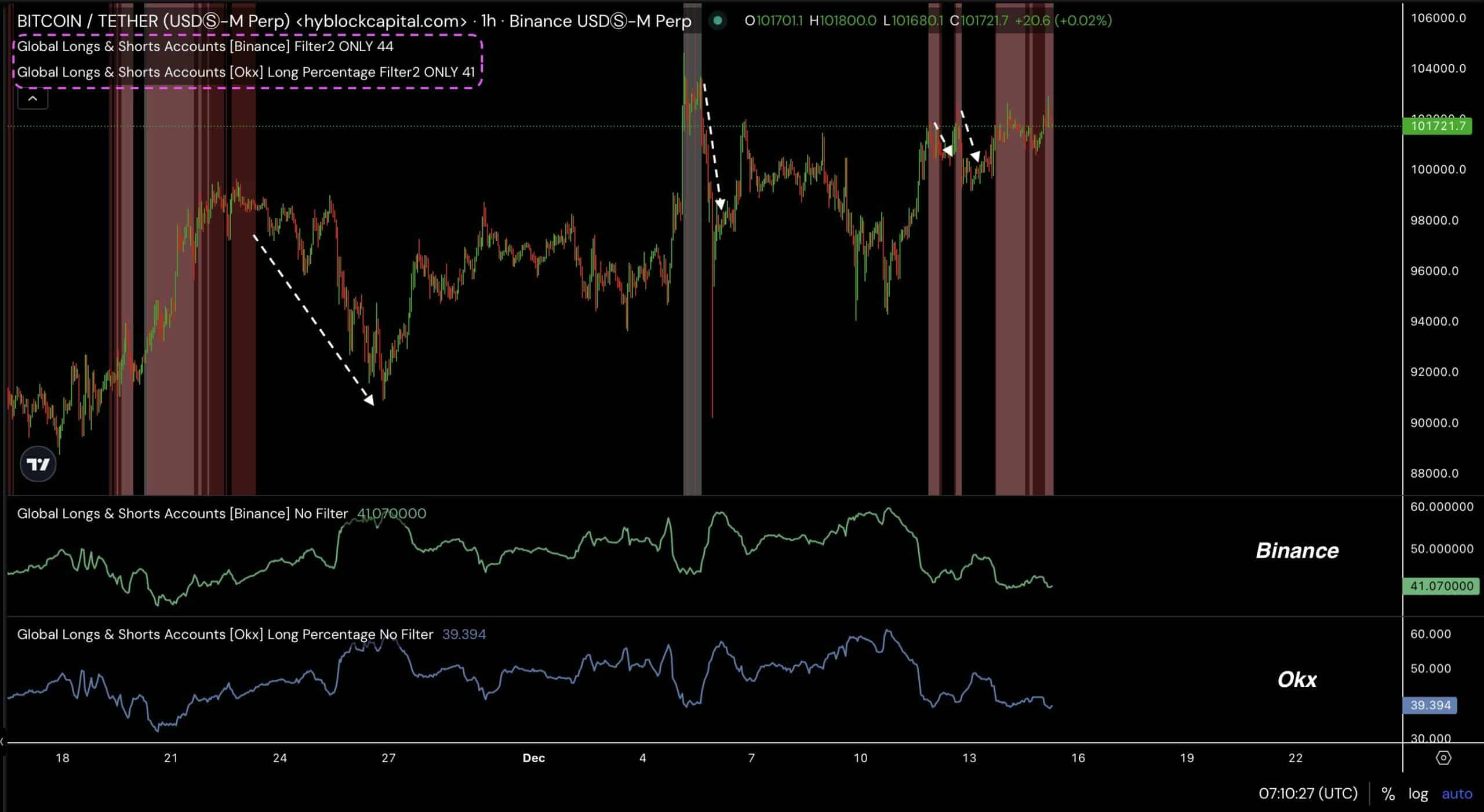

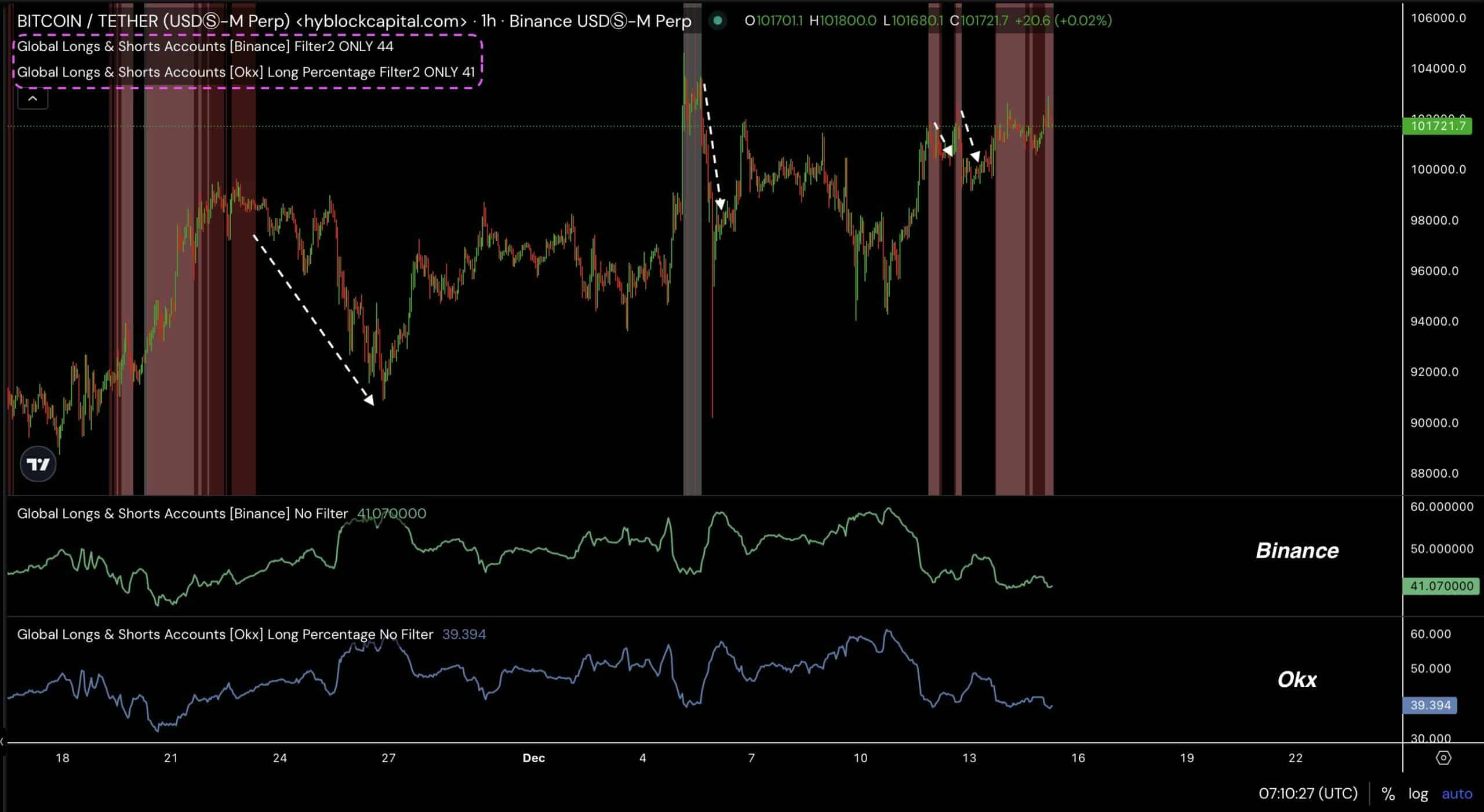

Source: Hyblock

At the time of writing, there were still significant leveraged short positions of $103K-$104K, reinforcing CrypNuevo’s projection.

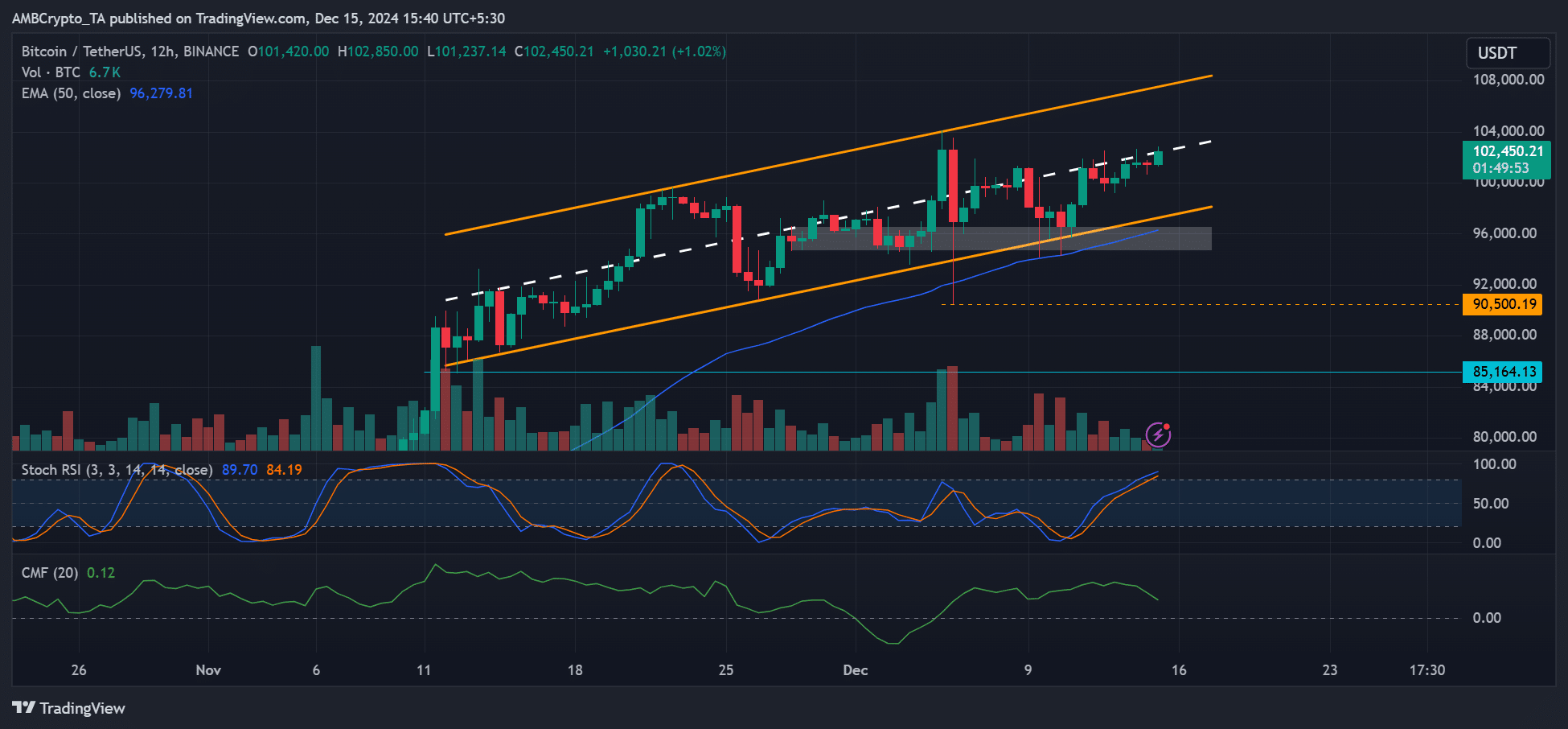

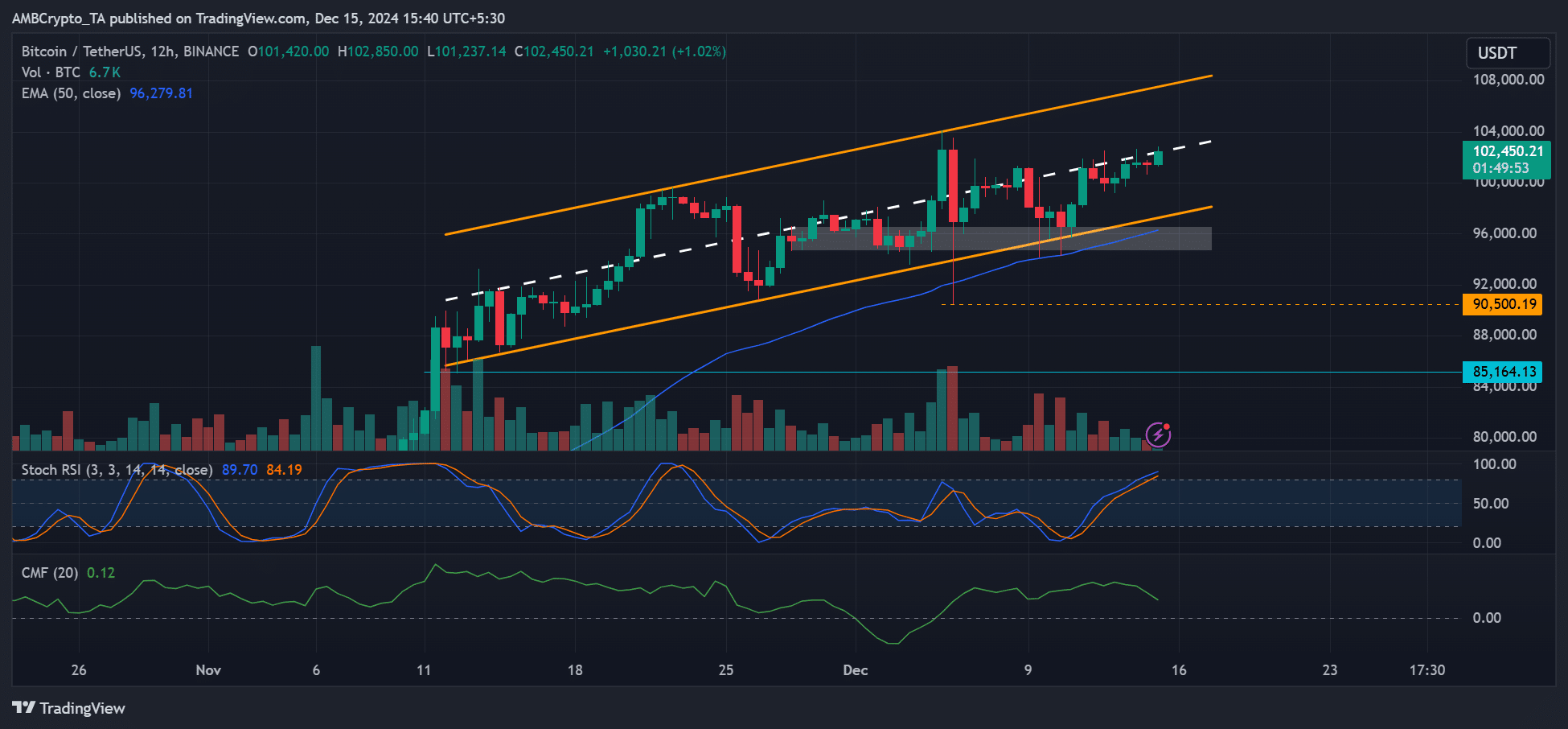

On the 12-hour chart, BTC is consolidating firmly around the mid-range of the ascending channel. The $103,000/$104,000 target was about 2% from the mid-range.

The upper channel target of $107,000 was 5% above the mid-range, but had less liquidity and would not attract strong price action like the $103,000 level.

Source: BTC/USDT, TradingView

If that’s the case, BTC could hit the $103,000/$104,000 targets, driven by liquidity improvements, and then retreat lower.

The channel’s lower range has halted previous retracements, and the potential pullback could narrow to $97K. After that, BTC could continue its range-bound move.

Hyblock’s retreating global desires indicator supported the likely slip to range-low after touching $103K. The oscillator always rises when BTC falls and falls when BTC pumps.

At the time of writing, the indicator was heading towards its low and could reverse, marking a likely BTC retracement and bull trap.

Source: Hyblock

Read Bitcoin [BTC] Price prediction 2024-2025

In short, BTC could rise slightly above the mid-range to liquidate shorts at $103K/$104K levels, before moving into leveraged longs at the channel lows near $97K.

However, a breakout on either side would negate the aforementioned bandwidth outlook.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer