Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

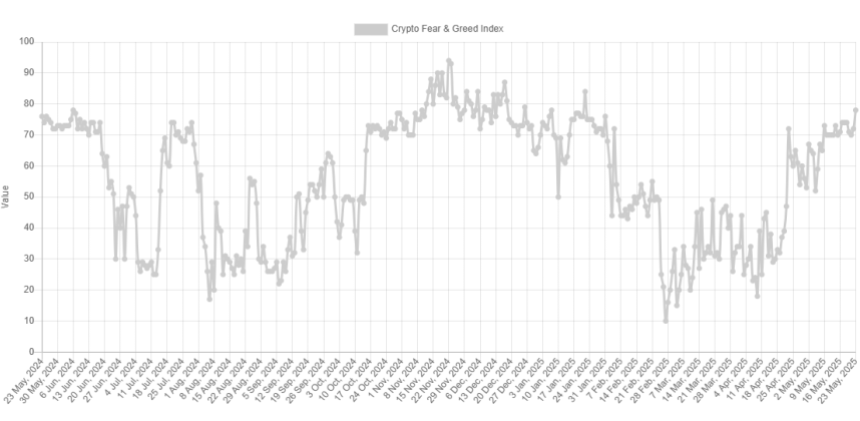

Data shows that the Bitcoin market sentiment was broken into the extreme greed area after the new high of the cryptocurrency above $ 111,000.

Bitcoin Fear & Greed Index has recently made progress

The “Fear & Greed IndexRefers to an indicator made by Alternative That tells us about the sentiment that the average trader in the Bitcoin and wider cryptocurrency markets is in possession. The metric uses a numerical scale that is performed from 0-100 to display the sentiment. All values above 53 represent greed among investors, while they indicate under 47 fear. The index between these two cutoffs implies a net neutral mentality.

Related lecture

In addition to these three main zones, there are also two ‘extreme’ regions called the extreme greed (above 75) and extreme anxiety (lower than 25). The market sentiment is currently within the first of the two, according to the last value of the Fear & Greed Index.

Historically, the extreme sentiments have had a lot of meaning for Bitcoin and other digital assets, because they have been where large tops and soils tend to form. However, the relationship has been a reverse, which means that an exaggerated bullish atmosphere is probably making tops and a surplus despair bottoms.

Some traders operate this fact to time their purchase and sales movements. This trade technique is popularly known as a contrary investing. The famous quote from Warren Buffet summarizes the core idea: “Be afraid if others are greedy and greedy if others are anxious.”

With the Bitcoin sentiment that now returns to the extreme greedy region, it is possible that followers of this philosophy may start to look at the exit.

That said, the Fear & Greed Index currently has a value of ‘Just’ 78. For comparison: the top of December took place at around 87 and the January at 84. Earlier in the rally, the metric even reached a much higher peak of 94 in November.

As such, it is possible that the current market may not be so overheated in terms of sentiment, assuming that investors’ demand does not leave leaving. However, it is only to see how Bitcoin and other cryptocurrencies would evolve under this extreme greed.

Speaking of the question, whales have just made a considerable amount of recordings of the Binance platform, as Cryptoquant Community analyst has noticed in an X after.

The indicator that is displayed in the graph is the “Exchange Netflow”, which tells us about the net amount of Bitcoin that goes in or out of the wallet that is associated with a centralized exchange, which in this case is Binance.

It is clear that the Binance Exchange Netflow has observed a great negative value, which implies that investors have moved a remarkable amount of coins from the stock market. More specifically, the net outflows for the platform are 2,190 BTC or around $ 237 million.

Related lecture

This may indicate the demand from the major money investors to conceive the cryptocurrency in self -wide portfolios.

BTC price

At the time of writing, Bitcoin floats around $ 108,400, an increase of more than 4% in the last seven days.

Featured image of Dall-e, cryptoquant.com, alternative.me, Chart van TradingView.com