- Bitcoin’s currency flow and reserves have fallen in recent months

- A move towards $100,000 remains very likely for the world’s largest cryptocurrency

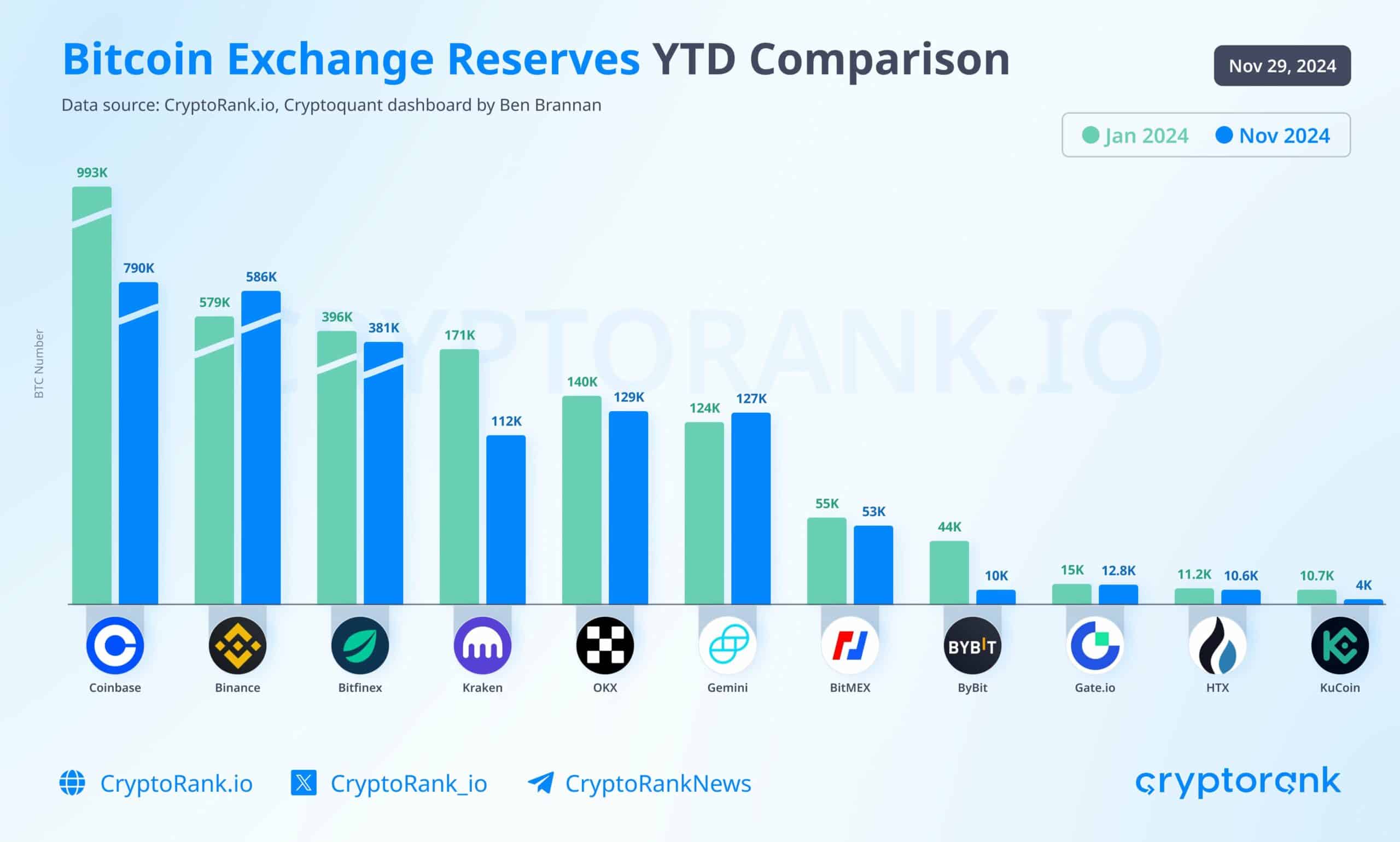

Bitcoin reserves on centralized exchanges (CEXs) have shown notable differences this year. While some exchanges, such as Binance, have maintained relatively stable reserves, others, such as Coinbase, have seen large declines.

These trends were accompanied by a significant drop in Bitcoin flows between exchanges. This can be interpreted as a sign of a maturing market and greater investor confidence.

Bitcoin exchange flows and market sentiment

The exchange-to-exchange flow metric, which tracks Bitcoin transfers between exchanges, fell to an all-time low. CryptoQuant. Historically, spikes in these flows have coincided with periods of market turmoil, as traders moved BTC to Binance during major price drops.

However, reduced flows can also point to less panic-driven behavior – a sign of a more stable and confident market environment.

Source: CryptoQuant

At the same time, Bitcoin’s foreign exchange reserves, especially on all centralized exchanges, have fallen sharply over the past two years.

From over 3.3 million BTC in early 2022 to just 2.5 million BTC at the end of 2024, this decline underscored a broader trend of self-adoption and reduced reliance on exchanges for storage. The accompanying chart illustrates this steady decline, which correlates with Bitcoin’s bullish trajectory towards $100,000.

How stock exchanges otherwise maintain reserves

A deeper dive into exchange-specific data revealed major differences in how platforms manage Bitcoin reserves.

Coinbase, which caters largely to institutional investors, has seen significant outflows over the past year, with reserves falling from 993,000 BTC in January to 790,000 BTC in November. This trend indicated the growing institutional preference for long-term self-management or cold storage solutions.

Source: CryptoRank

On the contrary, Binance’s reserves have remained relatively stable, declining only marginally from 579,000 BTC to 586,000 BTC.

The difference between these two major exchanges reiterates the different strategies of their user bases: Coinbase for institutional custody and Binance for retail.

Bitcoin price developments support market stability

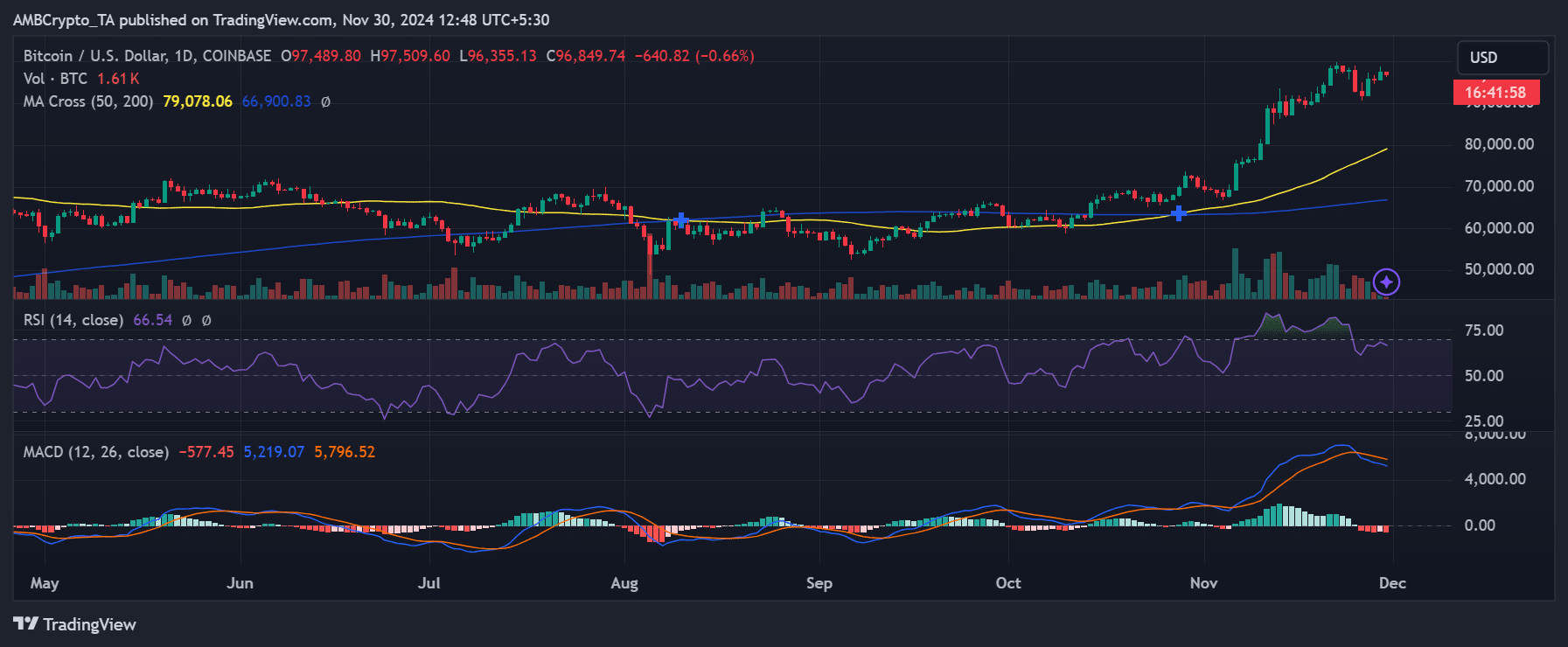

Bitcoin’s price, valued at $96,849 at the time of writing, reflected the strength of the broader market.

The RSI reading of 66.54 suggested that the asset is still in overbought territory, but without alarming divergence. The moving average convergence divergence (MACD) also indicated continued bullish sentiment – a sign of investor confidence.

Source: TradingView

Despite price corrections, reduced Bitcoin movement between exchanges means a lack of panic-driven selling. This stability is a departure from previous cycles, in which larger flows often coincided with sharp price declines.

The broader decline in foreign exchange reserves and reduced flows into Binance could point to evolving market dynamics. Lower volume of BTC on exchanges reduces immediate selling pressure, potentially paving the way for further price increases.

Moreover, the rise in self-custody is in line with a maturing market, one in which investors are less likely to succumb to panic selling.

– Read Bitcoin (BTC) price prediction 2024-25

However, the concentration of liquidity on fewer exchanges like Binance comes with its own challenges. During times of increased trading activity, liquidity problems may arise. Especially as the market moves closer to Bitcoin’s psychological $100,000 level.