- Bitcoin forms a classic bullish pattern while the influx of the exchange causes correction -saving problems.

- Whale accumulation and institutionally buys signal strongly long -term trust despite short -term volatility.

In the last 96 hours, more than 21,000 Bitcoin [BTC] have been transferred to exchanges, so that a significant peak is marked in exchange reserves.

Historically, such inflow often identify the growing pressure on the sales side, especially when traders anticipate local tops.

Bitcoin has remained steadily around $ 83,700 Mark and struggled to win Momentum after a recent dip. Now the market is closely aware of whether this inflow will cause a correction or whether bullish troops will prevail.

What does Bitcoin prepare for?

On the 4-hour graph, Bitcoin seemed to form a textbook cup and handle pattern, which traditionally signals a potential bullish continuation.

BTC traded at $ 85.138.04 and achieved a modest profit of 1.02% at the time of writing.

The neckline of the pattern was at the level of $ 88,860 – a key resistance zone that must be erased to confirm an outbreak.

A decisive movement above this level can cause a wave of purchasing pressure, so that the path to new highlights is opened.

However, the pattern still has to be completed and the handle part remains sensitive to a wider market sentiment.

If bulls do not build up sufficient momentum, Bitcoin can withdraw to the support level of $ 81,535, which has been shown in earlier dips.

Source: TradingView

Is Momentum weakened?

Market sentiment did not show a clear direction at the time of the press, with bulls and bears perfectly linked to 130 each over the past seven days.

This balance indicated a deep uncertainty in the market, where a small event could give the scales sharply.

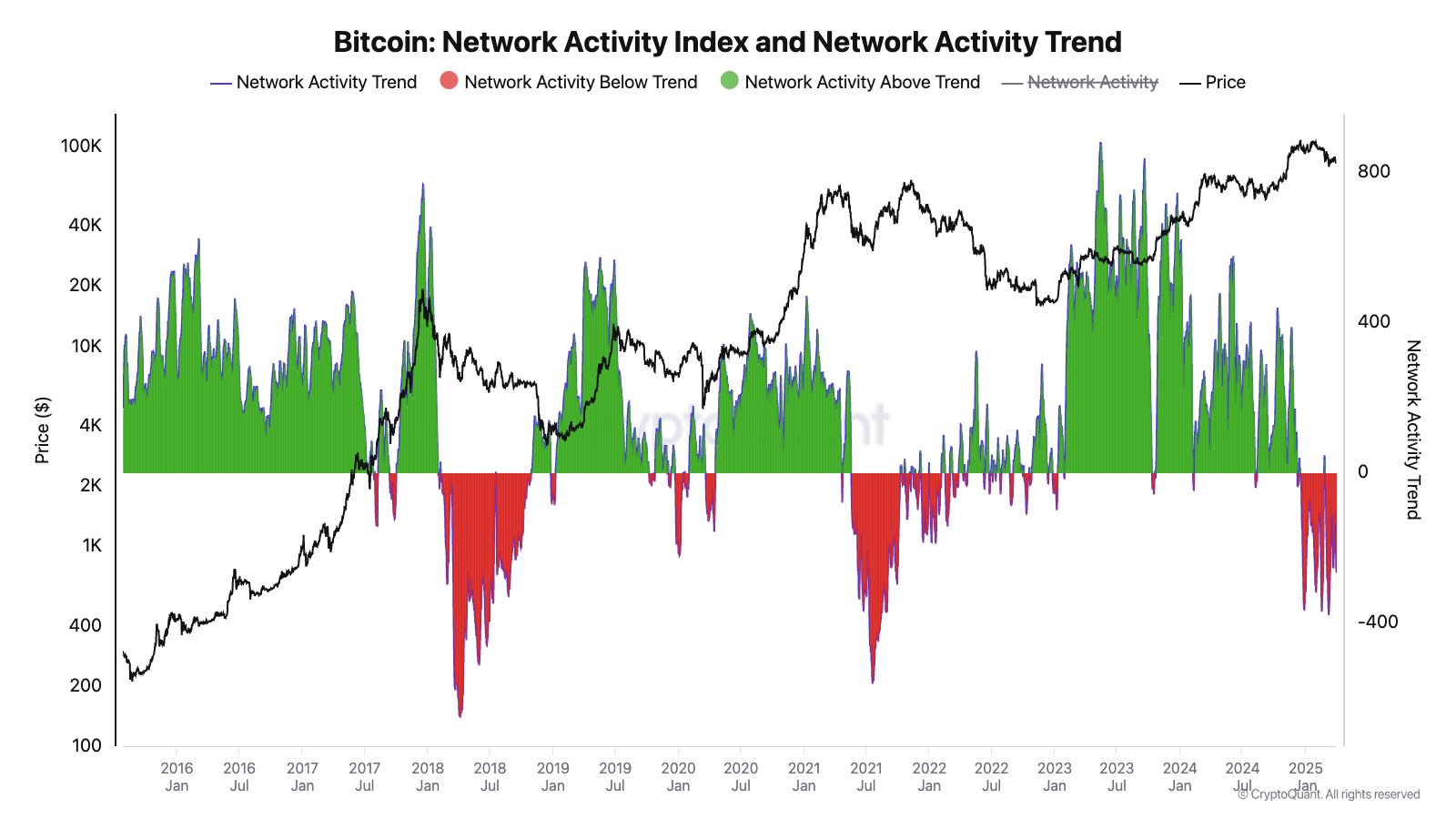

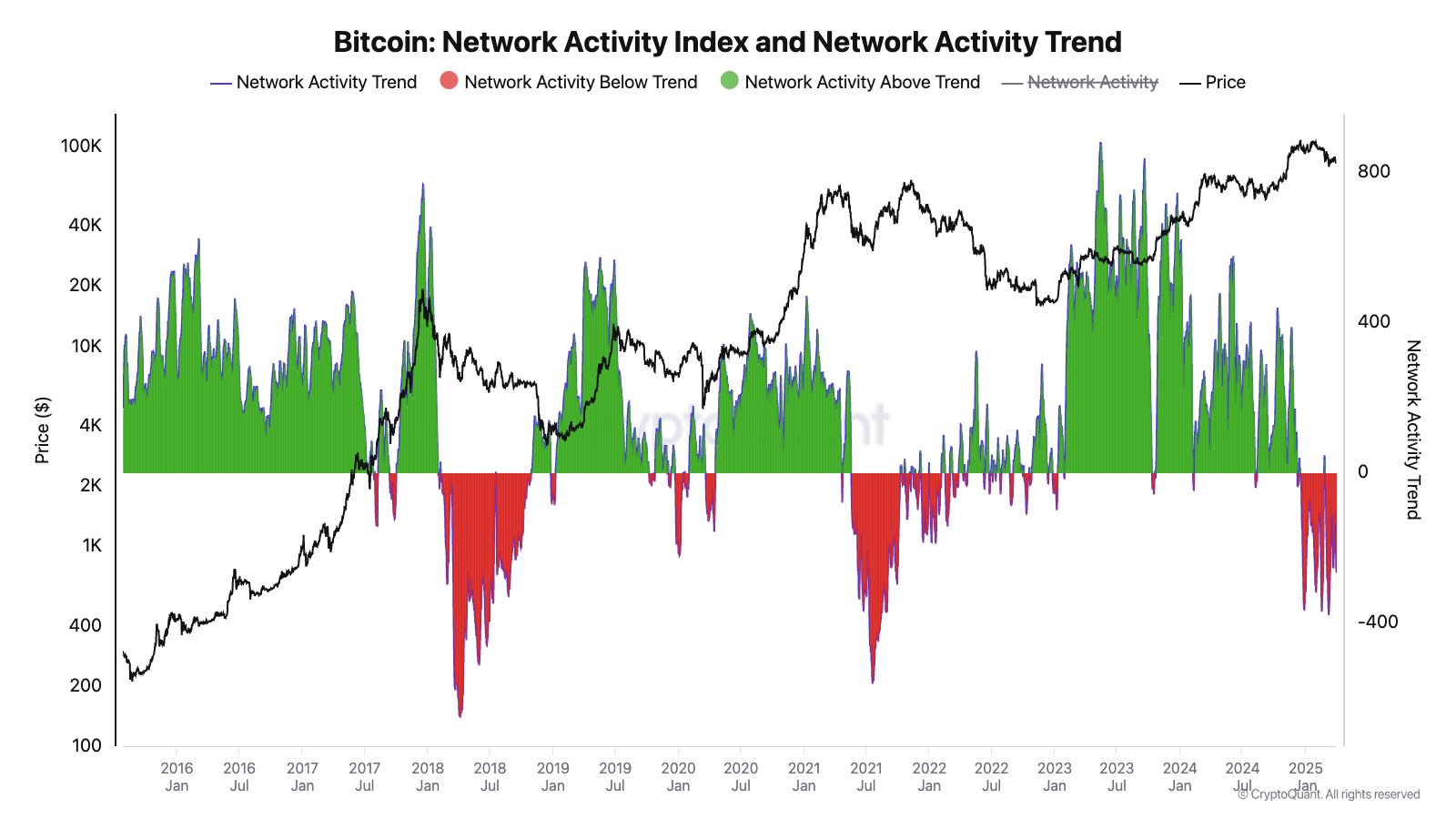

At the same time, Bitcoin’s network activity has fallen considerably and historical lows are approaching that were seen in 2018 and 2021.

A decrease in the involvement of the chain often reflects a reduced demand from users and weak market participation. However, renewed volume or institutional buying can quickly reverse this fall.

Source: Cryptuquant

Whale purchase is increasing

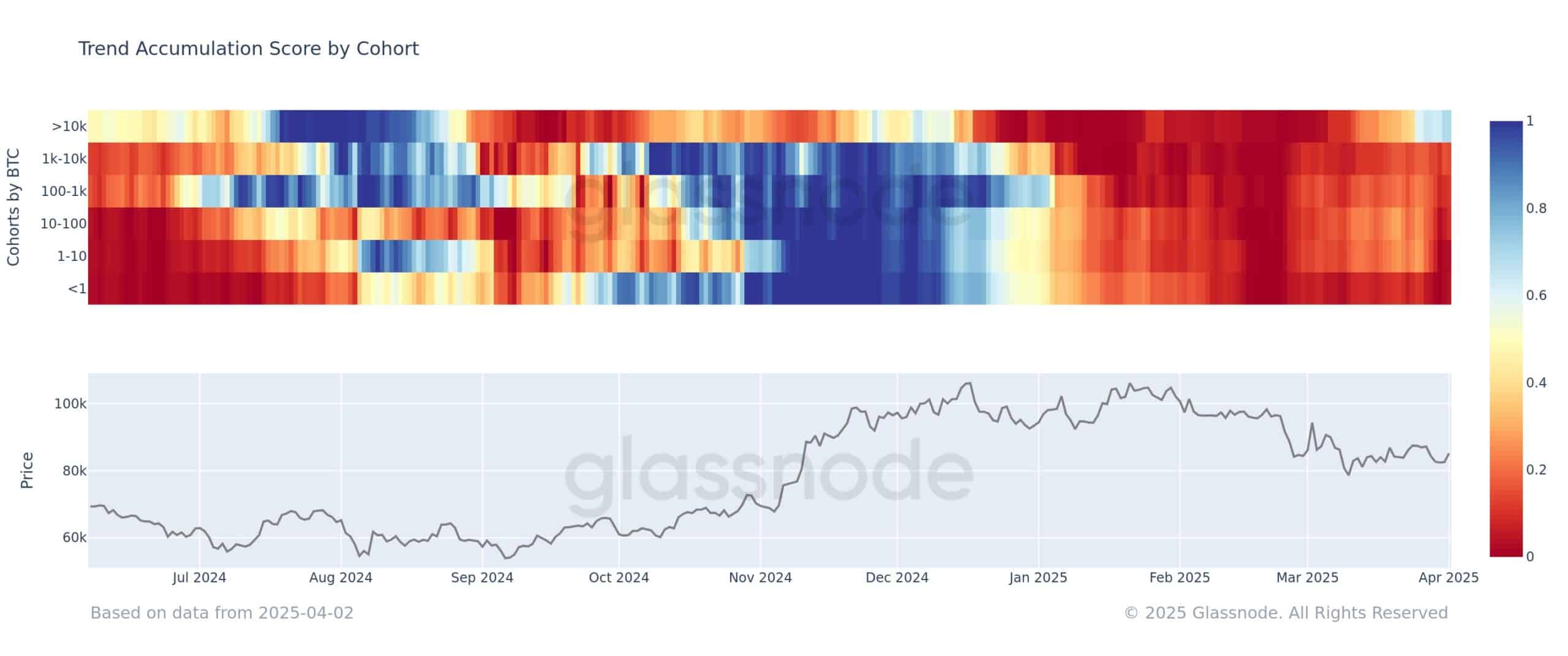

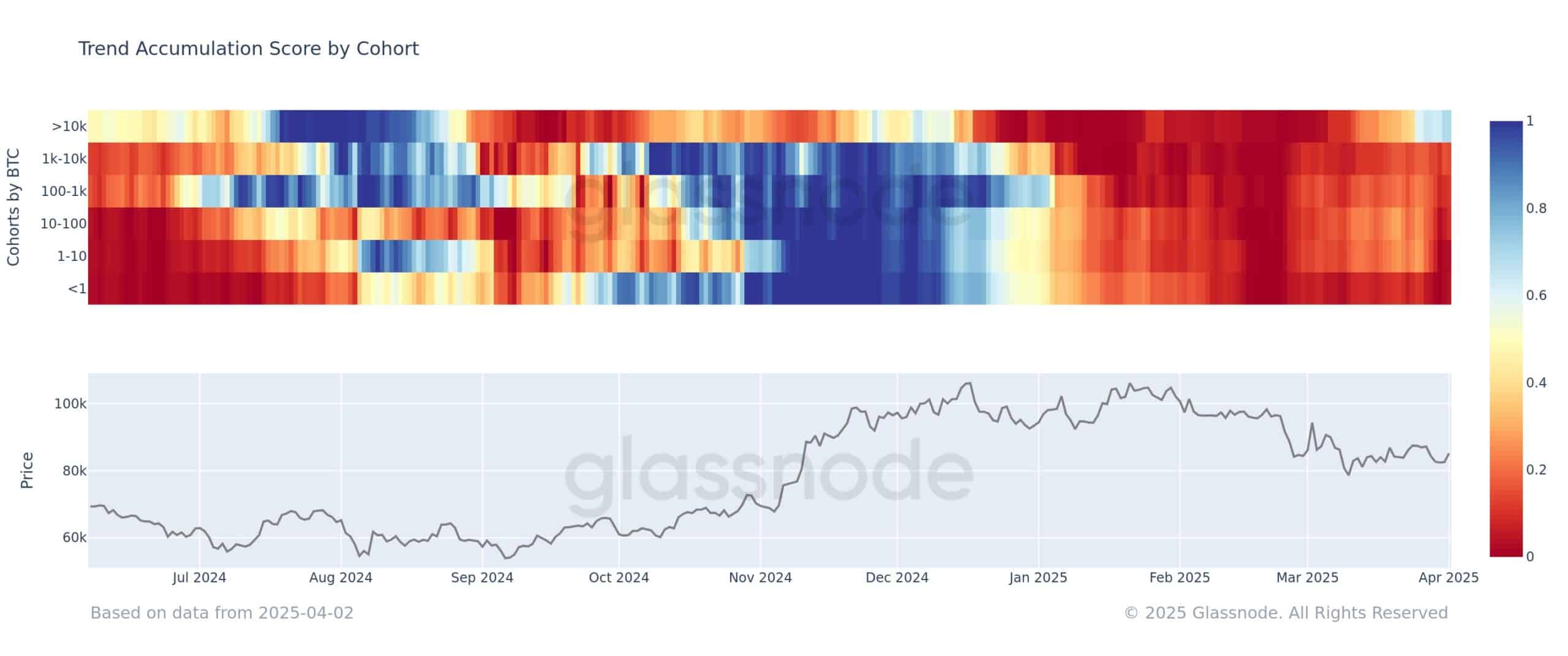

Despite increasing exchange reserves, whales and institutions seem to be aggressively. Glassnode -Data shows that portfolios more than 10,000 BTC with the increase of their participations that contain the accumulation score in the vicinity of 0.6.

In addition, Tether bought BTC for $ 750 million in 2025, now more than 100,000 BTC with a value of $ 8.5 billion.

BitWise has also discussed the battery phase with a purchase of $ 24.5 million, which emphasizes a long -term trust in the long term.

Source: Glassnode

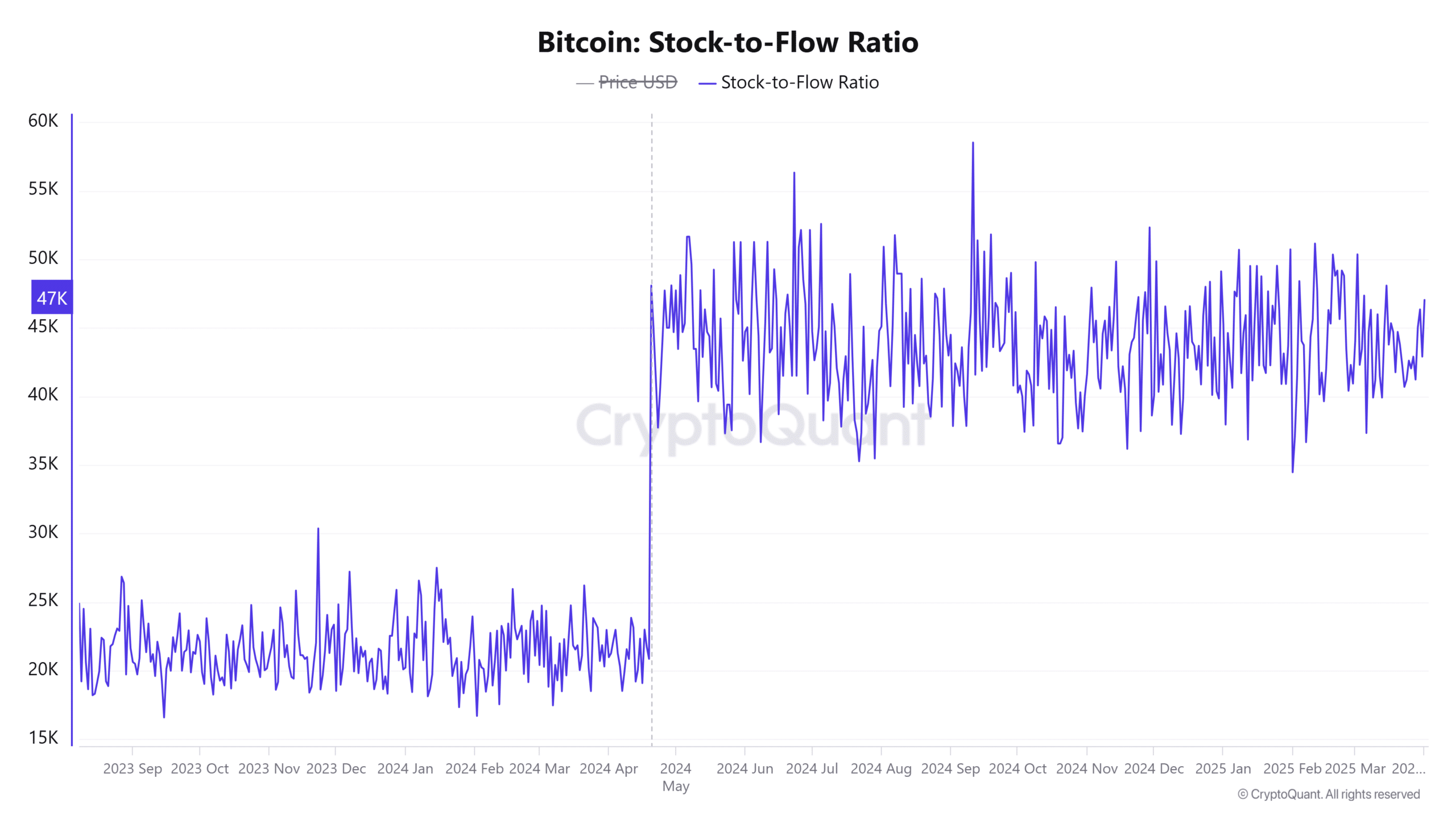

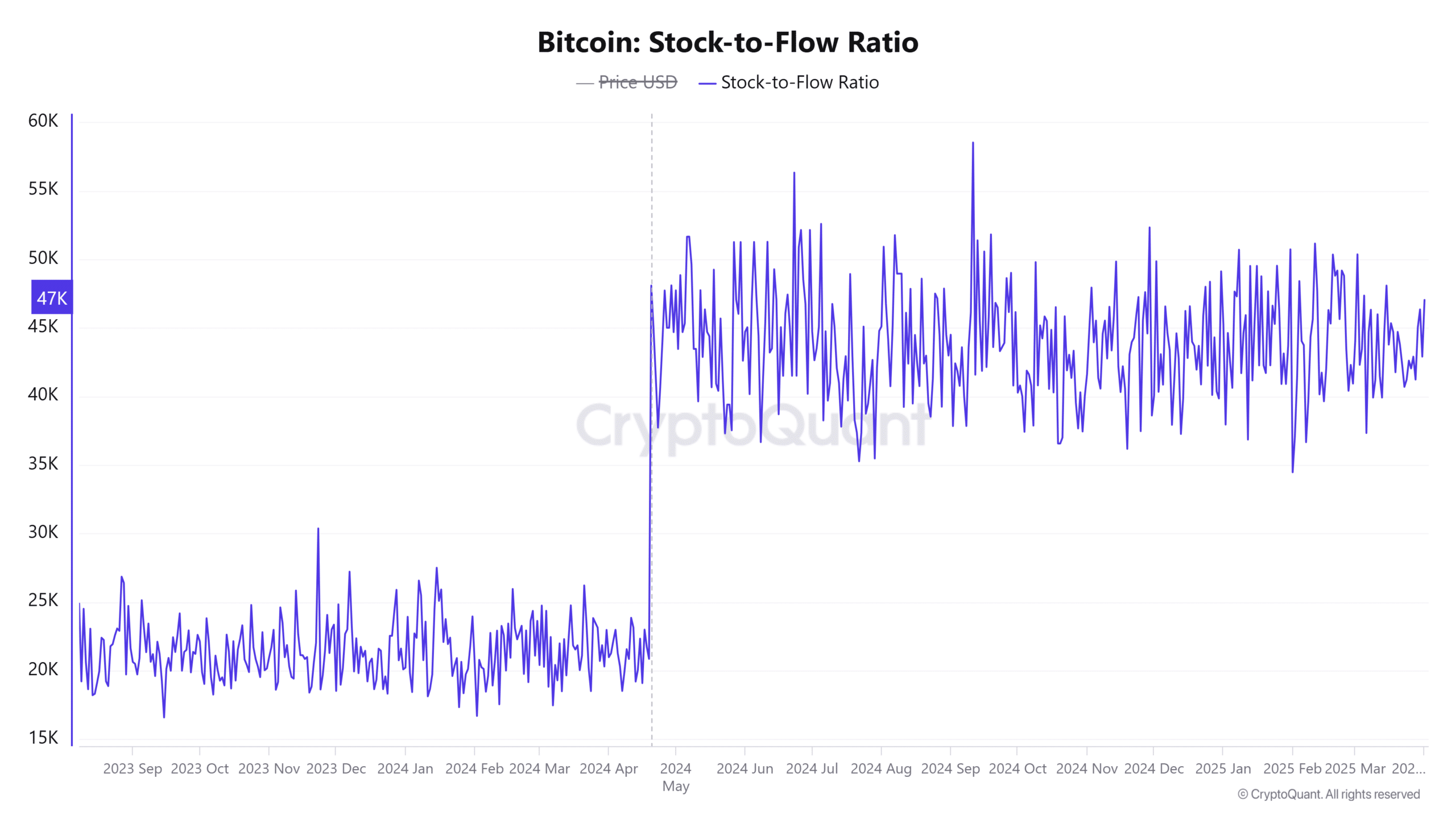

Loses scarcity of influence?

The to-flow ratio has fallen 71.43% in the last 24 hours, sitting at 907.2K at the time of the press. This metric evaluates scarcity by comparing the circulating delivery with the speed of new issue.

A decrease in this size suggests either market saturation or temporary doubt in scarcity as a value -the spring spring. Nevertheless, many investors still see the current levels as a strategic buying.

Source: Cryptuquant

Conclusion

A short -term correction probably seems to be the rising exchange reserves and weakening network activity. These signs often precede local tops or temporary market cooling.

However, strong whale accumulation and continuous institutional purchasing offer a solid pillow that could limit the disadvantage.

Although short -term volatility can continue to exist, the wider bullish structure and long -term prospects for Bitcoin therefore remain firmly intact.