- Bitcoin exchange deposits have hit a six-year low, marking the lowest level of BTC deposits in that time.

- That said, HODLERS are crucial to avoid a drop to the $55,000 support.

Bitcoin [BTC] Bulls suffered another setback after a brief weekend spike that pushed BTC above $60,000. With three consecutive red candles, BTC has retreated to $58K.

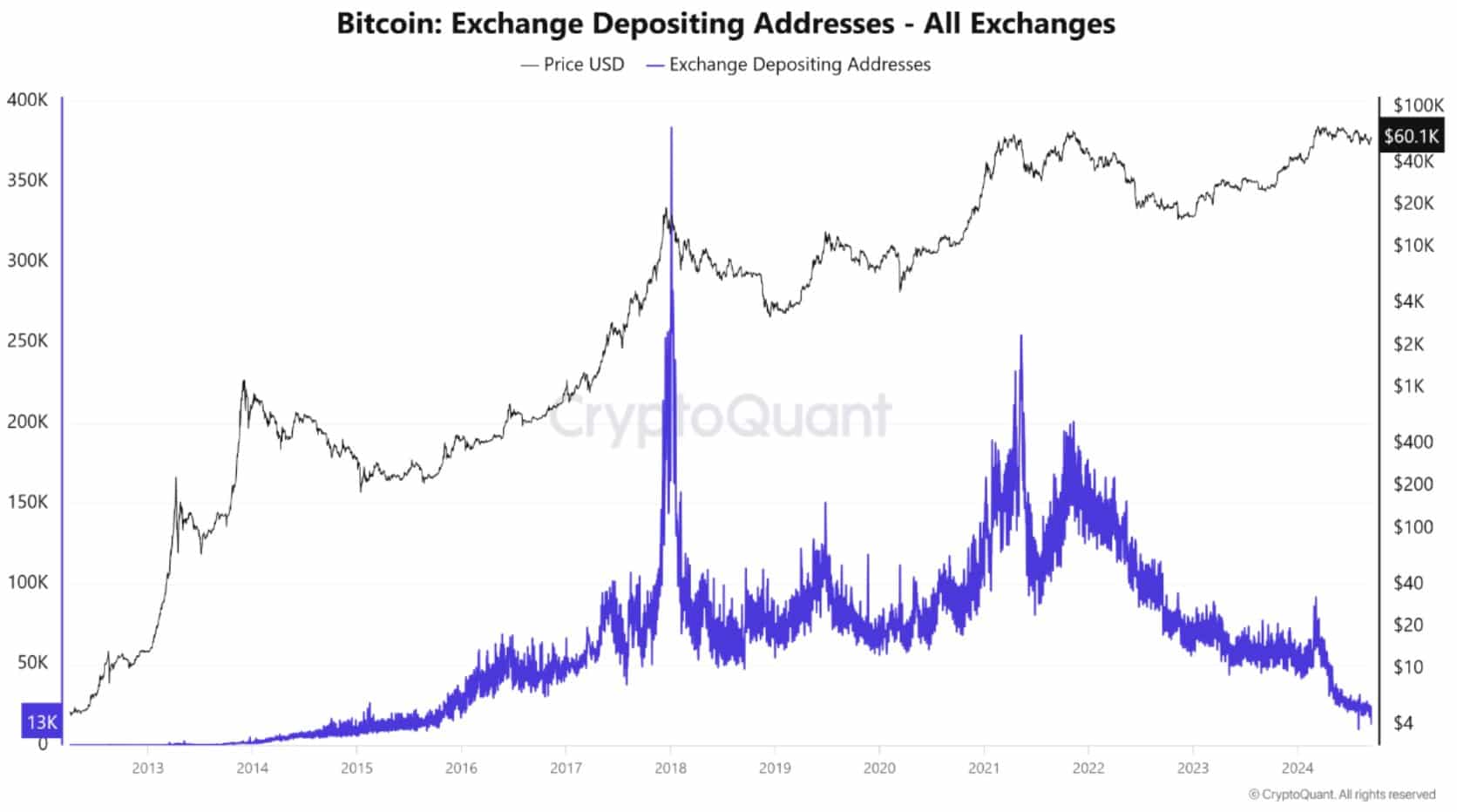

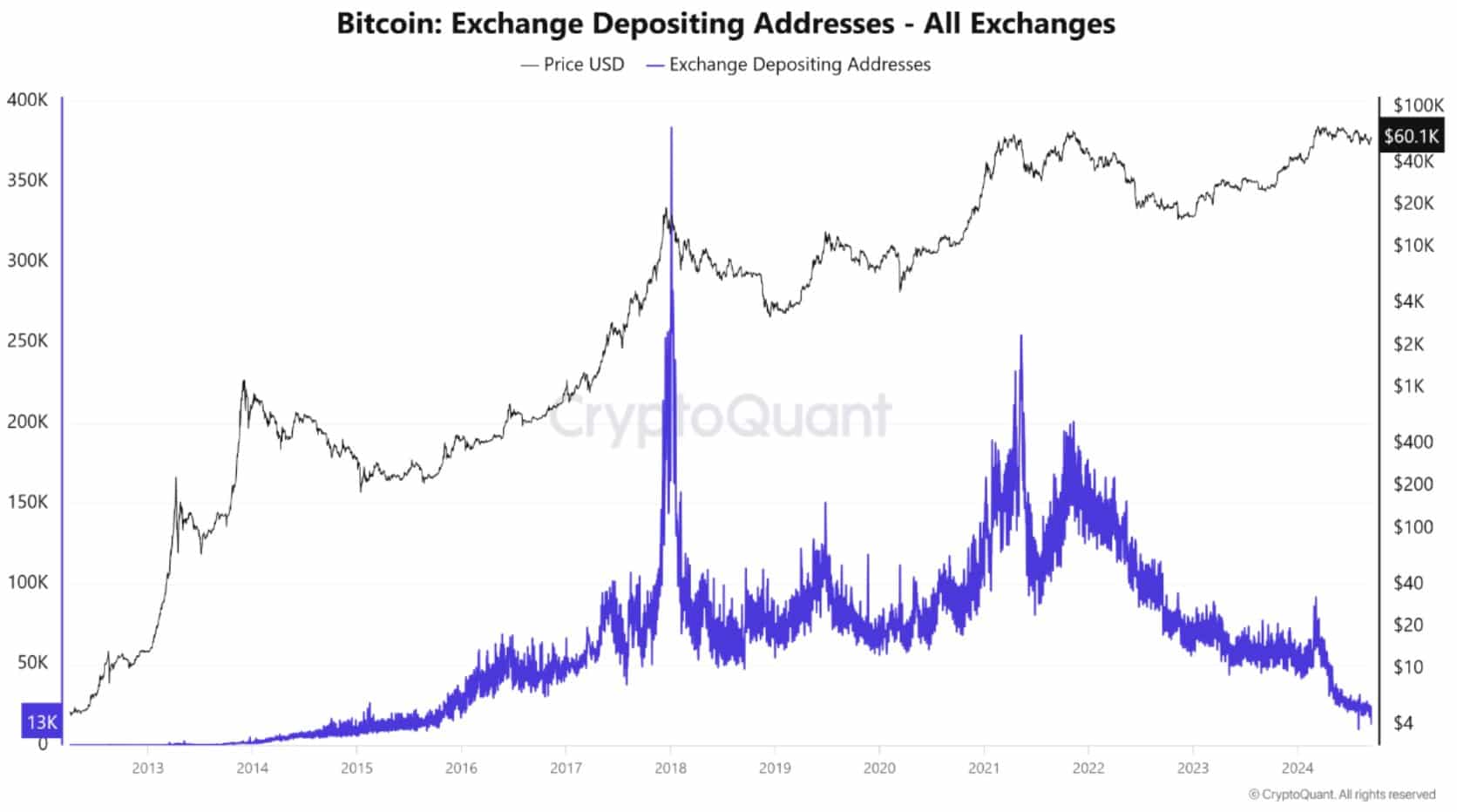

While analysts are divided on whether $60,000 is support or resistance, there is a new CryptoQuant report shows that Bitcoin exchange deposits have hit a six-year low of 132,100, indicating reduced selling pressure.

Could this milestone help BTC avoid a drop to $55,000?

Drop in BTC exchange indicates increasing hodler dominance

The chart shows fewer Bitcoin exchange deposits, which is usually a bullish signal. Economically, reduced supply can increase the value of each BTC token.

While for investors, less BTC on the exchanges indicates confidence in price recovery.

Source: CryptoQuant

Additionally, AMBCrypto’s analysis shows that spikes in BTC exchange deposits typically align with BTC testing high price levels, indicating profit-taking strategies and often leading to steep declines, indicating potential accumulation.

Conversely, fewer deposits indicate greater scrutiny by long-term hodlers, as observed over the past six years since the last peak.

Simply put, the Bitcoin space is now dominated by hodlers who are confident of a price correction.

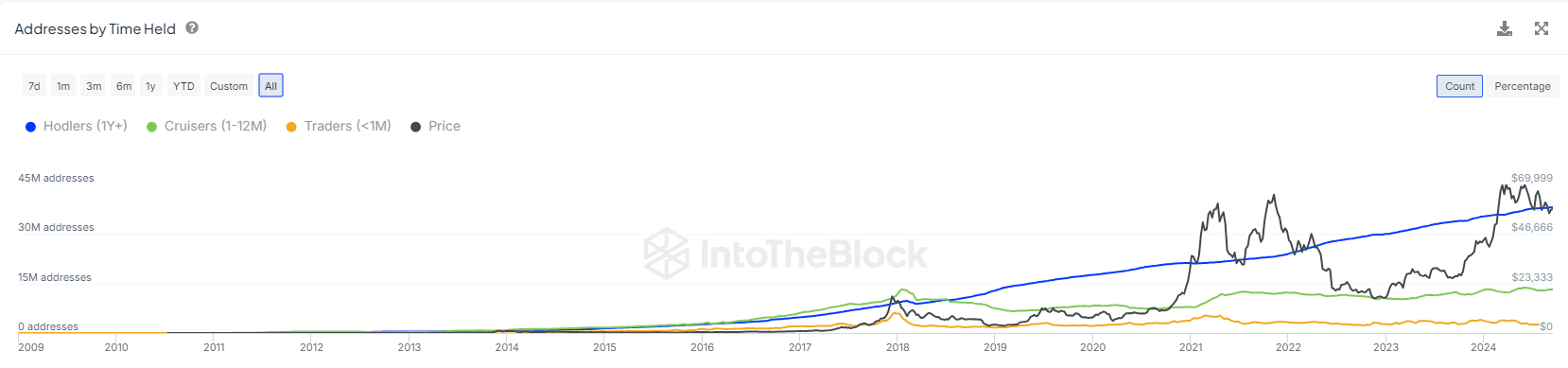

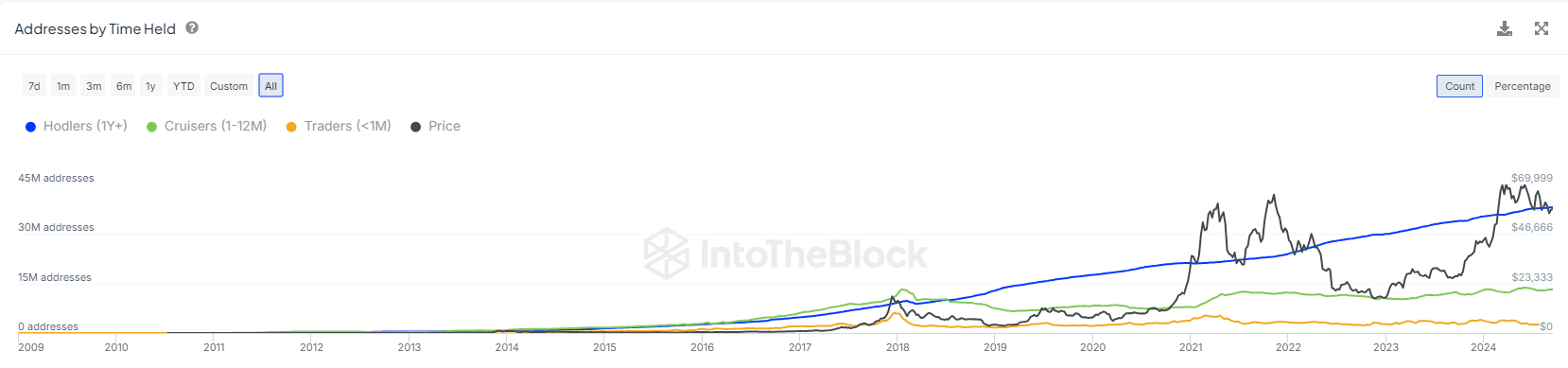

Source: IntoTheBlock

As expected, the number of hodlers has risen to 38 million, a staggering 375% increase from 8 million six years ago. Notably, hodlers who have owned BTC for more than a year now represent 70.77% of the total number of addresses.

Surprisingly, this percentage exceeds the amount observed during the mid-March rally when BTC reached its ATH.

In short, long-term holders are crucial to avoid a drop to $55,000 – but what are the chances?

The odds are intriguing

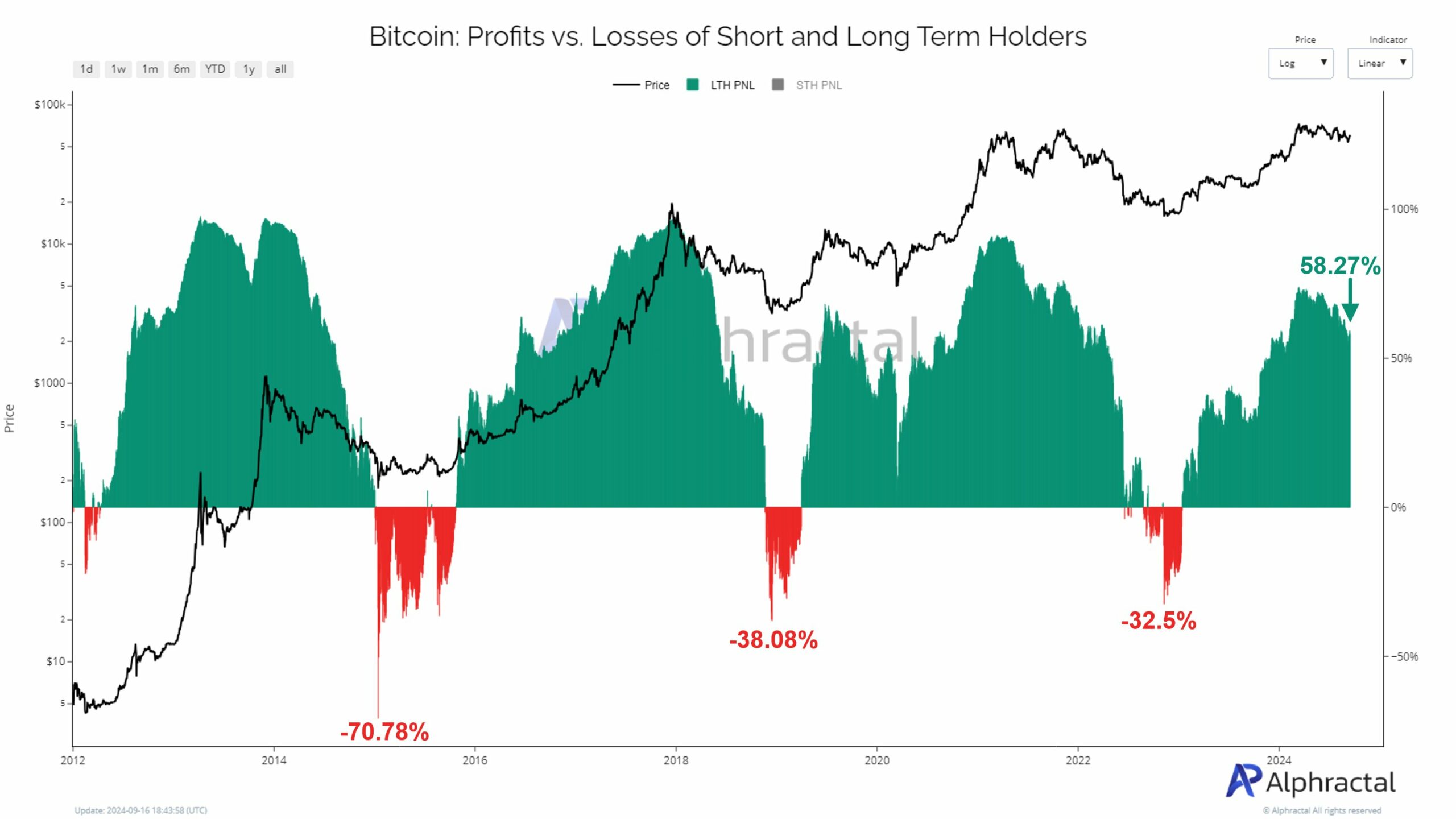

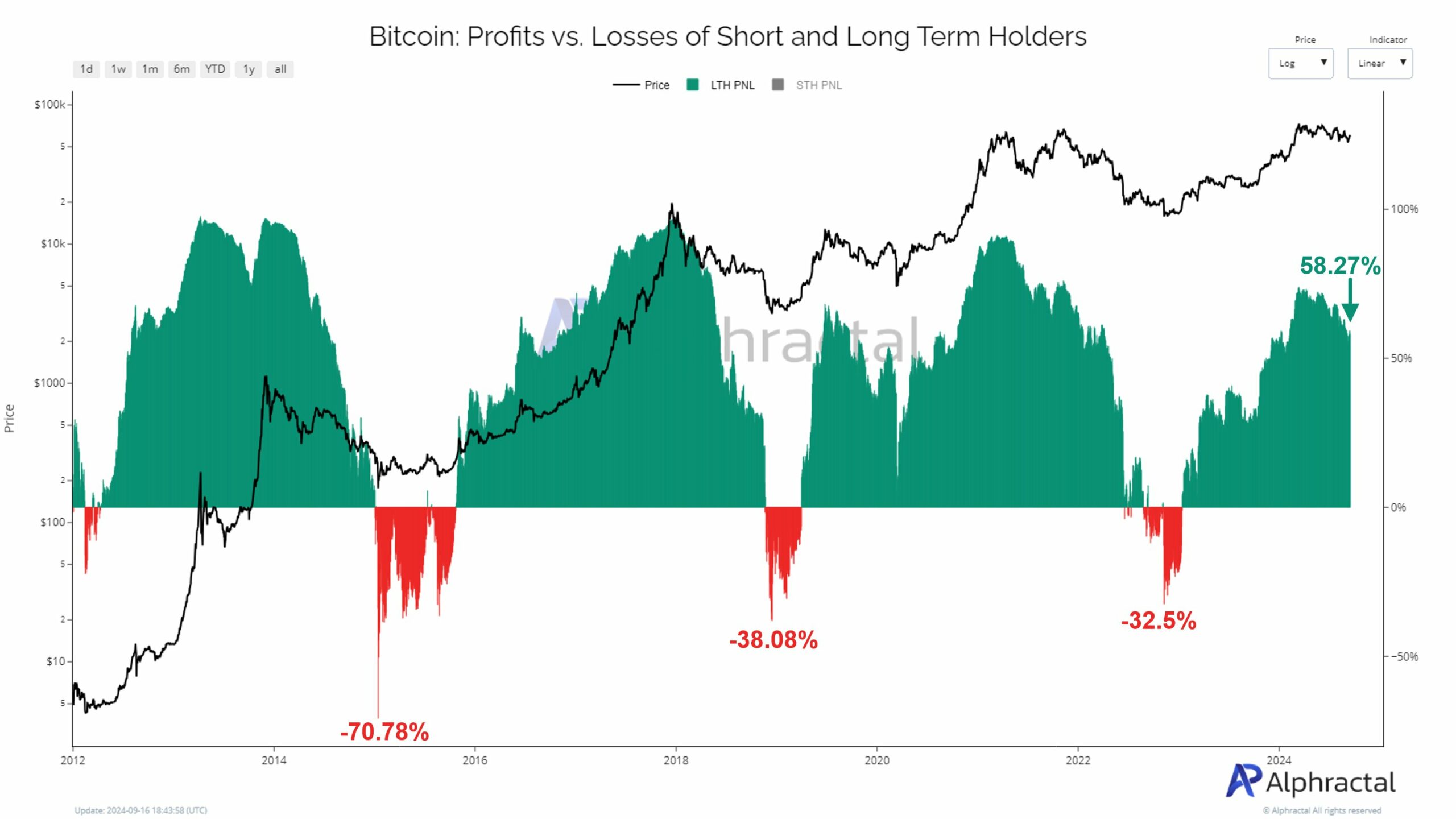

Currently, 58.27% of LTH are making profits, down from a peak of 74% on March 13 – a drop of 16%. Historically, a decline in profit margin after reaching a high months later can signal a potential bear market.

Source:

In short, while most LTH remains profitable, the weakening margin could indicate a slowdown or bearish trend ahead.

However, despite mounting losses since the March peak when BTC tested $70,000, LTH’s continued support signals belief in a possible price correction.

If this trend continues, LTH could delay sales, as evidenced by reduced BTC exchange deposits.

Additionally, a possible Fed rate cut could push BTC to a new ATH, assuming BTC deposits on exchanges continue their downward trend. Will they?

Time will tell

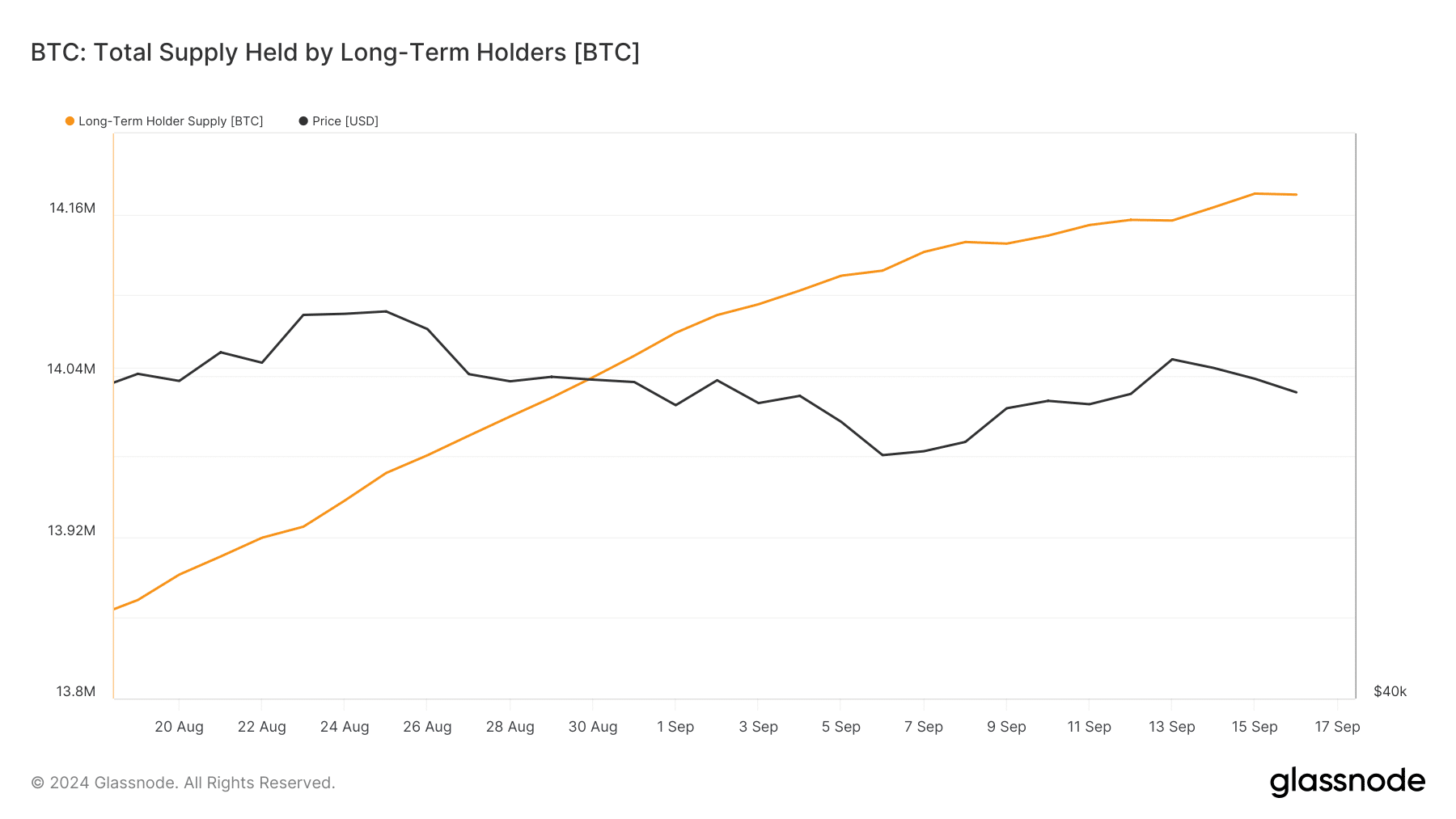

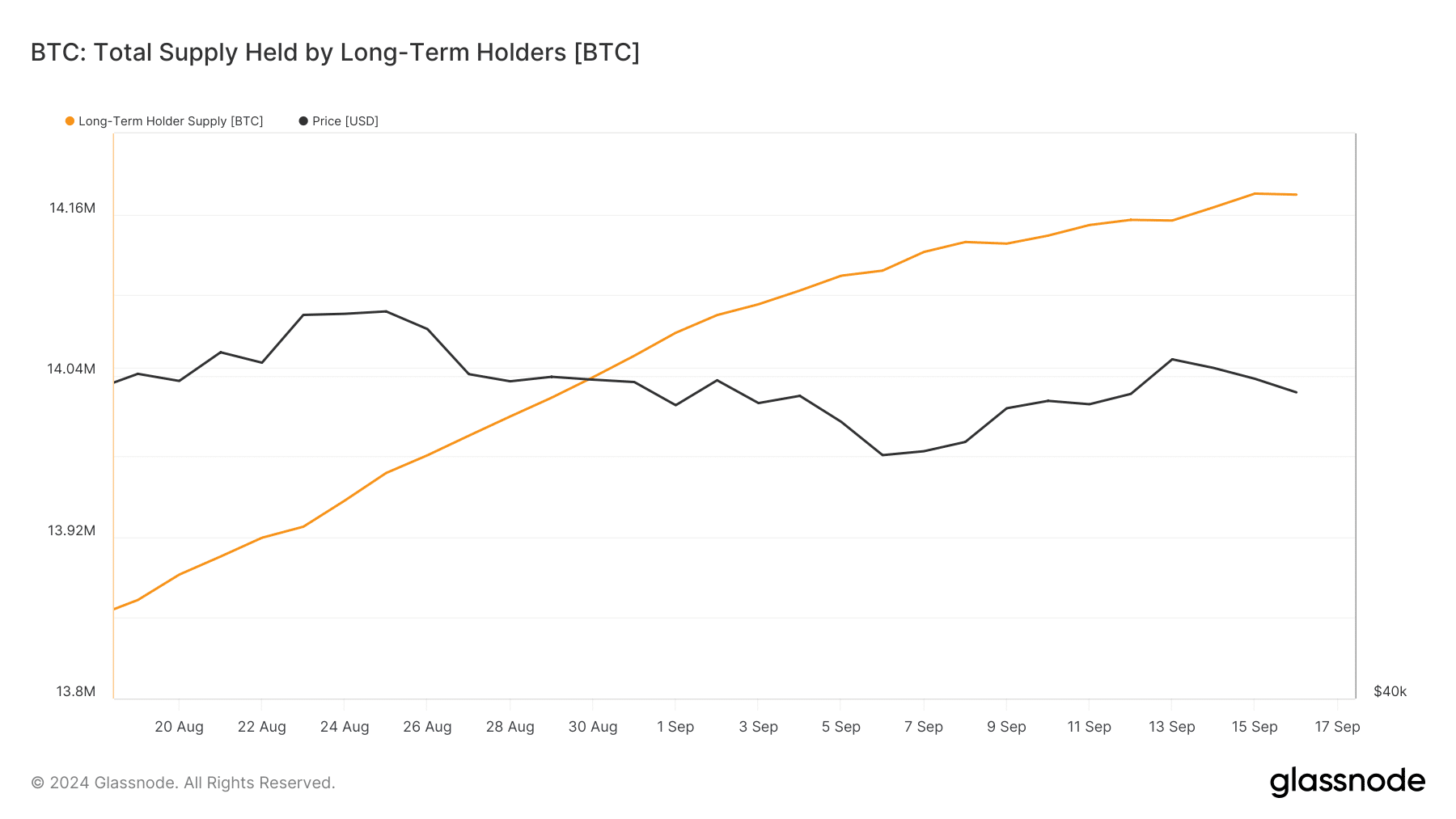

During the 30-day lookback period, LTHs sold a significant portion of their holdings for the first time on September 16, coinciding with BTC’s return to $58,000.

Source: Glassnode

As mentioned earlier, recovery requires LTHs to support their positions by avoiding further selling. However, this downturn was rare and still consistent with AMBCrypto’s previous projections.

Read Bitcoin’s [BTC] Price forecast 2024–2025

If LTHs can prove this event is an anomaly, and Bitcoin exchange deposits remain low, the door to a new ATH could still be wide open.

Conversely, if LTHs continue to sell, the $55,000 support could be at risk and the path forward could become much more uncertain.