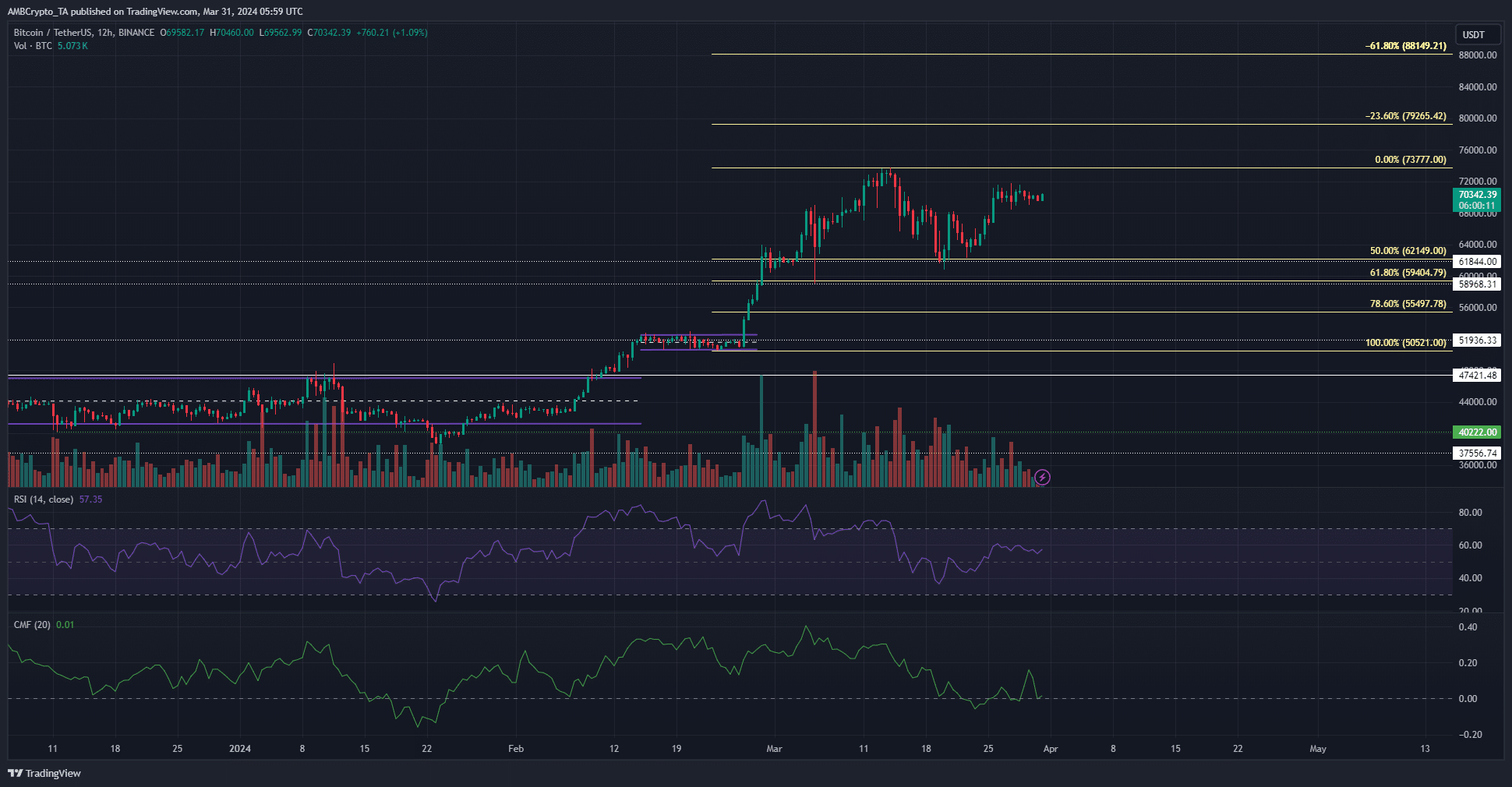

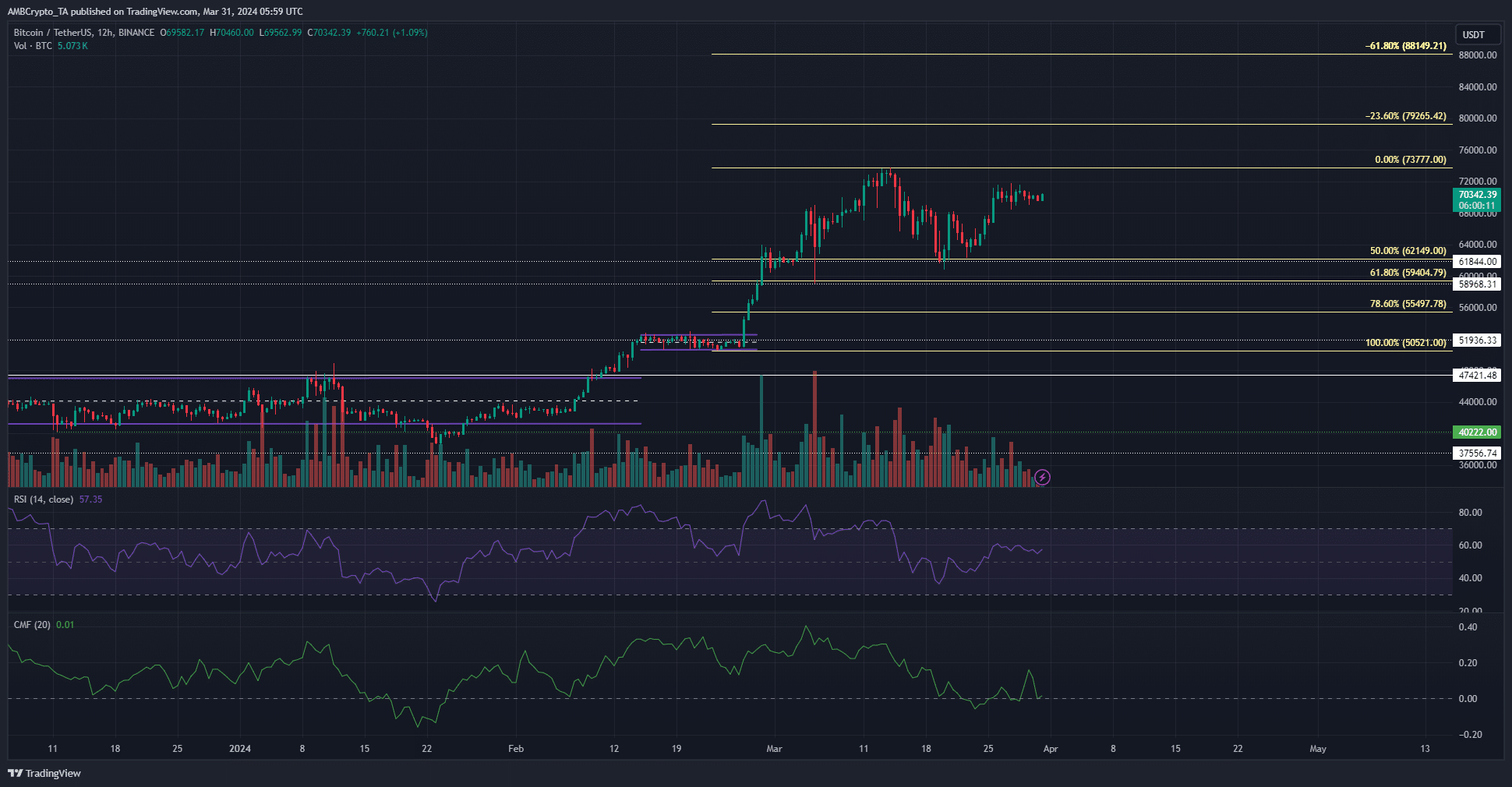

- Bitcoin and Ethereum showed a bullish market structure on the 12-hour chart.

- The main retracement levels have been defended so far, but a new test cannot yet be ruled out.

Bitcoin [BTC] and ether [ETH] continued to trade within the short-term range. They have a bullish bias on the higher timeframe price charts, and whales were accumulating both assets at a rapid pace.

A recent AMBCrypto report highlighted that this accumulation could continue for some time. Bitcoin has large amounts of liquidity nearby, which could hinder attempts to break out in either direction.

Bitcoin saw momentum and buying pressure stagnate

Source: BTC/USDT on TradingView

The Fibonacci retracement levels plotted for the rally from $50.5k to $73.7k showed the 50% retracement level being tested as support in mid-March.

There was a decent response and Bitcoin was trading at $50,000 at the time of writing.

Yet the 12-hour chart’s RSI was only at 57, indicating bullish momentum but not notable strength.

Chaikin money flow was +0.01 and would need to rise above +0.05 to see significant capital inflows.

The market structure on the 12-hour chart was bullish. A BTC falling below $60.7 would turn the market structure bearish.

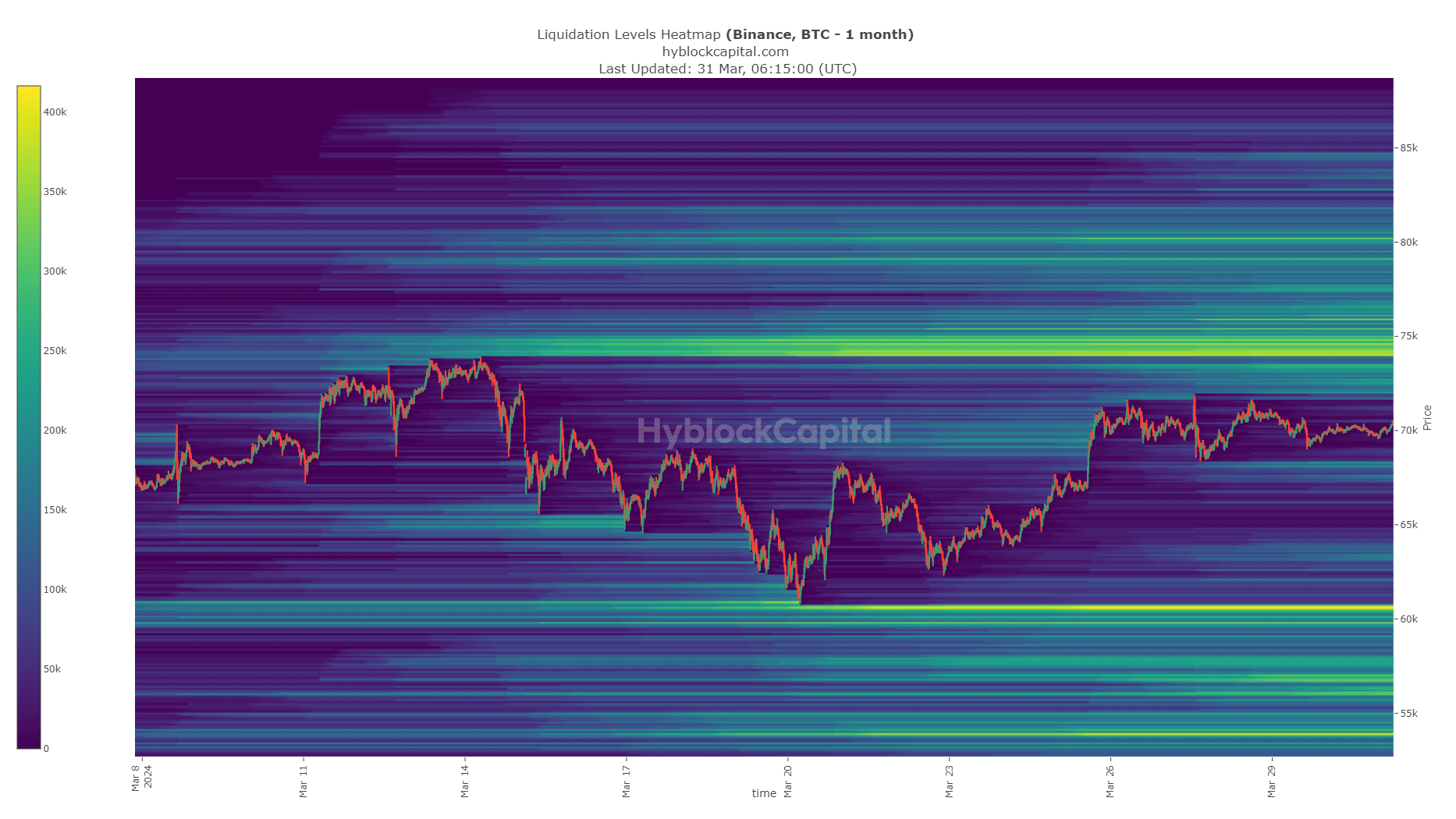

The heatmap of liquidation levels showed a significant concentration in the $74,000 to $74,800 zone. In the South, the $60k-$60.7k is also seeing intense levels of liquidation.

Closer to current prices, the $68.2k liquidity margin was also expected to play a role.

A move above $72,000 is a cause for celebration for Bitcoin bulls, but expect multiple attempts before prices break past the $75,000 region.

Ethereum Climbs Towards LTF Resistance – Will It Breakout Soon?

Source: ETH/USDT on TradingView

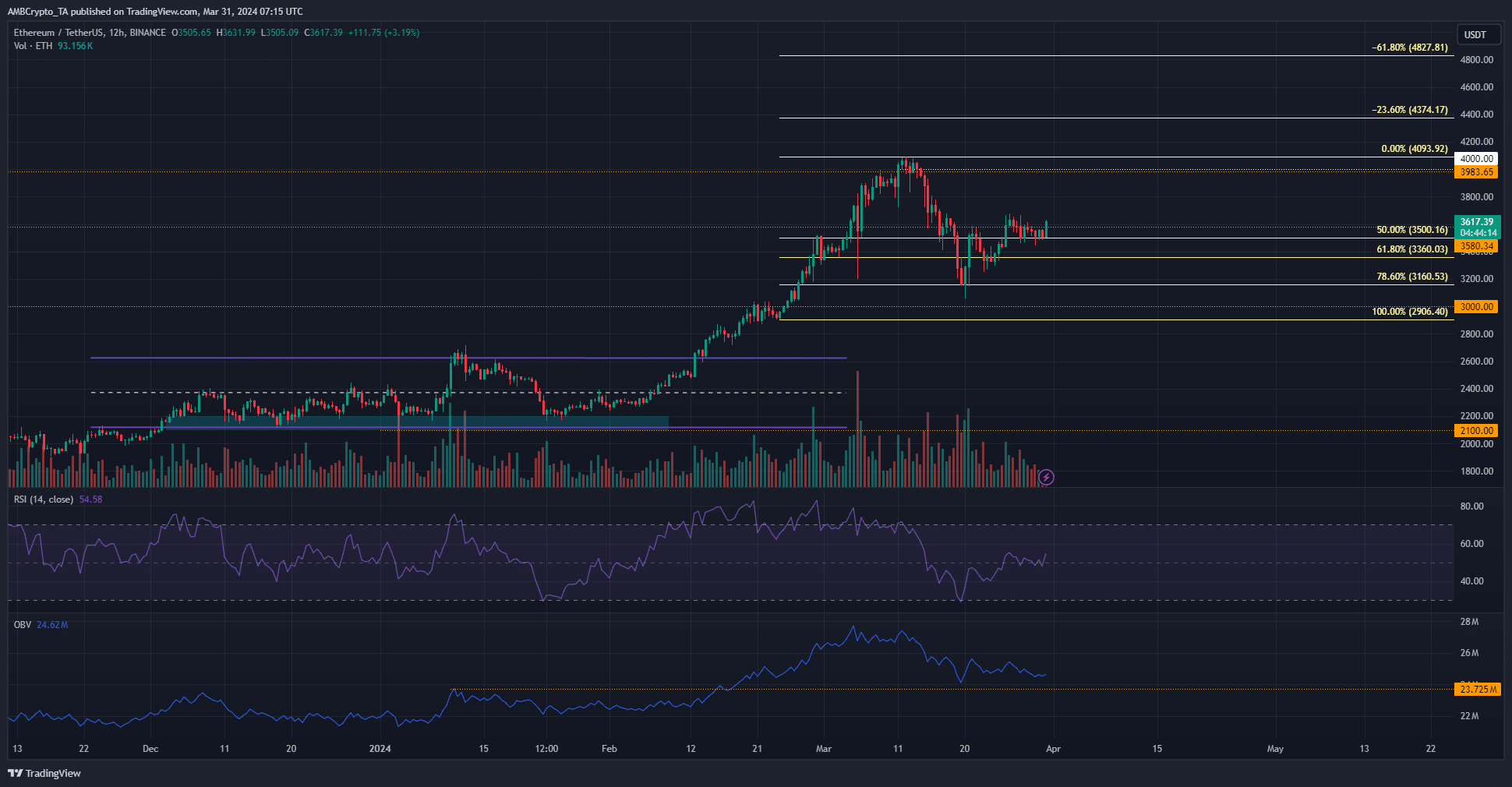

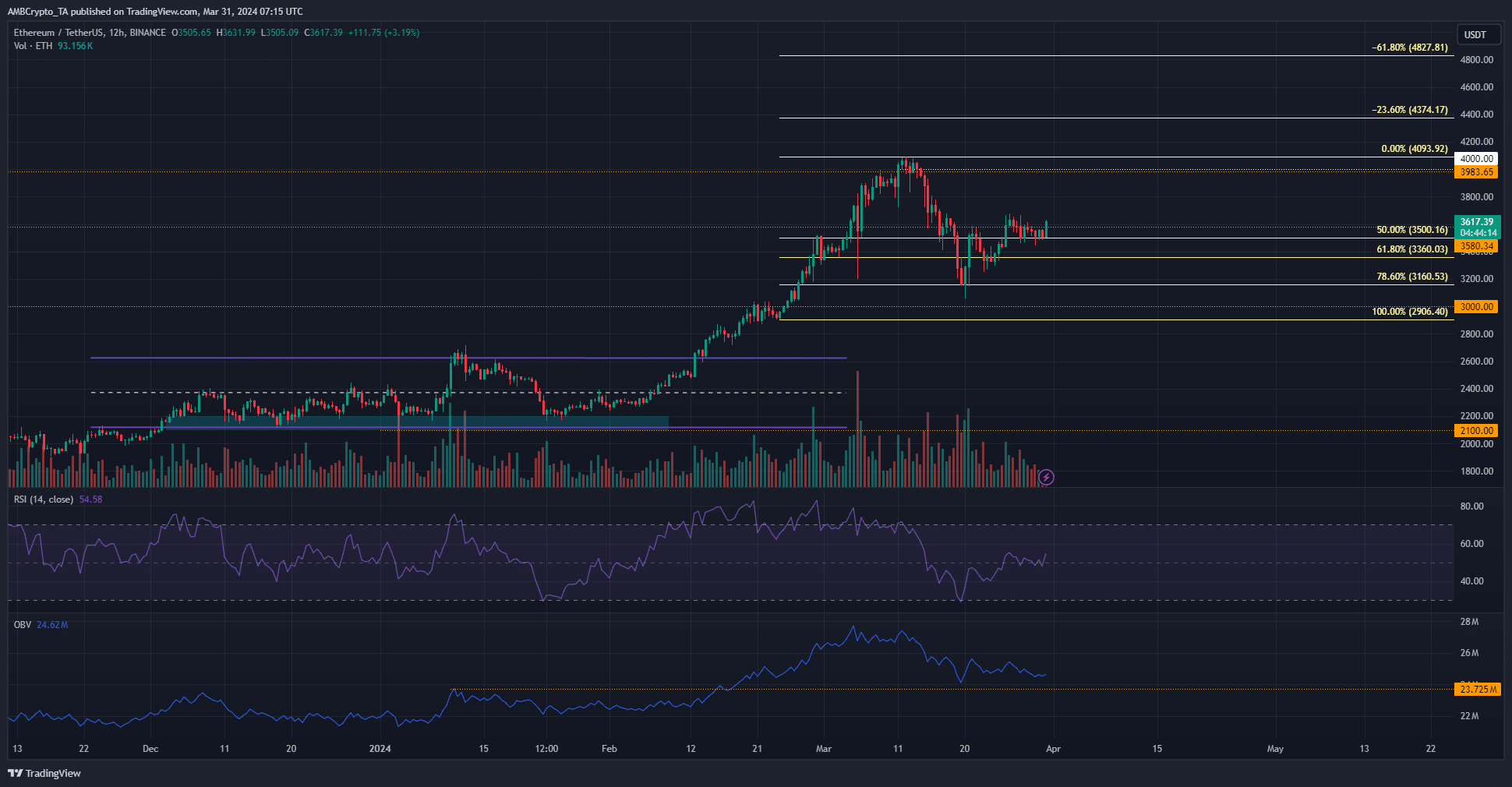

Ethereum has also seen its momentum slow over the past two weeks. The 12-hour RSI showed a reading of 54, indicating bullishness.

The market structure was also bullish and the 78.6% retracement level saw a good reaction from the buyers.

However, despite the buying volume over the past ten days, the OBV was unable to start an uptrend. It has sunk almost as low as the January highs, even though the price of ETH is almost 40% higher.

This lack of demand allowed Ethereum bulls to take time to catch their breath before starting the next rally. At the time of writing, the price was facing some short-term resistance at $3680.

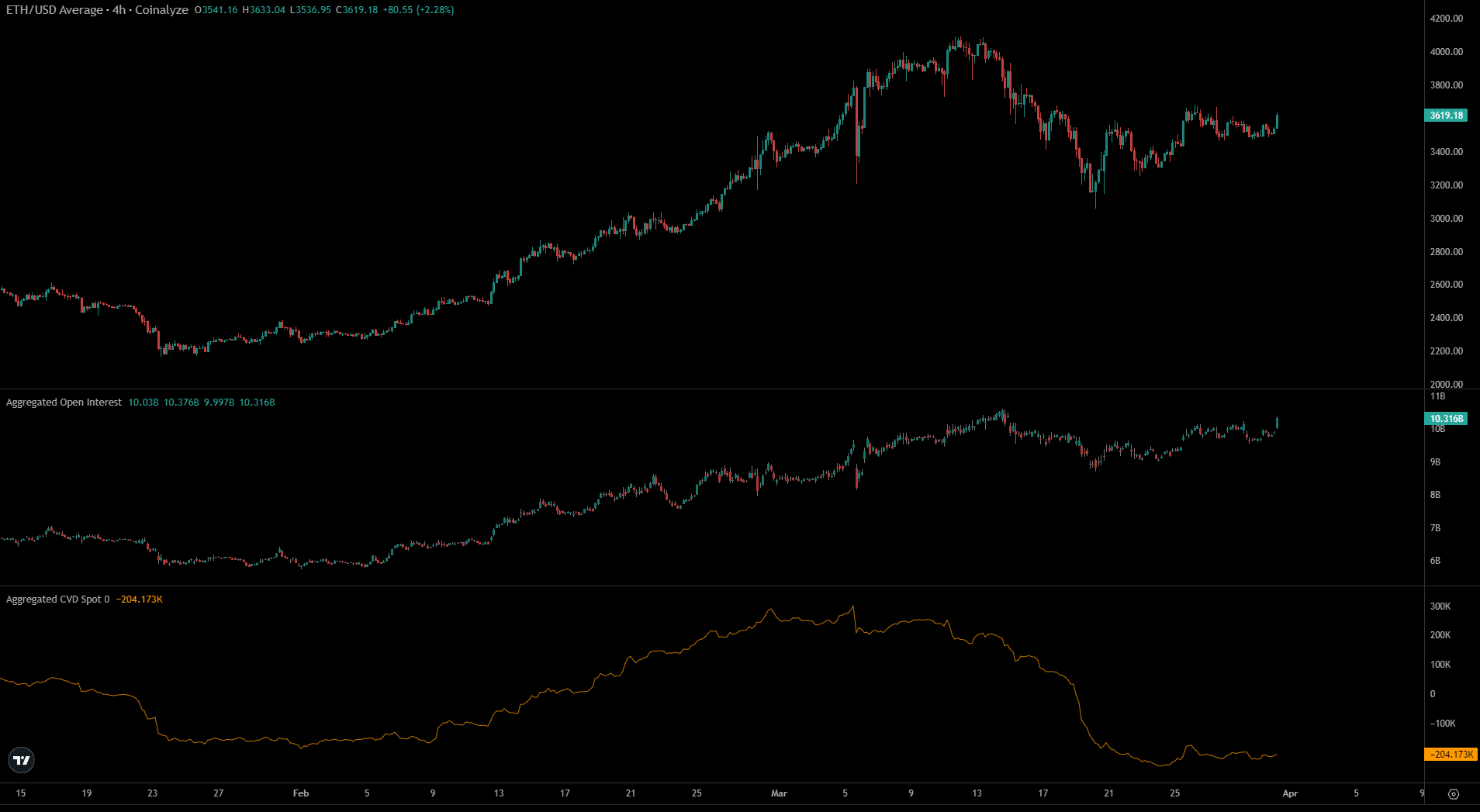

Coinalyze statistics highlighted strong selling pressure on spot markets in March. The spot CVD has been on a downward trend this month and only recently leveled off from the southward spiral.

Is your portfolio green? Check out the BTC profit calculator

Open Interest has increased significantly since March 17. It increased from $9 billion to $10.31 billion, while Ethereum rose from $3.2k to $3.6k.

This outlined some bullish conviction among speculators in the futures market.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.