- Bitcoin and Ethereum saw a remarkable decrease in retail adoption, as reflected by shrinking network activity.

- Will Q2 signal the start of a deeper corrective cycle?

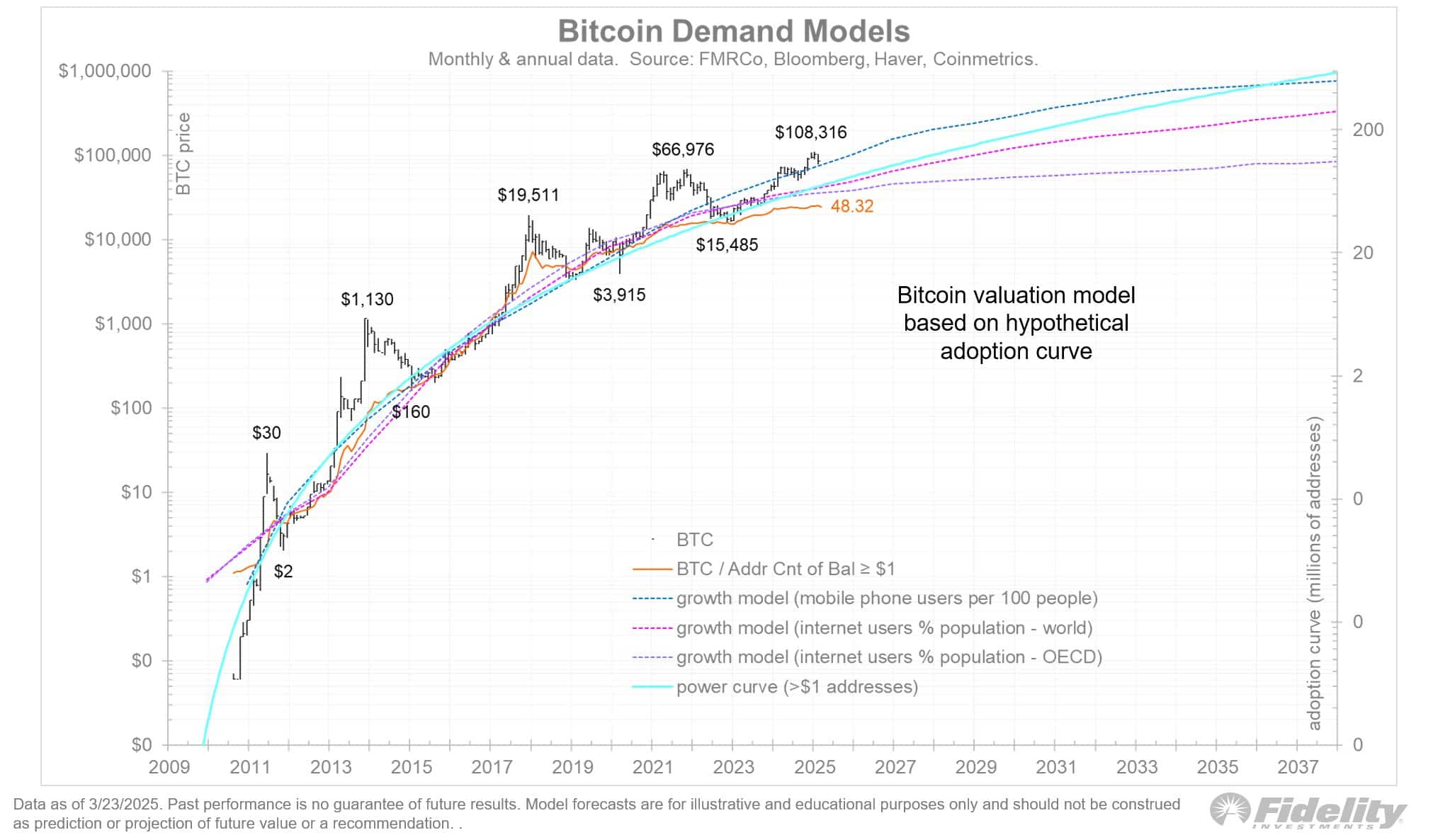

According to the graph below, since that of Bitcoin [BTC] After the 2020 bull cycle, the expansion of unique portfolios and active addresses is delayed, especially among portfolios that keep more than $ 1.

This stagnation corresponds to the Adoption curve modelWhich suggests that institutional accumulation BTC has consolidated in less high -quality portfolios.

Source: Fidelity Investments

In simple words, large-scale entities, such as micro strategy (MSTR), have concentrated companies, reducing the need for a broad wallet distribution. As a result, a broader distribution among private participants has decreased.

Ethereum [ETH] has shown this trend and registered the lowest adoption percentage in 2025. As institutional dominance grows, on-chain statistics can become less reliable for assessing the adoption of the retail trade in the future.

The market impact of this structural shift can be in -depth. Institutional portfolios are increasingly dictating liquidity cycles. For example, the sharp Retracement from Bitcoin to $ 77k in February correlated with persistent BTC ETF outflows.

On 25 February, BTC ETFs registered a net flow of $ 1.4 billion, which catalys a price drop of 5.11% within 24 hours. Ethereum ETFs have remained in the same way in a persistent phase on the sales side and is struggling to attract new inflow.

More critical, this one Institutional outsource have collided with Trump’s aggressive rate policy and added a macro -economic layer to the volatility of the crypto market.

While Q2 unfolds, the administration seems to be in full “reset” mode. While market reactions remain insecure, Bitcoin and Ethereum do not reply to their Q1 rally the question:

Will Q2 bring a gloomy Bearish cycle?

Food to think: is the Q2 cycle of Bitcoin and Ethereum in danger?

Bitcoin recovered $ 88k within two weeks because BTC ETFs returned to the net intake. MSTREN made use of the momentum and accumulated 6,911 BTC for $ 584 million at an average acquisition price of $ 86k.

Ethereum followed the example and retest short $ 2k. However, the long -term consolidation, in combination with decreasing network acceptance and modest institutional inflow, suggests underlying structural weakness.

If BTC resists and recovers, the price action of ETH can be vulnerable for a deeper corrective phase.

Source: TradingView (ETH/USDT)

Weak basic principles and selective accumulation by portfolios of high-quality and a headwind for both Bitcoin and the Q2 rally from Ethereum.

Historically, the Q1 force of BTC has activated an Altcoin -increase, but the price action of this cycle is varied. The most important distinctive factor? Increased macro -economic volatility.

If institutional capital flows do not compensate for this volatility in the coming quarter, both Bitcoin and Ethereum can be confronted with distribution pressure and postpone a full trend forecast.