- Inflows for Bitcoin ETFs grew, indicating increasing interest in BTC.

- Revenue generated by miners remained positive ahead of the upcoming halving.

Bitcoin[BTC] climbed past the $70,000 mark after hovering at that level for quite some time. However, recent interest in Bitcoin ETFs could see BTC turning green again.

A story of outflow and inflow

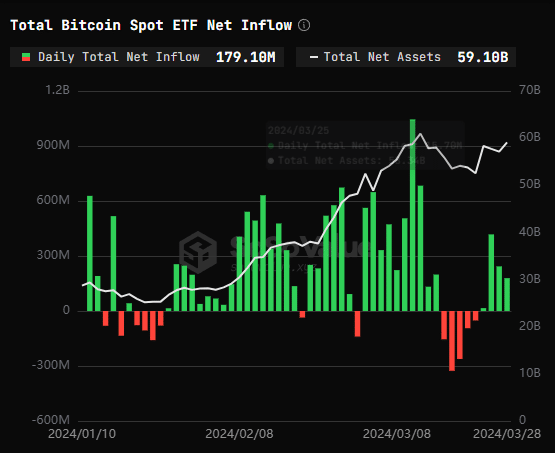

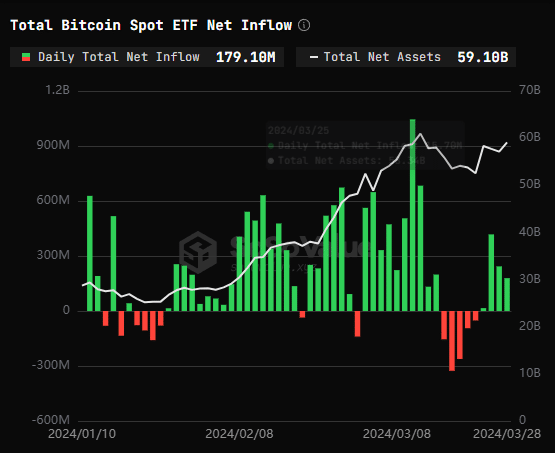

According to data from SoSoValue, total net inflows into Bitcoin spot ETFs amounted to $179 million as of March 28.

Specifically, the Grayscale ETF GBTC witnessed outflows of $104 million, while the BlackRock ETF IBIT saw inflows of $95.12 million and the Fidelity ETF FBTC saw inflows of $68.09 million.

As a result, the cumulative historical net inflows of these ETFs currently stood at $12.12 billion.

Source: SoSoValue

These strong inflows could imply that consumer interest in ETFs in traditional markets is increasing. High inflows could potentially result in a positive price movement for BTC in the future.

At the time of writing, BTC was trading at $69,864.20 and the price was down 0.81% over the past 24 hours.

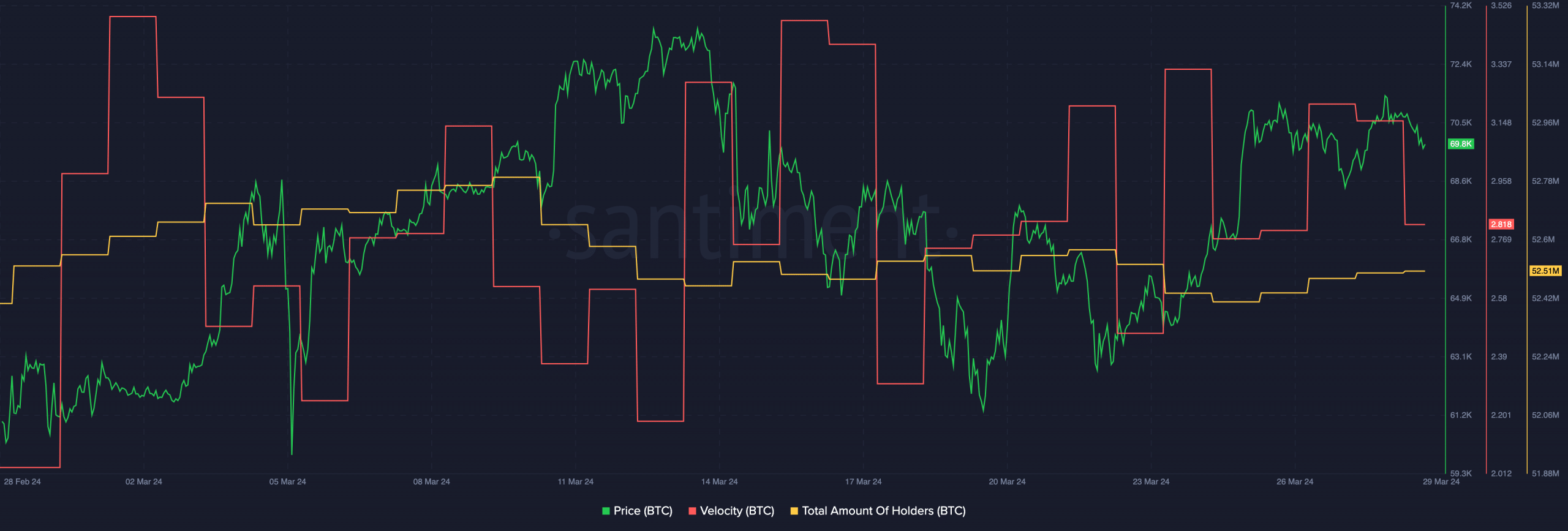

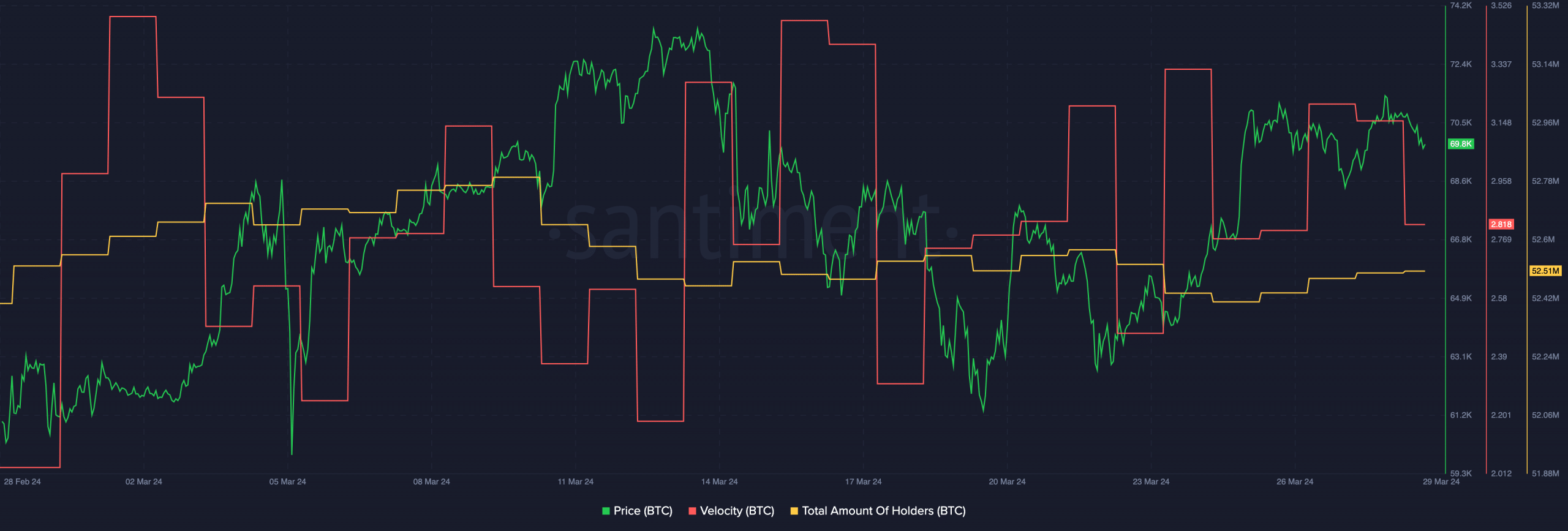

While interest in Bitcoin increased in the traditional financial sector, the same could not be said in terms of the crypto space. The speed at which BTC traded had also fallen during this period. This meant that the frequency with which the king coin was traded had decreased. The decrease in speed may indicate that current addresses may be losing interest in BTC.

Moreover, the total number of holders accumulating BTC had also decreased. These factors could affect the price of BTC in the future.

Source: Santiment

State of miners

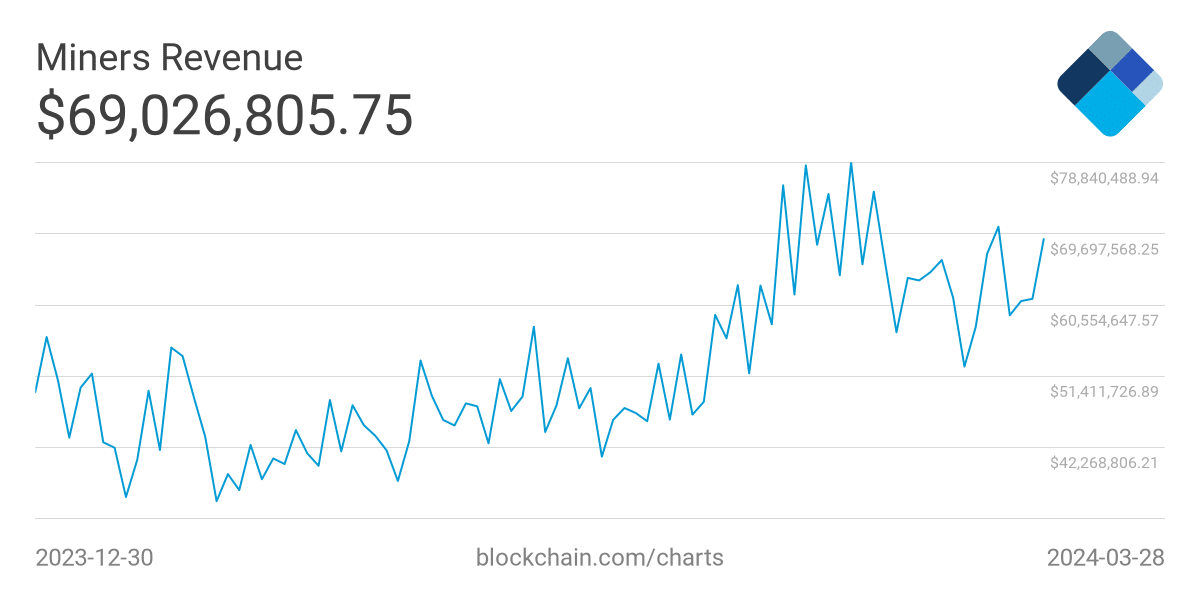

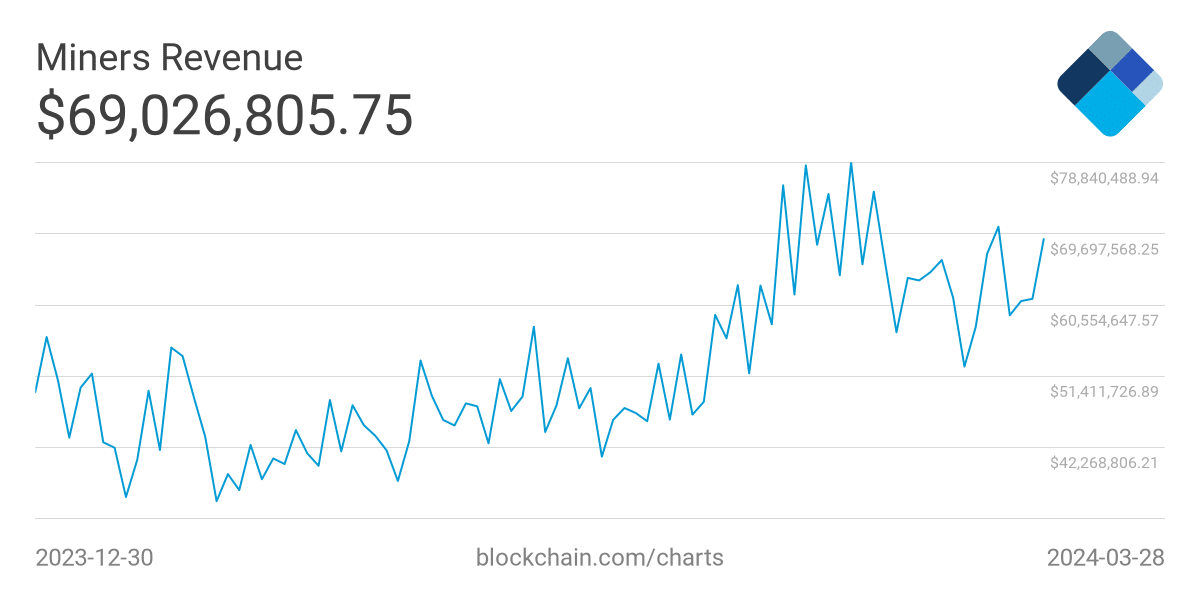

Another factor that could influence the price of Bitcoin is the state of miners on the network. AMBCrypto’s analysis of Blockhain.com data found that miners’ revenues had soared.

The increase in revenue means that miners do not have to sell their BTC holdings to remain profitable.

Read Bitcoin’s [BTC] Price forecast 2024-25

The overall selling pressure for BTC could also be reduced. However, the upcoming halving could change the course for miners as the reward generated by miners would decrease.

This could lead to many miners choosing to sell their holdings. While halvings have historically been a bullish event for Bitcoin, many holders should absorb the short-term sell-off that could occur as a result of the halving on the network.

Source: Blockchain