- Bitcoin ETFs saw significant inflows of $192.4 million after a brief outflow phase.

- Ethereum ETFs continue to struggle with inconsistent inflows, highlighting market volatility.

Institutional investors have temporarily halted their aggressive accumulation of Bitcoin [BTC]as the price of BTC enters a consolidation phase.

This is evident from recent data from various sources, including a British investment firm Farside InvestorsInflows into US Bitcoin Exchange-Traded Funds (ETFs) have become net negative for the first time in two weeks.

This lull in buying activity highlighted the increasing caution among investors as they assess the next move in BTC’s volatile market.

Bitcoin ETF analyzed

According to the latest update, Bitcoin ETFs saw significant outflows of $79.1 million on October 22.

Notably, Ark’s 21Shares BTC ETF led the downturn with the largest outflows, at $134.7 million.

However, not all ETFs saw negative movement; other Bitcoin ETFs recorded net inflows, with BlackRock’s iShares Bitcoin Trust (IBIT) standing out by recording the highest inflows of $43 million.

This divergence in fund movements reflects varying investor sentiment between different Bitcoin ETF products.

Furthermore, as of October 23, BTC ETFs reversed course, with a substantial inflow of $192.4 million.

Although Ark’s 21Shares continued to lead the outflows with $99 million, followed by Bitwise’s BITB losing $25.2 million and VanEck’s HODL falling $5.6 million, the overall trend changed.

Notably, BlackRock’s iShares Bitcoin Trust ETF (IBIT) recorded a notable inflow of $317.5 million, underscoring its continued appeal among investors.

This consistent inflow underlines investors’ growing confidence in BlackRock’s Bitcoin ETF as the preferred choice for market exposure.

Executives weigh in

Nate Geraci, co-founder of the ETF Institute, said the same thing, telling X (formerly Twitter):

Source: Nate Geraci/X

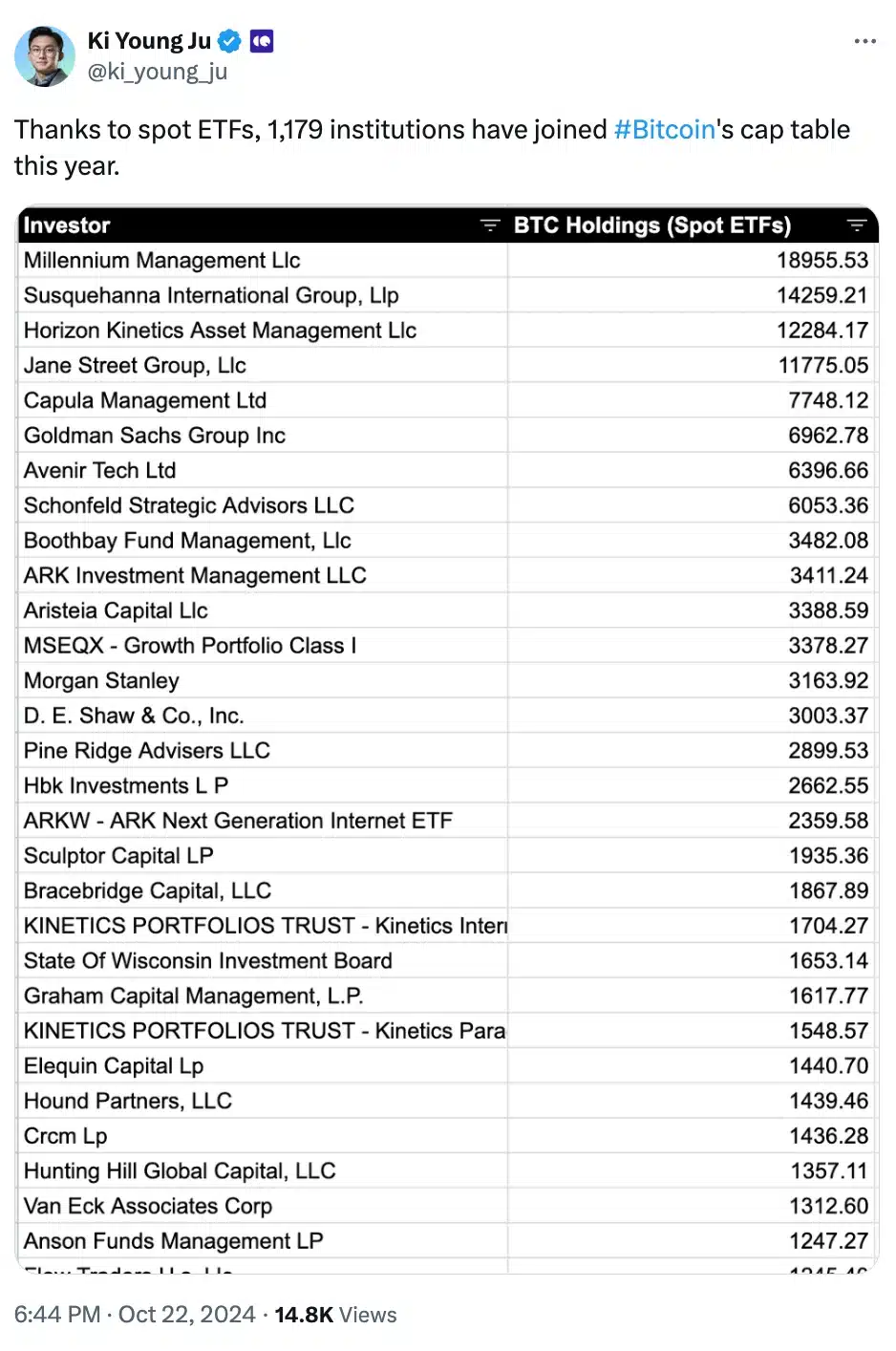

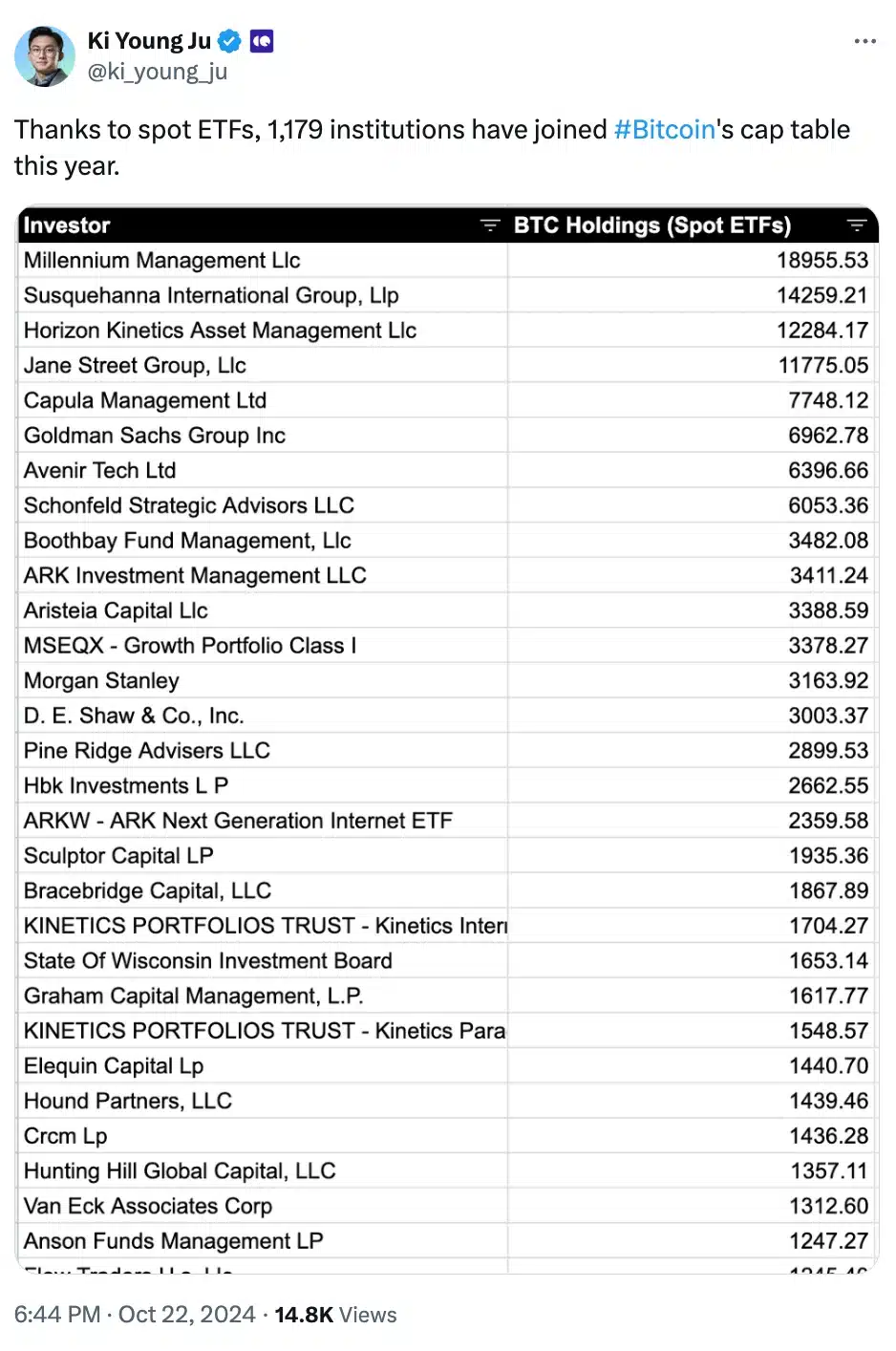

Adding to the fray was Ki Young Ju, co-founder of onchain analytics platform CryptoQuant, who said:

Source: Ki Young Ju/X

Ethereum ETF update

On the other hand, Ethereum [ETH] ETFs had mixed results on both October 22 and 23, although they have not received the same interest as Bitcoin ETFs.

On October 22, ETH ETFs saw total outflows of $11.9 million, with only BlackRock’s ETHA reporting any inflows, while all others stagnated.

The next day, Ethereum ETFs saw a modest inflow of $1.2 million.

However, Grayscale’s ETHE saw outflows of $7.6 million, while only Fidelity, 21Shares, and Invesco’s Ethereum ETFs managed to record inflows, highlighting the volatile nature of ETH ETF investments.

The price action of ETH and BTC explained

Meanwhile, as of the latest market updates, Bitcoin trades at $66,811.00, reflecting a 0.51% increase over the past 24 hours, showing steady momentum.

Ethereum, on the other hand, suffered a downturn, with its price falling 2.29% to $2,519.34 according to CoinMarketCap facts.

These fluctuations highlight the ongoing volatility in the crypto market, with BTC maintaining its uptrend while ETH faces short-term declines.