- The total net assets of Bitcoin ETFs reached $100 billion.

- The king coin is approaching a six-figure valuation.

Place Bitcoin [BTC] ETFs have reached a major milestone: surpassing $100 billion in assets under management (AUM).

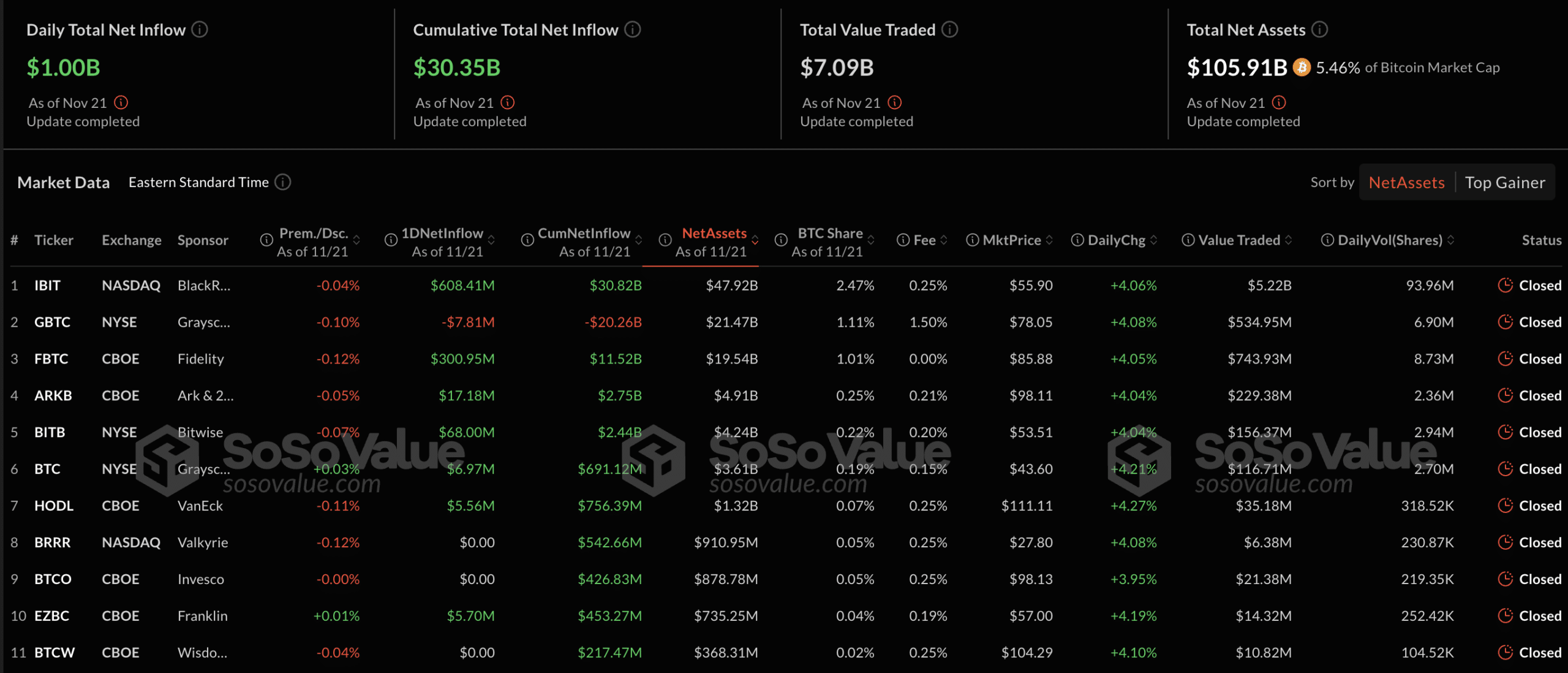

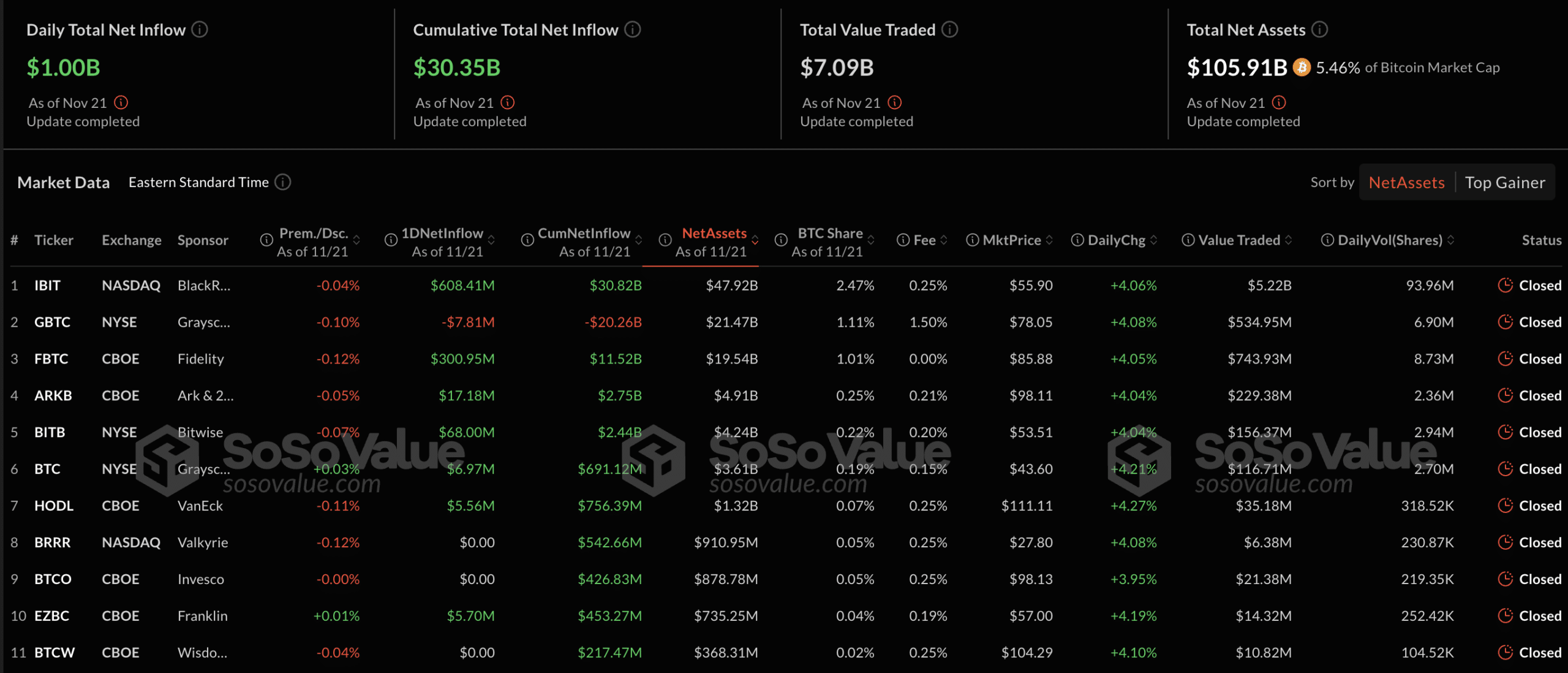

This week’s total net flows also set a record, reaching $2.89 billion with one trading day remaining. Moreover, the total net inflows amounted to $30.35 billion.

Eric Balchunas, Bloomberg senior ETF analyst, taken to social media platform

“Double our estimate.”

Balchunas noted that Bitcoin ETFs are now 97% on track to surpass Satoshi Nakamoto as the largest BTC holder and 82% closer to overtaking gold ETFs.

Bitcoin ETF Inflows

Facts from SoSo Value showed that this important milestone was preceded by a substantial inflow since the beginning of this week, which continued to strengthen as the week progressed.

On November 20, 2024, inflows rose to $796 million. At the same time, the total net worth exceeded the $100 billion mark. Moreover, daily net inflows reached $1 billion on November 21.

Source: SoSo value

Notably, at the time of writing, total net assets stood at $105.91 billion, representing 5.46% of Bitcoin’s market capitalization.

Unsurprisingly, IBIT was the largest contributor, with almost half of the total assets worth $47.92 billion. It also dominated the inflow figures, accounting for $608 million.

IBIT also made a strong impression in the options market. According to According to James Seyffart, ETF analyst at Bloomberg, 97% of Bitcoin ETF options volume was concentrated on IBIT.

BTC to $100,000?

Meanwhile, Jeff Park, head of Alpha Strategies at Bitwise, celebrated the achievement on to report:

“It is only fitting that we celebrate this milestone with Bitcoin reaching $100,000.”

Interestingly, this comes as Bitcoin hit a new ATH of over $99,300, which was closer to a six-figure valuation. At the time of writing, BTC was trading at $99,057, reflecting a daily increase of 1.98%, according to CoinMarketCap.

But how far can BTC go before the rally loses steam? Benjamin Cowen, CEO of Into The Cryptoverse shared insights about this.

He drew parallels between Bitcoin’s trajectory until the launch of QQQ in 1999, which rose from $48-$49 to $120 in 54 weeks despite brief pullbacks.

Cowen noted that Bitcoin ETFs launched at nearly $48,000 with a 54-week term ending January 20, coinciding with Donald Trump’s Inauguration Day and SEC Chairman Gary Gensler’s expected expectation. dismissal.

The director noted:

“What are the chances that BTC will rise until mid-January (along with #BTC’s dominance), after which BTC/USD will correct as it usually does in January of post-halving years?”

A new milestone for Bitcoin

Adding to Bitcoin’s momentum, Balchunas highlighted another win for the king coin as trading volume for the “Bitcoin Industrial Complex” hit a new record high.

He wrote:

“BITSANITY: Let’s Attempt $70 Billion in Volume for the Bitcoin Industrial Complex Today, Breaking Yesterday’s Record”

Of this, Balchunes noted that $50 billion came from MicroStrategy (MSTR) and related products, while IBIT contributed $5 billion – the second highest trading day.

With Bitcoin ETFs breaking records and the king coin approaching $100,000bullish sentiment in the market continues to rise.