- Bitcoin ETFs have surpassed the 1 million BTC mark in total

- On its 16th birthday, the cryptocurrency fell on the price charts

Less than a year after launch, US Bitcoin [BTC] ETFs have collectively accumulated over 1 million BTC. This is important, as Eric Balchunas, Senior ETF Analyst at Bloomberg, recently did predicted that the ETFs could exceed the assets of Bitcoin’s pseudonymous creator – Satoshi Nakamoto. He had predicted at the time that this would happen in mid-December.

However, BlackRock’s one-day purchase of 12,127 BTC, according to Kijkonchain, accelerated the timeline. Balchunas responded on this huge accumulation on X, which states:

“At this rate, they’ll pass Satoshi in less than two weeks.” Even if they can’t keep up this Joey Chestnut-level pace, right?”

At the time of writing, BlackRock owned 429,185 BTC, worth approximately $30.8 billion.

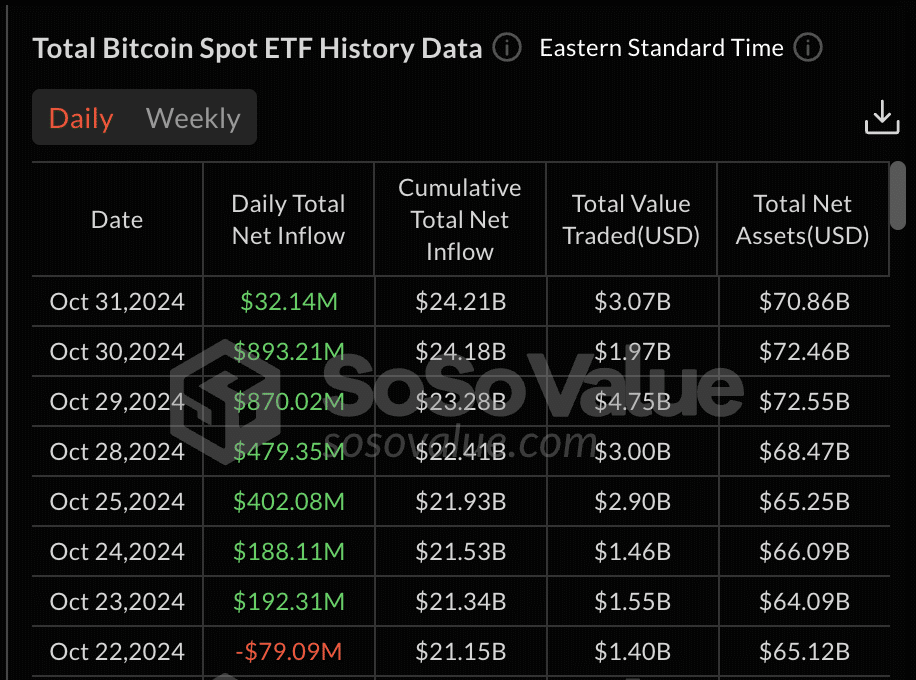

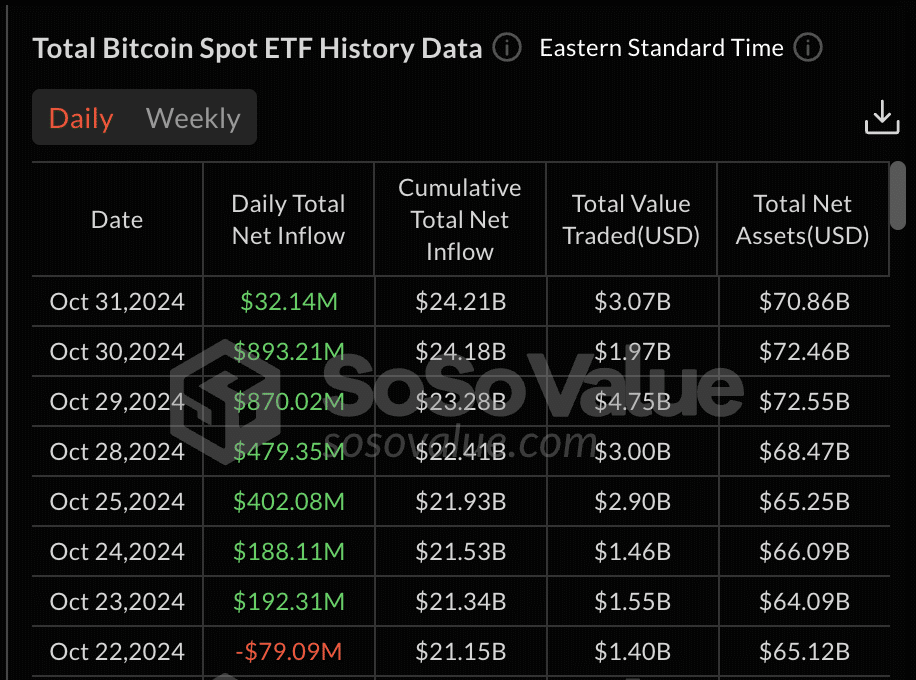

Combined, US Bitcoin ETFs now manage assets totaling $70.86 billion, representing 5.12% of Bitcoin’s market cap. This is evident from data from Soso value.

For context, Nakamoto owns an estimated 1.1 million BTC, currently worth $76 billion.

Are ETF inflows slowing down?

Formerly AMBCrypto reported that on October 30, BlackRock’s IBIT marked the largest single-day inflow since January. This increase in investment followed the trend of daily triple-digit total net inflows since October 23.

Source: Sosowaarde

However, total daily net inflows fell to $32.14 million on October 31. Additionally, IBIT and the CoinShares Valkyrie Bitcoin Fund ETF (BRRR) alone raised $318.80 million and $1.89 million, respectively.

Other ETFs experienced outflows or no inflows at all. Interestingly, this decline coincided with the king coin losing its position above the $70,000 level.

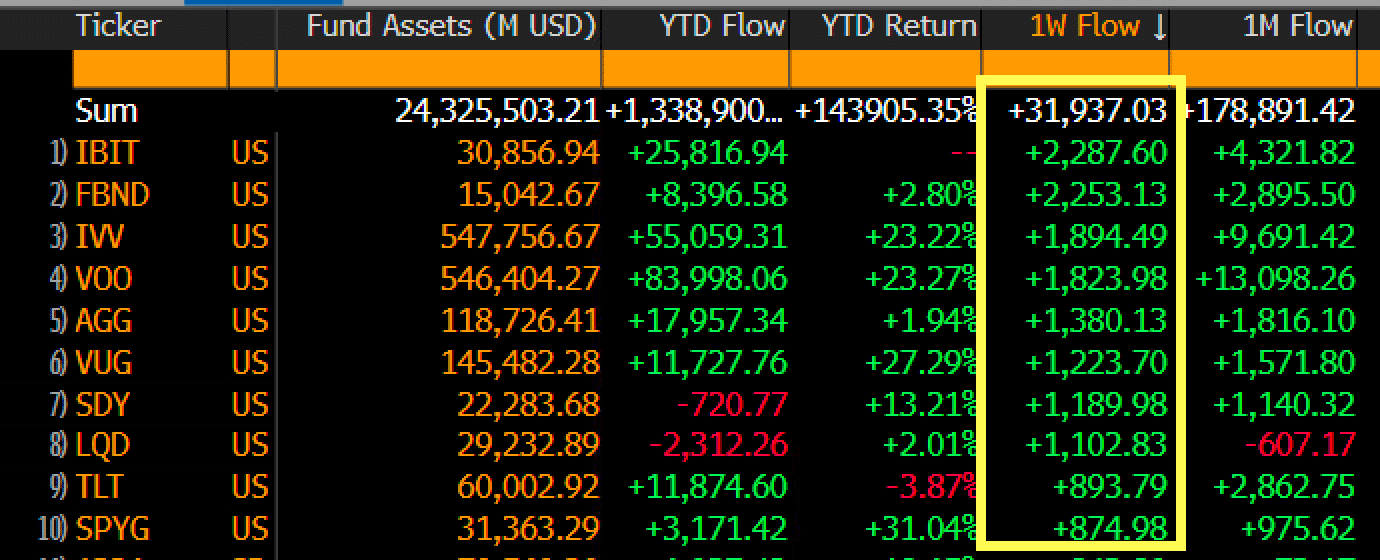

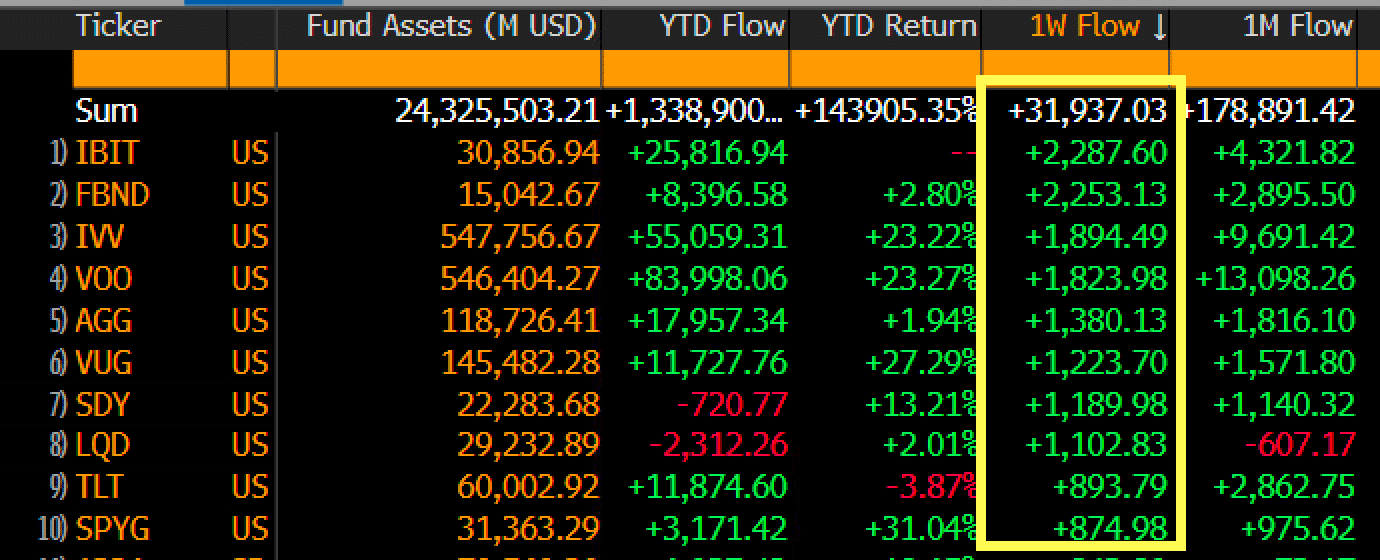

Despite this decline, however, Balchunas revealed that IBIT has managed to attract more money in the past week than the total of 13,227 ETFs worldwide. He emphasized that this performance is particularly important for an ETF that is less than a year old.

Source: Eric Balchunas/X

Executives weigh in

IBIT’s remarkable performance did not go unnoticed by industry experts. Nate Geraci, president of the ETF Store, shared his perspective on X:

“This thing turns into a $$$ vacuum cleaner.”

Geraci marked that the $70 billion in BTC ETF assets was more than 50% of the $130 billion held by gold ETFs since 2004 – all within just ten months of their 2024 launch.

Quinten Francois, co-founder of WeRate, echoed this sentiment: to report,

“Bitcoin ETFs had more inflows in the last two days than the Gold ETF had in its entire first year.”

Bitcoin turns 16

Meanwhile, the Uptober rally came to an end with BTC’s 16th anniversary, marking the day Nakamoto published the nine-page white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This milestone laid the foundation for a decentralized digital currency and the cryptocurrency era.

Interestingly, Bitcoin dipped below the $70,000 mark on its birthday. At the time of writing, the stock was valued at $69,821, down 3.33% in the past 24 hours.

While the recession has disappointed some, it also raises an intriguing question: Could this be an opportunity for institutional investors to “buy the dip” and acquire Nakamoto sooner than expected?

Such a move would accelerate the shift toward institutional dominance in a space that Nakamoto originally envisioned as decentralized.