- Most ETFs’ net flows were more than Grayscale’s BTC outflows.

- Technical indicators and on-chain metrics point to a Bitcoin rally within a few months.

For the first time since Bitcoin [BTC] ETFs went live, the net balance of BlackRock (IBIT), Fidelity (FBTC), Bitwise (BITB) and Franklin Templeton (EZBC) was more than Grayscale’s payout. AMBCrypto collected the data after examining the inflows and outflows of the ETFs.

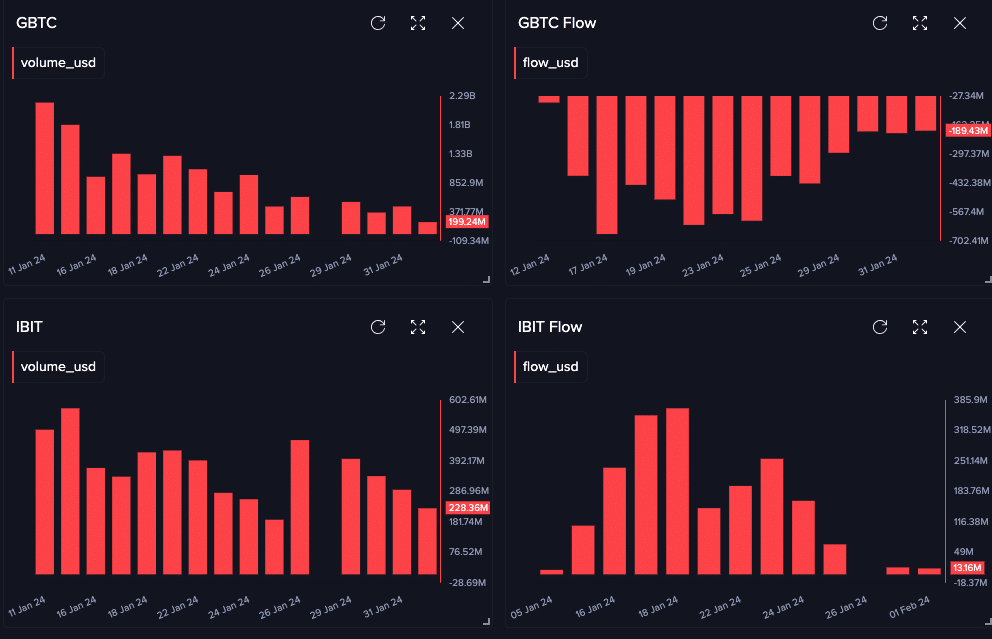

For most of the time, the Grayscale Bitcoin Trust ETF (GBTC) has dominated volumes. But not all these volumes were inflows.

In recent weeks, Grayscale has been removing GBTC in large numbers. This sell-off came at the expense of Bitcoin’s price, which once plummeted to $39,000 around that period.

IBIT and FBTC are now in charge

But now that the dump has subsided, other ETFs are gaining traction. According to AMBCryptos ask on Santiment, GBTC’s flow at the time of writing was -$189.43 million. This was the lowest flow since January 12.

In terms of volume, Grayscale only boasted $199.24 million. This means that BlackRock’s IBIT had a lot more in Bitcoin trading.

Source: Santiment

We also evaluated the volume of FBTC and BITB. At the time of writing, on-chain data showed that Fidelity’s FBTC has more Bitcoin trading volume than Grayscale at $893.16 million. However, Bitwise’s BITB was lower at $64.59 million.

Furthermore, the recent decline in the GBTC could signal a turnaround for Bitcoin. If the company continues to slow its outflows, we could see a rise in the price of BTC. A few weeks ago, BTC jumped to $49,000 following the approval of the SEC ETF.

But the event later proved to be disastrous for the coin price when it fell. But the past 24 hours have brought a calm of sorts to Bitcoin.

At the time of writing, the price of BTC was $43,073, which represents 2.08%. As such, there is a chance that the price could go higher than what it was.

Is the Change for Bitcoin’s Profits?

Should Grayscale finally stop selling, Bitcoin could go back to $49,000. But this prediction would require more than declining outflows and more ETF buying orders. Another possible catalyst that could drive up Bitcoin’s price could be competition between these companies.

Normally it is expected that each of these companies will want to have a higher volume than the other.

Therefore, demand for Bitcoin could increase as the battle for market share increases. But at the same time, it is also important to check the potential of BTC from a technical point of view.

At the time of writing, Bitcoin had not become extremely volatile, as evidenced by the Bollinger Bands (BB). This implies that the coin can continue to trade within a small margin. In a very bearish scenario, BTC could drop to $41,726. But if the momentum is bullish, the coin could reach $44,000.

The Aroon indicator also showed that the dominance of sellers (Aroon Down-blue) decreased, while buyers (Aroon Up-orange) slowly maintained control. Should this continue, BTC’s long-term uptrend could continue.

Source: Santiment

But in the short term, the potential increase to $49,000 may not be immediate. This was due to the indication that the Chaikin Money Flow (CMF) showed. At the time of writing, the CMF was -0.02.

The negative value of the CMF indicates higher distribution than accumulation. If the CMF eventually turns positive, Bitcoin could trigger a significant upward run.

Major players have bought the ‘blood’

Yet another statistic AMBCrypto checked when assessing Bitcoin’s price potential was the Accumulation Trend Score. The accumulation trend score reflects the relative size of entities actively accumulating coins on-chain in terms of their BTC holdings.

When the accumulation trend score is closer to 1, it indicates that larger entities are accumulating overall. However, an accumulation trend score closer to zero indicates that entities are distributing.

Source: Glassnode

How much are 1,10,100 BTCs worth today?

At the time of writing, Glassnode data showed the accumulation trend score to be exactly 1. This value means that many large entities aggressively bought the Bitcoin dip.

If accumulation continues to rise, the price of BTC could rise significantly in a few months.