- Outflows from US Bitcoin ETFs continued into the new week.

- The BTC price has remained subdued due to weak demand from US investors.

American place Bitcoin [BTC] ETFs (exchange traded funds) experienced significant exodus after Labor Day, underscoring continued risk-taking among investors.

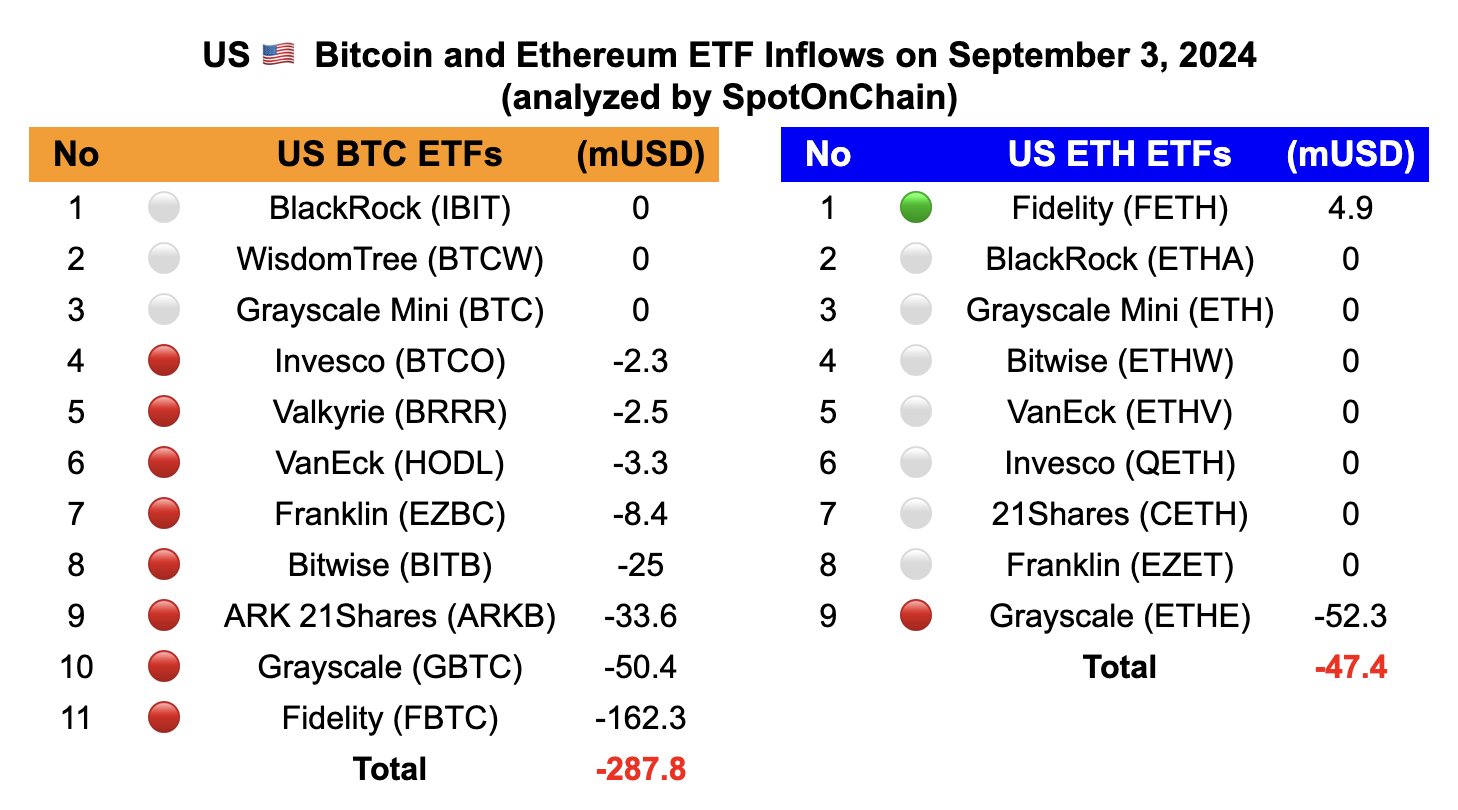

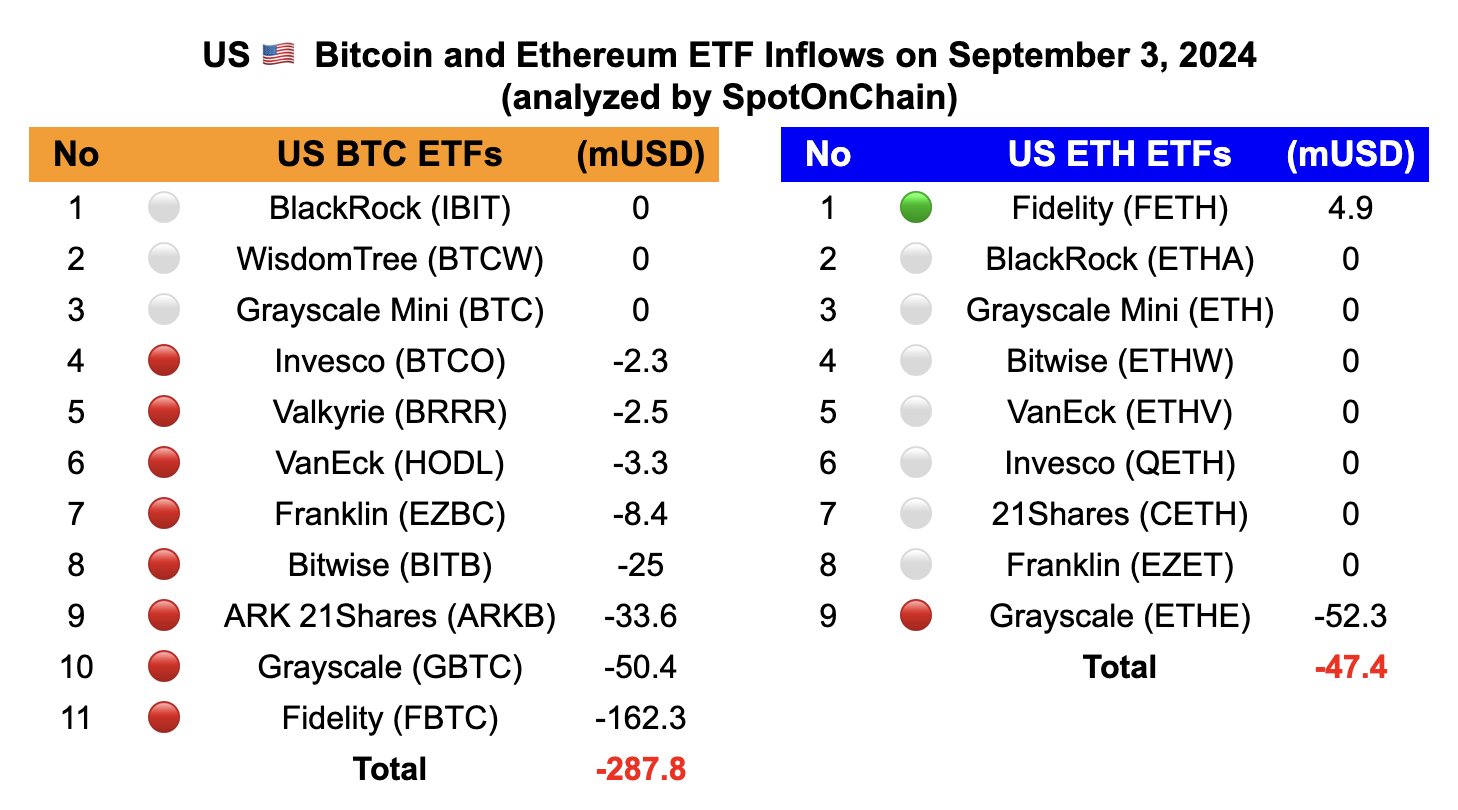

After an extended US weekend, the products recorded outflows of $288 million on September 3.

Source: SpotOnChain

Apart from BlackRock, Wisdom Tree and Grayscale Mini, which recorded zero flows, the rest reported negative flows.

Fidelity led the outflow as investors withdrew $162.3 million from the Bitcoin trust fund. Grayscale and Ark 21Shares followed closely, with $50.4 million and $33.6 million, respectively.

The risk-off mode of BTC ETF investors remains

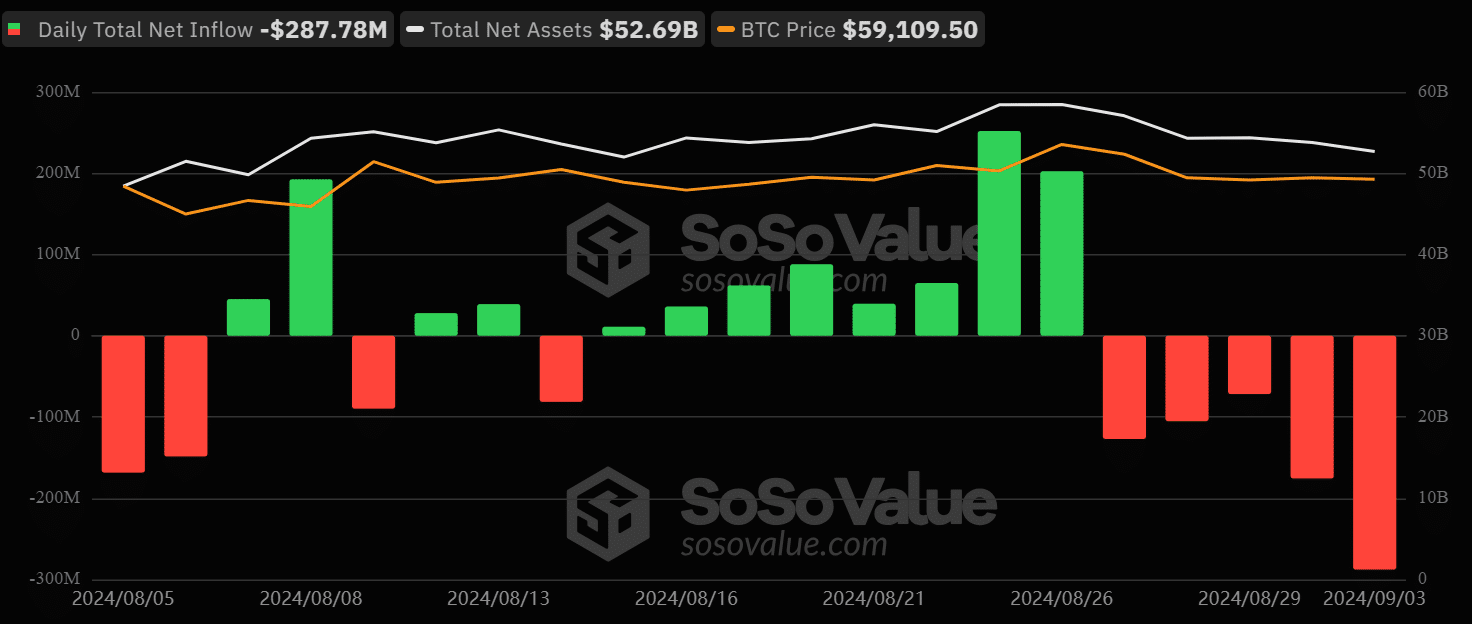

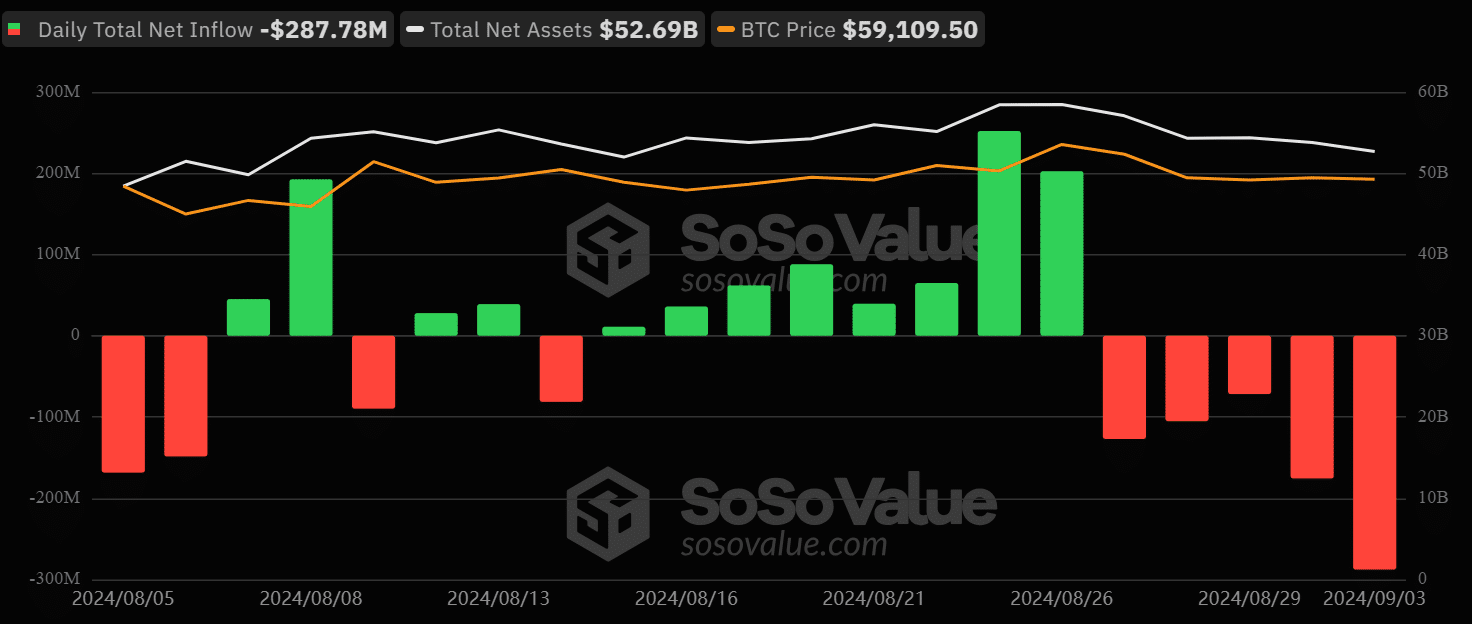

The outflows after Labor Day reinforced the weak trend that started last week. Soso value facts showed that the products experienced negative outflows every day for the past five trading days.

Source: Sosowaarde

The weak trend suggested that ETF investors’ risk-off mode continued into the new week. Last week, the products recorded cumulative outflows of $277 million.

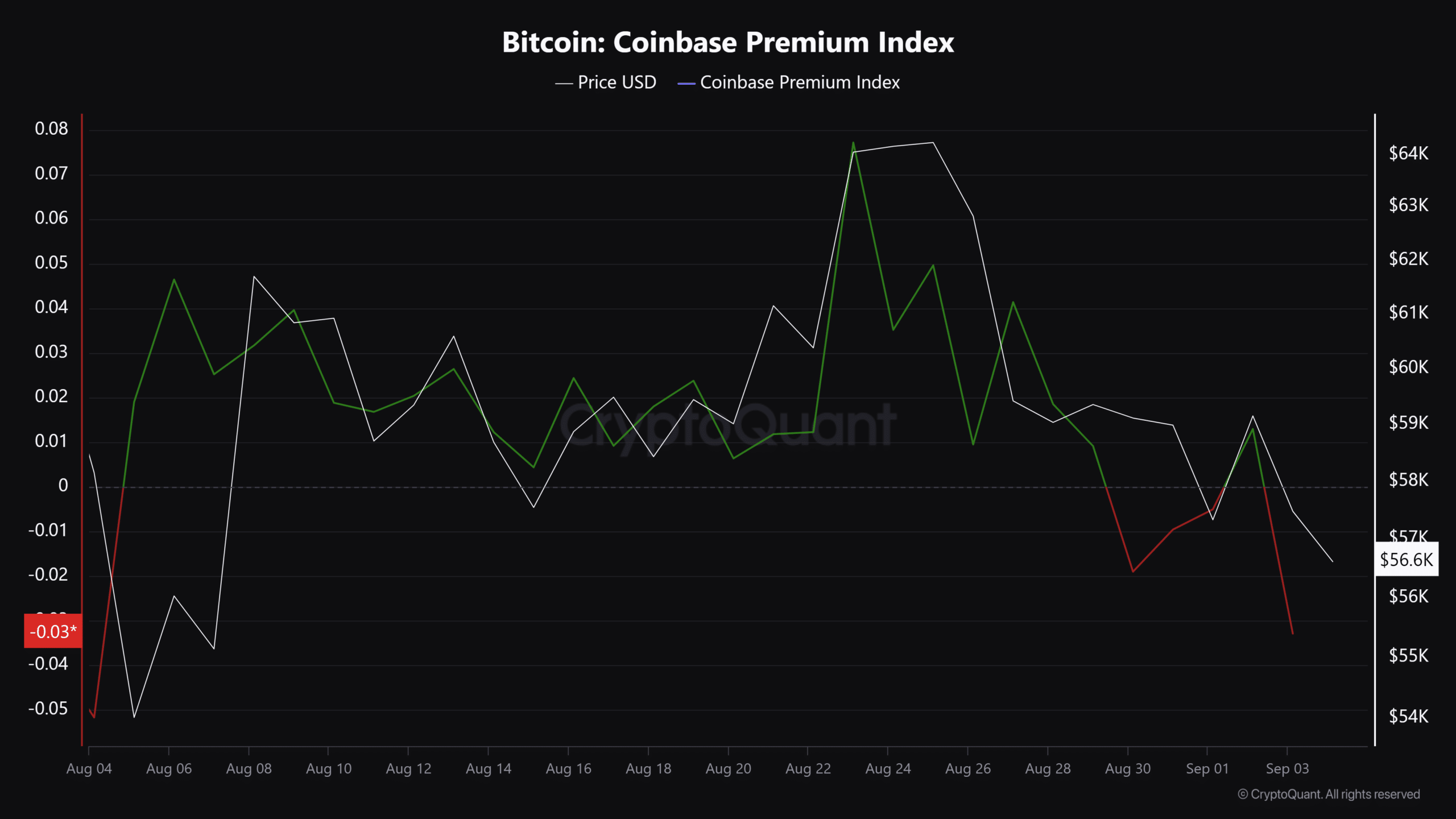

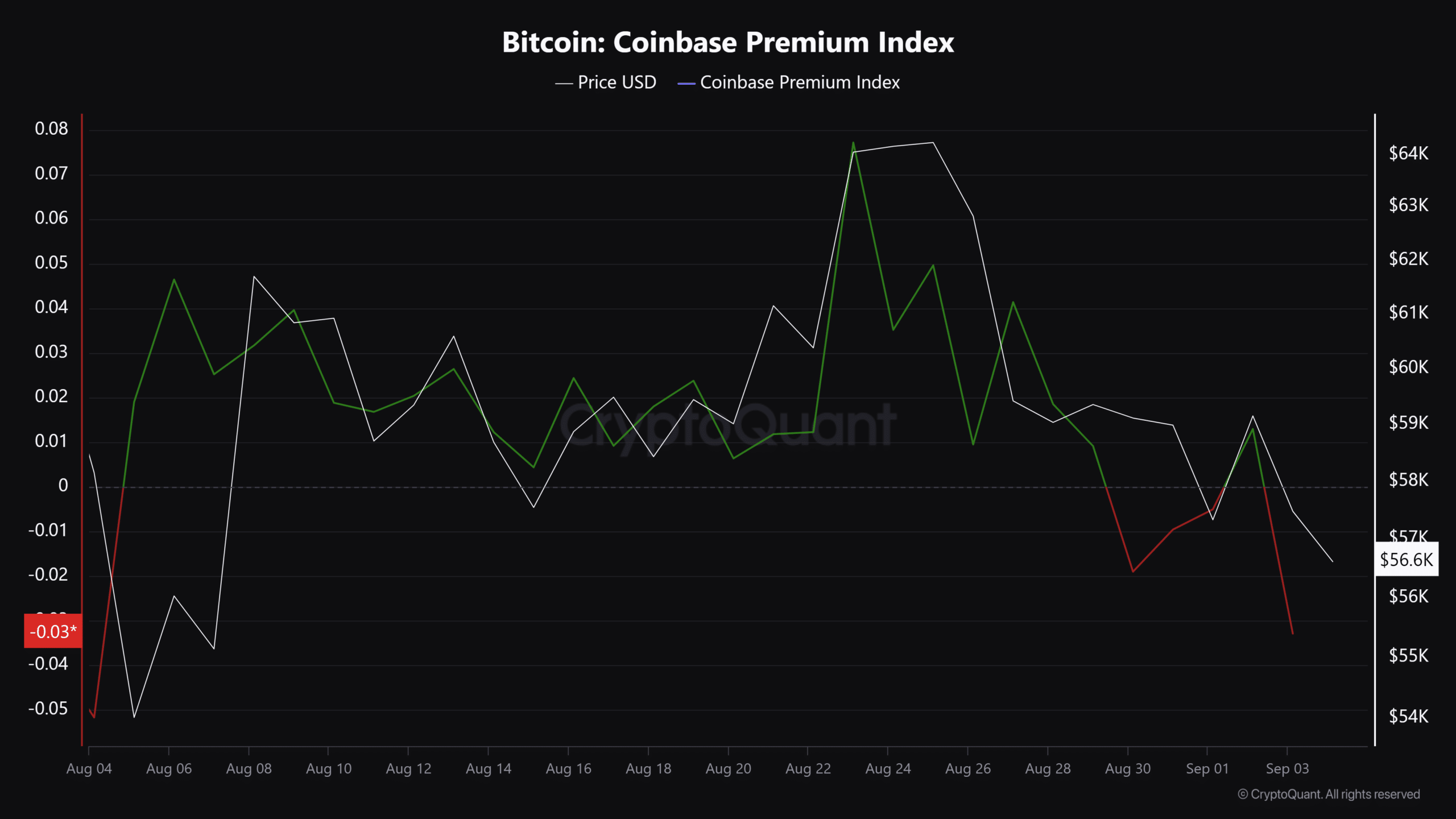

The price of BTC has remained subdued amid continued outflows from BTC ETFs.

Since last week, the digital asset has fallen below $60,000 and has weakened further as risk-off mode persists across the market. BTC was valued at $56.6K at the time of writing, down over 12% from a recent high of $64K.

That said, low demand from US investors could weigh on the crypto asset’s price in the short term.

As illustrated by the Coinbase Premium Index, which tracks investor demand for BTC, its price always rises when there is huge demand from the US.

Source: CryptoQuant

However, weak demand (highlighted by red) has exposed BTC to downward pressure since late August. A substantial turnaround could only occur if US investor demand shows a remarkable recovery.

Meanwhile, most analysts, including QCP Capital, predicted a weak performance for BTC in September based on historical trends.

However, according to one crypto trading firm, BTC could start a strong rally in October and the rest of the fourth quarter based on past patterns and options market data.

“October, however, has the strongest bullish seasonality… This seasonal play could explain the consistent call buying in the full market (the desk saw another 150x 80k December calls lifted in the morning in Asia).”