- Bitcoin ETFs are experiencing significant outflows, indicating increasing caution in the market.

- Ethereum ETFs have shown mixed performance, with recent inflows amid continued skepticism.

The Bitcoin [BTC] The ETF market has recently moved into bearish territory, as evidenced by a series of outflows from August 26 to 30.

Bitcoin ETF analyzed

According to Farside InvestorsDuring this four-day period, there were significant net outflows of $277 million from various BTC ETFs.

Notably, ARK Invest and 21Shares’ ARKB experienced significant withdrawals totaling $220 million, while Grayscale’s GBTC experienced strong outflows of $119 million.

Even BlackRock’s IBIT, which had previously seen positive inflows, reported zero flows on three out of four days, while flows stagnated at $13.5 million on August 29.

This trend underlines a growing cautious sentiment in the Bitcoin ETF sector.

The community remains positive

However, despite the recent downturn in Bitcoin’s performance, many industry executives remain optimistic about its future.

Making the same comment on this, Chip from onthechain.io went to X to express this feeling and said:

“I don’t see Bitcoin going away anytime soon, especially with the solid support it has now.”

Here he highlighted how the introduction of BTC ETFs has strengthened Bitcoin’s position in the financial sector.

However, he also pointed out in words of caution, adding:

“But as the market changes and new technologies emerge, Bitcoin may ultimately lose some of its appeal in the long term.”

Ethereum ETF explained

Unlike Bitcoin ETFs is Ethereum [ETH] ETFs have shown more stable performance.

Despite some outflows totaling $12.6 million during the observed period, Ethereum ETFs showed signs of recovery.

Grayscale’s Ethereum ETF (ETHE) saw a notable outflow of $27.86 million.

However, BlackRock’s ETHA and Grayscale’s Mini Ethereum Trust reported positive momentum, with inflows of $8.4 million and $3.57 million respectively, indicating a cautious but optimistic outlook for Ethereum in the ETF market.

Despite the recent inflows, skepticism remains about the potential of Ethereum ETFs, as highlighted by TourBillion who said,

“Ethereum just hangs on hopeium.”

Impact on price

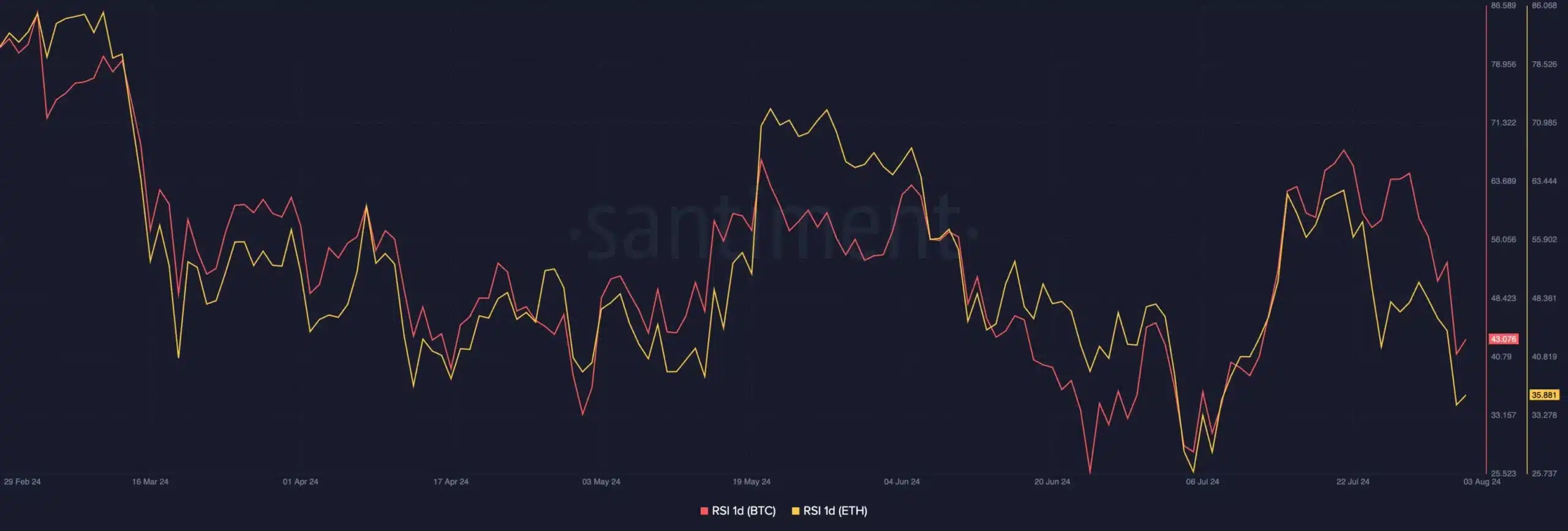

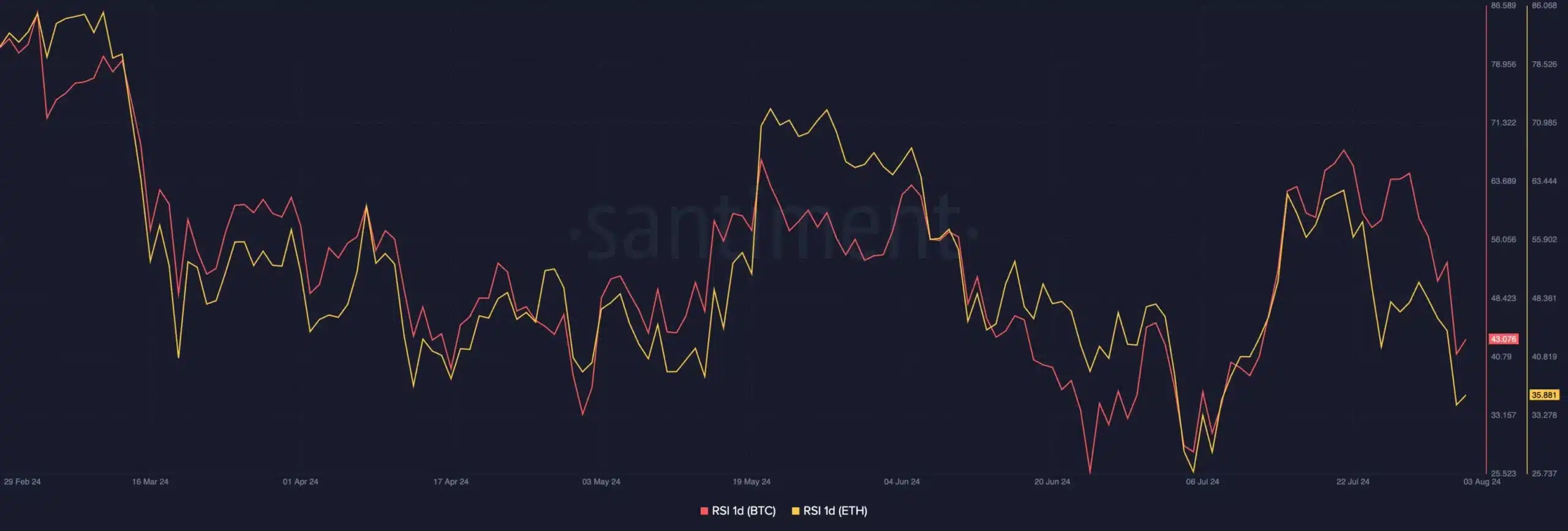

Meanwhile, despite recent price increases for both Bitcoin and Ethereum, with gains of 0.42% And 1.82% A deeper look at Santiment’s numbers reveals the underlying bearish sentiment respectively.

AMBCrypto’s analysis of the two tokens indicates that although prices are rising, the Relative Strength Index (RSI) for both cryptocurrencies remains below neutral levels.

Source: Santiment

This indicates that market sentiment is still cautious and it may take some time for sentiment to shift towards a more bullish outlook.