- Ethereum and Bitcoin ETF trends have been positive this past week.

- BTC is down slightly from its ATH of $100,000 ETH also fell below the $4,000 price level.

The Bitcoin [BTC] and ether [ETH] ETFs had an eventful week, with both hitting major milestones as their prices rose.

While Bitcoin ETFs reached an all-time high in net assets, Ethereum ETFs set a new record for weekly inflows, signaling increased institutional interest in the crypto market.

Bitcoin ETF hits new all-time high

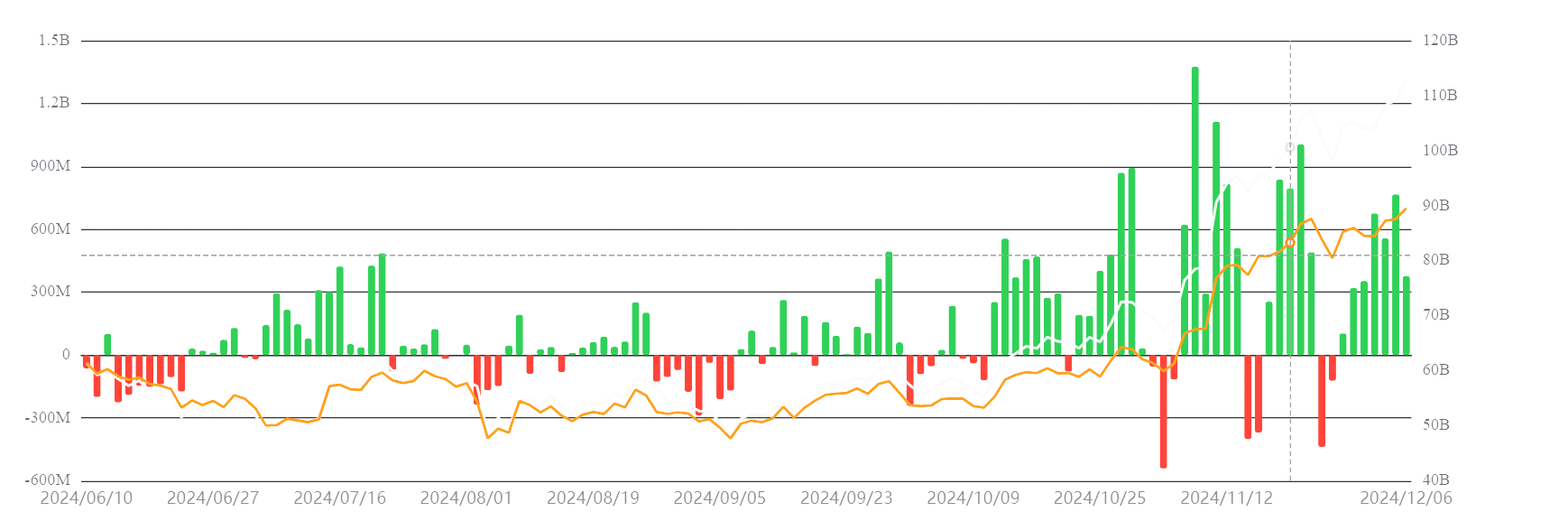

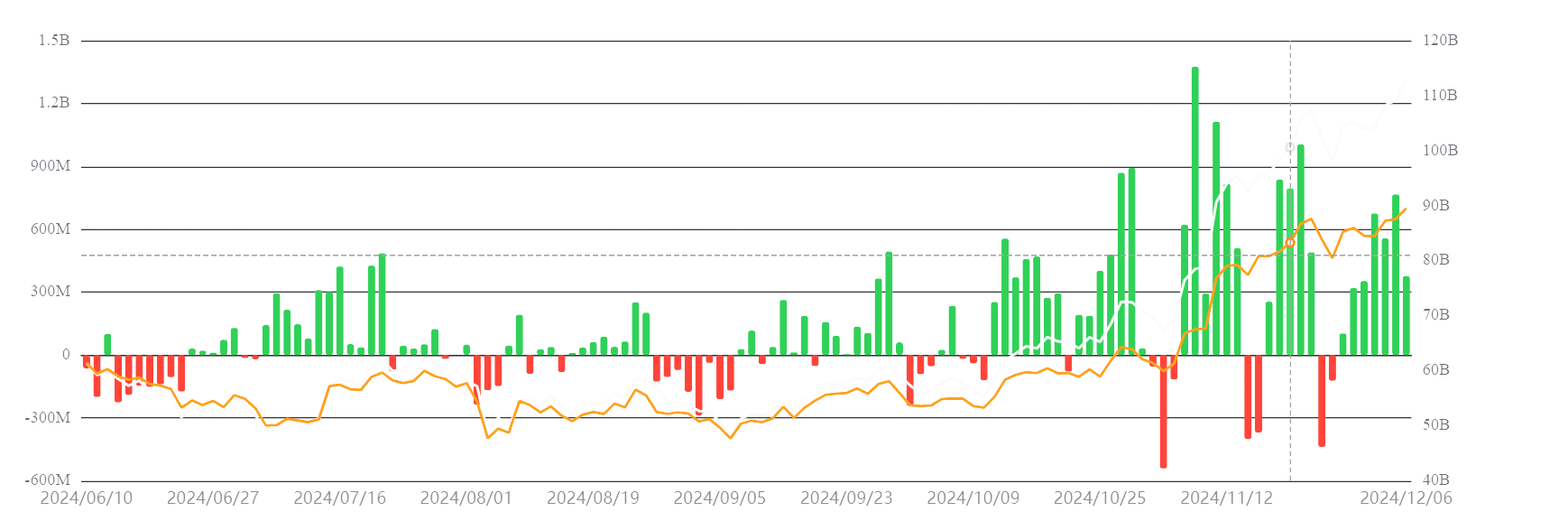

The Bitcoin The ETF market saw remarkable growth last week, coinciding with Bitcoin’s price surge to a new all-time high.

Data from SosoValue revealed that Bitcoin ETFs had a record $112.74 billion in assets at the time of writing, accounting for 5.62% of Bitcoin’s total market capitalization.

Source: SosoValue

Last week’s net inflows totaled $2.73 billion, with positive flows recorded on all days. BlackRock’s IBIT, the world’s largest BTC ETF, attracted the lion’s share of these inflows, receiving more than $2.6 billion.

This strengthens BlackRock’s dominant position in the ETF space and underlines the growing institutional interest in BTC exposure.

Ethereum ETF Breaks Weekly Net Inflows Records

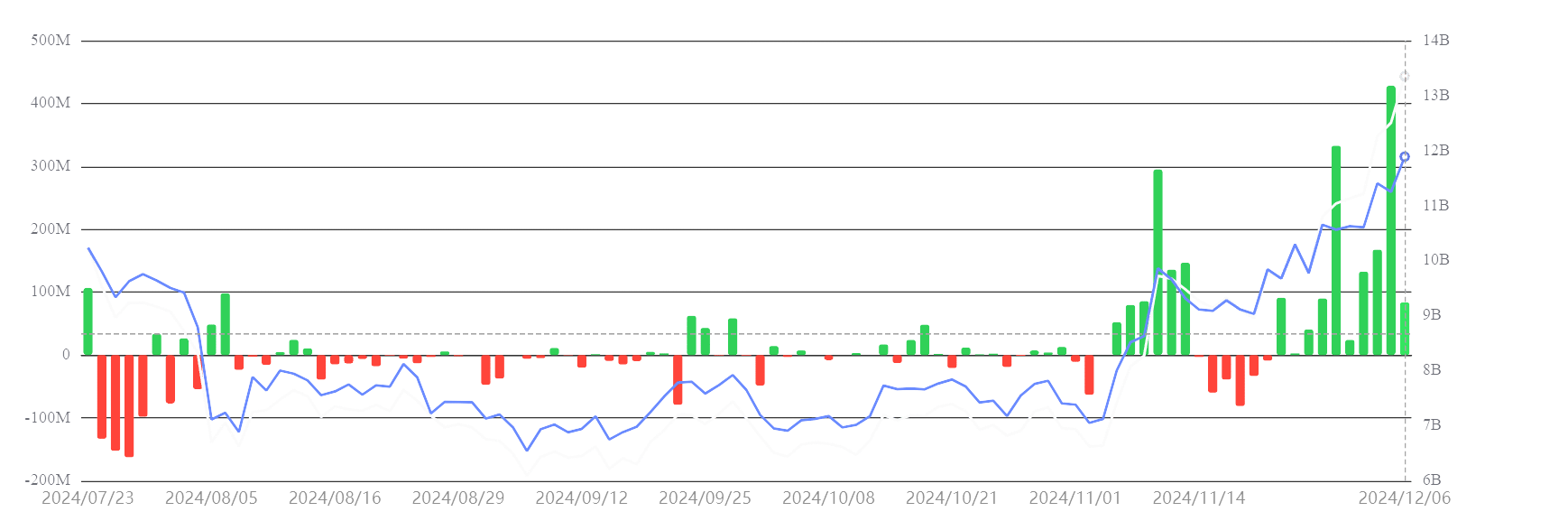

Ethereum ETFs mirrored Bitcoin’s success and reached a milestone of their own.

Weekly net inflows reached $836.69 million, the highest in Ethereum ETF history, bringing total assets under management to a record $13.6 billion.

For the first time since their approval, Ethereum ETFs recorded two consecutive weeks of positive net inflows, a significant shift in investor sentiment.

Source: SosoValue

On December 5, Ethereum ETFs set another record, with daily net inflows of $428.44 million, the highest ever for the asset class.

These inflows demonstrate growing confidence in Ethereum’s potential as a long-term investment, driven by its growing utility in DeFi and smart contracts.

Bitcoin Price Consolidates After Historic Rally

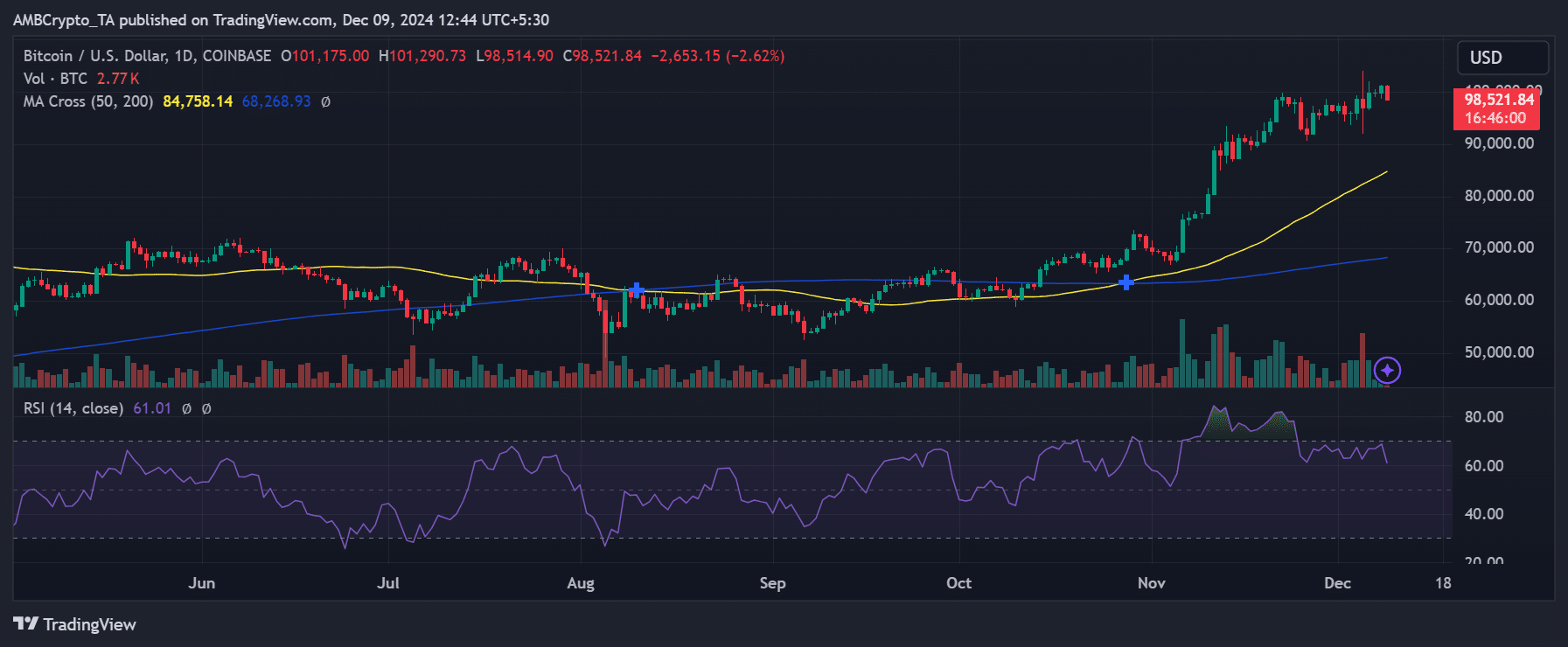

Bitcoins The price stood at $98,521 at the time of writing, reflecting a healthy consolidation phase after the sharp rally above $100,000.

The 50-day moving average has crossed above the 200-day moving average and forms a golden cross: a strong bullish indicator.

With an RSI of 61, Bitcoin maintains room for further upside while remaining within a stable trading range.

Source: TradingView

With their record-breaking net assets of $112.74 billion, Bitcoin ETFs underscore the continued dominance of these assets in institutional portfolios.

Investors still view Bitcoin as a reliable store of value, even as Ethereum is gaining attention for its growth potential.

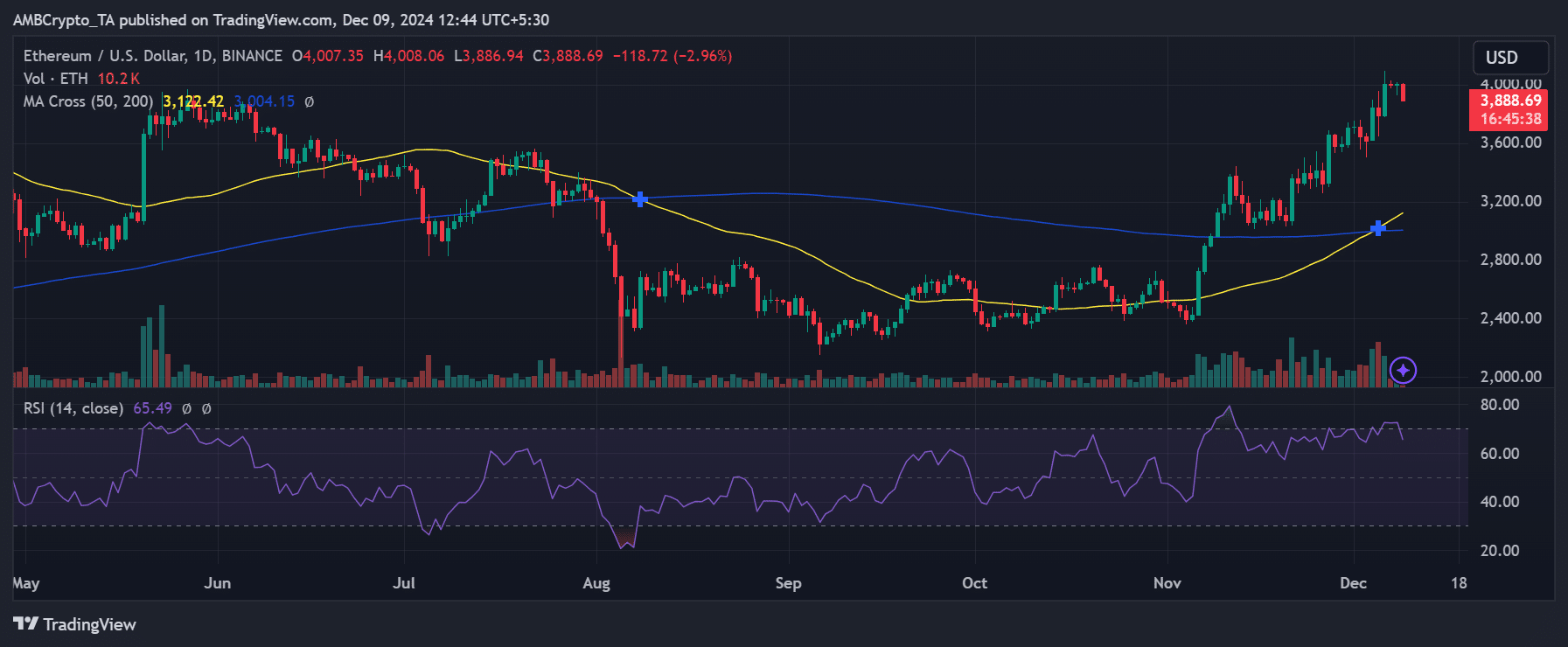

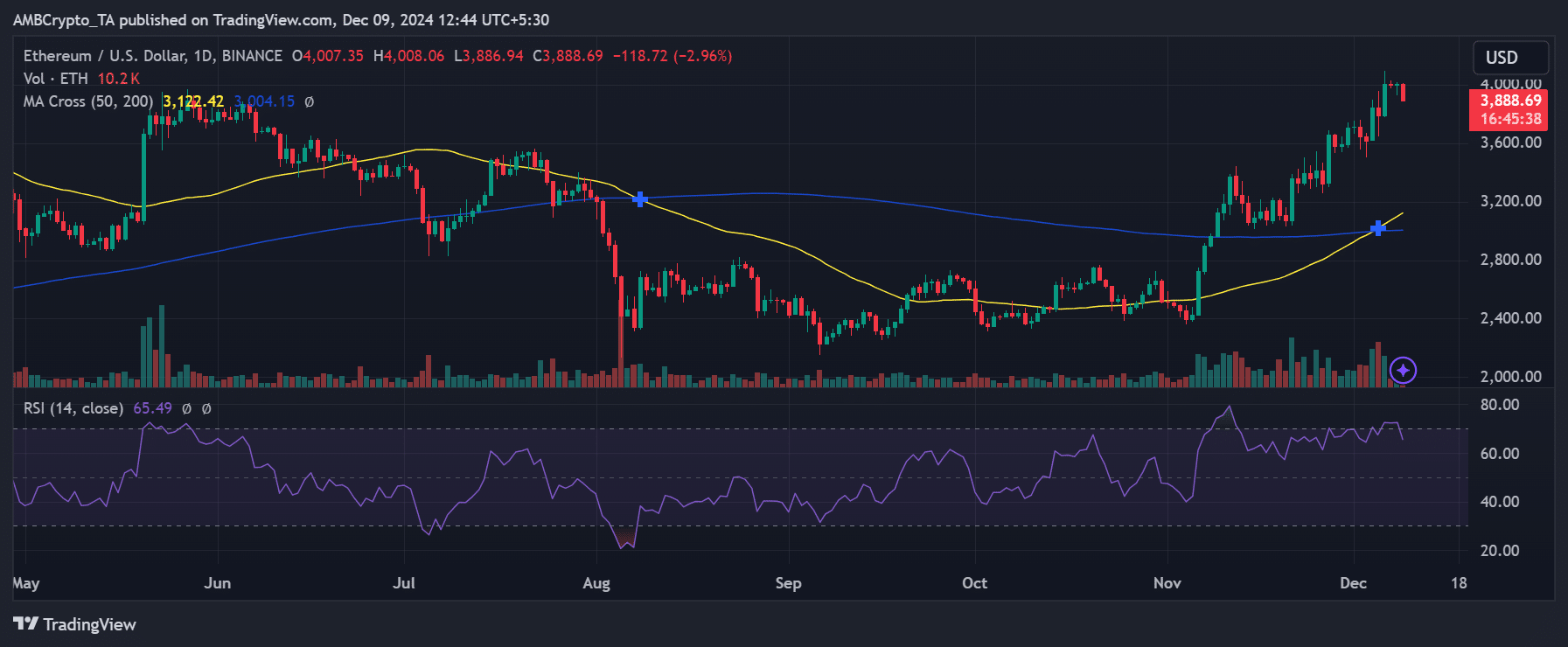

Ethereum’s price momentum has matched the growth of ETFs

Ethereums The price, at $3,888, has seen a slight pullback after recently crossing the $4,000 mark. However, the bullish technical indicators remained intact.

The golden cross between the 50-day and 200-day moving averages pointed to further upside potential. Meanwhile, an RSI of 65 suggested that Ethereum was approaching overbought levels but still has room for growth.

Source: TradingView

The record inflows into Ethereum ETFs matched this price momentum and reflect institutional confidence in Ethereum’s long-term prospects.

These inflows could catalyze a sustained price increase, further strengthening Ethereum’s position as the leading alternative to Bitcoin.

Bitcoin and Ethereum ETFs are breaking records, driven by rising institutional demand and strong price momentum.

Read Bitcoin’s [BTC] Price forecast 2024–2025

While Bitcoin maintains its dominant position as a store of value, Ethereum’s explosive weekly inflows underscore its growing role as a dynamic growth asset.

These developments mark a pivotal moment for the cryptocurrency ETF market and underscore the increasing integration of digital assets into traditional financial portfolios.