- Last week’s ETF inflows were the fourth highest in its history

- During this period, the price of BTC exceeded $72,000 in an attempt to exceed its ATH

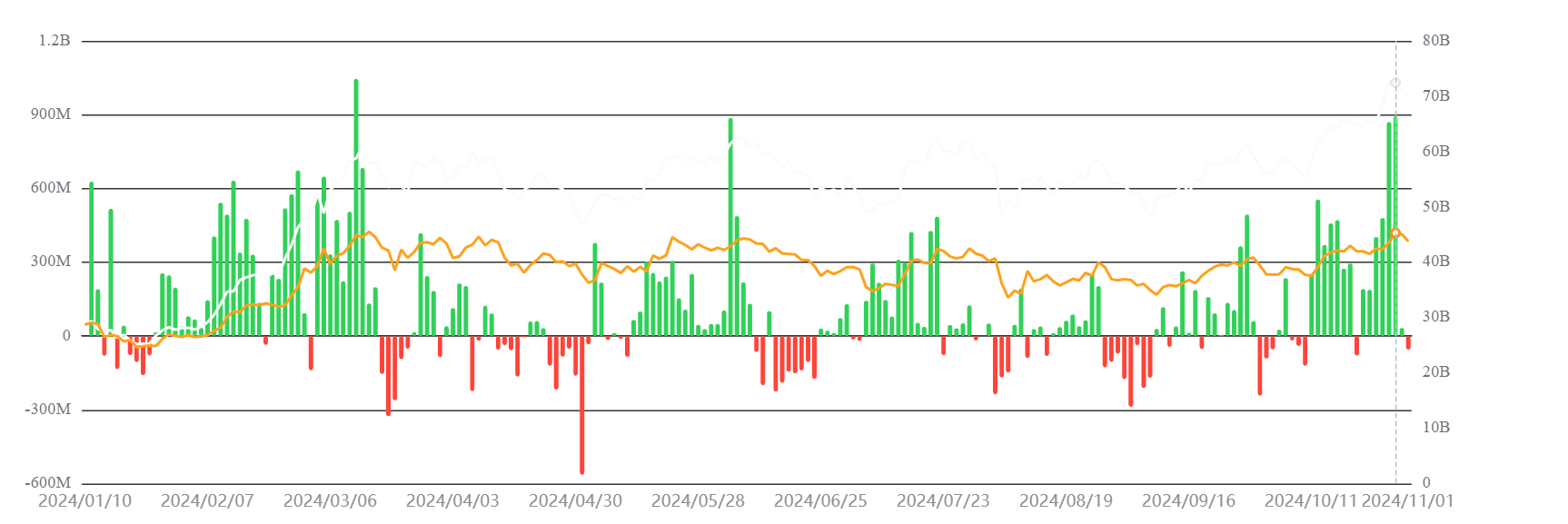

In recent weeks, the Bitcoin market has been closely intertwined with the influx of funds into Bitcoin ETFs. October saw significant activity as investor interest in Spot Bitcoin ETFs continued to increase.

In particular, ETF flows for the week ending November 1 reflected strong bullish sentiment, marking a notable trend from previous weeks.

Bitcoin ETF’s record inflows in recent weeks

Data from Soso value revealed that Bitcoin ETF flows saw a substantial net inflow of $2.22 billion for the week ending November 1. This figure is among the highest for 2024 – a sign of strong investor demand.

The market saw higher inflows in mid-March, with figures of $2.57 billion. Figures of $2.27 billion were also recorded in the week ending February 16.

Source: Sosowaarde

The recent influx is a sign of growing optimism, positioning this product offering as a preferred option to gain Bitcoin exposure.

This steady flow of capital is a sign of increasing confidence among institutional and retail investors, potentially creating a solid demand base for BTC in the long term.

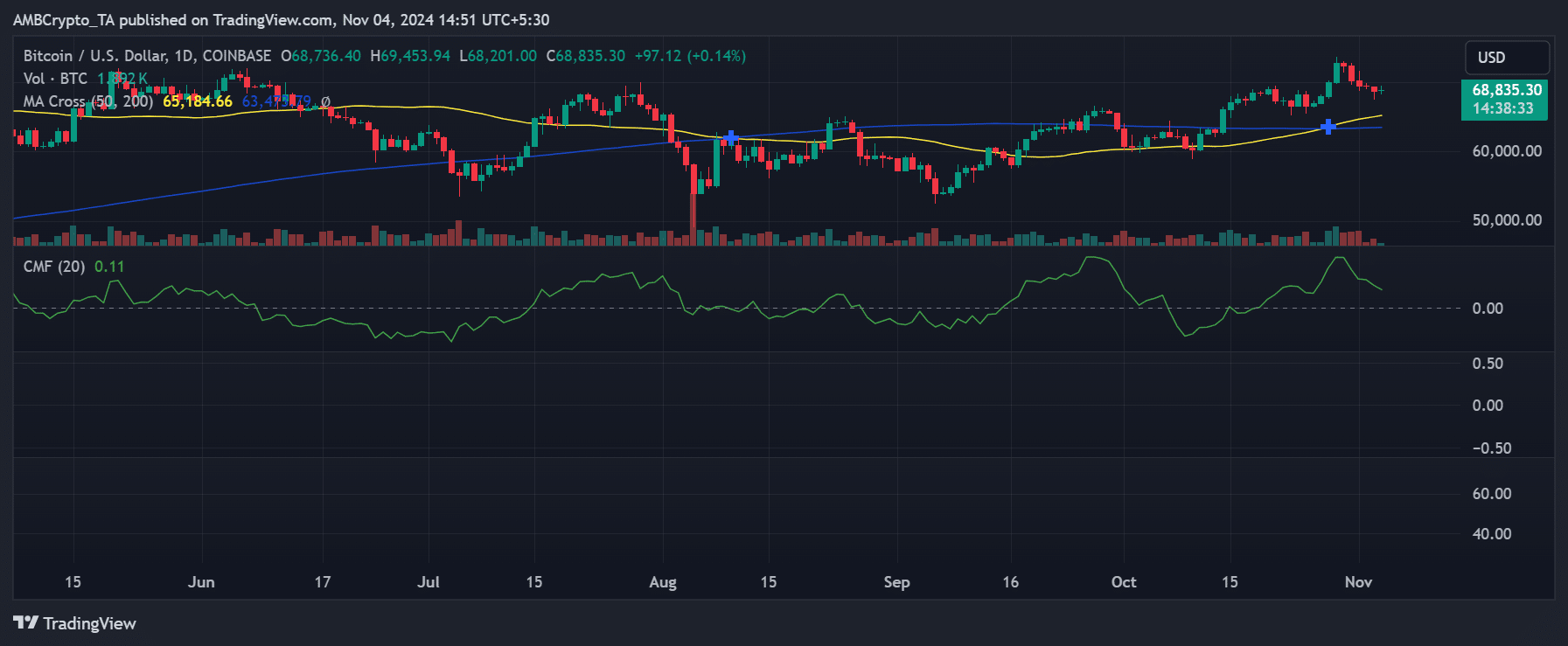

Price reaction to ETF inflows

Bitcoin’s recent price action highlighted the influence of ETF inflows. This past week, BTC peaked at $72,724 before falling back slightly to around $68,835.30.

This momentum corresponded with a rise in ETF investments, indicating that bullish sentiment from ETFs is influencing Bitcoin’s price. The positive price trend may continue as more capital flows into the market, especially if regulatory conditions remain favorable.

Source: TradingView

The correlation between Bitcoin price and ETF activity seems to indicate that this source of investment could be contributing to the current market upswing.

This reaction could be an early sign of Bitcoin gaining momentum on ETF-driven interest, a trend that could continue depending on future regulatory developments.

Are Bitcoin ETF Inflows a Lasting Signal?

While the influx of Bitcoin ETFs is a promising sign, questions remain as to whether this trend will have a lasting impact on Bitcoin’s price or not. Historically, an inflow of this magnitude has led to price increases. And yet, factors such as regulation, macroeconomic trends, and liquidity still influence the broader crypto market.

Bitcoin ETFs open doors for traditional investors to more easily enter the crypto market, potentially leading to sustainable price levels or even further gains. However, this momentum may come with short-term volatility as profit-taking increases.

– Read Bitcoin (BTC) price prediction 2024-25

For now, the recent surge in Bitcoin ETF inflows indicates strong bullish sentiment, which has supported BTC’s recent price gains. Whether this interest can fuel a longer-term rally remains uncertain. Still, continued ETF activity is likely to strengthen Bitcoin’s position in the market.