- Bitcoin ETF inflows have hit a weekly low as the market simmers with both “anticipation” and “uncertainty.”

- A mix of internal dynamics and external factors makes Bitcoin’s next target unclear.

The past 40 days have been “highly volatile,” which really tested Bitcoin’s patience [BTC] stakeholders. The highs pushed BTC to its ATH of $104,000, but the lows dragged it back to around $94,000, leaving investors on edge.

And the real challenge? It’s just beginning. Just two days ago, support from BlackRock (IBIT) fueled nearly $300 million in net ETF inflows, sending Bitcoin up 4% in one day. This institutional push helped BTC close above the $100,000 mark.

But here’s the catch: the rally feels fragile. BlackRock’s inflows have since shrunk to net zero, signaling the end of a week-long surge. Even a general ETF inflow have been halved.

Meanwhile, rumors of a possible 25 basis point rate cut by the Fed keep hopes alive, but Bitcoin’s biggest asset remains institutional support.

So now that early investors are making money like millionaires, all eyes are on the institutional heavyweights. Will they be the ones to push BTC towards the ambitious $200,000 goal, or will their waning support create a new wave of doubt?

Bitcoin’s latest surge could be ‘cautious’ optimism

Early investors appear to be benefiting out at the crucial resistance level of $100,000, indicating a retreat from greed and a drop in risk appetite.

Still, the recent surge that has catapulted Bitcoin above $101,000 – after weeks of wild swings between the $94,000 and $100,000 price range – has sparked new optimism.

According to AMBCrypto, this optimism remains somewhat cautious, driven more by “anticipation” than by the actual “execution” of a rate cut by the Fed.

Although the US labor market is promising with a decline in unemployment, inflation has made a noticeable comeback. The CPI has increased to 2.7% year-on-year, with a slight increase of 0.3% in just one month.

With these mixed signals, all eyes are now on the upcoming FOMC meeting planned for next week. Will the Fed take a more conservative stance in response to the uptick in inflation, possibly opting for higher interest rates? Or will it become more liberal, given an interest rate cut to support the economy?

Either way, the short-term impact on Bitcoin’s price is already clear.

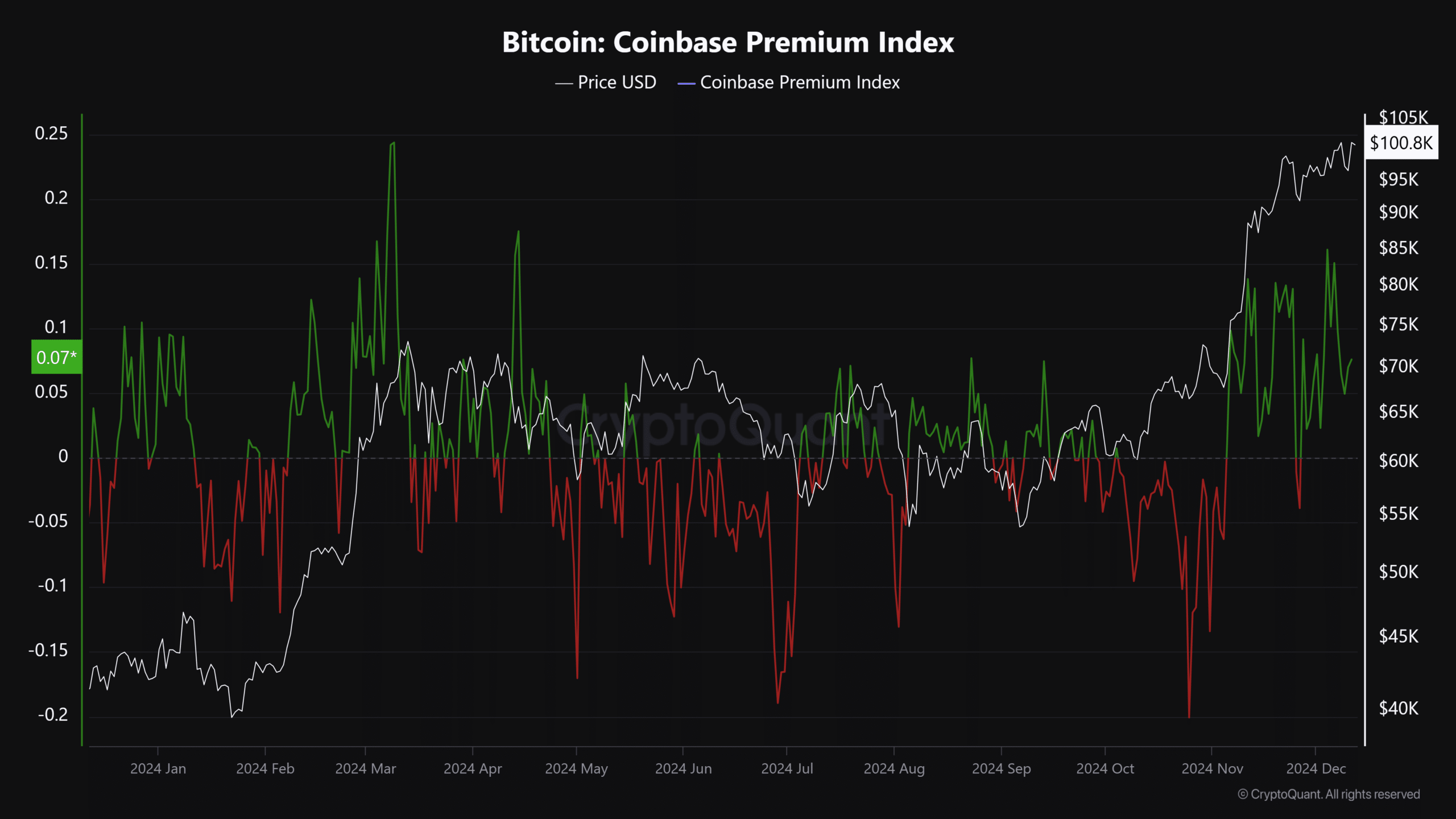

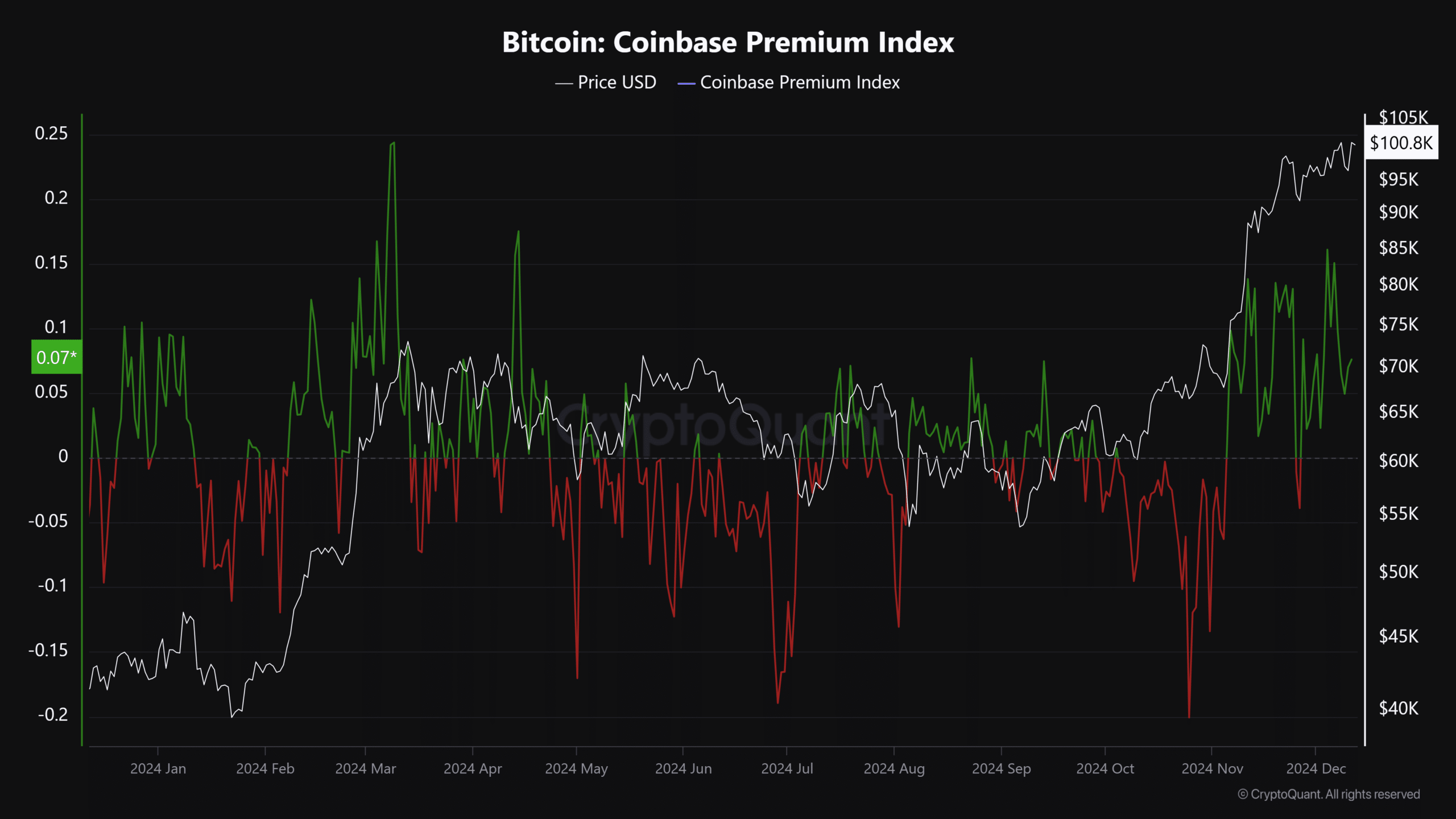

Source: CryptoQuant

US investors have eagerly seized the opportunity to buy BTC, especially through their Coinbase cohorts, following a period of distribution that dominated much of the second week of December.

While this rebound is undeniably bullish, it could prove to be a temporary blip unless Bitcoin’s fundamentals, including strong inflows into Bitcoin ETFs, generate continued interest from both retail and institutional investors.

Falling Bitcoin ETFs Signal Signs of Uncertainty

Since their launch in January, Bitcoin ETFs have become a popular way for retail investors to access Bitcoin’s volatility, with strong support from institutions.

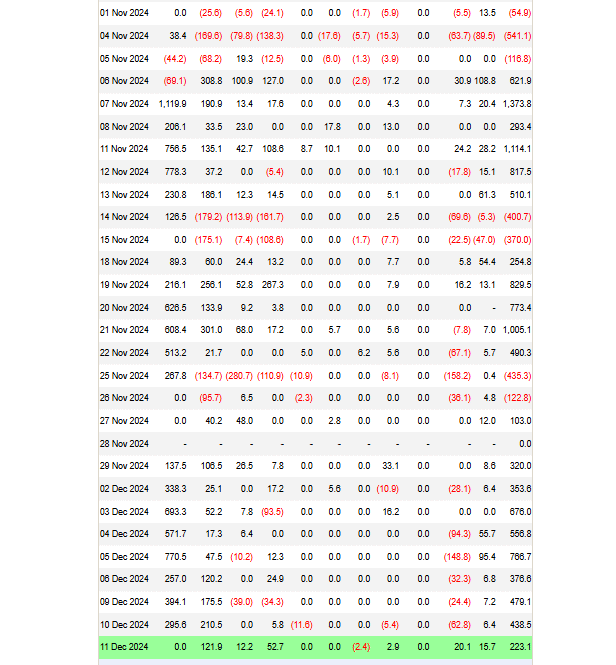

After the “Trump pump” created excitement, Bitcoin ETFs hit record inflows of $1.3 billion, with BlackRock contributing $1.2 billion.

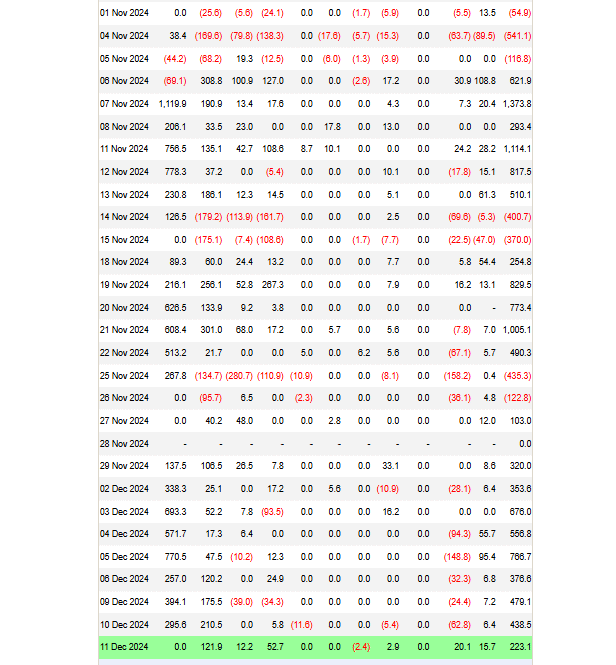

Source: FarsideInvestors

However, recent trends indicate a shift. BlackRock’s inflows have stalled, ending a streak of consecutive gains.

While this doesn’t indicate a completely bearish outlook for Bitcoin, it does indicate a dip in enthusiasm for Bitcoin ETFs, with overall inflows hitting a weekly low.

Read Bitcoin’s [BTC] Price forecast 2024–2025

This reinforces AMBCrypto’s view of a “more cautious” optimism in the market – enough to potentially set $100,000 as a floor for Bitcoin, but not enough to drive it to a new all-time high.

So the market is in a delicate balance, where hope remains, but the path to new highs seems uncertain.