- Bitcoin ETFs saw a resurgence, with inflows of $365.7 million as of September 26.

- BlackRock’s spot Bitcoin ETF recorded inflows of $184.4 million, the highest increase of the month.

After weeks of uncertainty, Bitcoin [BTC] ETFs are gaining momentum again.

Despite September’s bearish reputation for BTC, both the cryptocurrency and its associated ETFs have defied expectations with a trend reversal.

Bitcoin ETF, analyzed

According to the most recent data from September 26: total inflow for everyone Bitcoin ETFs have reached an impressive $365.7 million.

Leading the charge was Ark’s ARKB with $113.8 million, followed by Blackrock’s IBT with $93.4 million.

Fidelity’s FBTC registered $74 million, while Bitwise’s BITB is $50.4 million.

VanEck’s HODL, Invesco’s BTCO and Franklin’s EZBC also contributed to inflows of $22.1 million, $6.5 million and $5.7 million, respectively.

While two more smaller ETFs saw modest inflows of less than $5 million, the overall increase underlines renewed investor confidence in BTC ETFs.

Notably, on September 25, BlackRock, the world’s largest asset manager, witnessed an extraordinary surge of $184.4 million in inflows for its spot Bitcoin ETF, making it the highest single-day inflow of the month for any fund.

What’s behind this?

This spike comes amid increasing market speculation, possibly influenced by developments in Asia.

For those unaware, Chinese stocks rose on reports that the Chinese government could inject up to ¥1 trillion ($142 billion) into its major state-owned banks, aiming to stimulate an economy that has faced challenges of late .

Earlier this week, the People’s Bank of China (PBOC) took easing measures by cutting reserve requirements for mainland banks by 50 basis points and cutting the seven-day reverse repo rate by 20 basis points to 1.5%.

These actions have seemingly fueled optimism, which may be playing a role in inflows into global markets, including Bitcoin ETFs.

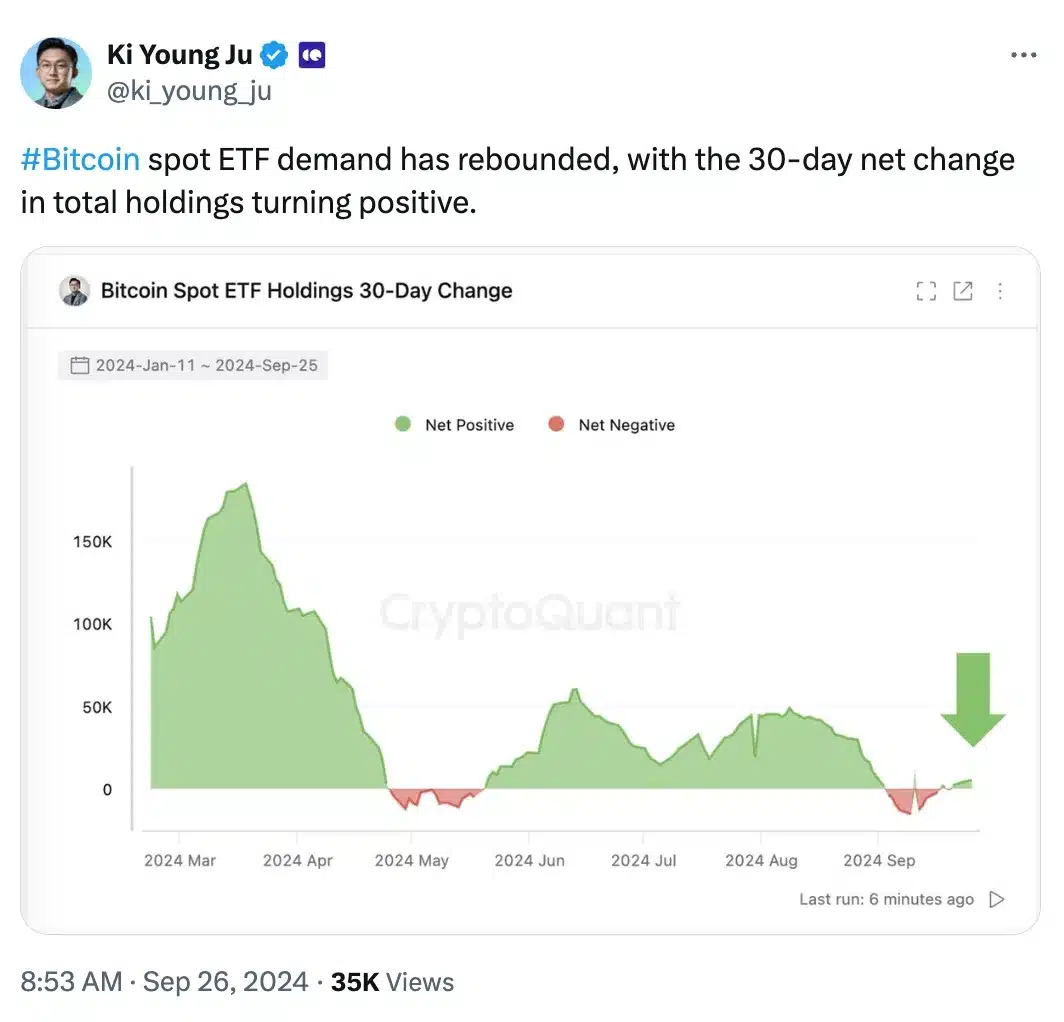

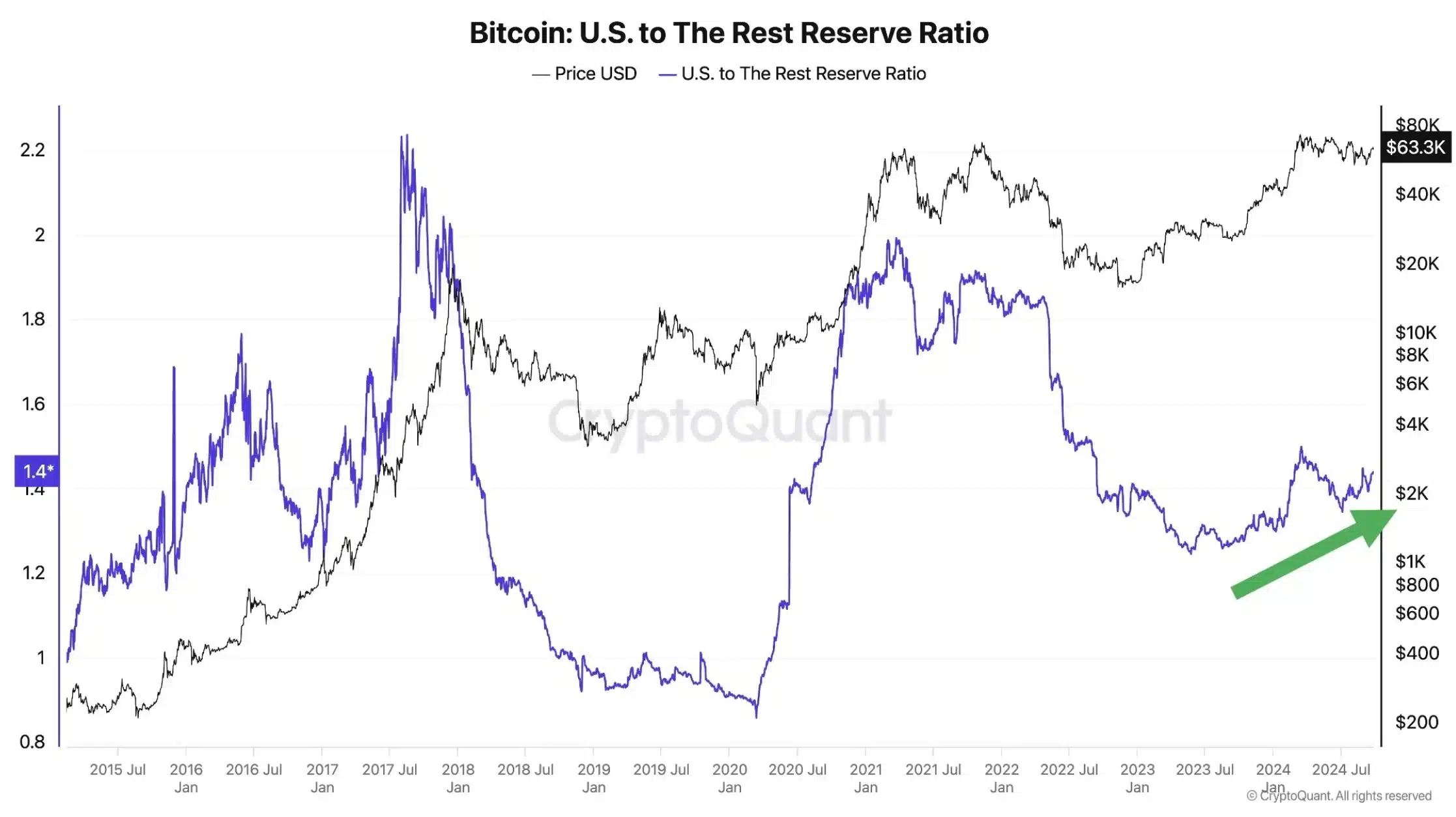

Ki Young Ju, Founder and CEO of CryptoQuant, said:

Source: Ki Young Ju/X

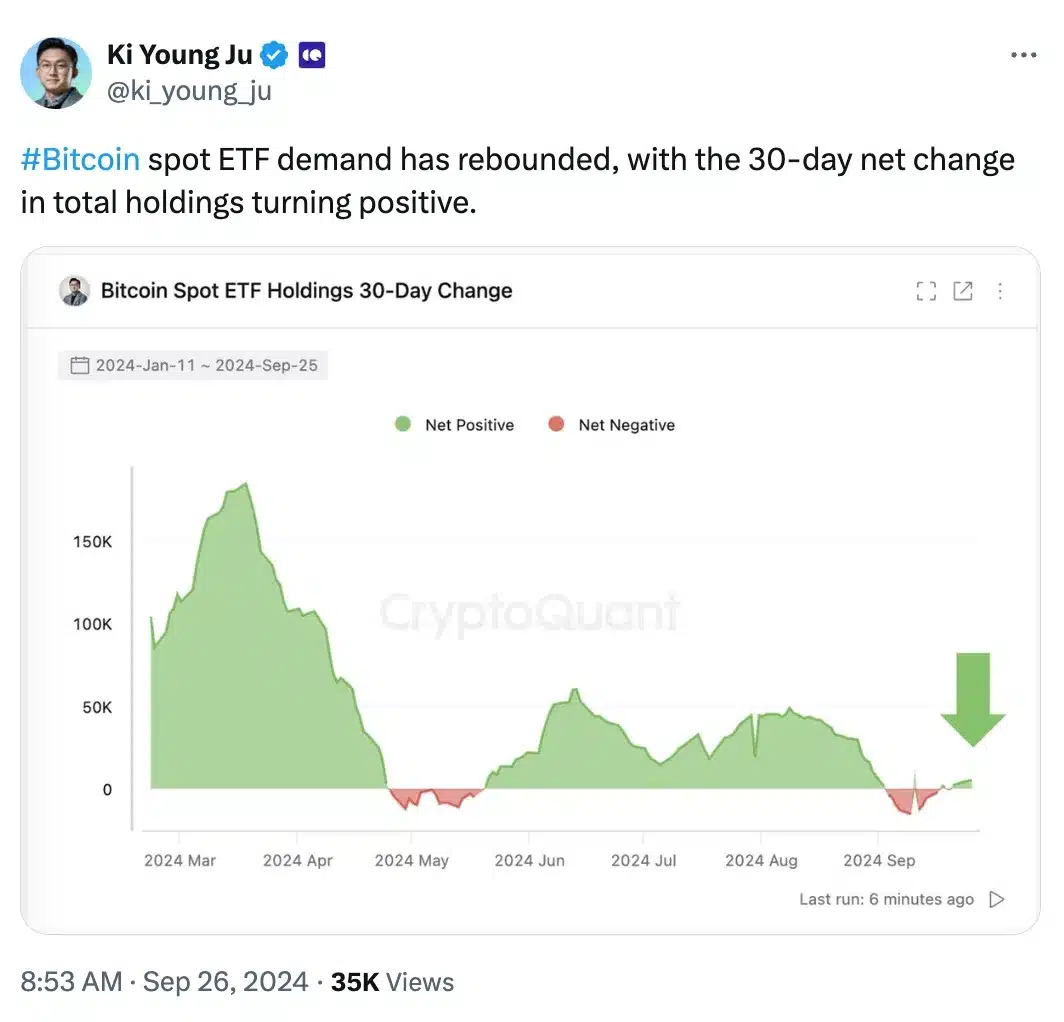

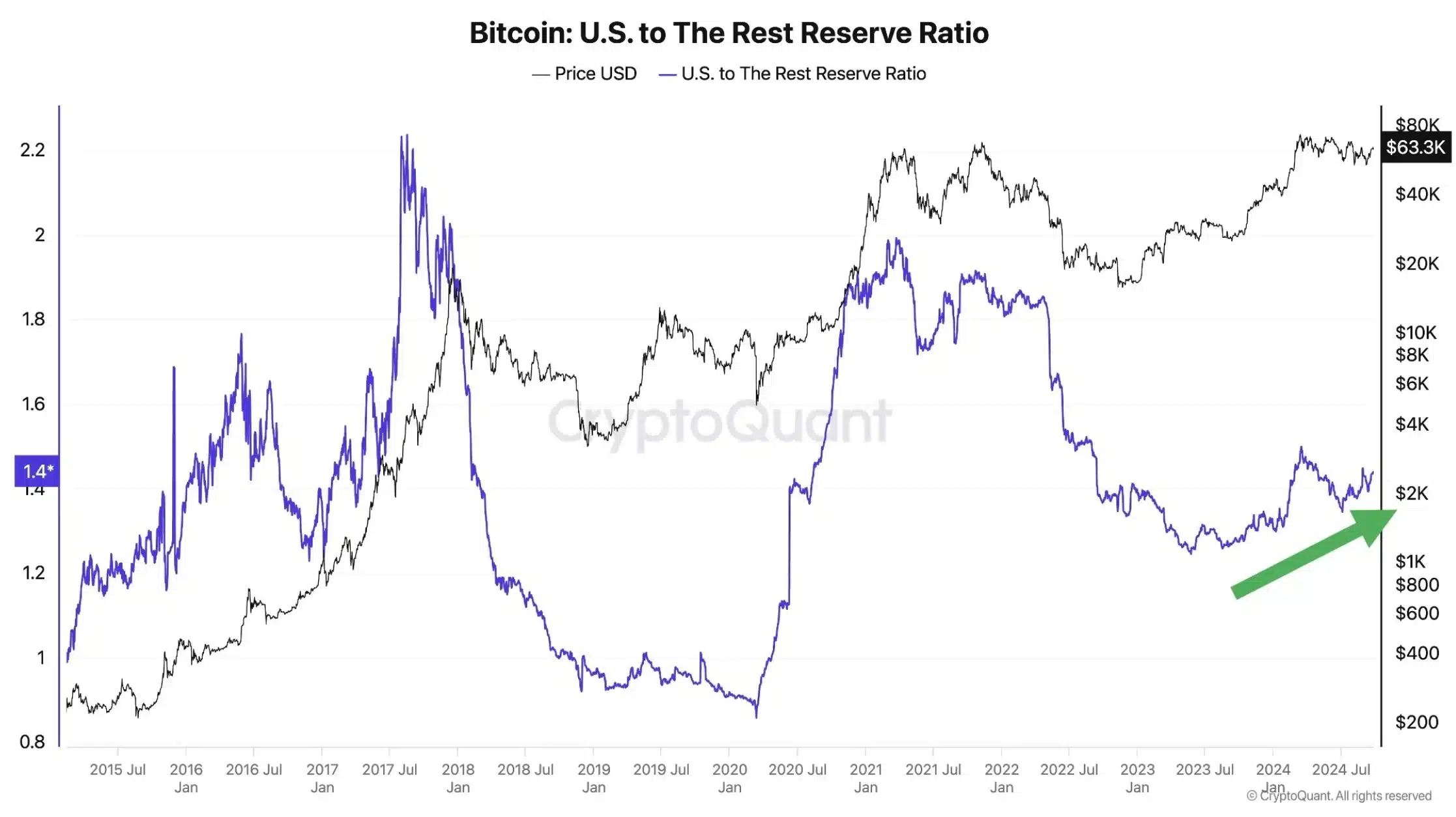

He added:

“The US is regaining dominance in #Bitcoin ownership. Its ratio compared to other countries is increasing, driven by the demand for ETFs on the spot market. Only known entities are included.”

Source: Ki Young Ju/X

A look at the price front

Meanwhile, on the price front, BTC’s price action has shown remarkable resilience.

After struggling for days to break the $60,000 mark, the leading cryptocurrency rose. to $65,642. This marked a gain of 2.89% in the past 24 hours.

As the month comes to a close, Bitcoin is showing a strong bullish trend with an impressive monthly increase of 10.98%, indicating continued upward momentum in the market.