After a week of net outflows, the Bitcoin ETF spot market has rebounded this week with impressive net inflows, highlighting growing investor confidence in Bitcoin and its related financial products. This week’s market activity has seen a notable turnaround from the previous five-day net outflow, with Tuesday seeing a substantial net inflow of $480 million, followed by $243.5 million on Wednesday.

Yesterday’s revival of investor interest was particularly boosted by Blackrock’s huge inflows of $323.8 million, which effectively offset Grayscale GBTC’s $299.8 million outflow. Additionally, Ark Invest’s ARKB reported its best day yet, with $200 million in inflows, despite Fidelity having its worst day with only $1.5 million in outflows. Nevertheless, Fidelity managed to recover with significant inflows of $261 million and $279 million on Monday and Tuesday, respectively.

Yesterday’s ETF flows were positive at $243.5 million.

Blackrock finally woke up again, losing $323.8 million completely $GBTC‘s $299.8 million outflow.

Ark had their best day yet with $200 million. Fidelity had its worst day with $1.5 million.

Price dumped on… pic.twitter.com/LLChkITN7q

— WalvisPanda (@WalvisPanda) March 28, 2024

Down 1%, 99% to go for Bitcoin ETFs

However, according to Matt Hougan, Chief Investment Officer (CIO) of Bitwise, this is just the beginning of what will happen in the coming months. Hougans commentary, part of his weekly memo to investment professionals, sheds light on current market dynamics and the colossal potential that lies ahead. “1% lower; 99% to go,” Hougan wrote, highlighting the nascent but promising journey of Bitcoin ETFs.

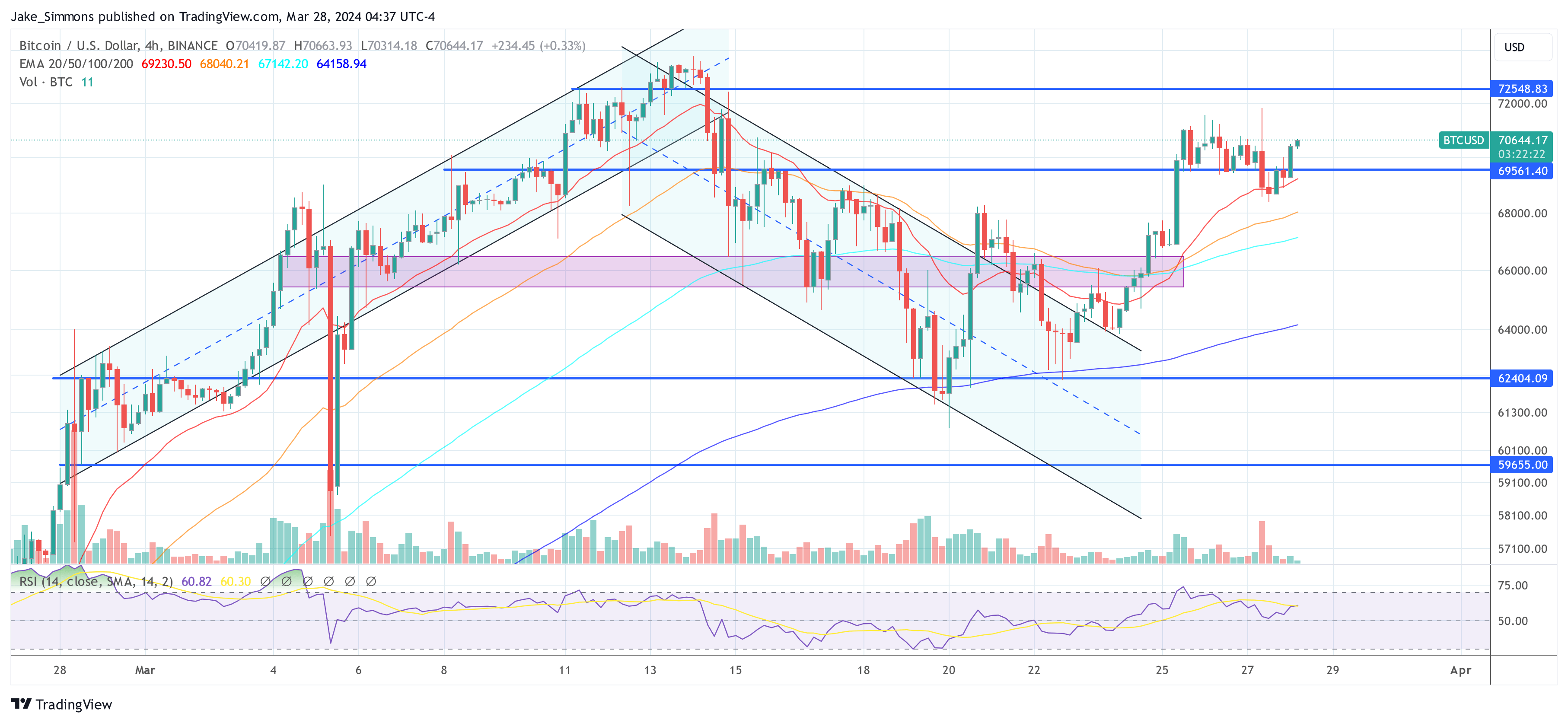

Lately, the market has been characterized by its volatility, with the price of Bitcoin fluctuating between $60,000 and $70,000. Hougan advises a calm and long-term perspective amid these fluctuations, especially as the industry anticipates the upcoming Bitcoin halving around April 20, the approval of Bitcoin ETFs on national account platforms, and the soon-to-be completion of due diligence by several investments. committees.

Despite the current sideways movement in Bitcoin’s price, Hougan remains optimistic about its long-term trajectory. “Bitcoin is in a raging bull market,” he claims, noting a nearly 300% increase in the past 15 months. The launch of spot Bitcoin ETFs in January has been a major milestone, opening up the Bitcoin market to investment professionals on an unprecedented scale.

Hougan’s analysis points to a profound shift as global asset managers, who collectively control more than $100 trillion, explore investments in “digital gold.” He suggests that even a conservative allocation of 1% of their portfolios to Bitcoin could result in an inflow of around $1 trillion into the space.

This perspective is supported by historical data showing that even a 2.5% allocation to Bitcoin has improved the risk-adjusted returns of traditional 60/40 portfolios in every three-year period of Bitcoin’s history.

The recent inflows into Bitcoin ETFs, while impressive, are seen by Hougan as just the beginning of a much larger movement. “We’re all excited about the $12 billion that has flowed into ETFs since January. And it’s exciting: collectively the most successful ETF launch of all time. But imagine if global asset managers allocated an average of just 1% of their portfolios to bitcoin,” Hougan explains, highlighting the magnitude of potential growth awaiting the cryptocurrency market. He concludes:

Think about the implications. […] A 1% allocation across the board would mean an inflow of ~$1 trillion into the space. On the other hand, $12 billion is hardly a down payment. 1% down, 99% to go.

At the time of writing, BTC was trading at $70,644.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.