- Bitcoin ETF outflows and Miner Activity Signal Letce despite a bullish breakout attempt.

- Bitcoin apparent question shows early rebound, but the sentiment remains under the neutral threshold.

After weeks of oppressed interest, Bitcoin’s [BTC] 30-day clear question statistics has finally returned from its lows in March and points to a potential market shift.

The 30 -day measuring measurement, which had fallen to -200,000 BTC -are lowest level since the beginning of 2023 -is started to go up.

Of course this subtle rebound hinted at renewed buyer curiosity. The question, however, still lingered in the red, which shows that the recovery remained fragile.

Without a clean push in a positive area, it was unlikely that the trust of investors would return with full force.

Source: Cryptuquant

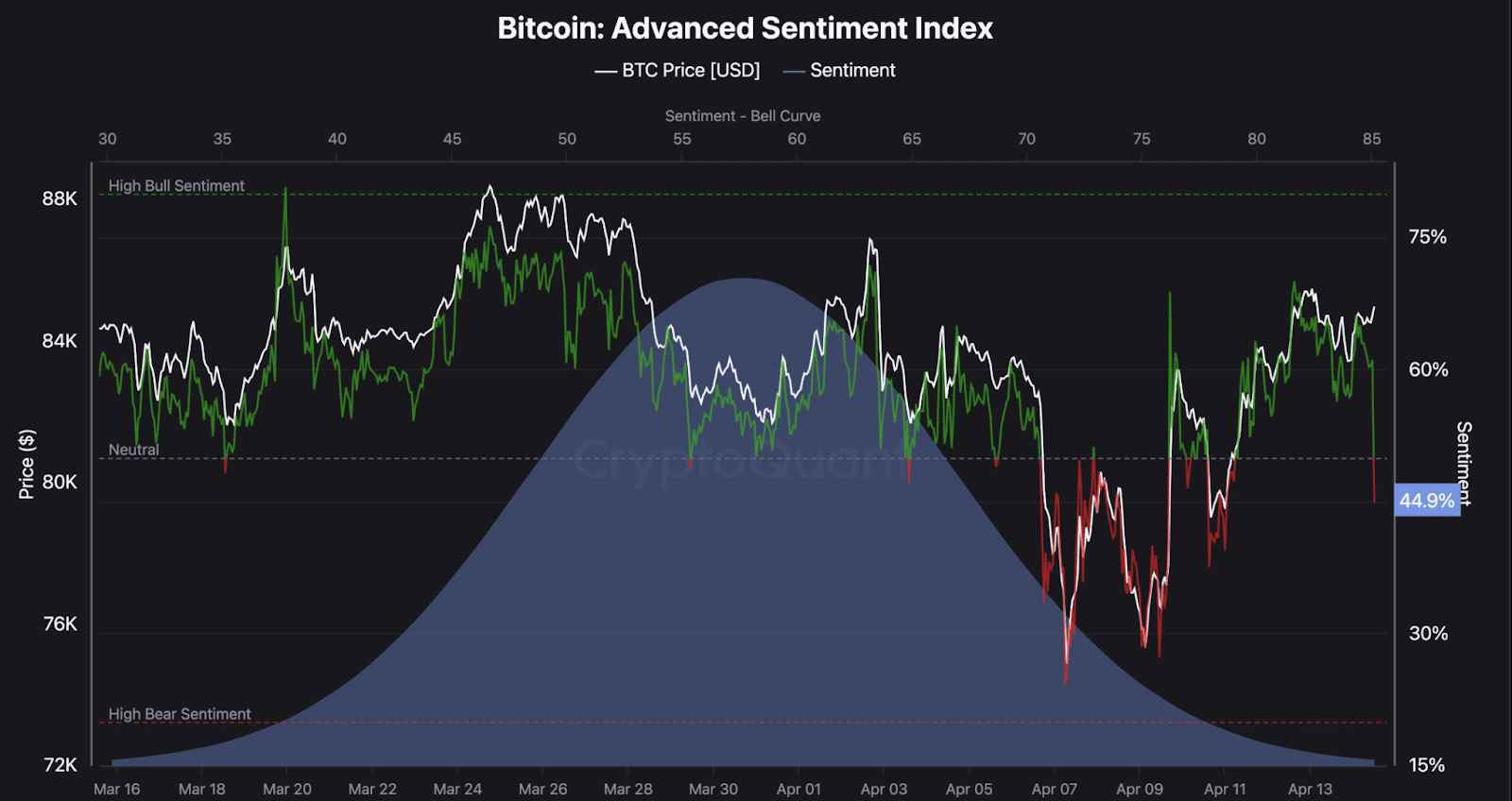

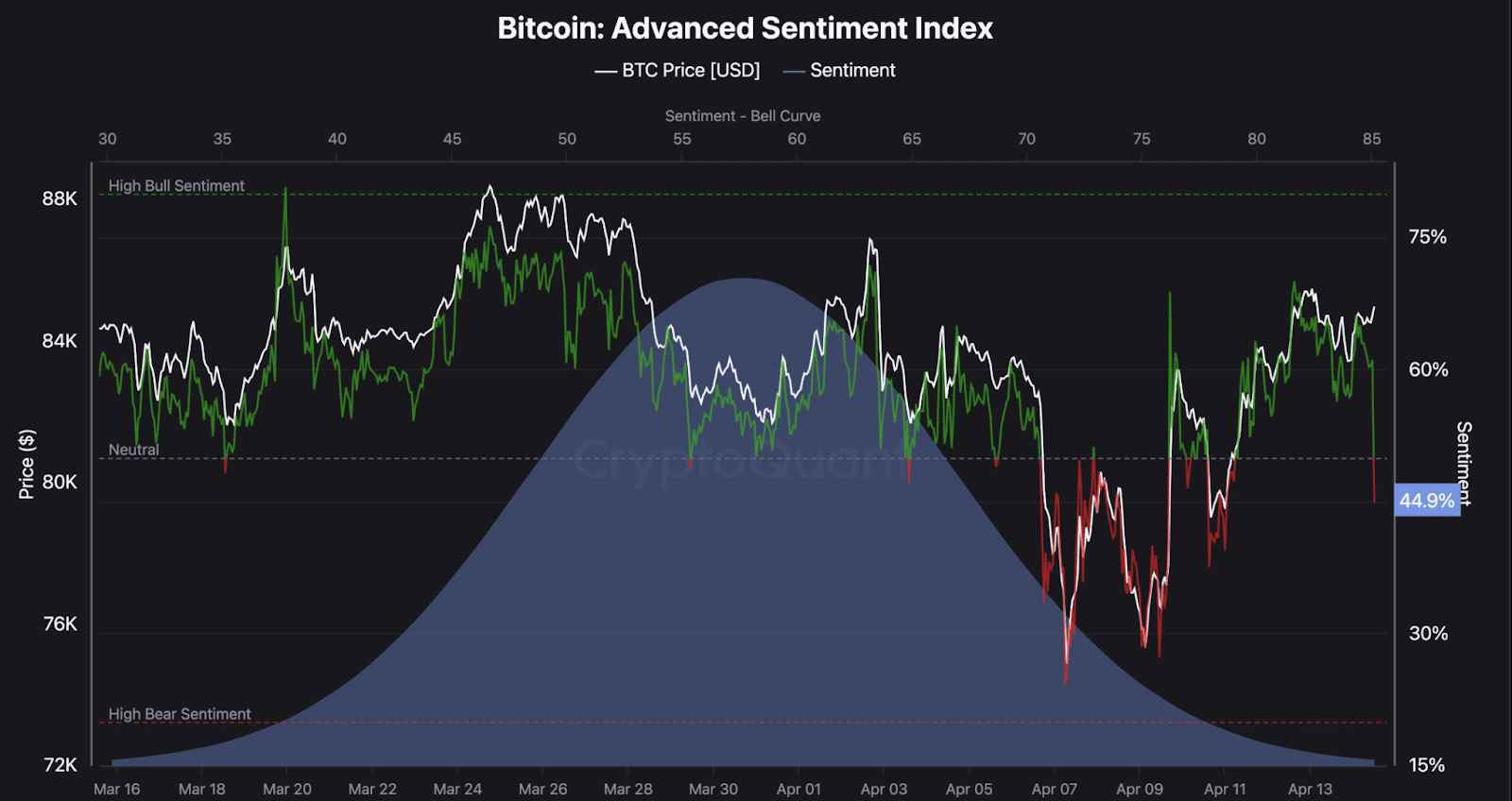

Market sentiment drops under neutral as a volatility efficiency

Of course the question was not the only shaky pillar. Sentiment had also become careful.

By the time of writing, the Bitcoin Advanced Sentiment Index HAd dropped to 44.9%, dropped under the neutral zone and Arary is approaching circumstances.

The sentiment was about 70% in mid -March, but deteriorated in addition to the increased market volatility.

Bitcoin hit $ 88,000 on April 2, before he fell sharply to $ 75,000 in the first half of April.

Although price action has been stabilized since then, the decrease in sentiment has reflected the unequal recovery, which further strengthens the hesitation of the market to bind to a strong bullish story.

Source: Cryptuquant

Institutions are withdrawing while Bitcoin ETF is decreasing

Institutional currents, as soon as an important pillar of the power of Bitcoin has begun to weaken.

Spot ETF Holdings fell at the beginning of April from 1.19 million BTC in March to only 1.115 million BTC. This figure broke under the alarm threshold of 1,116,067 BTC, causing warnings from an important institutional withdrawal.

What is even more important, this meant a break of the stable ETF accumulation trend that had dominated most of 2024.

Now that institutions are withdrawing, there seemed to be trust in the long term, despite some signs of return of retail interest.

At the same time, my rider activity has shifted to a potentially bearish attitude. The position index of the miners (MPI) rose nearly 40% in 24 hours, which reflects an increased outflow from BTC compared to the average of one year.

Historically, such an increase indicates that miners are preparing to sell part of their reserves – either to guarantee a profit or awaiting further downward disadvantage.

In combination with ETF outflows and weakening sentiment, this mining behavior adds a different pressure layer to Bitcoin’s recovery path.

Source: Cryptuquant

BTC Breakout offers hope, but …

Bitcoin is broken from a falling trendline on a technical level, which causes optimism for a bullish reversal. With the last check, BTC floated around $ 83,946 – 0.29% in the last 24 hours.

In addition, a visible pattern with double bottom in recent sessions, which strengthened the bullish potentially. BTC now trades between $ 76,572 support and $ 87,889 resistance-to-say important short-term levels.

Source: TradingView

For bulls to get the check back, a clean break above $ 87,889 is necessary, which would open the path to the level of $ 98,825.

Until this resistance is decisive, the wider market recovery will remain on macro and on-chain developments for the time being.