The Bitcoin market was thrown into turmoil following an alleged hack of the US Securities and Exchange Commission (SEC) X account, falsely claiming approval of 11 spot ETFs. This misinformation led to a rollercoaster in the price of Bitcoin, which initially rose from $46,800 to $48,000, but crashed to $45,000 within a span of 20 minutes.

This incident has become a pivotal moment for market analysts, providing insight into how the market could react to the current potential Bitcoin spot ETF approvals in the near term. So here’s what experts from K33 Research, QCP Capital and Daan Crypto Trades have to say.

#1 K33 Study: Approval will be a Sell-The-News event

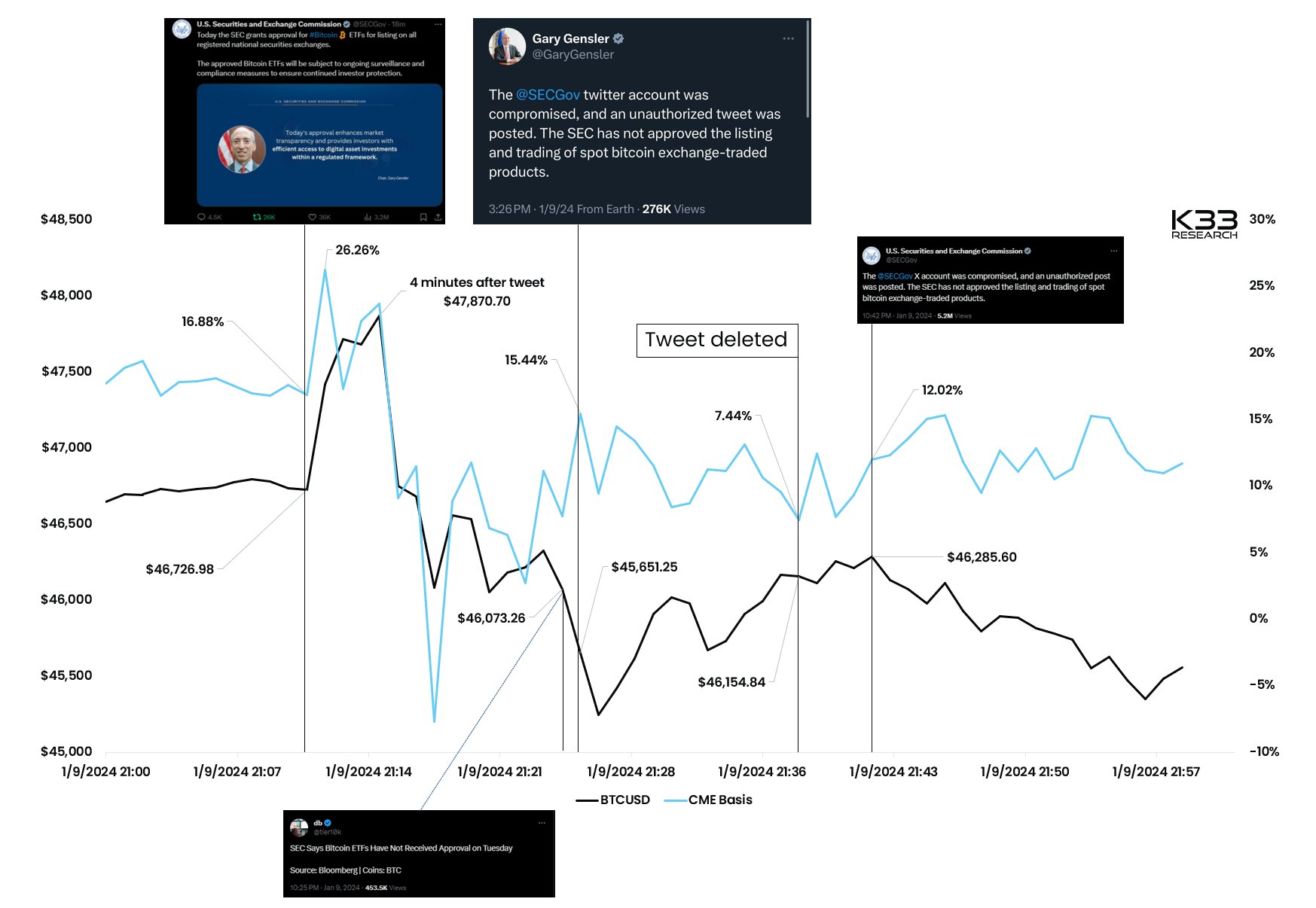

Vetle Lunde, senior analyst at K33 Research, as long as an in-depth analysis of the market’s reaction to the erroneous announcement. He noted that the market’s immediate reaction was indicative of a trend towards a sell-the-news response. The initial surge in Bitcoin’s price was quickly met with a flood of long positions, causing significant price swings.

“The market showed its hand yesterday; the ETF endorsement rehearsal favors a sell-the-news response. Immediately following the announcement, longs quickly crowded the market, forcing a whipsaw in the ensuing minutes,” Lunde said.

Lunde also pointed out that until the SEC provided clarification, the market largely accepted the announcement at face value, triggering an organic reaction. Outlining the sequence of events, he noted a 2.4% increase in Bitcoin’s price within four minutes of the announcement, followed by a 1.4% decline in 14 minutes until Bloomberg debunked the approval news.

The market eventually stabilized when Gensler confirmed the hack, highlighting the market’s sensitivity to regulatory news and rumors.

#2 QCP Capital: Warning Sign for Bitcoin Traders

QCP Capital, in their “QCP Market Update – 10 Jan 24,” reflected about the bizarre nature of the event with a mix of humor and analysis. “We are on the cusp of a BTC Spot ETF approval, and what has happened in the last 24 hours is something you can’t make up for,” their update began.

They pointed to the tepid initial response to the “approval,” which indicated that the market may have already priced in the possibility of an actual ETF approval.

“The initial reaction to the ‘approval’ was muted, as BTC was unable to trade outside the resistance area. We view this as a warning sign that an approval is largely priced in and there may not be a major rally post-approval,” QCP warned.

QCP Capital also focused on the implications of this event for future market trends. “The cautious reaction to the fake approval signals a warning – the actual approval of a Bitcoin ETF may not trigger the expected rally,” they noted, also pointing to current market dynamics such as increased options volatility and the basis spread on spot futures. . Notably, the firm expects the next support for Bitcoin at $40,000 to $42,000, and resistance around 48,500.

Daan Crypto Trades: ETH/BTC could see a spike

Daan Crypto Trades provided a concise but insightful analysis. “The bogus ETF approval news was a litmus test for the direction of the market after the approval,” he noted. The analysis highlights the pattern of Bitcoin price increases, which then completely reversed themselves after the false announcement.

“This pattern could repeat itself upon actual ETF approval, but with more pronounced selling pressure,” he suggested. Daan Crypto Trades also addressed the broader market implications, especially for the ETH/BTC ratio, which started to rise immediately after the false announcement.

He further noted:

ETH/BTC immediately started to rise, which is what we were looking for. I think we could get a small spike in ETH/BTC today as BTC rises, but after that I don’t see much holding back the ETH/BTC ratio. Especially if BTC cools off after ETF.

At the time of writing, BTC was trading at $45,346.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.