Resume:

- A trader spent nearly $1 million buying Bitcoin Inscription #5232025 amid growing debates about congestion on the BTC network.

- This particular BTC inscription contains 50,000 ORDI coins, the Ordinals Protocol native asset created by developer Casey Rodarmor.

- ORDI was introduced earlier this year using the BRC-20 standard after developer Rodarmor designed a protocol for embedding digital data like art on any satoshi and pseudonymous builder Domo unveiled a token format similar to ERC-20 on Ethereum.

A trader spent 35 BTC buying Bitcoin Inscription #5232025 amid growing debates about congestion on the BTC network due to BRC-20 memecoins and an increase in text-based NFTs issued on crypto’s largest blockchain.

This particular BTC inscription contains 50,000 ORDI coins, the Ordinals Protocol native asset created by developer Casey Rodarmor.

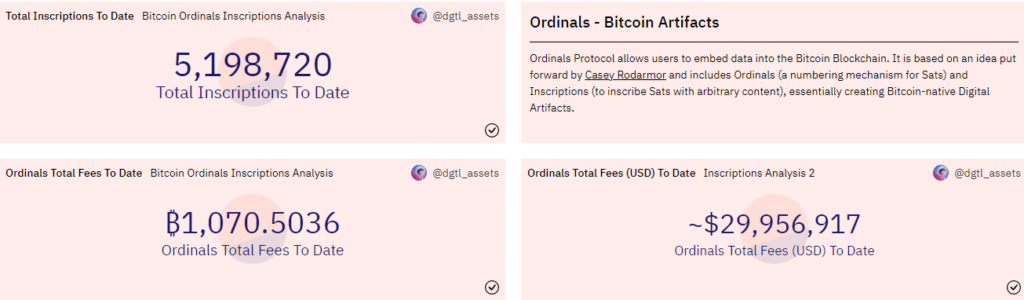

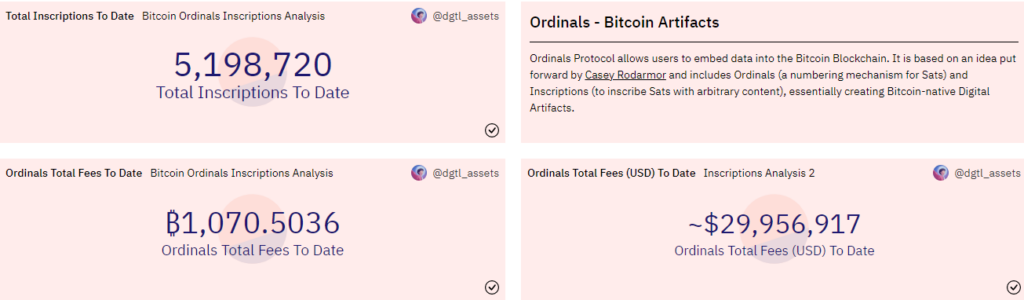

The gossip cost more than $960,000 in Bitcoin at current market prices, possibly the highest sale for an inscription since the asset debuted earlier in January 2023. Since then, more than 5 million inscriptions have been hit on Bitcoin’s blockchain, a wave that BTC purists say has drastically overburdened the network.

Dune Analytics data showed that over 4 million of these Bitcoin inscriptions are text-based. Less than half a million contain visual digital data in PNG format or what some consider NFT art. These inscriptions are made possible using the Ordinals Protocol, developed and launched by Casey Rodarmor.

Ordinals, as they are commonly referred to by crypto participants, have also earned a fortune in fees. Users have spent more than $29 million in fees experimenting with ordinal numbers and linking data to satoshi, the smallest unit of Bitcoin.

Average fees skyrocket with Bitcoin enrollment activity

The emergence of Ordinals and a token standard similar to ERC-20 on Ethereum seems to have sparked a battle over block space on Bitcoin’s network. Indeed, the increased demand for BTC’s blockchain led to an increase in transaction costs. BTC fees averaged more than $20, a two-year high according to on-chain data.

Rising average fees and a deluge of BRC-20 tokens have formed a crescendo around arguments for and against ordinal numbers. On the one hand, BTC bullies like Michael Saylor — whose company owns billions in Bitcoin — are urging that Ordinals could serve as a “catalystfor adoption.

BTC purists and some developers are opposing the position and are going to sink NFTs and altcoins onto the BTC network.