Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

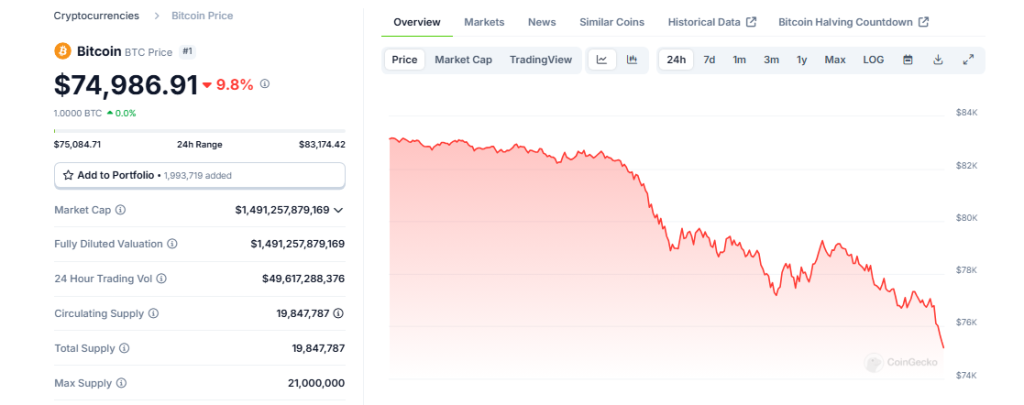

Bitcoin prices fell below $ 75,000 on Monday 7 April, the lowest since mid-March, while investors responded to the US trade relations of the US-China escalated. The digital currency deposits around 6% in 24 hours, revealed coinmarketcap data, as part of a broader sale on both crypto and traditional markets.

Related lecture

US-China Trade War Triggers Market Panic

The sharp decline comes after the recent imposition of US President Donald Trump of tariff increases and countermeasures by Beijing. The commercial tensions sent shock waves through world markets, With Wall Street who suffers the worst fall since the COVID-19 Pandemie. On Friday, April 4, the S&P 500 fell by 6%, the industrial average of Dow Jones fell by 5.5%and the technically heavy Nasdaq composite fell by 5.8%.

Market commentator Charles Gasparino warned on Twitter that “Monday will be the ultimate pain day”, and that investors must prepare for further sales pressure as the markets open this week. That prediction seems to come true when Bitcoin acts between $ 74,000 and $ 75,000, much lower than last week’s levels.

Breaking: A large market analyst just told me: “Monday will be the Ultimate Pain Day.” Another: “Some really nice purchases, especially in the financial data.” As they say, disagreement makes a market! Story development

– Charles Gasparino (@cgasparino) April 6, 2025

Ethereum and Altcoins get harder than Bitcoin

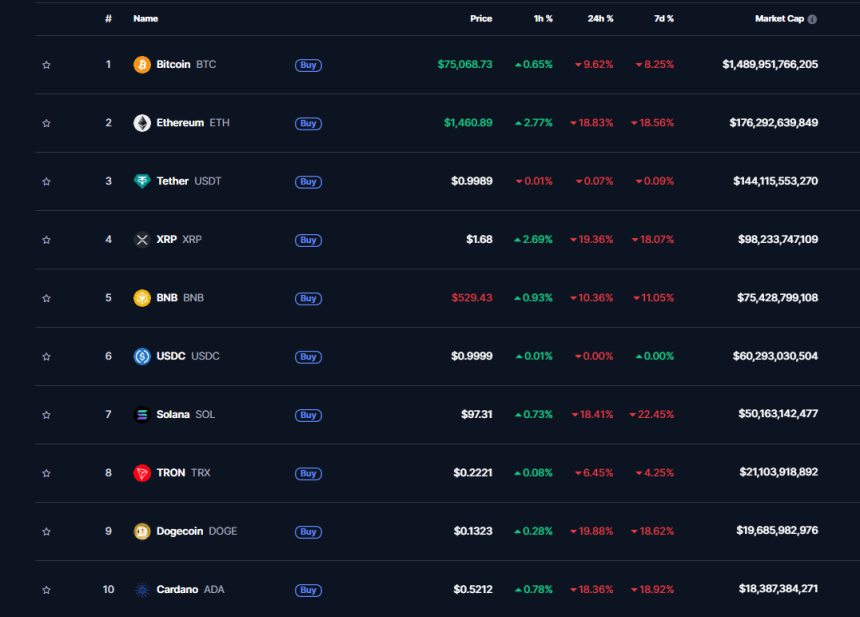

As Bitcoin lost heavily, Other cryptocurrencies fell Even deeper. Ethereum, the second largest cryptocurrency, per market capitalization, lost 13%more than double the percentage decrease in Bitcoin. Other well -known altcoins also fell hard, with Sol and Doge lost more than 10% in one day. ADA fell by 10.40%, while XRP and BNB lost 7%and 6%respectively.

The global market capitalization of cryptocurrency is currently $ 2.62 trillion because most top coins do not find support. Even with the price fall, the 24-hour trade volume rose from Bitcoin to $ 26 billion-a increase of 80% in the last 24 hours what indicates strong levels of market activity during the sale.

Investors turn to crypto -reserves of the government for potential exemption

There is a possible silver lining in market chaos. According to Edul Patel, CEO and co-founder at Mudrex, US government agencies will reveal their crypto assets today. “An enormous confirmation can lead to a auxiliary prally,” said Patel.

Related lecture

Market sentiment remains weak with the fear and greed index that in the direction of what experts are period “Extreme fear.” This indicator implies that panic sales have checked recent market trends instead of a good investment choice.

According to reports from Market Observers, Bitcoin now has a crucial technical test. “Bitcoin has to take the level of $ 80,000 again or it will restore his earlier all time around $ 74,000,” Patel added further. This earlier all -time, previously praised as a milestone, is now a possible support level that traders wish will stop with further price decreases.

Featured image of Gemini Imagen, Graph of TradingView