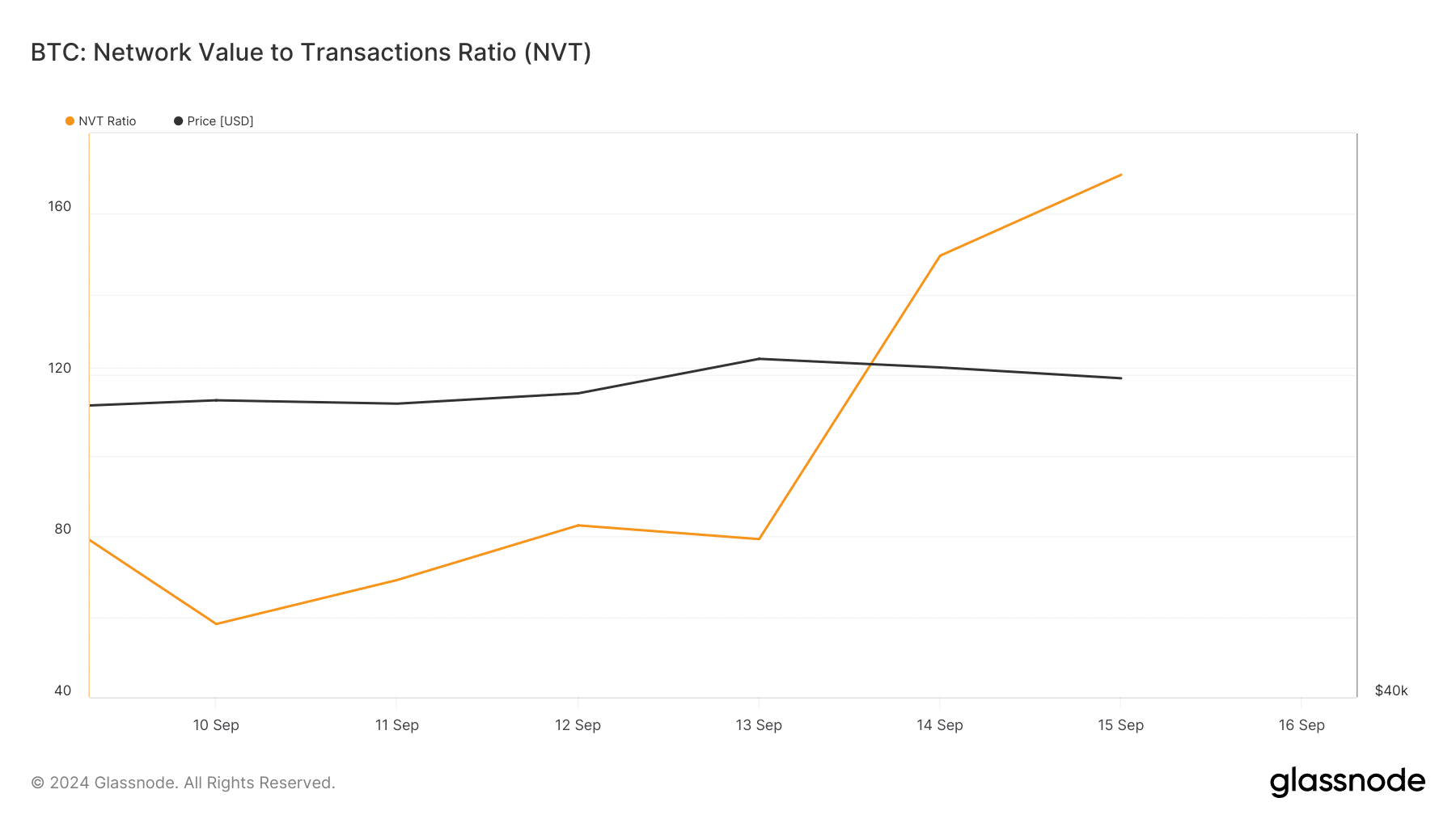

- Statistics showed that Bitcoin was overvalued.

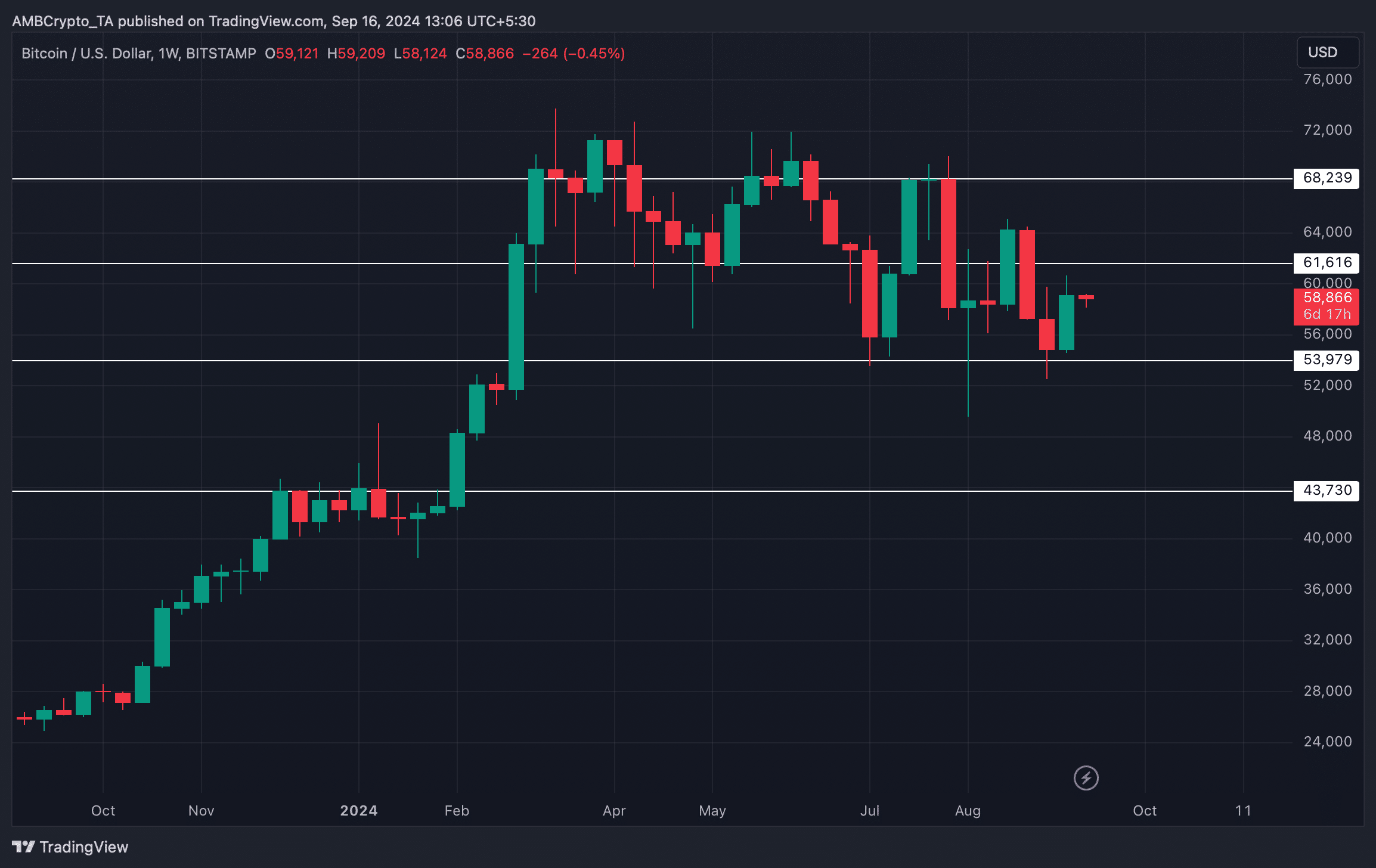

- A continued price decline could push BTC to $53,000 again.

Bitcoin [BTC] Bulls managed to increase the price of the coin by a promising amount last week. But the trend changed in recent hours when the daily chart of the king coin turned red again. Notably, just before the price dropped, a whale sold a significant amount of BTC.

Are Bitcoin Whales Being Sold?

Lookonchain recently posted a tweet revealing a whale’s movement. According to the tweet, a few ago a whale sold 500 BTC, worth $30.07 million, before the BTC price dropped. This whale has made three swing trades on BTC, but only made money the first time; the next two trades were losses.

Since the amount of BTC sold by the whale was significant, AMBCrypto checked other data sets to find out if the overall selling pressure exerted by whales was high.

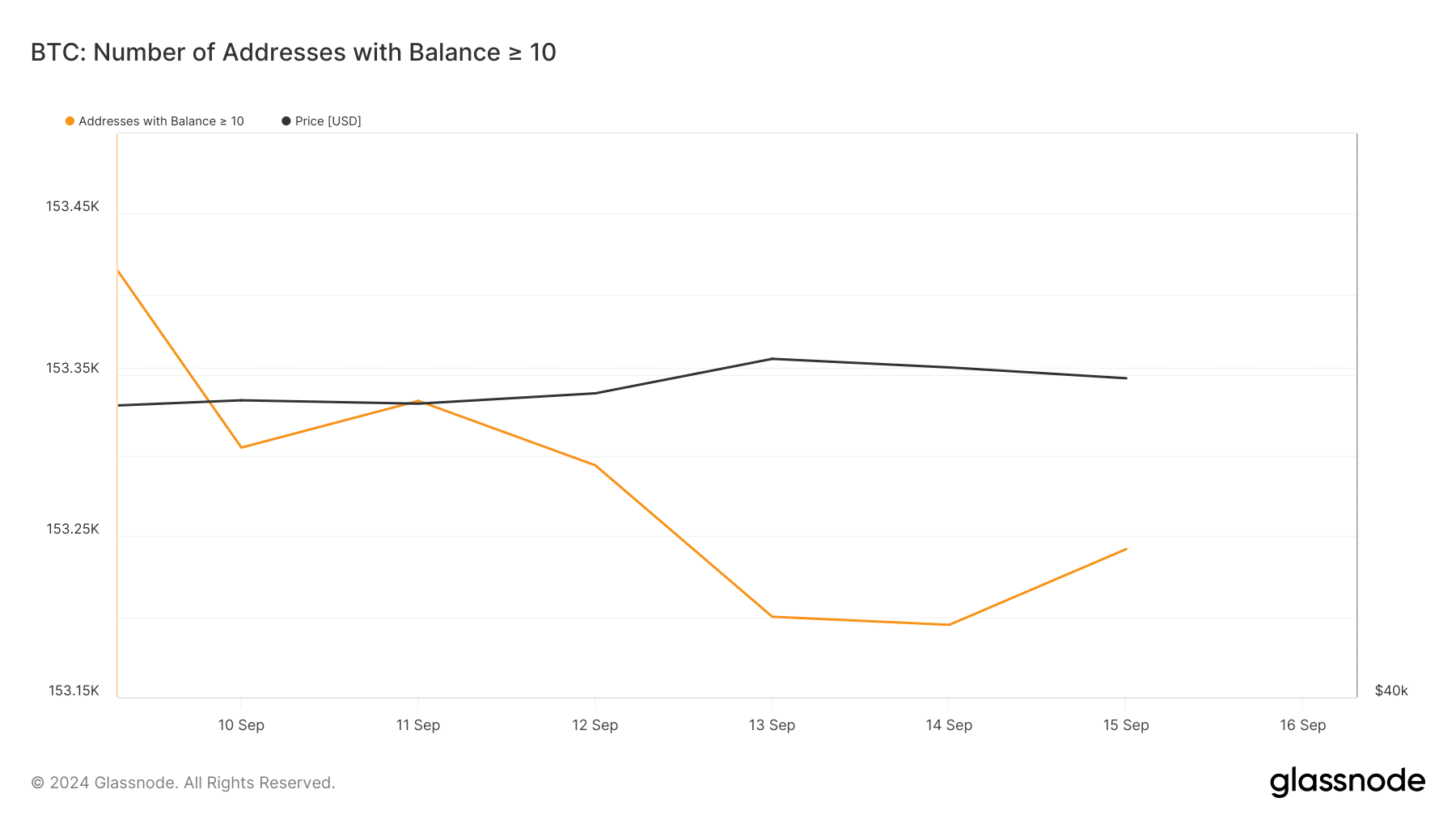

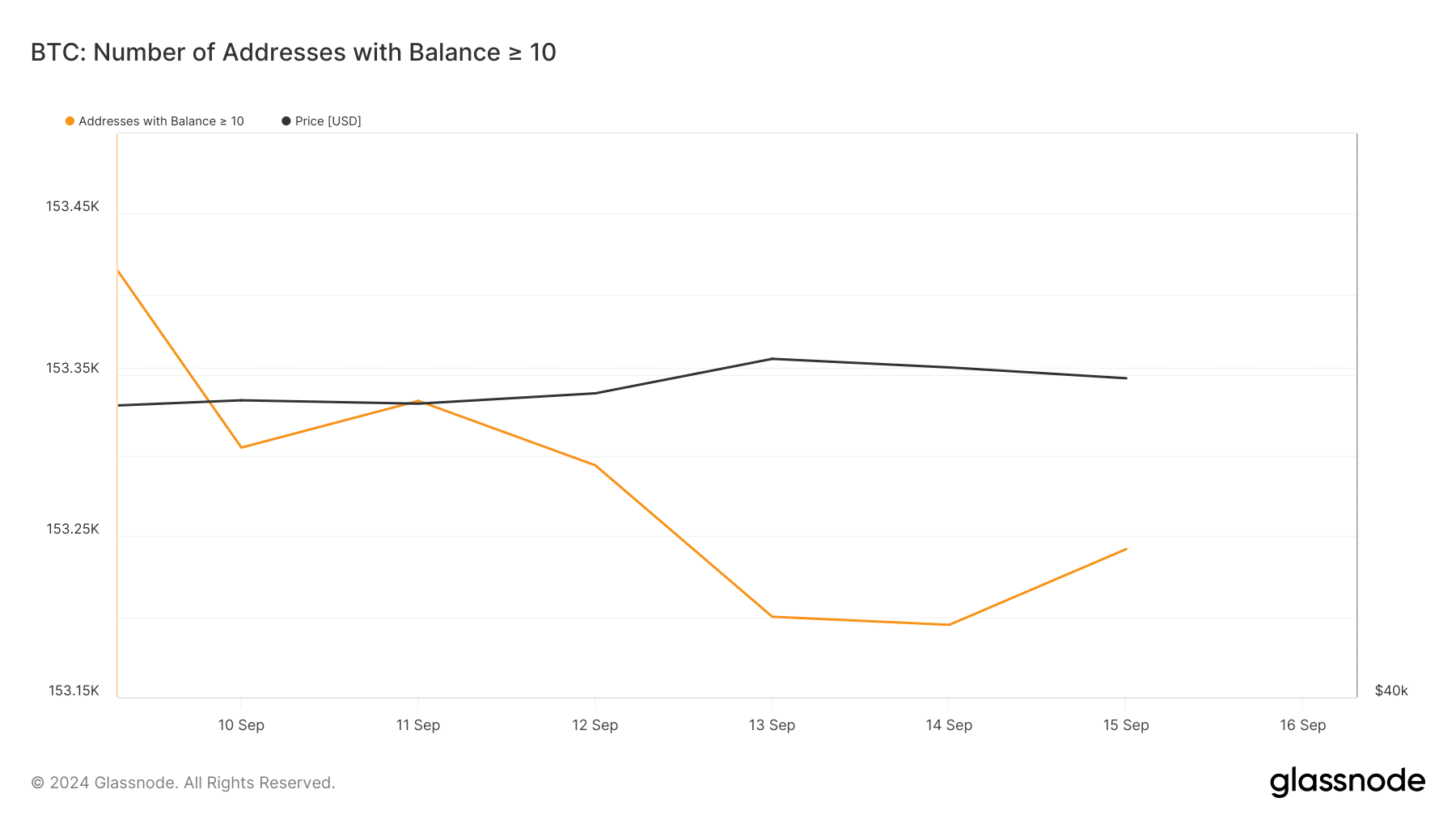

According to our analysis of Glassnode’s data, the number of addresses with a balance of 10 or more BTC decreased last week. A drop in the metric means that the major players in the crypto space were selling BTC, which could have caused the price of BTC to drop over the past 24 hours.

Source: Glassnode

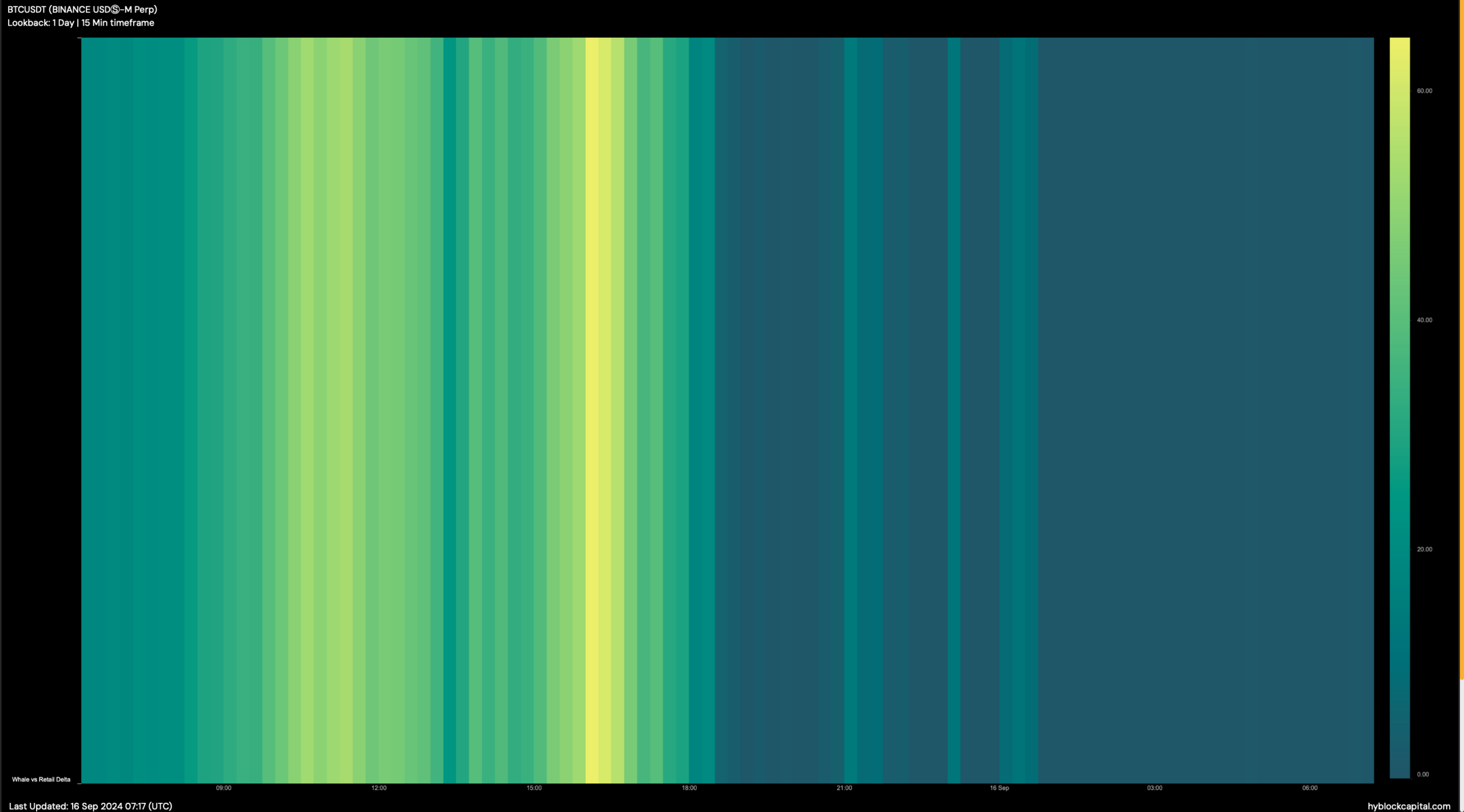

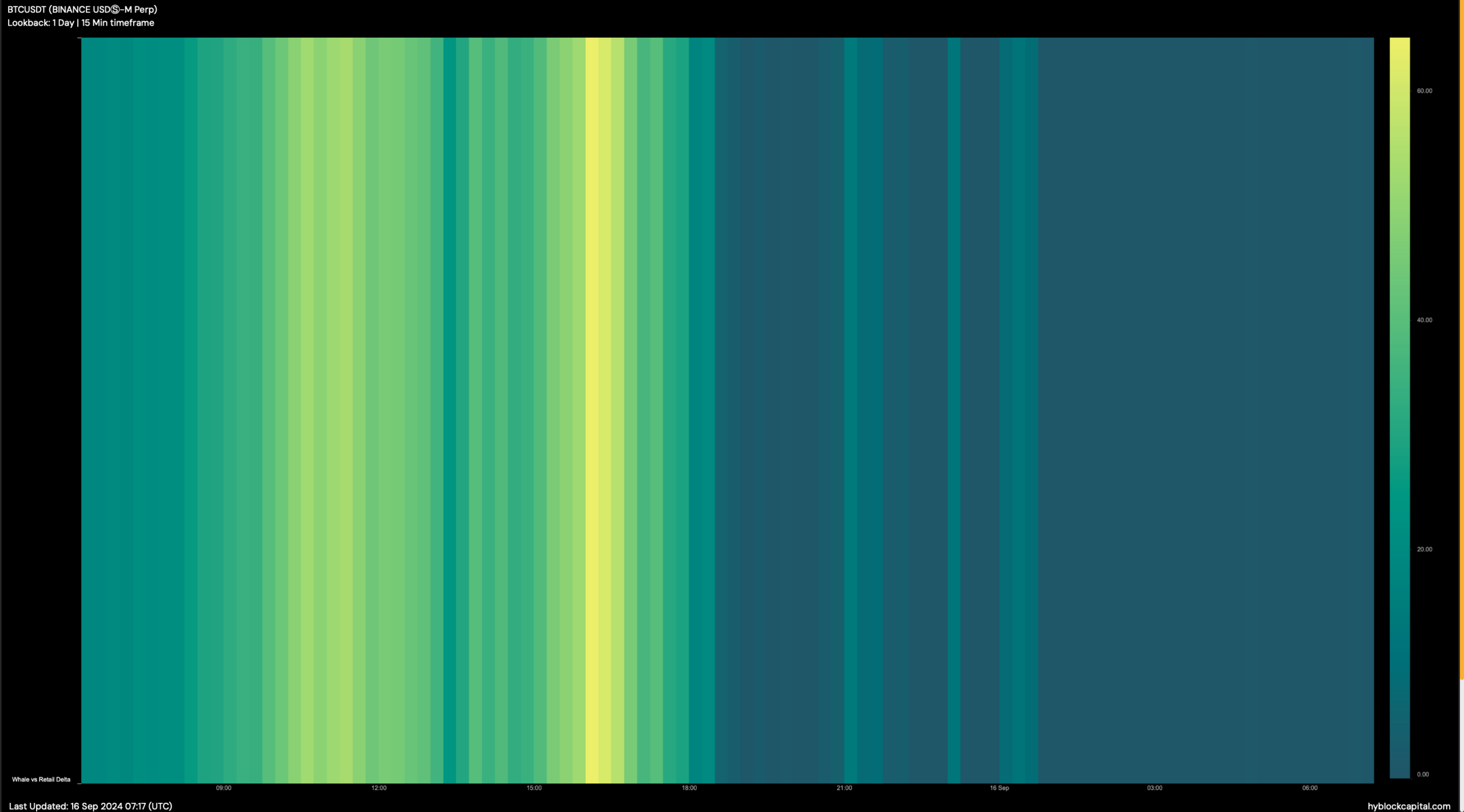

To be precise, BTC has fallen by more than 2% in the last 24 hours. At the time of writing, it was trading at $58,789.75. In addition, Hyblock Capital’s data showed that market exposure to whales has also decreased over the past 24 hours.

This was the case when Bitcoin’s whale vs. retail delta dropped from 64 to 0. For starters, when the whale vs. retail delta drops to 0, it means that retail investors and whales have equal exposure to the market.

Source: Hyblock Capital

However, the actions of whales were not the only cause of this price drop. AMBCrypto also found that BTC’s NVT ratio increased. In general, an increase in the benchmark means an asset is overvalued, often resulting in price corrections.

Source: Glassnode

What to expect from Bitcoin

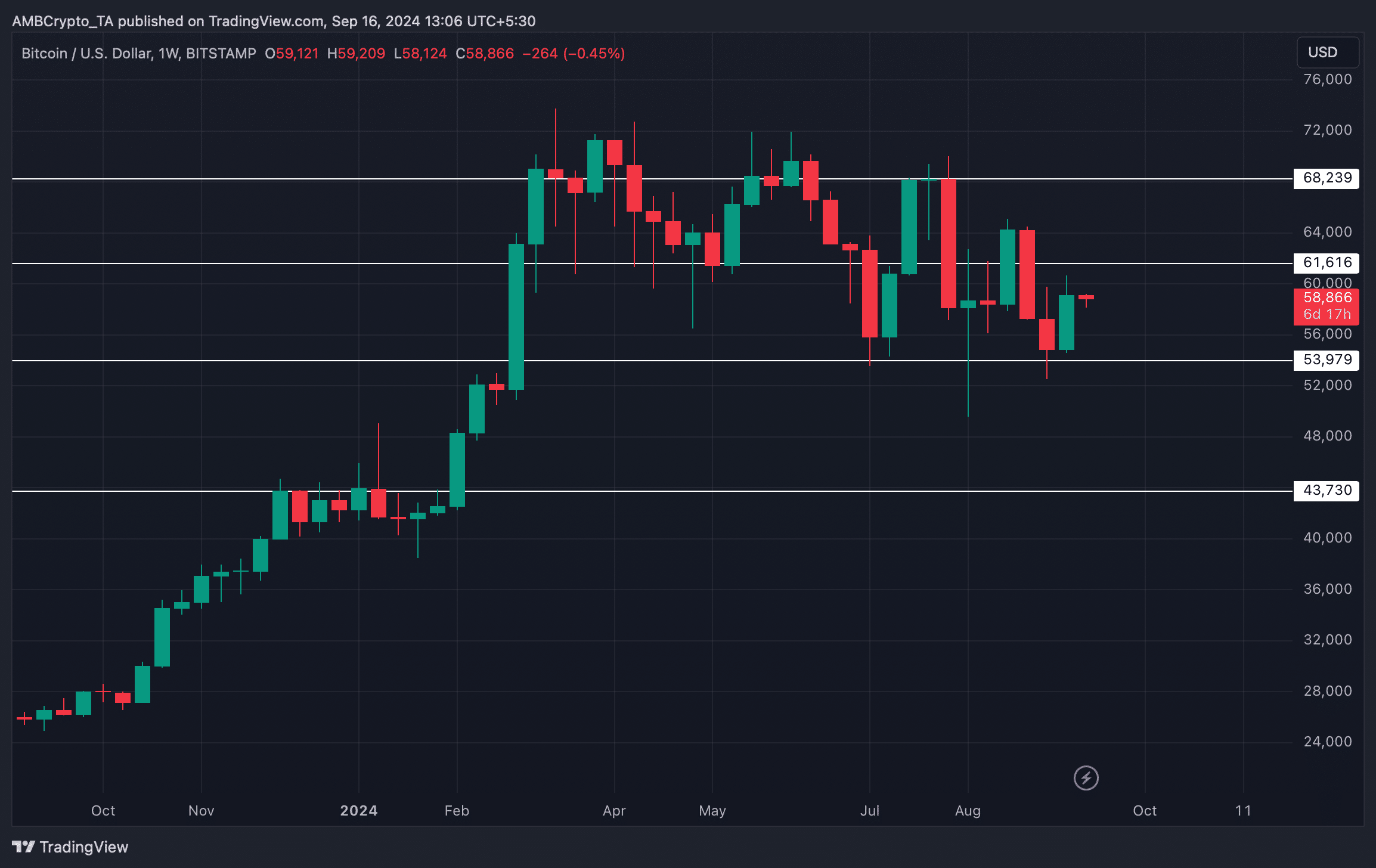

AMBCrypto then checked the weekly chart of the king of cryptos to find out what could happen if the bears continue to drive down the coin’s price. According to our analysis, a sustained price decline could push BTC back towards its support near $53,000.

Read Bitcoins [BTC] Price prediction 2024–2025

A slip below support could cause BTC to drop to $43,000. However, AMBCrypto reported rather that there were high chances that the price of BTC would rise. One of the reasons was that Bitcoin’s NVM ratio fell.

If the BTC bulls take over, the coin will first approach its resistance near $61,000. A successful breakout could see BTC target $68,000 in the coming weeks.

Source: TradingView