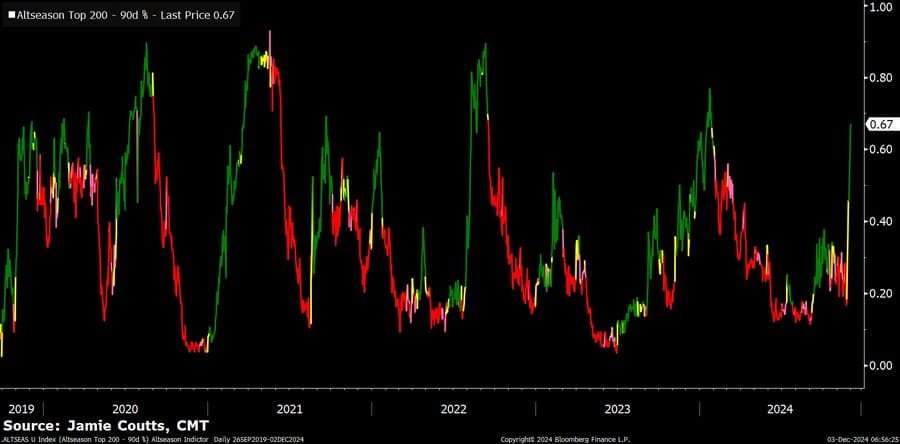

Jamie CouttsChief Crypto Analyst at Real Vision, has provided valuable insights into what really triggers an altcoin season, shifting the focus from Bitcoin’s dominance.

Rather than relying solely on Bitcoin’s market share, Coutts emphasized the importance of market breadth – specifically the performance of altcoins against Bitcoin.

Source:

Currently, the Altseason indicator stands at 67%, indicating growing altcoin strength. However, Coutts notes that a full-fledged altcoin season only begins when this indicator reaches 75%, providing a more comprehensive approach to understanding market cycles.

His position challenges conventional wisdom and encourages traders to broaden their analysis beyond Bitcoin’s dominance.

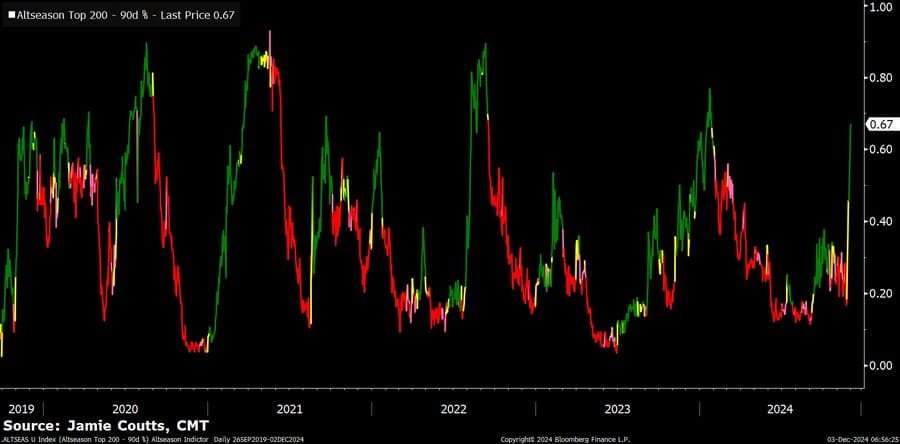

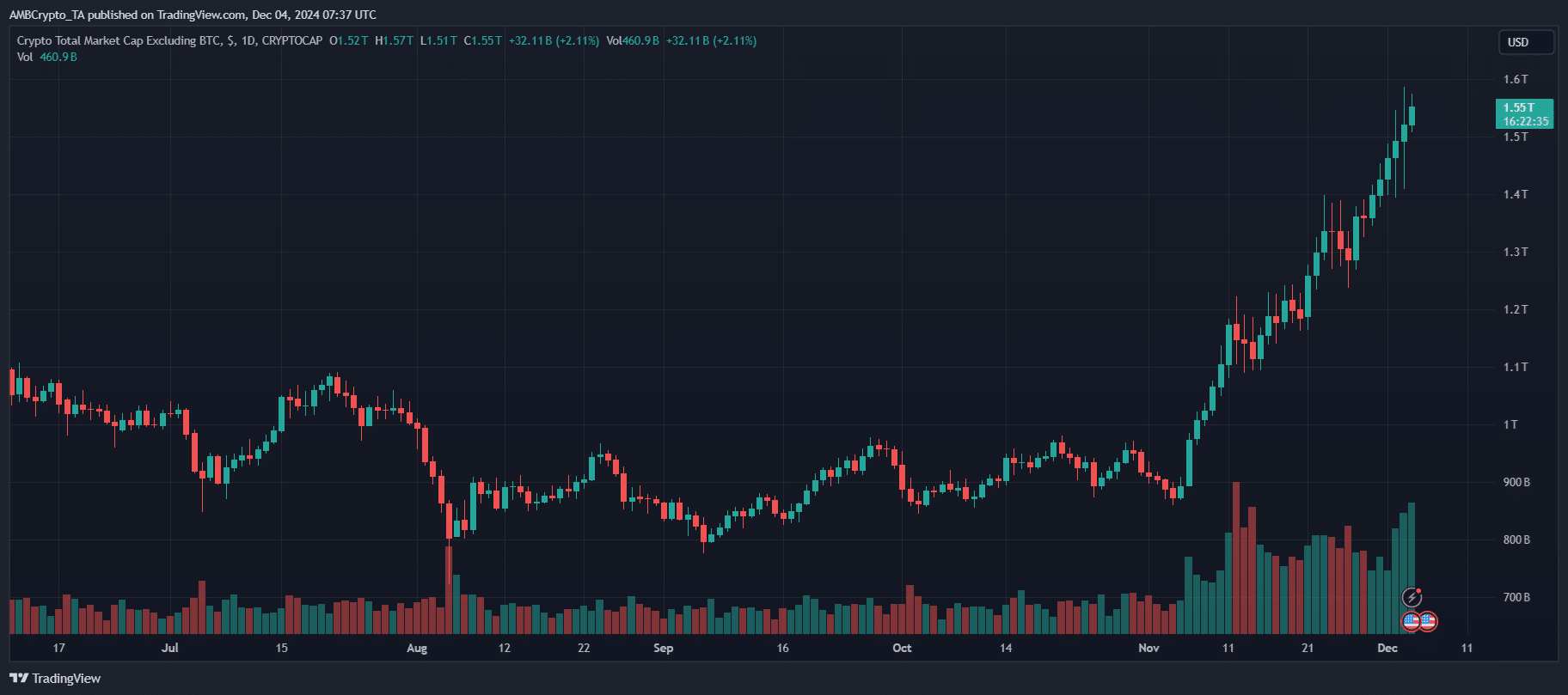

Does altcoin season no longer depend on asset rotation?

Source: TradingView

Ki Young JuCEO of CryptoQuant, has emphasized that the altcoin season story is evolving beyond Bitcoin’s traditional asset rotation.

He argues that the increasing utility of altcoins individually, along with various market factors, are reshaping this cycle. According to Ju, the rise in altcoin trading volume is now driven by Stablecoin and fiat pairs rather than Bitcoin pairs, indicating real market expansion rather than simple asset rotation.

This shift highlights the growing importance of stablecoin liquidity as a key indicator of market direction, suggesting that the dynamics behind the current altcoin rally are more complex than previous Bitcoin-dominated cycles.

The role of market sentiment in the altcoin movement

Market sentiment is playing a crucial role in the current altcoin rally, as investor confidence turns away from Bitcoin and embraces altcoins.

Positive sentiment towards new developments, such as the rise of decentralized finance (DeFi) and innovative blockchain projects, is driving strong demand.