- Bitcoin’s dominance is a crucial measure of where investors send their money.

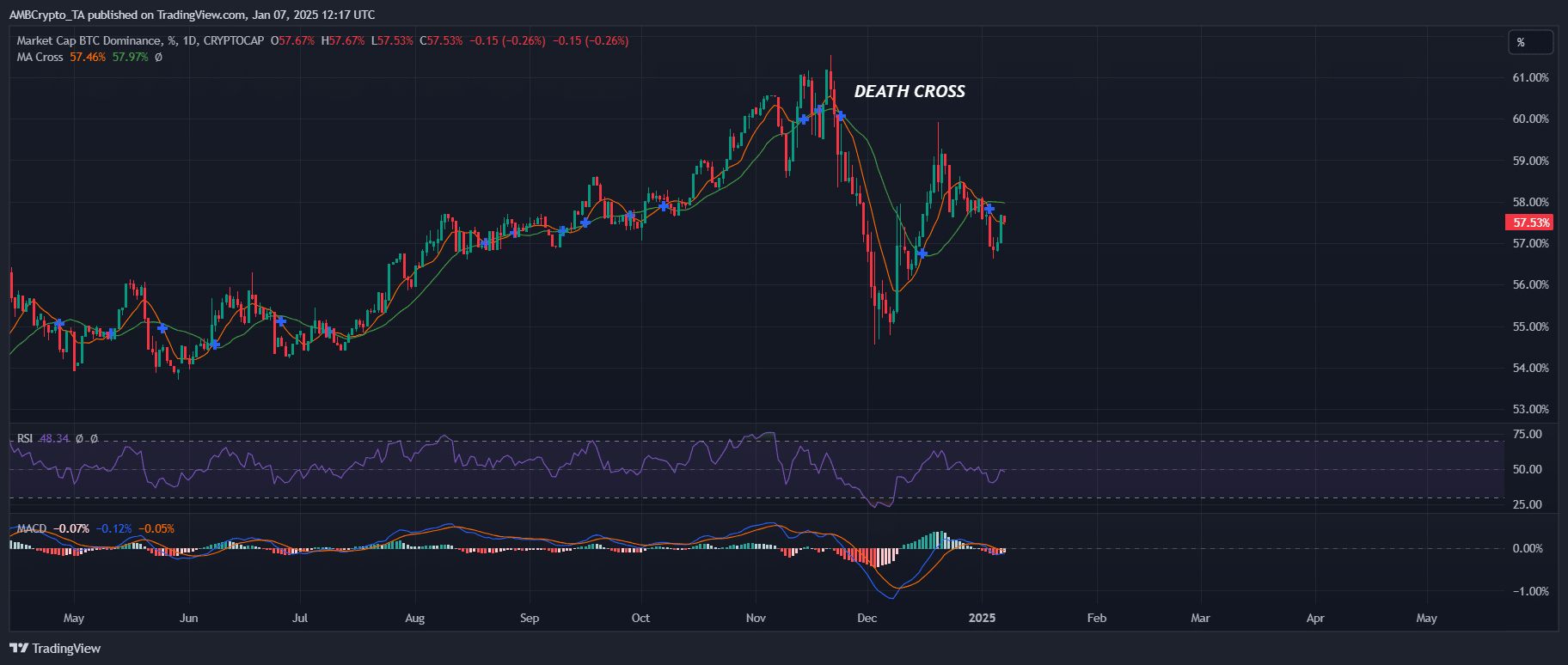

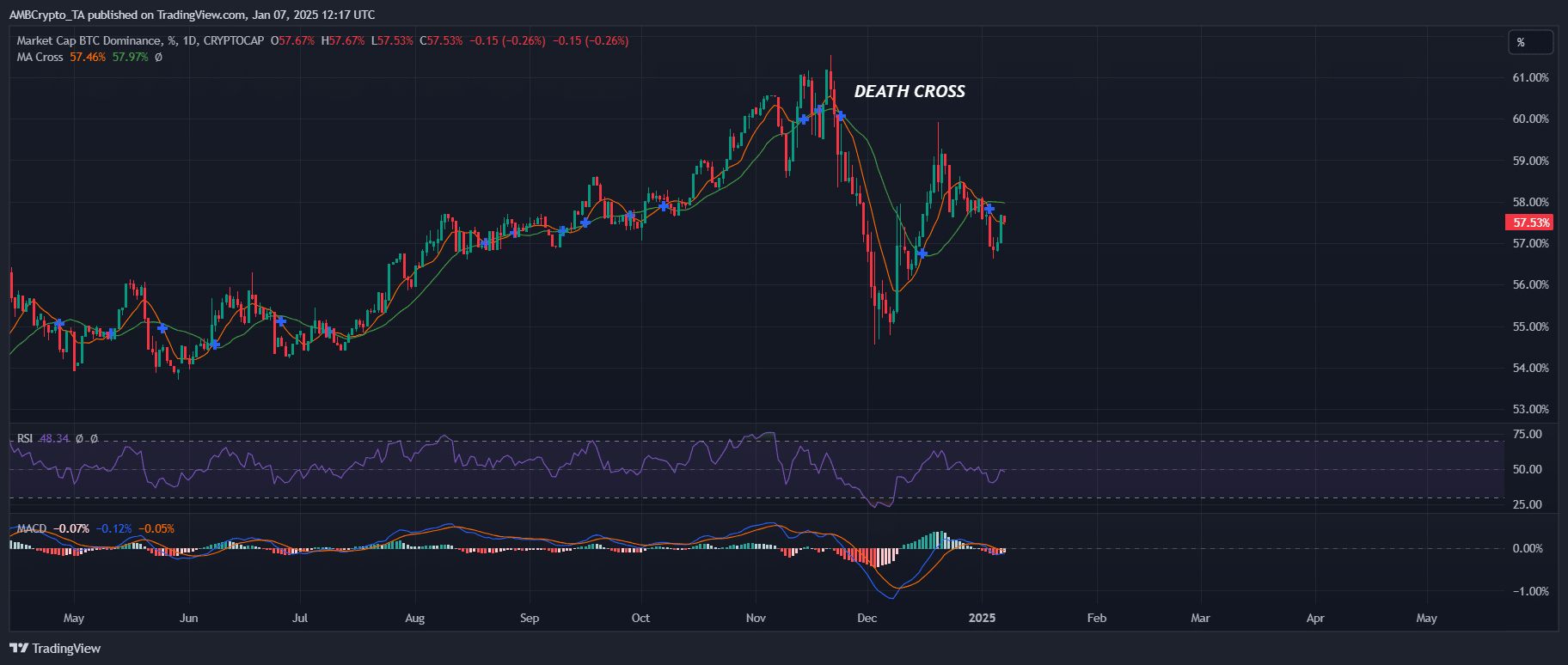

- The emergence of a death cross after four years is not just a technical signal – it is a clear warning.

Despite Bitcoin [BTC] After ending the first week of 2025 on a high, recovering $102,000 after two weeks of market decline, the market’s dominance has taken a bit of a dip.

This could indicate that altcoins are starting to gain attention as investors rush to diversify.

So is there a repeat of the 2021 cycle on the charts?

When Bitcoin’s dominance ebbs, it’s usually a strong sign that an altcoin season is about to kick off. And right now that hypothesis is becoming increasingly important.

Over the past week, the market has turned green, with high-cap altcoins post double-digit gains. While it is still too early to make bold predictions, the signs are already there and it is a trend that should definitely be monitored.

Why? Four years ago, Bitcoin started the first quarter with 72% dominance, but in less than four months that dropped below 40%, just as a death cross appeared on Bitcoin’s dominance chart.

In response, Ethereum [ETH] skyrocketed from $737 in January to $4,183 in May, a huge jump of 467%. And get this: that’s four times the 107% jump that Bitcoin made in the same period.

So is history repeating itself? The market seems to be into it. In mid-November, a death cross formed on Bitcoin’s dominance chart for the first time in four years.

Source: TradingView

The result? BTC’s market share fell from 60% to 54% in just two weeks. During that same time, Ethereum rose 30% to close above $4K.

But a lot has changed in the past four years. While a death cross often signals an altcoin rally, it does not automatically mean that Ethereum will take the lead.

The crypto landscape has evolved and new contenders may emerge to take the spotlight.

So who could take the lead if Bitcoin’s dominance slips away??

Interestingly, memecoins are on the rise and dominate the market list of top winners with weekly increases of more than 50%. In fact, three of the top five tokens are based on memes, proving that meme mania is on the rise.

However, this trend also highlights that investors are looking for quick, short-term profits, especially as Bitcoin breaks the $100,000 mark. It’s clear: memecoins are following suit.

What’s even more interesting is how meme-based tokens are currently outperforming traditional altcoins. Take DOGE/BTC for example – on the verge of a breakout as MACD turns bullish.

Source: TradingView

Read Dogecoins [DOGE] Price forecast 2025–2026

The takeaway? Investors seem more interested in the ‘hype’ than the long-term ‘value’, which means the memecoin market should be closely monitored.

With Bitcoin’s dominance under increasing pressure from those looking for cheaper, less volatile alternatives, the spotlight on memecoins could become even brighter.