- Bitcoin’s dominance is approaching 60% as volatility increases, indicating a bullish outlook in the short term.

- What does this mean for altcoins?

In just over two weeks, Bitcoin [BTC] Its dominance has risen from 57% to almost 60%, expanding control over the crypto market despite fierce competition from rival assets.

However, despite this milestone, the price of BTC has remained below $68,000 for an entire week. If this trend continues, the high dominance could signal a market top, with the current price serving as an important psychological resistance level.

On the other hand, prevailing market sentiment is largely determined by key macroeconomic factors. The upcoming election results are expected to bring shifts in monetary policy, potentially setting BTC up for a volatile week. However, this situation underlines a more important problem.

Investors are becoming increasingly risk averse

The cryptocurrency market is witnessing a remarkable transition. While Bitcoin continues to reach new highs, altcoins are lagging behind.

Currently, only 14 of the top 50 altcoins have outperformed BTC over the past 90 days, accounting for just 29% of their dominance. Meanwhile, Ethereum has seen its market share plummet by more than 7% in just 30 days, and now stands at 13% at the time of writing.

Simply put, there is a perception that Bitcoin serves as a safe haven during increased volatility. With regulatory uncertainties looming, more capital is expected to flow into BTC, potentially dealing another blow to high-cap altcoins.

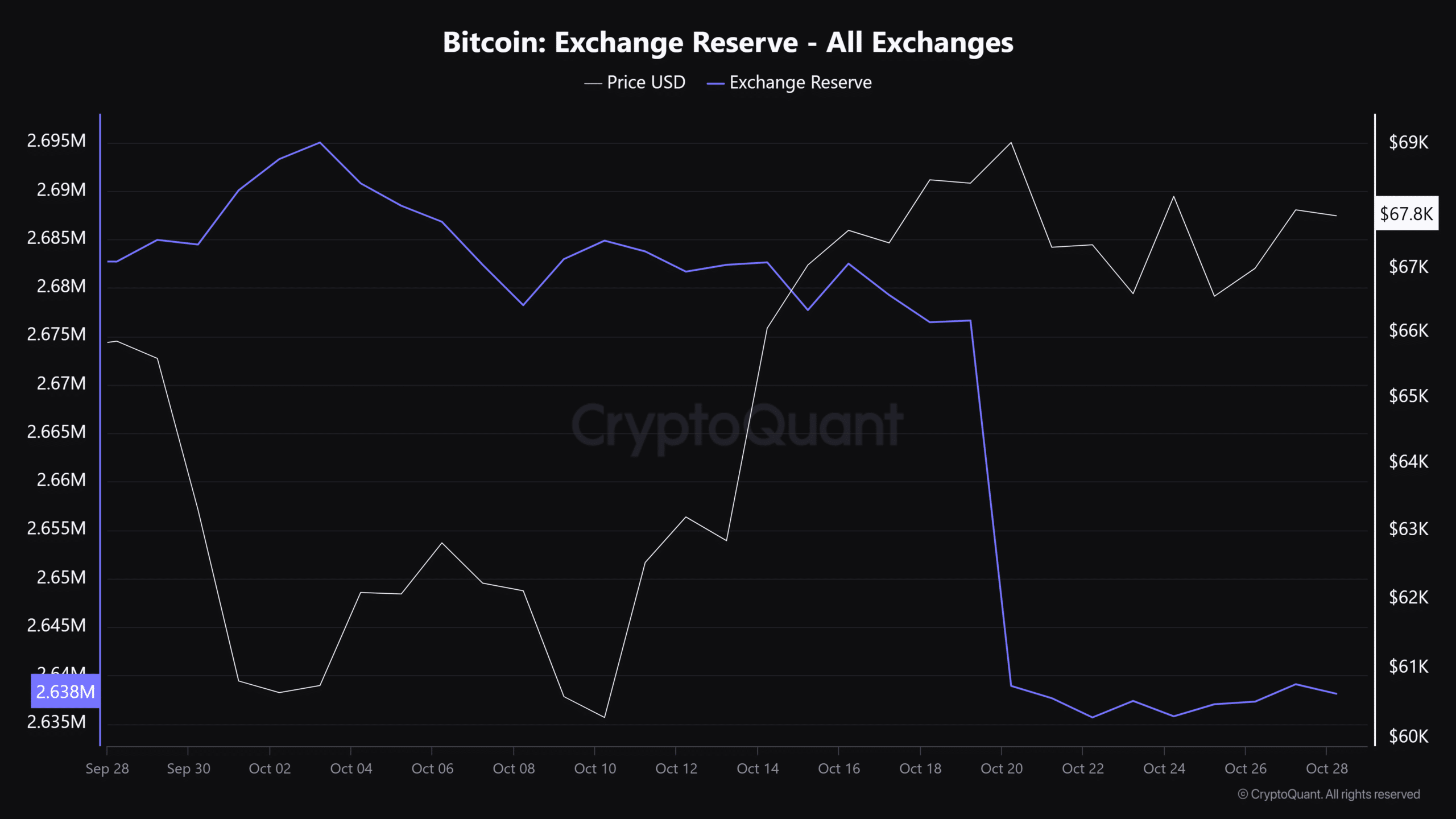

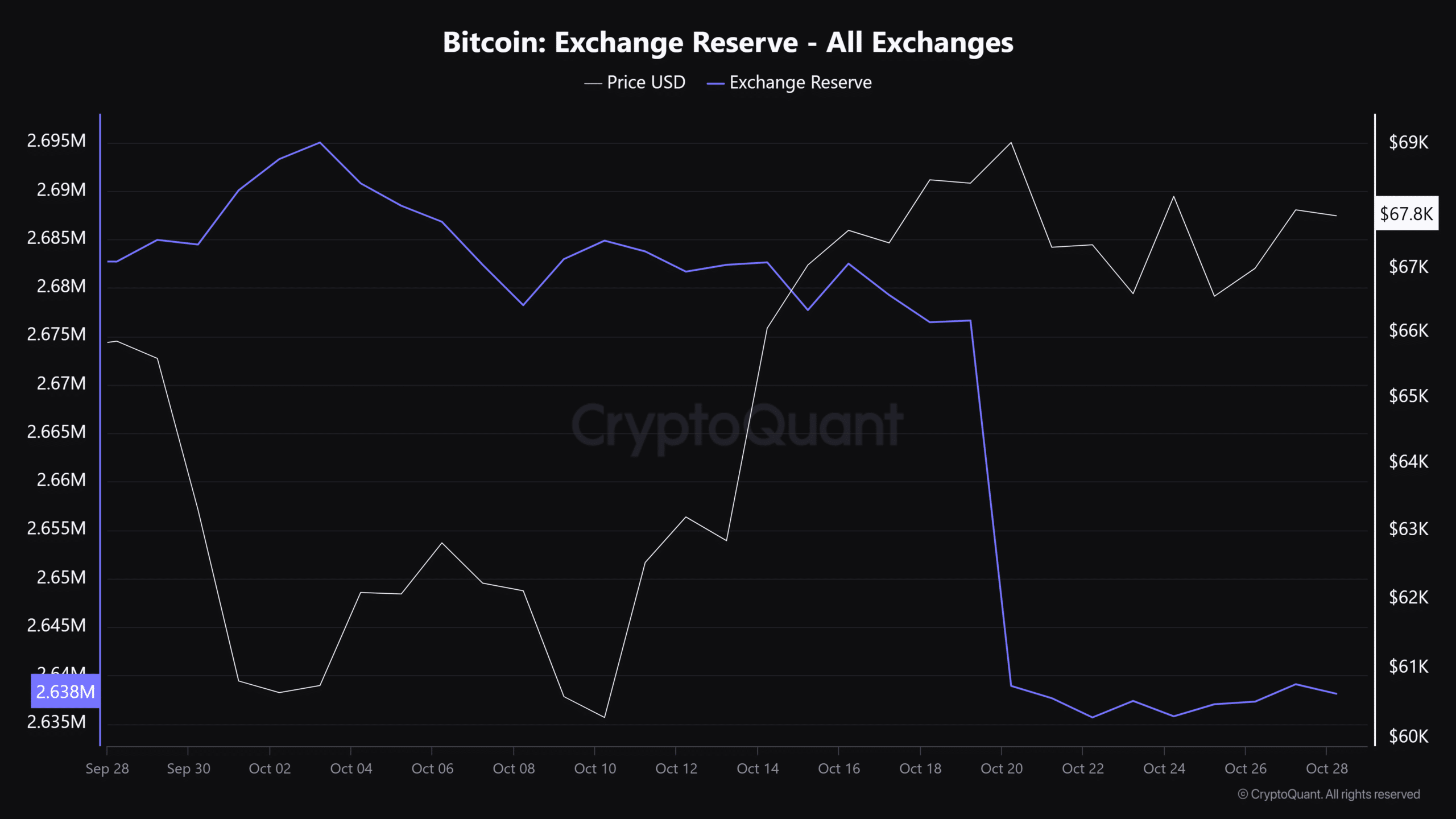

Source: CryptoQuant

The total amount of Bitcoin held on exchanges has hit a lower low, a pattern that often signals market bottoms during bullish trends. This development, among several others indicatorsindicates a possible shift in sentiment among investors.

AMBCrypto suggests that as the election buzz begins to subside, more investors will flock to Bitcoin – at least until a clearer regulatory landscape emerges.

This situation points to a neutral short-term outlook for BTC as market participants look for stability despite the uncertainty.

Altcoins poised for short-term gains

Since Bitcoin will benefit from the current volatility, altcoins could also see some movement. However, an altcoin season remains out of reach.

While altcoins could gain the necessary momentum for a small turnaround, their momentum is still highly dependent on Bitcoin’s performance.

Consequently, AMBCrypto dismisses the possibility of a robust altcoin season unless the post-election landscape ushers in more pro-altcoin sentiment or Bitcoin dominance approaches 70%, indicating an overheated market and a potential top.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Currently, on-chain data indicates that $67K is a significant local low for BTC. With volatility expected to increase next week, Bitcoin appears poised to challenge its previous resistance at $69K and could even reach a new ATH.

As a result, altcoins are also showing a bullish short-term outlook, hoping to benefit from Bitcoin’s positive trajectory. However, the highly anticipated altcoin season still remains elusive.