Bitcoin has dipped below $27,000 in the past day. Here are the market segments that may be participating in this sale.

These Bitcoin investors have been spending their coins lately

In a new tweet, the on-chain analytics company Glasnode broke down the prices at which the average coins sold today were purchased. In general, the BTC market is divided into two main segments: the long-term holders (LTHs) and the short-term holders (STHs).

The STHs include a cohort of all investors who acquired their Bitcoin in the past 155 days. The LTHs, on the other hand, are investors who have held above this threshold amount.

In the context of the current discussion, the relevant indicator is the “average spending rest periods”, which indicate the periods when the average coins issued/transferred by these two groups were first acquired.

For example, if the stat shows the 7-day spending range for the LTHs as $20,000 to $30,000, it means that the coins these investors sold in the past week were initially bought at prices in this range.

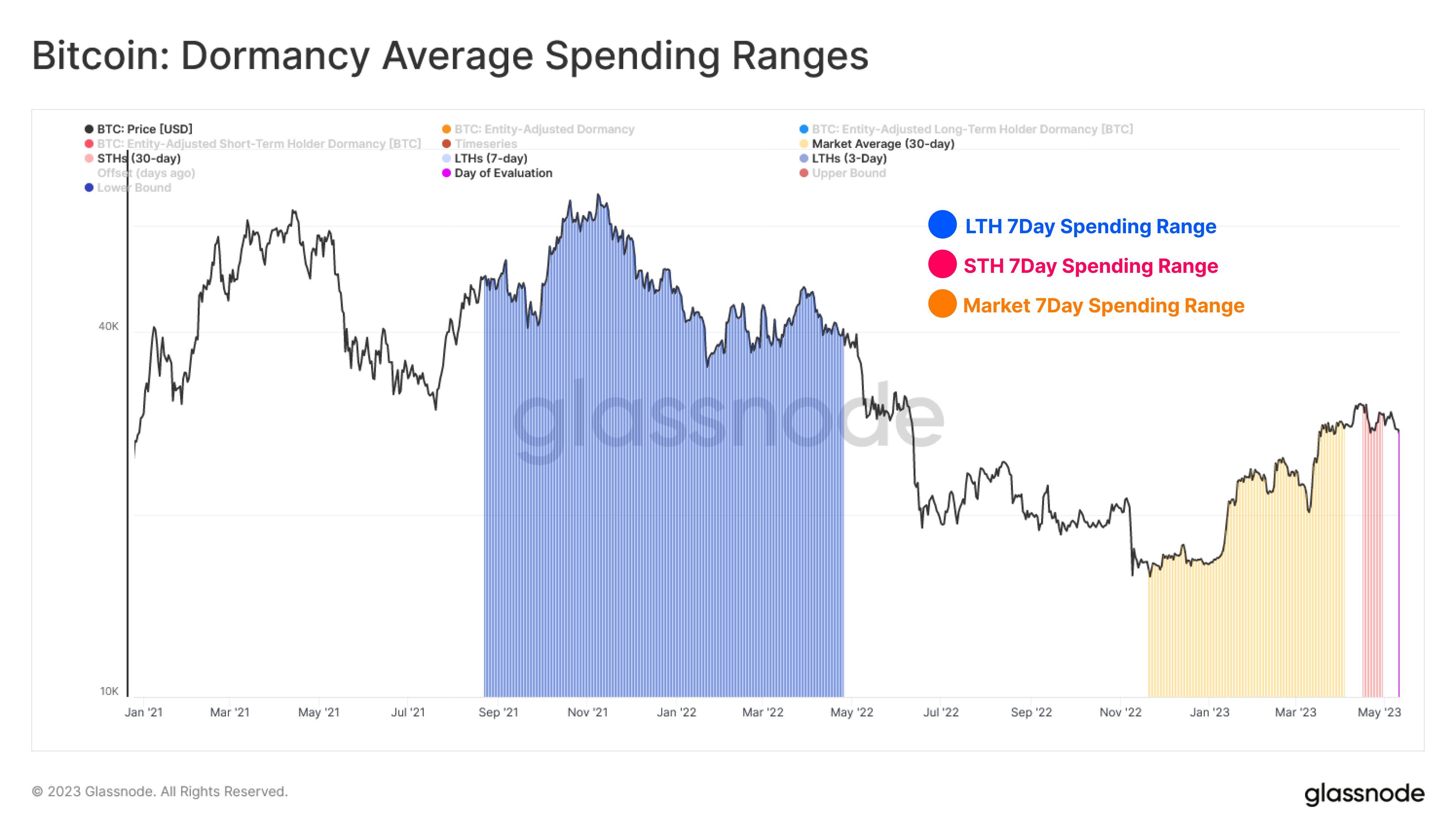

Here’s a chart showing the data for the current 7-day average spend rests for the STHs and LTHs, as well as for the combined market.

The different average spending ranges of the main segments of the sector | Source: Glassnode on Twitter

The chart shows that the 7-day average spending range for the STHs is quite close to current prices of $30,400 to $27,300. Some of these sellers were buying at higher prices than last week’s, so they must have sold at a loss (though not particularly deeply).

The indicator estimates the acquisition range of the LTHs at $67,600 to $35,000. As indicated in the chart, the time frame of these purchases included the run-up to the all-time high in November 2021, the top itself, and the period when the decline into the bear market first began.

It seems that these holders who bought at the high bull market prices have succumbed to the pressure the cryptocurrency has been under as of late and have finally decided to take their losses and move on.

In general, the longer an investor holds onto their coins, the less likely they are to sell at any point. This might explain why the acquisition period of current STHs is so recent; the capricious are the ones who last but a short while.

For the BTC LTHs, the likely reason why the average seller’s acquisition period in this group is so far back, rather than closer to 155 days ago (the youngest LTHs cutoff), is that many of the younger LTHs would currently be making a profit as they bought during the lower prices in the bear market.

As such, the Bitcoin investors who are more likely to waver in their beliefs at this point would be the ones with the biggest losses, the 2021 bull run top buyers.

The chart also includes the 7-day average spending range for the combined BTC sector, and as expected, this range is in the middle of the two cohorts ($15,800 to $28,500), but the time frame is closer to the STHs, as a many of the sellers will no doubt be recent buyers.

BTC price

At the time of writing, Bitcoin is trading around $26,300, down 10% over the past week.

Looks like BTC has taken a plunge during the past day | Source: BTCUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com