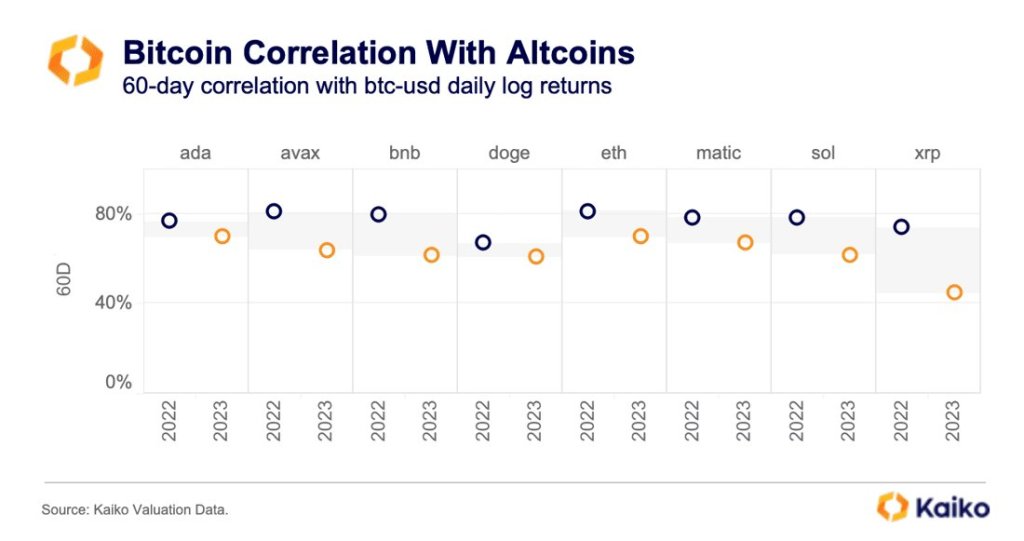

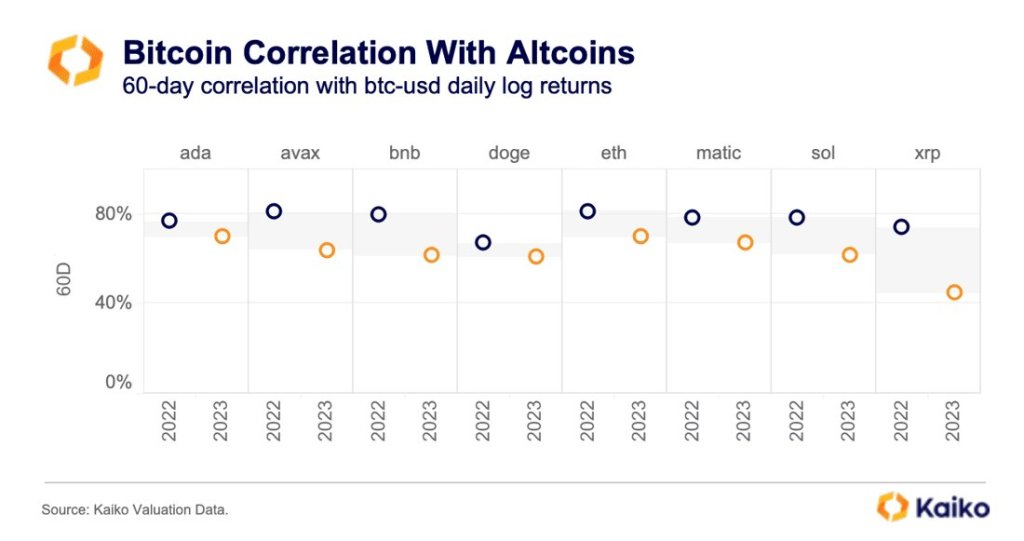

Over the past two months, Bitcoin (BTC), the world’s most valuable cryptocurrency, has increasingly decoupled from XRP, the native currency of the XRP Ledger (XRPL), and BNB, the coin powering the broader Binance ecosystem. While this is expanding, Dogecoin (DOGE) and Cardano (ADA) remain largely correlated with Bitcoin.

XRP, BNB decouples from Bitcoin

While increasing correlation suggests that the market is maturing and becoming more sophisticated, secondary factors may be causing some of the top altcoins to break away and chart their course away from Bitcoin’s tight grip.

To share facts from Kaiko, a blockchain analytics company, @cryptobusy on X notes that the correlation between Bitcoin, XRP and BNB has decreased over the past two months. Meanwhile, the prices of BTC, Dogecoin, and Cardano move in sync despite fundamental factors of each project influencing the price action during this period.

The drop in correlation indicates that altcoins are increasingly gaining market share from Bitcoin. This decline in Bitcoin dominance mainly occurs when certain altcoins move independently and are not affected by Bitcoin’s trends.

In most cases, as was the case in the fourth quarter of 2023, a spike in Bitcoin prices causes demand for altcoins, causing them to rise. For example, besides Cardano and Dogecoin, Solana (SOL) and Tron (TRX) are two altcoins that have gathered and followed Bitcoin.

Furthermore, the decline in correlation could mean that the altcoin scene is maturing, and more investors are keen to pick projects that offer more utility, not just BTC proxies. With more investors, altcoins tend to be more liquid and attract even more capital.

BNB, XRP and BTC influenced by fundamental factors

Still, there could be more to explain the disconnect, especially in BNB and XRP. Seismic fundamental events have impacted the BTC, XRP, and BNB ecosystems over the past two months.

For example, the US Securities and Exchange Commission (SEC) is likely to approve several spot Bitcoin ETFs filed by several heavyweights, including BlackRock and Fidelity, in the coming weeks. Hopes that the regulator would authorize these derivatives to track BTC prices have catalyzed demand, pushing the coin to new highs in 2023.

Meanwhile, a US court ruled that XRP is a utility when sold to retailers. The case initially forced prices up, but the coin fell throughout the third quarter of 2023 and 2024 and only stabilized when BTC recovered.

At the same time, BNB was negatively affected by Binance founder Changpeng Zhao’s resignation in November 2023. The Department of Justice also fined Binance with a $4.3 billion fine as a settlement.

Feature image from Canva, chart from TradingView