This article is available in Spanish.

Bitcoin has proven unstoppable, breaking all-time highs and crossing the $82,000 mark five times in six days. This latest milestone strengthens Bitcoin’s momentum as it enters uncharted territory, attracting the attention of the bulls and sparking new levels of optimism in the market.

According to recent data from CryptoQuant, the number of bullish investors is growing rapidly, but there are still reasons to believe that Bitcoin’s rally is far from over.

Related reading

CryptoQuant’s insights indicate that BTC remains significantly below its March 2024 peak in several key metrics, suggesting Bitcoin may still have room to rise within this cycle. This gap highlights that despite the impressive gains, Bitcoin may still be heading towards a true cycle peak, with potential gains yet to be realized.

As investor sentiment strengthens and Bitcoin shows resilience at each new level, the market is watching closely for signs of continued upside momentum. The coming days will be crucial in determining how far Bitcoin can go as it solidifies its place in the next phase of this bull run.

Bitcoin bulls enter the room

Bitcoin bulls have returned after eight months of sideways consolidation and significant selling pressure. With Bitcoin now trading 11% above its previous record high from March, market sentiment has turned decisively bullish, marking the start of a new trend.

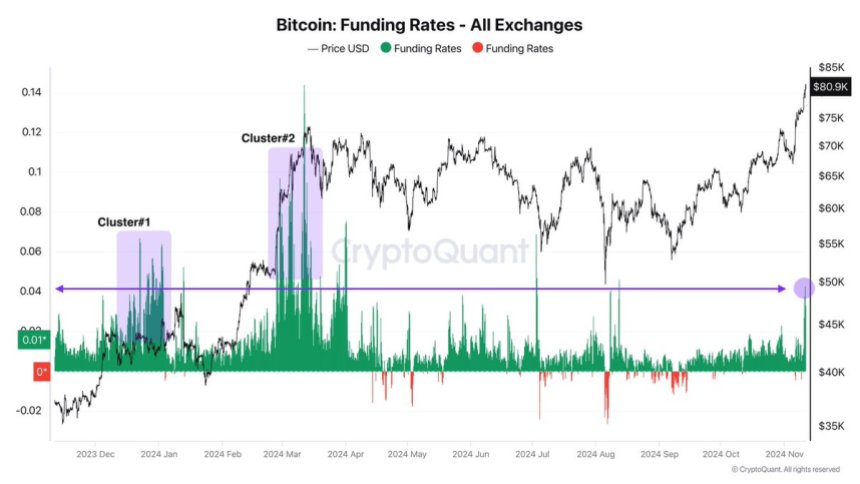

This is evident from data from CryptoQuant analyst Axel AdlerThe number of bullish investors in the market is steadily increasing, indicating growing confidence. However, despite this rebound, the current rally lacks the frenzied demand seen during the March 2024 rally, when both private and institutional interest reached euphoric levels.

Adler’s data shows that while bulls have a strong position in the market, the rate of accumulation of new retail and institutional participants is still relatively modest. This gap between current market dynamics and those of March suggests that Bitcoin’s latest surge may be just the beginning and not the end of its upward trajectory in this cycle.

Related reading

The slower but steady rise in buying interest could indicate that Bitcoin is still in the early stages of this bullish phase, with room for further growth before reaching a cycle peak.

For investors, this could be a promising opportunity. The moderate level of excitement in the retail and institutional sectors suggests that Bitcoin has still not attracted mainstream attention as it did during previous peaks. If demand gradually increases, Bitcoin could see continued growth in the coming months and possibly reach new highs as momentum builds.

BTC sets new high

Bitcoin recently set a new all-time high above $82,000, which many investors previously considered a likely local top. However, BTC price action remains robust and it may be too early to call for a definitive peak.

Despite this upside momentum, a potential pullback to $77,000 could be in store as there is an unfilled gap in the CME futures market between $77,000 and $81,000 – a technical level that often leads to price action as traders try to close the gap.

This week is likely to bring significant volatility as bulls control the market. With Bitcoin in uncharted territory, some investors may seize the opportunity to lock in profits, which could create selling pressure.

Related reading

Nevertheless, the dominant trend is bullish, and a short correction to $77,000 could provide a basis for further upside potential. Bitcoin’s strength remains intact for now, but all eyes will be on how it responds to the volatility and whether it can maintain this high range or drop slightly before resuming its climb.

Featured image of Dall-E, chart from TradingView