Bitcoin bulls are back in power, with the world’s leading cryptocurrency soared past $52,000 On Wednesday, it regained its trillion-dollar market cap after a 26-month hiatus.

This rally follows a brief dip below $50,000 caused by better-than-expected inflation data in the US, but investors shrugged it off, showing resilient confidence in the future of digital assets.

Bitcoin shows courage with $52,000 breach

This latest wave marks an important milestone not just for Bitcoin, but for the entire cryptocurrency ecosystem. After 26 months the top crypto asset has officially surpassed the coveted $1 trillion market cap, a testament to its growing adoption and mainstream appeal.

Bitcoin breaks past the $52k level. Source: Coingecko

But what drives this newfound optimism? Several factors appear to be fanning the flames. First, there is the bullish sentiment surrounding Bitcoin, with many analysts and traders expecting further price gains. Optimists are particularly bullish, betting that one BTC could reach $75,000 in the coming months, adding fuel to the fire.

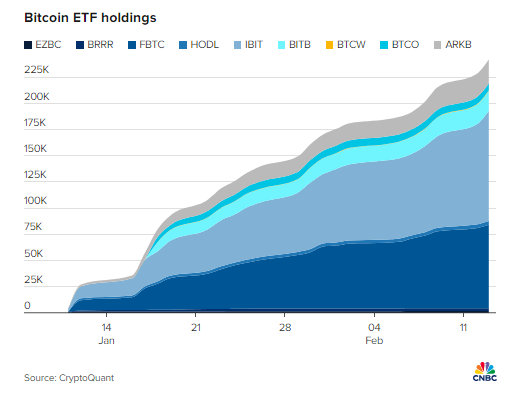

Second, the recent launch of spot exchange-traded funds (ETFs) in the US has played an important role. These ETFs allow investors to gain exposure to Bitcoin without directly owning it, attracting institutional investors and driving significant inflows.

Nearly $10 billion flows into the crypto market

Data from CryptoQuant shows that as much as $9.5 billion has flowed into the Bitcoin market through these ETFs since their debut in January. More than 70% of the new money invested in Bitcoin over the past two weeks has come from these spot ETFs, underscoring their growing impact.

Looking ahead, the next halving is looming in April. This programmed halving, which takes place every four years, reduces the amount of new Bitcoin entering circulation, potentially impacting its price due to increased scarcity. Historically, Bitcoin has witnessed significant rallies following halving events, and many analysts believe this time will be no different.

BTCUSD reclaiming the key $52k level on the daily chart: TradingView.com

“The upcoming halving will further reduce supply,” said Duncan Ash, head of product go-to-market strategy at Coincover. “If history repeats itself, we can expect continued BTC price growth in the coming months.”

However, not everyone is singing a completely bullish tune. While Swissblock analysts agree that the uptrend is likely to continue, they caution against excessive exuberance and warn of potential slowing momentum and the market’s inherent volatility.

Ultimately, Bitcoin’s future remains uncertain, as with any cryptocurrency. However, this recent surge, driven by bullish sentiment, ETF inflows and the upcoming halving, suggests that the bulls are firmly in control for now.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.