Ethena Labs has unveiled its latest strategic move: the inclusion of Bitcoin (BTC) as collateral for its synthetic dollar-pegged product USDe. This decision, aimed at significantly scaling the product’s offering from the current $2 billion, capitalizes on the fast-growing BTC derivatives markets for improved scalability and liquidity in delta hedging practices.

Ethena Labs’ ambitious goal is to leverage the significant growth in BTC’s open interest, which has seen a substantial increase from $10 billion to $25 billion in just one year, easily surpassing the growth rates of Ethereum (ETH) . Ethena’s statement highlighted the strategic benefits of integrating BTC, highlighting Bitcoin’s superior liquidity and maturity profile compared to liquid staking tokens and the potential for USDe to achieve greater scalability as a result.

“With $25 billion of open interest in BTC readily available for Ethena to delta hedge, the capacity for USDe to scale has increased by >2.5x,” the announcement said, illustrating the robust support BTC provides.

Excited to announce that Ethena has added BTC as a supporting asset for USDe

This is a critical enabler that will enable USDe to scale significantly from its current $2 billion offering pic.twitter.com/FOZRWBrVZV

— Ethena Labs (@ethena_labs) April 4, 2024

CryptoQuant CEO Issues Bitcoin Crash Warning

This step was not taken without skepticism. Ki Young Ju, CEO of analytics company CryptoQuant, asked X to express his to assuredrawing parallels to the infamous collapse of LUNA and questioning Ethena Labs’ risk management strategies.

“This is not good news for Bitcoin holders – it sounds like a potential contagion risk, just like LUNA. How do they maintain a delta-neutral strategy for BTC in bear markets?” Ju wondered, implying that the success of such strategies is largely dependent on market conditions that favor bull runs.

He further elaborated on the complexities of shorting BTC in bear markets, suggesting that the market size for such operations could be smaller than the total value (TVL), potentially leading to significant market disruptions. The CEO of CryptoQuant stated:

How do they maintain a delta neutral strategy for BTC in bear markets? In bull markets, they own spot BTC and short BTC. If there is a method to short BTC by holding some DeFi wrapped BTC, the market size would be smaller than the TVL. This is a CeFi stablecoin that is managed by a hedge fund and is only effective in bull markets. Correct me if I’m wrong.

Ju added that he worries about a repeat of a LUNA-like doomsday scenario: “Selling BTC to stabilize USDe’s peg if their algorithm fails during bear markets.”

Adding to the discourse, OMAKASE, a former consultant for Sushiswap, said: referred to historical challenges faced by delta-neutral strategies, highlighting their tendency to become illiquid and the difficulty of unwinding such positions without causing market slippage.

“Delta-neutral strategies are generally never delta-neutral. After the rise of the dotcom in Singapore, it took years for banks to sell off the delta-neutral books, which had suddenly become illiquid. Size breeds slippage,” OMAKASE noted, underscoring the inherent risks of such financial maneuvers.

Industry reaction to Ethena Labs’ announcement has been mixed, with some praising the potential for greater scalability, while others warning of the risks of repeating past financial crises. A few days ago, Fantom founder Andre Cronje also questioned the stability of USDe.

Amid these concerns, Ethena Labs stands by its decision, pointing to favorable market conditions and growing BTC derivatives markets as key factors supporting their strategy. “While BTC does not have a native staking yield like staked ETH, staking yields of 3-4% are less significant in a bull market when funding rates are >30%,” the company said, indicating a strategic optimization for the current market environment. . According to Ethena, this step is not only about scaling up, but also about offering a more secure and robust product to its users.

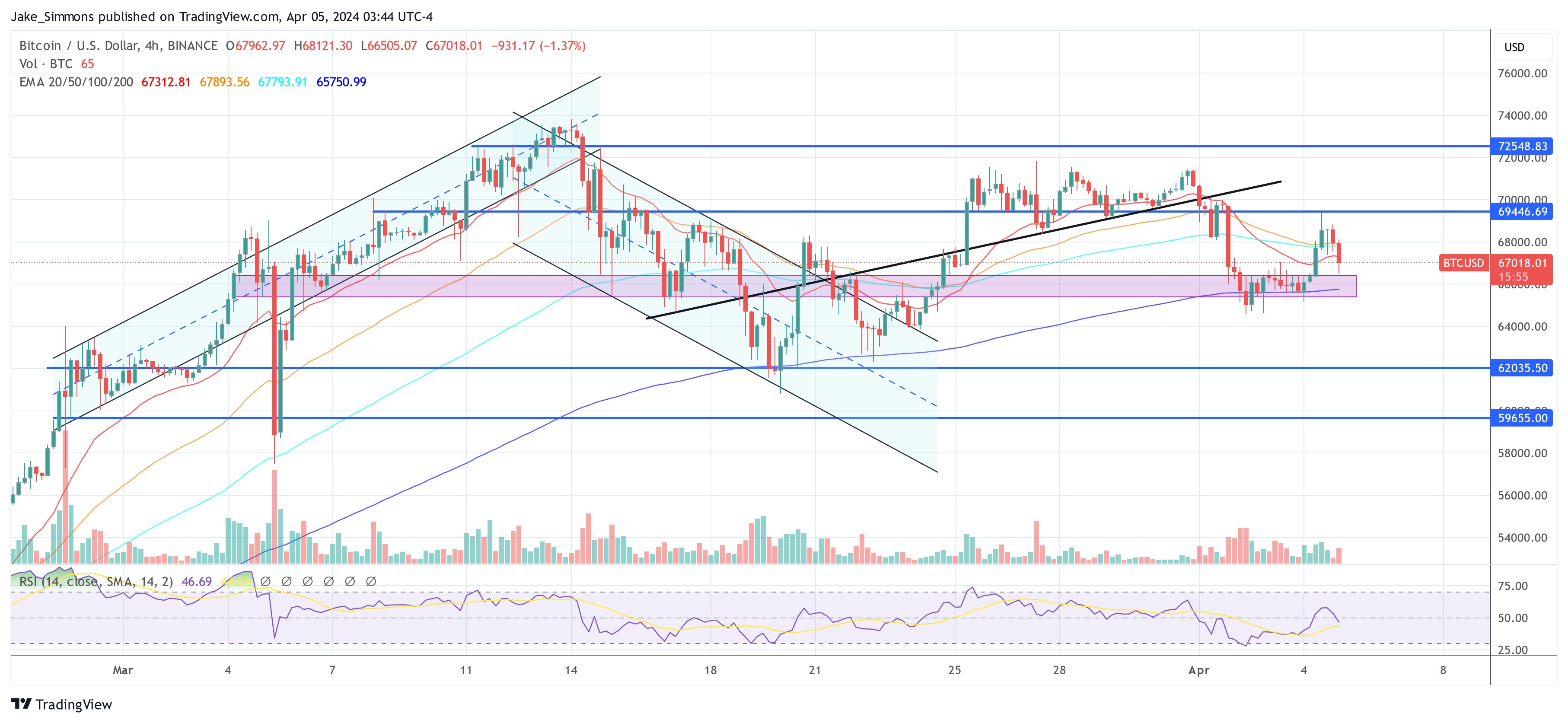

At the time of writing, BTC was trading at $67,018.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.