- Altcoin-Bitcoin correlation broke off and hints to the fragility under the Bitcoin solo rally.

- Whale-powered dominance spot showed caution, not conviction; The risk of snapback weaving looms in the vicinity of all time.

Bitcoin’s [BTC] The last wave is running heads, but not for the usual reasons. While the BTC is slowly climbing, the wider Altcoin market is running a rare divergence.

With Bitcoin -Dominance rising and historical correlations that break down, analysts Alarms sound: This rally can run on vapors and the risk of a sudden reversal is growing.

Altcoin correlation crumbles like Bitcoin –

The climb of Bitcoin no longer lifts all boats.

Source: Alfractaal

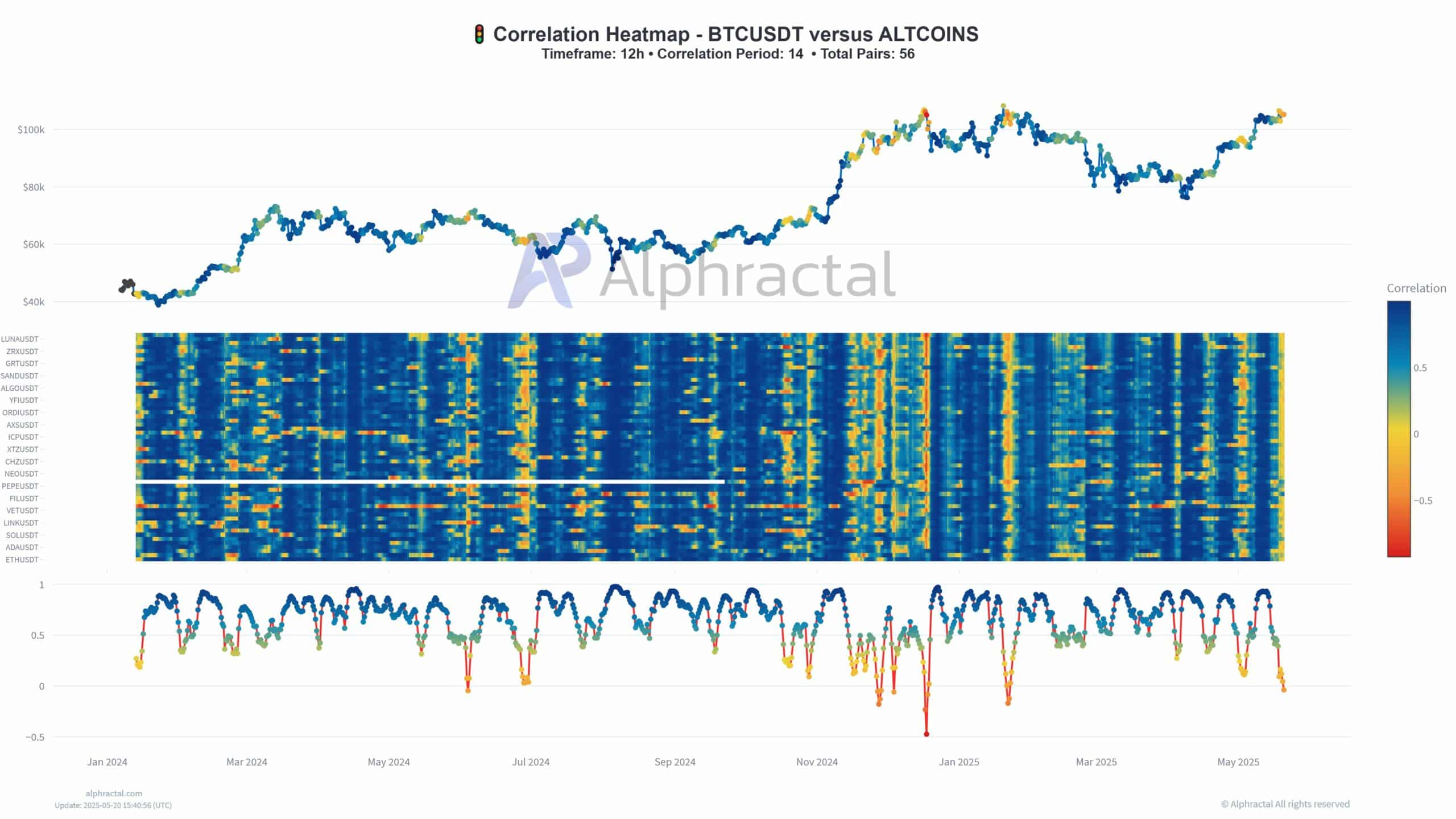

The rolling correlation of 14 periods between BTC and Major Altcoins has fallen sharply since the end of April 2025.

In contrast to earlier rallies where Altcoins ran synchronously with Bitcoin, the current trend fragmentation shows. Most altcoins now show almost zero or negative correlation on the 12 -hour period.

This decoupling, marked by cooler blue tones in the heatmap, indicates a narrowing market.

A rally guided by Bitcoin often lacks strength in the long term and can sometimes precede a broader risk-off shift in the market.

Dominance recovered

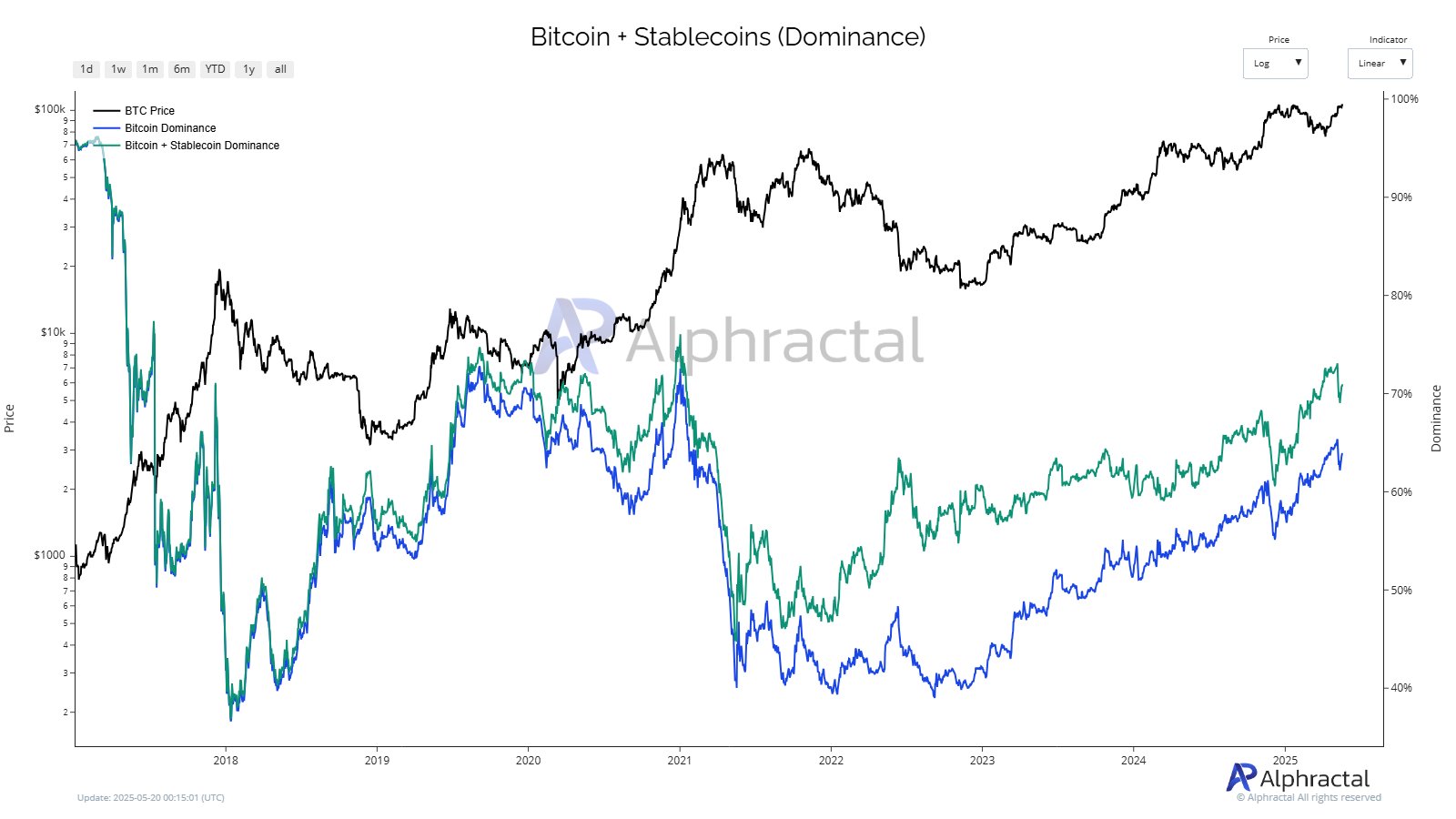

The price climb of BTC is accompanied by a powerful revival of market dominance, not only for BTC alone, but in combination with stablecoins.

The joint dominance borders 70%, which shows a return to risk-off behavior and consolidation of capital in “safer” crypto-assets.

Source: Alfractaal

Although Bitcoin -Dominance remains only under the peak of 2021, the recording of Stablecoins shows that traders are waiting on the sidelines.

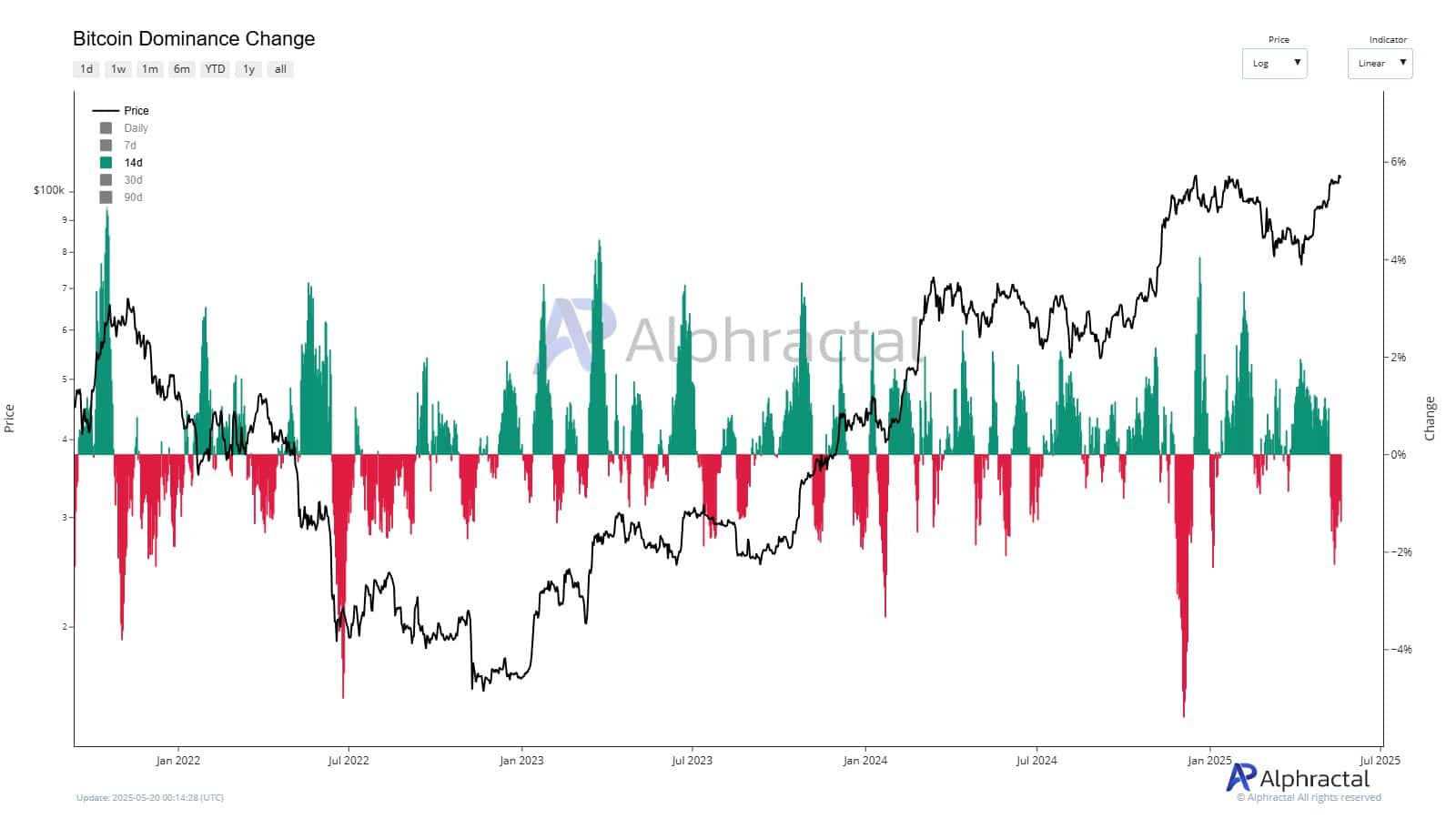

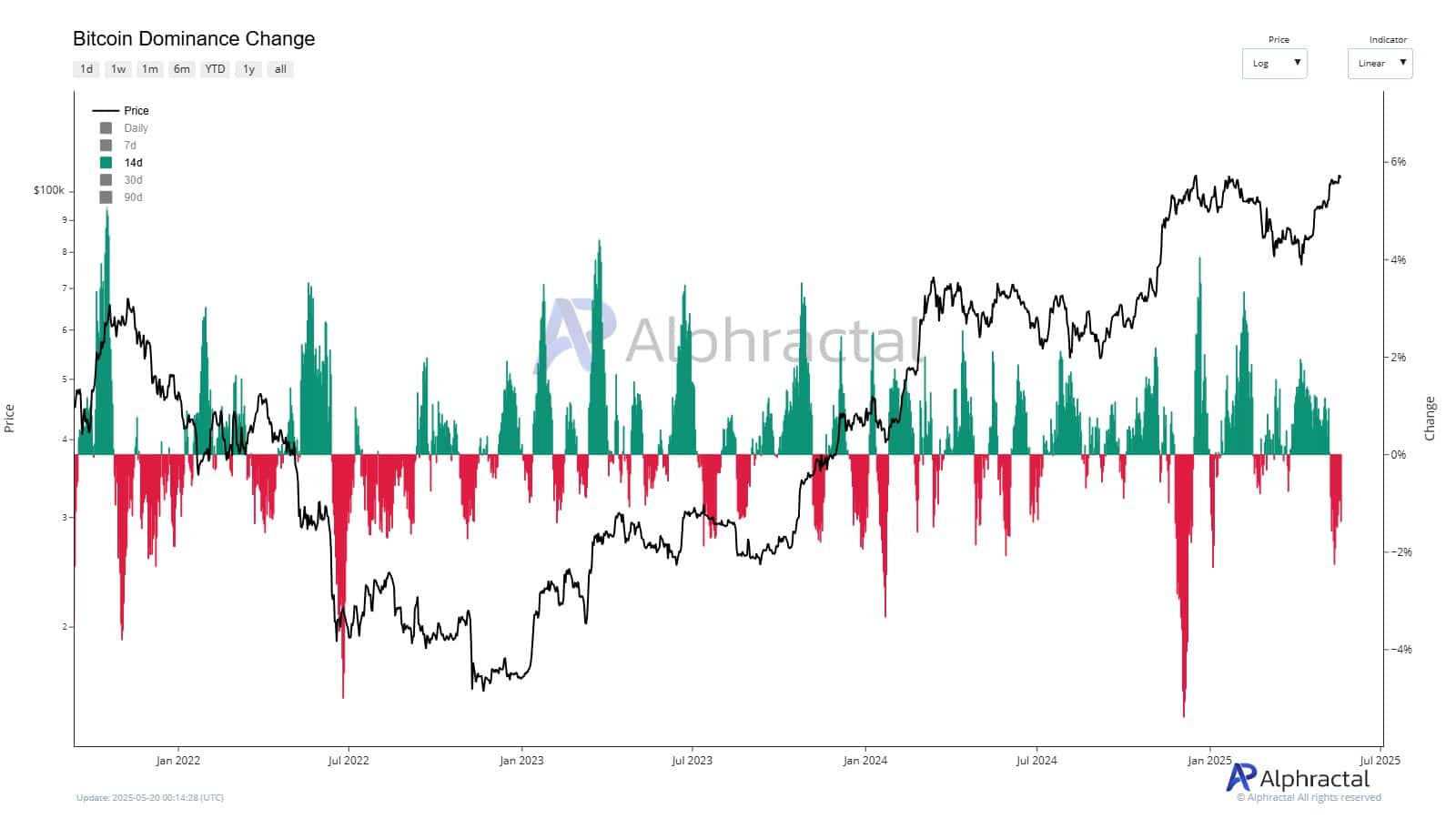

Source: Alfractaal

Despite price winsts, BTC -Dominance change has often become negative, which emphasizes the continuous capital rotation and market decision under the surface strength.