- Bitcoin’s price prospects look good despite the liquidity squeeze.

- Bitcoin’s key liquidity level is at $65,000.

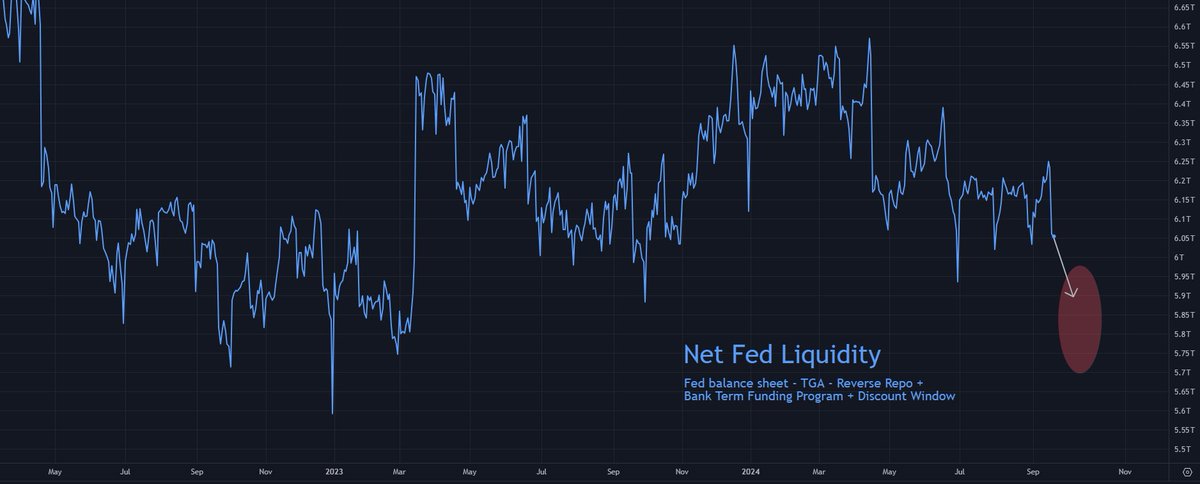

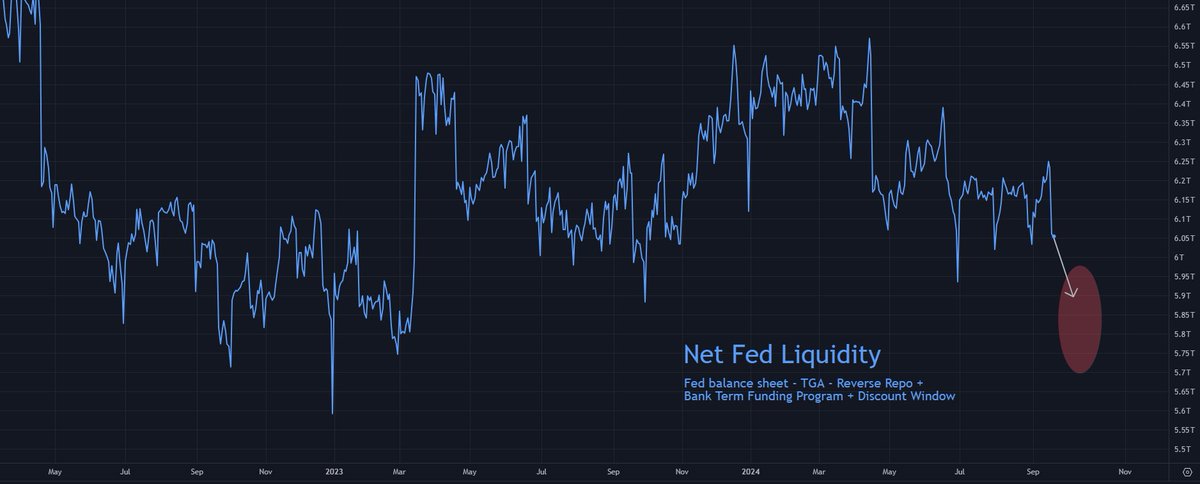

The liquidity crisis at the Federal Reserve is in full swing, with net liquidity falling by about $200 billion since Monday.

This decline is due to corporate tax payments increasing the Treasury’s General Account, followed by a likely increase in the use of Reverse Repos towards the end of the month.

The market is now about halfway through this liquidity crisis, which is expected to last another seven trading days.

Another $100 billion to $300 billion in liquidity could be siphoned off before October 1. However, despite this tightening, major risk assets such as US stock indices, gold and Bitcoin remain [BTC] have risen sharply, boosted by the Fed’s recent 50 basis point rate cut.

Source: Tomas/X

Bitcoin markets have largely emerged from the short-term liquidity crisis, but caution is still warranted until this liquidity storm passes.

Can Bitcoin Continue Its Rally Despite the Fed’s Liquidity Drop?

Over $2 billion in Bitcoin futures contracts opened

Despite the drop in liquidity, several indicators suggest that Bitcoin could continue its upward trajectory. One such sign is the increase in open interest in futures contracts.

In just 48 hours, more than $2 billion worth of Bitcoin futures contracts were opened. While this sharp increase could lead to a potential long squeeze, it also shows that traders are optimistic about Bitcoin’s future price.

The Federal Reserve’s rate cut appears to have eased liquidity concerns, encouraging traders to bet on Bitcoin reaching higher levels.

Source: Coinalyze/X

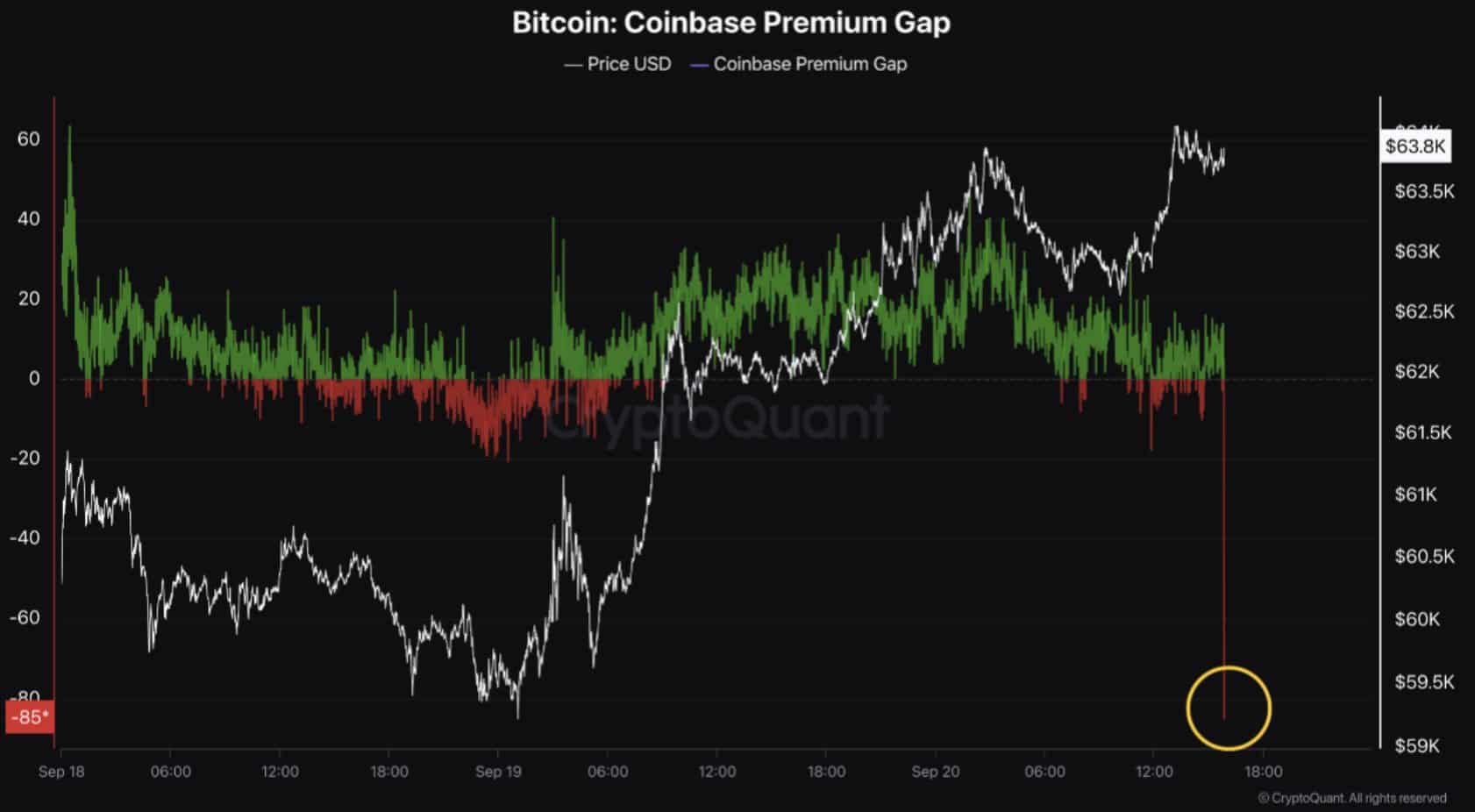

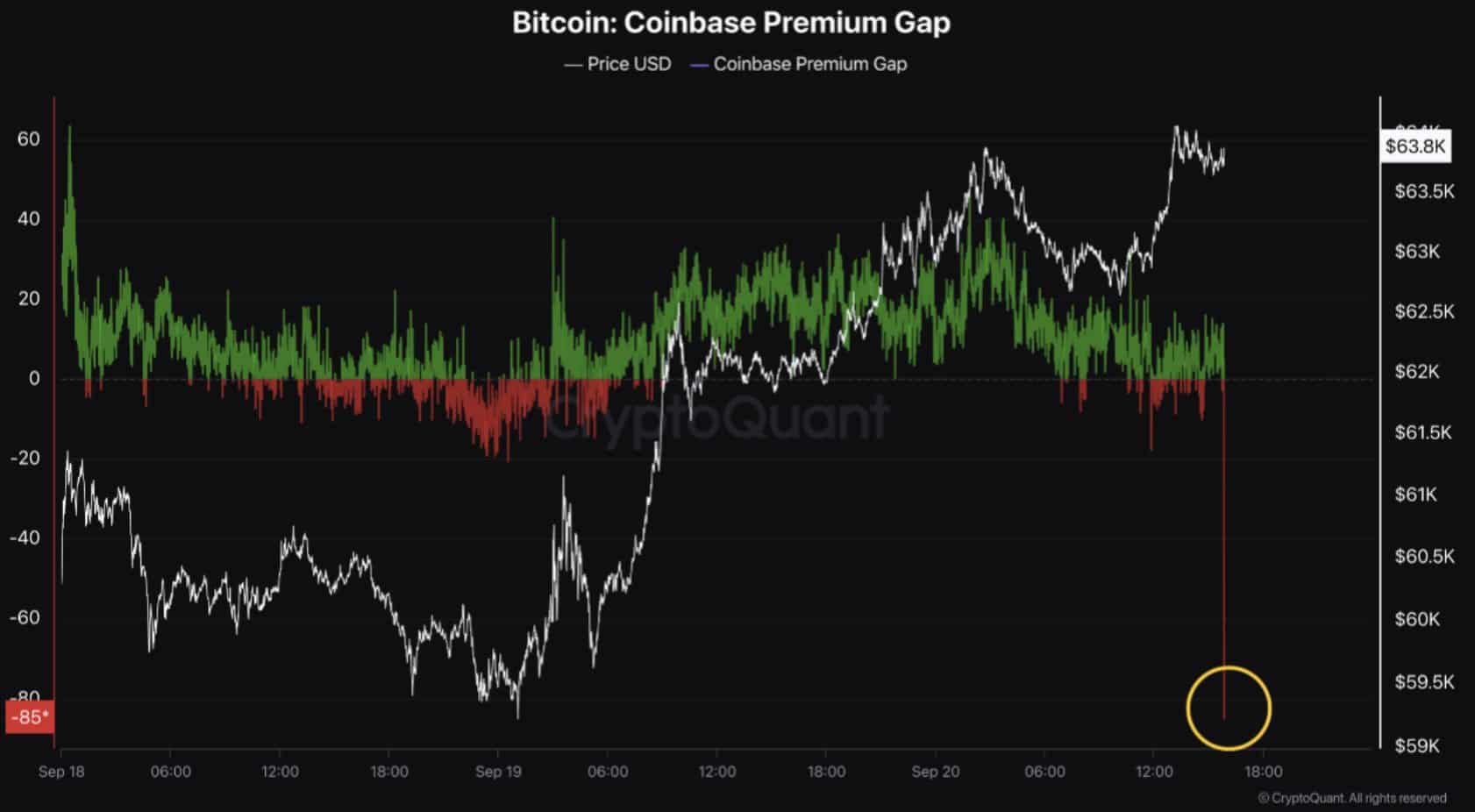

Another positive signal comes from the Coinbase Premium index, which measures the price difference between Bitcoin on Coinbase and Binance.

Currently, Coinbase Premium is negative, meaning Bitcoin is cheaper on Coinbase than on Binance. This pattern, known as divergence, typically indicates strong buying pressure, especially on Binance.

When two related metrics move in opposite directions, it often signals a reversal, indicating that Bitcoin’s recent downtrend may have bottomed out.

Source: CryptoQuant

Although the price of Bitcoin has not fallen, this buying pressure indicates that Bitcoin could experience a price increase.

Important levels and liquidation zones for the next move

Liquidation levels are essential for traders as they help identify zones where the price can move to increase liquidity. Currently, Bitcoin’s key liquidity level is at $65,000.

If Bitcoin breaks above this level, it will likely reach $75K, where significant liquidity awaits.

A break above $65,000 would not only bring Bitcoin closer to this next target but also confirm a bullish market structure. It would mark a higher high, following the recent higher low following Bitcoin’s price drop in August.

Source: Coinglass

Despite the Fed’s ongoing liquidity crunch, Bitcoin has shown resilience, with several indicators pointing to a continued rally.

Read Bitcoin’s [BTC] Price forecast 2024–2025

The rise in open interest, strong buying pressure on Binance, and key liquidity levels all indicate that Bitcoin’s price could move higher in the coming weeks.

Traders should look for a break above the USD 65,000 level, which could mean a significant upside move towards USD 75,000. However, caution remains necessary until the liquidity storm is completely over.