- BCH’s trading volume increased exponentially amid a new listing and Asian participation.

- The balance on addresses rose, as did the outstanding interest.

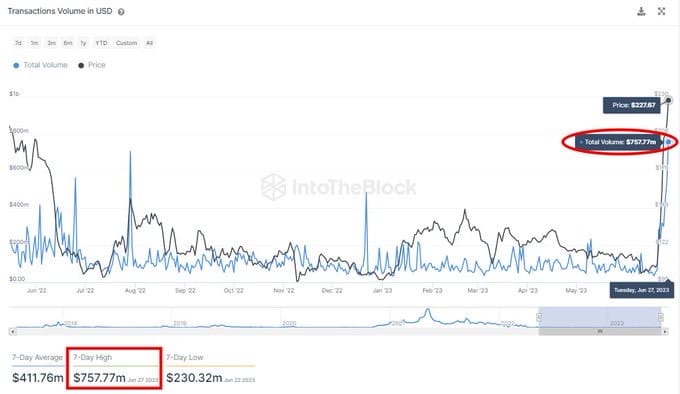

Bitcoin cash [BCH] reached a daily trading volume of $750 million – the highest the coin has reached all year. The data, shared by IntoTheBlockrevealed that the increase came as a result of EDX Markets’ inclusion of BCH in its first set of trading assets.

Realistic or not, here it is BCH’s market cap in BTC terms

The volume increase represents a renewed interest in BCH, which until recently received little attention. However, the rise did not come without a surge in price action.

Source: IntoTheBlock

According to CoinMarketCap, the price of BCH is up 112.34% in the past seven days. But what was the motivation?

Upbit rules with high priority

For starters, BCH, next Bitcoin [BTC], Litecoin [LTC]And Ethereum [ETH] was listed on EDX Markets last week.

For the unfamiliar: EDX Markets recently launched on June 20th. And traditional finance firms Citadel Securities, Charles Schwab and Fidelity Digital Assets have been involved in powering the cryptocurrency exchange. However, the institutions did not consider it appropriate to list dozens of cryptocurrencies, considering only the aforementioned ones.

Also, the decision to list the four cryptocurrencies could be related to the recent US SEC suppression of many other cryptocurrencies. Perhaps the traditional companies prefer to stick with the “safe” assets, especially as chairman Gary Gensler once said were no guarantees.

The move came shortly after the SEC approved BlackRock’s Bitcoin Leveraged ETFspointing to another evidence of institutional money quickly entering the crypto market.

Second, South Korea has done its part to ensure that the Bitcoin hard fork pump does not stop. CoinMarketCap, the largest exchange in the country, reports this to Upbit’s BCH/KRW trading volume was over $460 million in the past 24 hours.

This represented a share of 24.51% of the total volume on all exchanges. And it was also much more than the SOL/KRW and BTC/KRW pairs that placed second and third respectively.

BCH suits the “New Balance”

Moreover, IntoTheBlock also showed that BCH experienced a substantial addition of BCH less than 30 days ago. This was based on the “Balance by Time Held” indicator. Typically, tare indicator takes into account the number of addresses in relation to their retention period.

And by tracking participant behavior, the 33% increase in the indicator suggests that many addresses have increased their balances. And often this is a sign of the entry of the bull cycle.

Source: IntoTheBlock

How many Worth 1,10,100 BCHs today?

On the derivatives front, BCHs Open interest reached its Year-To-Date (YTD) peak at the time of this writing. Typically, Open Interest measures the total number of participants’ future contracts while evaluating price strength and market sentiment.

As Open Interest increased, it means that traders opened new positions. Also, the huge spike indicates a huge influx of money into the BCH market.

Source: Coinglass