- BTC could hit a new ATH in the coming three months, according to a macro analyst.

- The actual MVRV value was at 1.7, which suggests a light space for growth before BTC touches a local peak.

Bitcoin [BTC] has consolidated around $ 105k for four days, which indicates a structure for an extra rally or a likely withdrawal.

But analysts have made price calls for $ 135k $ 200k in the next 3-6 months, referring to the macro front improvement.

On May 12, BTC dumped 4% from $ 105k to $ 100.7K, a typical sales-de-news after the trade agreement in the US-China.

However, the active losses turned on 13 May after a modest 0.2% month-on-month April CPI inflation print, against the expected 0.3%.

The annual rate amounted to 2.3%and fell under the predicted 2.4%, a positive prospect of the expectations of the FED rate reduction of Q3.

Low inflation, positive macro for BTC fuel?

In an e -mail statement, 21Shares Crypto Investment Specialist David Hernandez told Ambcrypto,

“If this process (the inflation, the acceptance of the nation state) continues, the price objectives of $ 200,000 a year now seem increasingly realistic.”

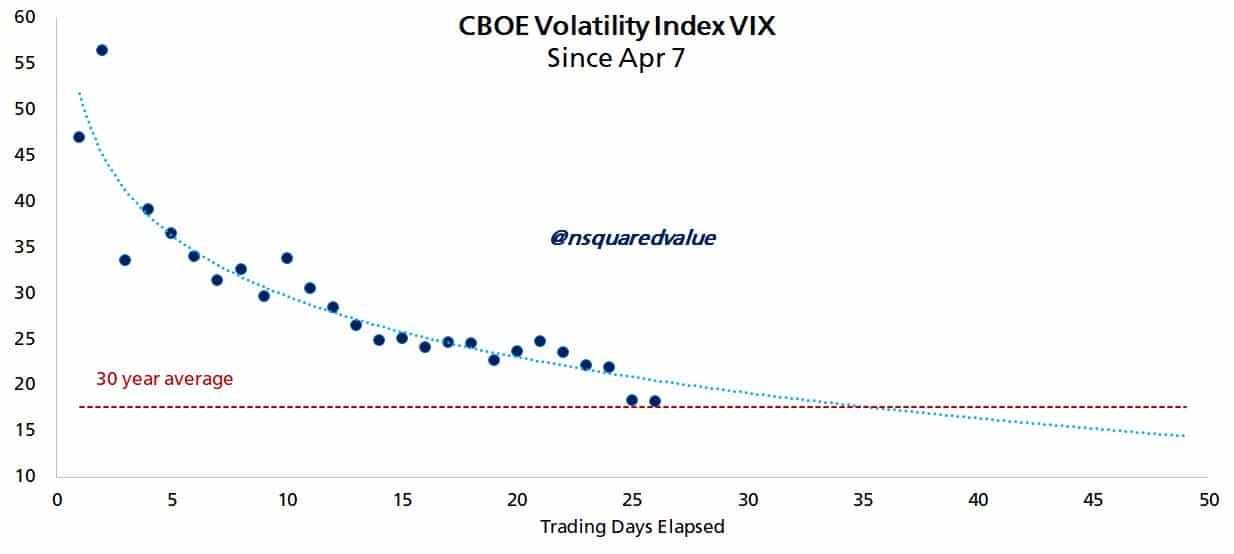

Likewise, Timothy Peterson, a BTC network analyst, noted That the trade agreement in the US caused the VIX (Volatity Index) to fall to a ‘normal’ 30-year-old average.

The VIX decline and lower inflation were a perfect set-up for a ‘risk-on’ rally, Peterson added.

“Inflation came just lower than expected. This will be a ‘risk of’ environment for the near future.”

Source: X

For those who are unknown, VIX follows future price fluctuations and, by extension, the market anxiety market.

Simply put, with the US-China rate from the road, market anxiety (higher VIX) has been replaced by risk-on (lower VIX) sentiment.

X after On 1 May Peterson emphasized that a potential VIX dip to 18 BTC could push to $ 107k in 100 days in 3 weeks and +$ 135k.

“A continuation of this path, and VIX <= 18, implies Bitcoin at $ 107k in 2-3 weeks and $ 135,000+ in 100 days."

What is the short term?

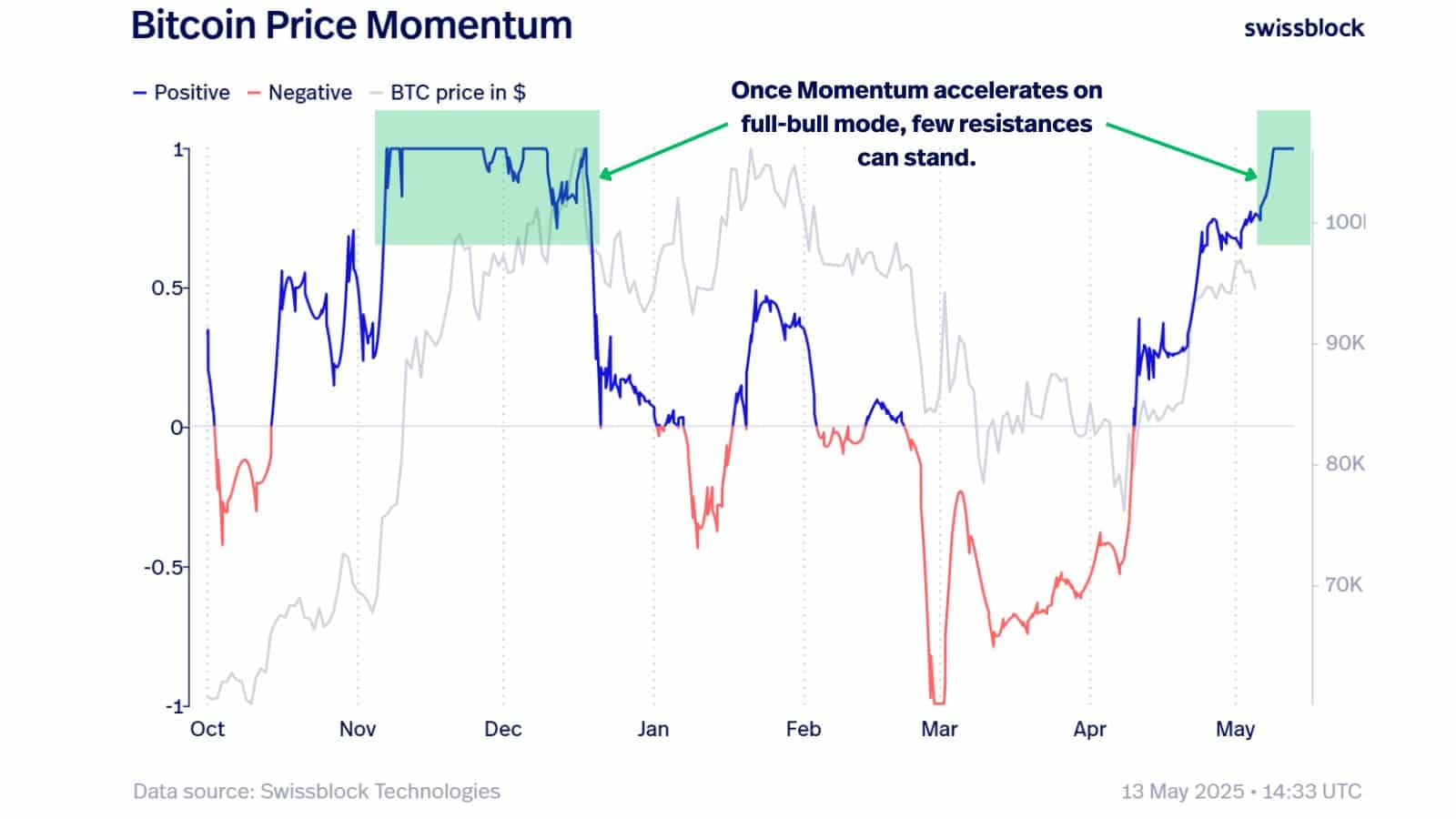

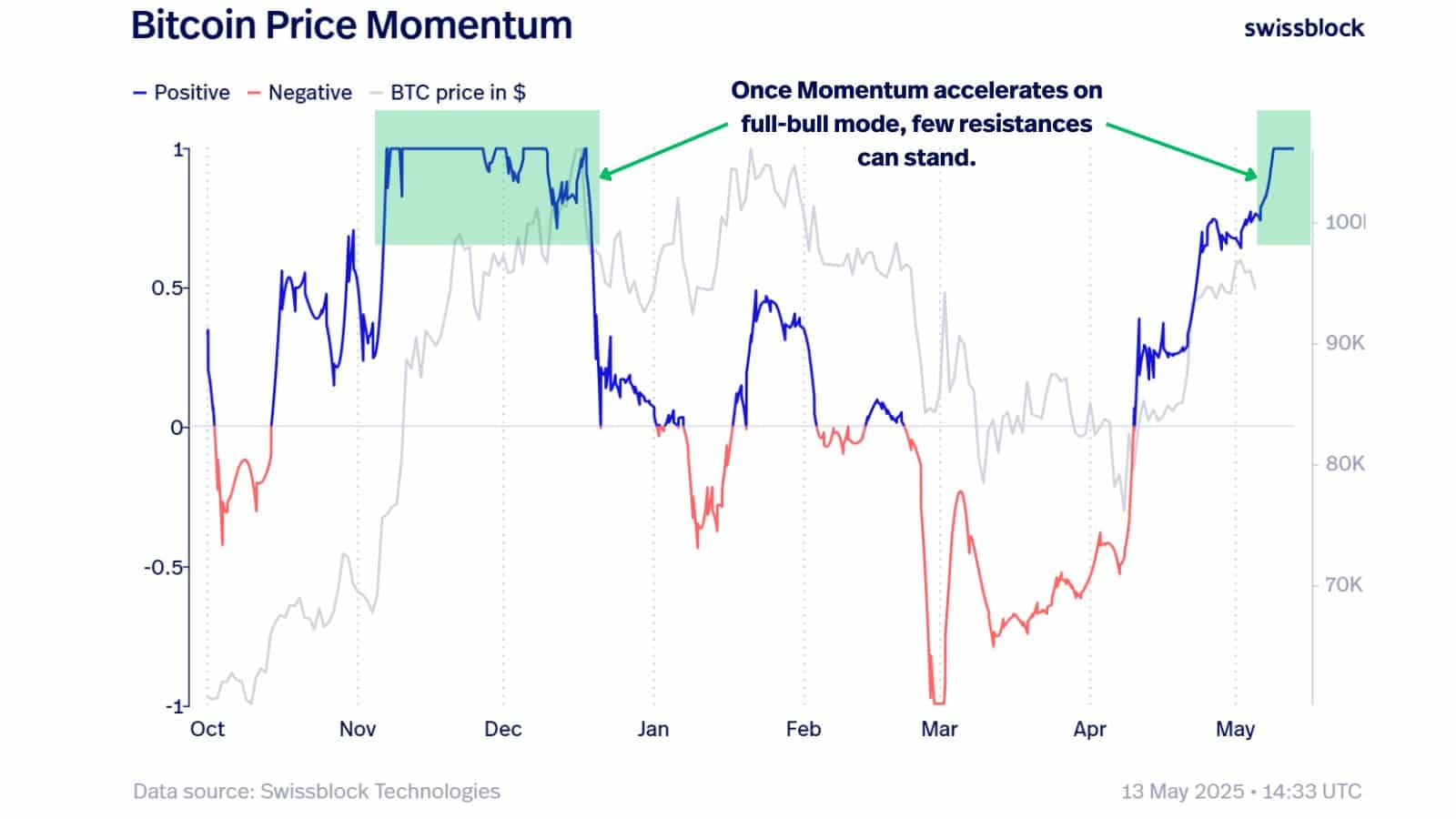

However, the jump to a new ATH may not be a smooth ride, according to one report by Crypto research agency Swissblock.

The company mentioned BTC-PRIJSMOTUM and declared a potential correction at $ 104k $ 106k before a rebound to a record level was likely.

“Can $ BTC push to unknown territory? A reset can feed the next leg.”

Source: Swissblock

The attached graph showed that BTC was in full bullish momentum, but the current levels also marked a retracement in the last rally of November-December.

But real MVRV, a valuation statistics that marked local peaks and soils early and at the end of 2024, did not agree with the Swissblock for views.

The reading of the metric was at 1.7, slightly far from the potential local peak level of 2. In other words, BTC still had room for growth before a likely massive withdrawal.

On the option market, traders positioned themselves for both scenarios.

In the last 24 hours, $ 95k PUT options (Bearish Bets) were the largest by trade volume, while calling up to $ 105k and $ 115k (bullish bets) are in second place.

In other words, the traders expected BTC to hit $ 115k in May, but were prepared for a potential dip up to $ 95k.

In general, the positive macro environment could further feed risk-on sentiment and push BTC to a new Ath. However, there were still opportunities to fall under $ 100k.